-

Susan Sarandon to be honoured at Spain's top film awards

Susan Sarandon to be honoured at Spain's top film awards

-

Trump says 'time running out' as Iran rejects talks amid 'threats'

-

Spain eyes full service on train tragedy line in 10 days

Spain eyes full service on train tragedy line in 10 days

-

Greenland dispute 'strategic wake-up call for all of Europe,' says Macron

-

'Intimidation and coercion': Iran pressuring families of killed protesters

'Intimidation and coercion': Iran pressuring families of killed protesters

-

Europe urged to 'step up' on defence as Trump upends ties

-

Sinner hails 'inspiration' Djokovic ahead of Australian Open blockbuster

Sinner hails 'inspiration' Djokovic ahead of Australian Open blockbuster

-

Dollar rebounds while gold climbs again before Fed update

-

Aki a doubt for Ireland's Six Nations opener over disciplinary issue

Aki a doubt for Ireland's Six Nations opener over disciplinary issue

-

West Ham sign Fulham winger Traore

-

Relentless Sinner sets up Australian Open blockbuster with Djokovic

Relentless Sinner sets up Australian Open blockbuster with Djokovic

-

Israel prepares to bury last Gaza hostage

-

Iran rejects talks with US amid military 'threats'

Iran rejects talks with US amid military 'threats'

-

Heart attack ends iconic French prop Atonio's career

-

SKorean chip giant SK hynix posts record operating profit for 2025

SKorean chip giant SK hynix posts record operating profit for 2025

-

Greenland's elite dogsled unit patrols desolate, icy Arctic

-

Dutch tech giant ASML posts bumper profits, cuts jobs

Dutch tech giant ASML posts bumper profits, cuts jobs

-

Musetti rues 'really painful' retirement after schooling Djokovic

-

Russian volcano puts on display in latest eruption

Russian volcano puts on display in latest eruption

-

Thailand uses contraceptive vaccine to limit wild elephant births

-

Djokovic gets lucky to join Pegula, Rybakina in Melbourne semi-finals

Djokovic gets lucky to join Pegula, Rybakina in Melbourne semi-finals

-

Trump says to 'de-escalate' Minneapolis, as aide questions agents' 'protocol'

-

'Extremely lucky' Djokovic into Melbourne semi-finals as Musetti retires

'Extremely lucky' Djokovic into Melbourne semi-finals as Musetti retires

-

'Animals in a zoo': Players back Gauff call for more privacy

-

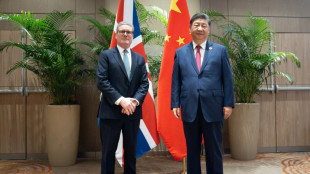

Starmer heads to China to defend 'pragmatic' partnership

Starmer heads to China to defend 'pragmatic' partnership

-

Uganda's Quidditch players with global dreams

-

'Hard to survive': Kyiv's elderly shiver after Russian attacks on power and heat

'Hard to survive': Kyiv's elderly shiver after Russian attacks on power and heat

-

South Korea's ex-first lady jailed for 20 months for taking bribes

-

Polish migrants return home to a changed country

Polish migrants return home to a changed country

-

Dutch tech giant ASML posts bumper profits, eyes bright AI future

-

South Korea's ex-first lady jailed for 20 months for corruption

South Korea's ex-first lady jailed for 20 months for corruption

-

Minnesota congresswoman unbowed after attacked with liquid

-

Backlash as Australia kills dingoes after backpacker death

Backlash as Australia kills dingoes after backpacker death

-

Brazil declares acai a national fruit to ward off 'biopiracy'

-

Anisimova 'loses her mind' after Melbourne quarter-final exit

Anisimova 'loses her mind' after Melbourne quarter-final exit

-

Home hope Goggia on medal mission at Milan-Cortina Winter Olympics

-

Omar attacked in Minneapolis after Trump vows to 'de-escalate'

Omar attacked in Minneapolis after Trump vows to 'de-escalate'

-

Pistons escape Nuggets rally, Thunder roll Pelicans

-

Dominant Pegula sets up Australian Open semi-final against Rybakina

Dominant Pegula sets up Australian Open semi-final against Rybakina

-

'Animals in a zoo': Swiatek backs Gauff call for more privacy

-

Japan PM's tax giveaway roils markets and worries voters

Japan PM's tax giveaway roils markets and worries voters

-

Amid Ukraine war fallout, fearful Chechen women seek escape route

-

Rybakina surges into Melbourne semis as Djokovic takes centre stage

Rybakina surges into Melbourne semis as Djokovic takes centre stage

-

Dollar struggles to recover from losses after Trump comments

-

Greenland blues to Delhi red carpet: EU finds solace in India

Greenland blues to Delhi red carpet: EU finds solace in India

-

Will the EU ban social media for children in 2026?

