-

Tesla proposes package for Musk that could top $1 trillion

Tesla proposes package for Musk that could top $1 trillion

-

Shiite ministers walk out of Lebanon cabinet discussion on Hezbollah disarmament

-

Stocks rise, dollar drops as US jobs data boosts rate cut hopes

Stocks rise, dollar drops as US jobs data boosts rate cut hopes

-

New folk music documentary taps into Bob Dylan revival

-

Europe bets on supercomputer to catch up in AI race

Europe bets on supercomputer to catch up in AI race

-

11 foreigners killed in Portugal funicular crash

-

'Roblox' game to impose age controls this year

'Roblox' game to impose age controls this year

-

WHO backs weight-loss drugs, urges cheap generics

-

Merz inaugurates supercomputer, says Europe can catch up in AI race

Merz inaugurates supercomputer, says Europe can catch up in AI race

-

Hamilton tops Monza practice in Ferrari one-two

-

Hitwomen: how teen girls are being used in Sweden crime wars

Hitwomen: how teen girls are being used in Sweden crime wars

-

South Africa's Du Preez out of Rugby Championship with injury

-

Newcastle's Burn has 'nothing but good wishes' for Isak

Newcastle's Burn has 'nothing but good wishes' for Isak

-

Israel army begins targeting Gaza City high-rises

-

Socceroos edge New Zealand 1-0 to keep unbeaten streak intact

Socceroos edge New Zealand 1-0 to keep unbeaten streak intact

-

Don't panic: UK phones to sound at once in emergency drill

-

'No curse' on England, insists Tuchel despite near misses

'No curse' on England, insists Tuchel despite near misses

-

Venice Film Festival a red carpet pulpit for 'King Giorgio' Armani

-

Putin threatens to target any Western troops sent to Ukraine

Putin threatens to target any Western troops sent to Ukraine

-

The massive debt behind France's political turmoil

-

Britain's Duchess of Kent dies aged 92: palace

Britain's Duchess of Kent dies aged 92: palace

-

China to impose temporary duties on EU pork

-

Stocks rise ahead of key US jobs data

Stocks rise ahead of key US jobs data

-

England's Stones out of Andorra, Serbia World Cup qualifiers

-

Conservative Thai tycoon wins parliament vote to become PM

Conservative Thai tycoon wins parliament vote to become PM

-

Lebanon to discuss army plan to disarm Hezbollah

-

China to impose temporary duties on EU pork over 'dumping'

China to impose temporary duties on EU pork over 'dumping'

-

US sanctions Palestinian rights groups over ICC probe

-

Sax-playing pilot Anutin lands Thai prime ministerial vote

Sax-playing pilot Anutin lands Thai prime ministerial vote

-

PSG's Geyoro joins London City Lionesses for reported women's world record £1.43 mn

-

Danish wind giant sues US government over project halt

Danish wind giant sues US government over project halt

-

Asian, European markets rally ahead of US jobs data

-

US AI giant Anthropic bars Chinese-owned entities

US AI giant Anthropic bars Chinese-owned entities

-

Powerful quake aftershocks cause more injuries in Afghanistan

-

Putin threatens to target any Western troops in Ukraine

Putin threatens to target any Western troops in Ukraine

-

German factory orders drop in new blow to economy

-

Positivity wins as Anisimova wills way into US Open final

Positivity wins as Anisimova wills way into US Open final

-

Osaka eager for more after US Open run ends in semi-finals

-

Savea-Kolisi clash one to savour, says All Blacks captain Barrett

Savea-Kolisi clash one to savour, says All Blacks captain Barrett

-

Cooling US jobs market in focus as political scrutiny heats up

-

Sabalenka returns to US Open final as Anisimova sinks Osaka

Sabalenka returns to US Open final as Anisimova sinks Osaka

-

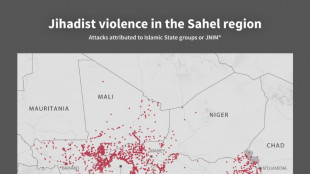

Chinese firms pay price of jihadist strikes against Mali junta

-

Europe's fastest supercomputer to boost AI drive

Europe's fastest supercomputer to boost AI drive

-

Super Bowl champion Eagles down Cowboys in NFL season opener

-

New recipes help Pakistani mothers ward off malnutrition

New recipes help Pakistani mothers ward off malnutrition

-

'Brutal': Olympic pole vault champion Kennedy pulls out of worlds

-

Lebanon to discuss army's plan to disarm Hezbollah

Lebanon to discuss army's plan to disarm Hezbollah

-

Australia and Argentina primed for battle of the fittest

-

Asian markets rally as Chinese stocks selloff eases

Asian markets rally as Chinese stocks selloff eases

-

Messi hits emotional brace as Uruguay, Colombia, Paraguay seal World Cup spots

The massive debt behind France's political turmoil

France's growing debt pile is at the heart of the confidence vote that could topple the government of Prime Minister Francois Bayrou next week.

Bayrou called the vote to settle a fight over the budget as he seeks 44 billion euros ($51 billion) in savings to cut the debt.

But his plan, which includes reducing the number of holidays, has proved unpopular.

Here is a look at the country's fiscal situation ahead of Monday's vote in parliament:

- How big is it? -

France's public debt has steadily risen for decades, fuelled by chronic budget deficits financed through borrowing on bond markets.

The debt grew to 3.3 trillion euros ($3.9 trillion) in the first three months of this year, or over 48,000 euros per French national.

The debt amounts to 114 percent of France's annual gross domestic product (GDP, a measure of economic output) -- the third highest debt ratio in the eurozone after Greece and Italy.

The debt ratio is almost double the limit of 60 percent allowed by the European Union.

By comparison, the debt-to-GDP ratio was at 57.8 percent in 1995, but financial crises, the Covid pandemic and high inflation have fuelled its rise.

It's not great, but it could be worse.

The Avant-Garde Institute, a think tank, noted that France's debt ratio was as high as 300 percent of GDP between World War I and World War II.

Eric Heyer, an economist at the French Economic Observatory think tank, told AFP that "many countries are above" France's 114 percent debt-to-GDP ratio.

- What's the problem? -

More debt means more of the country's taxpayer money goes into paying interest to creditors.

The growth of state spending on servicing the debt has been one the threats cited by the government.

The government's debt burden, or interest payments, totals 53 billion euros in 2025, according to the medium-term budget plan presented in April.

Bayrou has warned that the number will grow to 66 billion euros in 2026, making it the government's main spending item ahead of education.

"The consequence for French people is that we can't do other things," Pierre Moscovici, president of the national audit body, told news channel LCI on Sunday.

But economists from Attac, a French activist group campaigning for financial justice, and the Copernic Foundation, a left-leaning organisation, recently argued in Le Monde that France’s debt isn’t as alarming as the government suggests.

The government spent just two percent of the country's GDP on interest payments last year, the groups said in a joint column in Le Monde newspaper.

Other experts, including Heyer, also question the government’s presentation of interest costs, saying it does not take inflation into account.

When prices rise, inflation can reduce the real burden of debt because the government collects more in taxes and the economy grows, giving it more room to manoeuvre financially.

- Is there a risk of crisis? -

Some, including the French government itself, have raised the spectre of a scenario reminiscent of the Greek debt crisis that rocked the eurozone more than a decade ago.

France's long-term borrowing cost jumped to its highest level since 2011 on Tuesday as the yield on 30-year government bonds topped 4.5 percent.

The yield on 10-year sovereign bonds exceeded 3.6 percent this week, the highest since March and approaching the same level as Italy, long seen as a budget laggard in Europe.

The rates, however, do not suggest that another Greek-like crisis is in the offing, said Ipek Ozkardeskaya, analyst at Swissquote Bank.

"The contagion risk remains limited. But France must find a way to tidy up its finances before gaining investors confidence back," Ozkardeskaya said.

There is still strong demand for French debt: On Thursday, the state raised 7.3 billion euros in a sale of 10-year bonds.

The European Central Bank also provides a safety net by intervening in bond markets to buy government debt, said Christopher Dembik, a strategist at Pictet investment firm.

He predicted, however, that ratings agencies will downgrade France's debt.

C.Kreuzer--VB