-

Netherlands faces 'test case' climate verdict over Caribbean island

Netherlands faces 'test case' climate verdict over Caribbean island

-

Rybakina stuns Swiatek to reach Australian Open semi-finals

-

US ouster of Maduro nightmare scenario for Kim: N. Korean ex-diplomat

US ouster of Maduro nightmare scenario for Kim: N. Korean ex-diplomat

-

Svitolina credits mental health break for reaching Melbourne semis

Rare earth production outside China 'major milestone'

An Australian firm's production of a heavy rare earth, a first outside of China, is a "major milestone" in diversifying a critical supply chain dominated by Beijing, experts say.

But the announcement by Lynas Rare Earths also illustrates how much more needs to be done to broaden the supply of elements critical for electric vehicles and renewable technology.

What are rare earths?

Rare earth elements (REE) are 17 metals that are used in a wide variety of everyday and high-tech products, from light bulbs to guided missiles.

Among the most sought-after are neodymium and dysprosium, used to make super-strong magnets that power electric car batteries and ocean wind turbines.

Despite their name, rare earths are relatively abundant in the Earth's crust. Their moniker is a nod to how unusual it is to find them in a pure form.

Heavy rare earths, a subset of overall REE, have higher atomic weights, are generally less abundant and often more valuable.

China dominates all elements of the rare earths supply chain, accounting for more than 60 percent of mining production and 92 percent of global refined output, according to the International Energy Agency.

What did Lynas achieve?

Lynas said it produced dysprosium oxide at its Malaysia facility, making it the only commercial producer of separated heavy rare earths outside of China.

It hopes to refine a second heavy rare earth -- terbium -- at the same facility next month. It too can be used in permanent magnets, as well as some light bulbs.

It "is a major milestone," said Neha Mukherjee, senior analyst on raw materials at Benchmark Mineral Intelligence.

The announcement comes with China's REE supply caught up in its trade war with Washington.

It is unclear whether a 90-day truce means Chinese export controls on some rare earths will be lifted, and experts say a backlog in permit approvals will snarl trade regardless.

"Given this context, the Lynas development marks a real and timely shift, though it doesn't eliminate the need for broader, global diversification efforts," said Mukherjee.

How significant is it?

Lynas did not say how much dysprosium it refined, and rare earths expert Jon Hykawy warned the firm faces constraints.

"The ore mined by Lynas contains relatively little of the heavy rare earths, so their produced tonnages can't be that large," said Hykawy, president of Stormcrow Capital.

"Lynas can make terbium and dysprosium, but not enough, and more is needed."

The mines most suited for extracting dysprosium are in south China, but deposits are known in Africa, South America and elsewhere.

"Even with Lynas' production, China will still be in a position of dominance," added Gavin Wendt, founding director and senior resource analyst at MineLife.

"However, it is a start, and it is crucial that other possible projects in the USA, Canada, Brazil, Europe and Asia, also prove technically viable and can be approved, so that the supply balance can really begin to shift."

What are the challenges to diversifying?

China's domination of the sector is partly the result of long-standing industrial policy. Just a handful of facilities refining light rare earths operate elsewhere, including in Estonia.

It also reflects a tolerance for "in-situ mining", an extraction technique that is cheap but polluting, and difficult to replicate in countries with higher environmental standards.

For them, "production is more expensive, so they need prices to increase to make any seriously interesting profits," said Hykawy.

That is a major obstacle for now.

"Prices have not supported new project development for over a year," said Mukherjee.

"Most non-Chinese projects would struggle to break even at current price levels."

There are also technical challenges, as processing rare earths requires highly specialised and efficient techniques, and can produce difficult-to-manage waste.

What more capacity is near?

Lynas has commissioned more processing capacity at its Malaysia plant, designed to produce up to 1,500 tonnes of heavy rare earths.

If that focused on dysprosium and terbium, it could capture a third of global production, said Mukherjee.

The firm is building a processing facility in Texas, though cost increases have cast doubt on the project, and Lynas wants the US government to pitch in more funds.

US firm MP Materials has also completed pilot testing for heavy rare earth separation and plans to boost production this year.

Canada's Aclara Resources is also developing a rare earths separation plant in the United States.

And Chinese export uncertainty could mean prices start to rise, boosting balance sheets and the capacity of small players to expand.

"The Lynas announcement shows progress is possible," said Mukherjee.

"It sends a strong signal that with the right mix of technical readiness, strategic demand, and geopolitical urgency, breakthroughs can happen."

K.Hofmann--VB