-

Man Utd post sixth straight annual loss despite record revenues

Man Utd post sixth straight annual loss despite record revenues

-

Australian teen Gout Gout revels in world championships debut

-

AI may boost global trade value by nearly 40%: WTO

AI may boost global trade value by nearly 40%: WTO

-

New Zealand star Miller out of Women's Rugby World Cup semi-final

-

Lyles and Gout Gout advance to world 200m semi-finals

Lyles and Gout Gout advance to world 200m semi-finals

-

S.Africa commission begins probe into alleged links between politics and crime

-

PSG women in audacious bid to sign Barca's Putellas

PSG women in audacious bid to sign Barca's Putellas

-

Jefferson-Wooden eases into world 200m semis and sets sights on being next Fraser-Pryce

-

Germany's Merz vows 'autumn of reforms' in turbulent times

Germany's Merz vows 'autumn of reforms' in turbulent times

-

EU says India's Russian oil purchases, military drills hinder closer ties

-

Gold worth 600,000 euros stolen in Paris museum heist

Gold worth 600,000 euros stolen in Paris museum heist

-

Top music body says AI firms guilty of 'wilful' copyright theft

-

Trump gets royal treatment on UK state visit

Trump gets royal treatment on UK state visit

-

Ostrich and emu ancestor could fly, scientists discover

-

Former boxing world champion Hatton 'excited for the future' before death: family

Former boxing world champion Hatton 'excited for the future' before death: family

-

After mass Nepal jailbreak, some prisoners surrender

-

Poison killed Putin critic Navalny, wife says

Poison killed Putin critic Navalny, wife says

-

Australia coach expects Cummins to play 'key part' in Ashes

-

Ben & Jerry's co-founder quits, says independence 'gone'

Ben & Jerry's co-founder quits, says independence 'gone'

-

Erasmus keeps faith with Springbok squad after record All Blacks win

-

Hong Kong leader unveils plan to boost growth with border mega-project, AI push

Hong Kong leader unveils plan to boost growth with border mega-project, AI push

-

New Zealand's historic athletics worlds a decade in the making

-

Trump to get royal treatment on UK state visit

Trump to get royal treatment on UK state visit

-

Benfica sack Lage after shock defeat, Mourinho next?

-

Israel says to open new route for Gazans fleeing embattled city

Israel says to open new route for Gazans fleeing embattled city

-

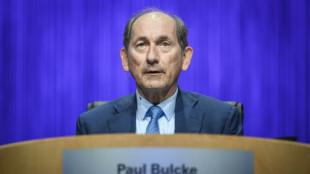

Nestle share price slips as chairman follows CEO out the door

-

German suspect in Madeleine McCann case freed from prison

German suspect in Madeleine McCann case freed from prison

-

US tennis star Townsend apologises for 'crazy' Chinese food post

-

Peru evacuates 1,600 tourists from Machu Picchu amid protest

Peru evacuates 1,600 tourists from Machu Picchu amid protest

-

Nepal mourns its dead after anti-corruption protests

-

UK inflation stable ahead of central bank rate call

UK inflation stable ahead of central bank rate call

-

India checks Maoist rebel offer of suspending armed struggle

-

Israel to open new route for Gazans fleeing besieged city

Israel to open new route for Gazans fleeing besieged city

-

Lower shipments to US, China weigh on Singapore August exports

-

Inside the hunt for the suspect in Charlie Kirk's killing

Inside the hunt for the suspect in Charlie Kirk's killing

-

Junta accused of coveting power in crucial Guinea referendum

-

TV writer Hagai Levi: boycott risks hitting Israel's critical voices

TV writer Hagai Levi: boycott risks hitting Israel's critical voices

-

Sri Lanka to ban predatory pet fish to protect ecosystems

-

'Genius' De Bruyne leads Napoli in emotional return to Man City

'Genius' De Bruyne leads Napoli in emotional return to Man City

-

World number one Sabalenka out of China Open with injury

-

Estimated 16,500 climate change deaths during Europe summer: study

Estimated 16,500 climate change deaths during Europe summer: study

-

'Fifa' successor 'FC 26' polishes the beautiful game

-

Park Chan-wook's murder comedy to open Asia's biggest film festival

Park Chan-wook's murder comedy to open Asia's biggest film festival

-

India's gaming fans eye illegal sites after gambling ban

-

EU business lobby head says China rare earths snag persists

EU business lobby head says China rare earths snag persists

-

Botox under burqas: Cosmetic surgery in vogue in Afghanistan

-

Asian stocks swing as traders bide time ahead of US rate decision

Asian stocks swing as traders bide time ahead of US rate decision

-

Australia, Papua New Guinea delay mutual defence treaty

-

PGA's 2026 opener will not be played at drought-hit Kapalua

PGA's 2026 opener will not be played at drought-hit Kapalua

-

Toucans, tortoises saved in major Brazil trafficking bust

| RYCEF | -0.06% | 15.64 | $ | |

| JRI | -1.01% | 13.92 | $ | |

| CMSC | 0.29% | 24.39 | $ | |

| RBGPF | 0% | 77.27 | $ | |

| BCC | -3.31% | 82.39 | $ | |

| GSK | -0.62% | 40.05 | $ | |

| SCS | 0.06% | 16.88 | $ | |

| NGG | -1.04% | 70.88 | $ | |

| RIO | -0.44% | 63.44 | $ | |

| BCE | -1.11% | 23.43 | $ | |

| VOD | -0.34% | 11.77 | $ | |

| CMSD | 0.04% | 24.46 | $ | |

| AZN | -0.63% | 77.56 | $ | |

| BP | 0.64% | 34.43 | $ | |

| RELX | -0.36% | 46.69 | $ | |

| BTI | -0.43% | 55.79 | $ |

US stocks finish higher as markets gyrate on Powell firing fears

Wall Street stocks finished higher Wednesday, overcoming a mid-session swoon after US President Donald Trump denied plans to fire Federal Reserve Chair Jerome Powell.

Major equity indices had moved suddenly negative following reports that a dismissal could be imminent, but they recovered quickly once Trump ruled out firing Powell -- for now.

Trump, who has bitterly attacked the Fed chair for months, said such a move was "highly unlikely" and that "I'm not talking about that" when asked if he would fire Powell.

All three major US indices finished the rollercoaster day higher, with the tech-focused Nasdaq ending at a third straight record.

"It's very clear that the market wants to go higher," said Adam Sarhan of 50 Park Investments, who described investor reaction to Trump's mixed messaging on Powell as typical of a bullish tilt.

"Every time we get bad news thrown at it, the market shrugs it off and continues to rally, including today," Sarhan said.

The Powell drama also jolted the Treasury and currency markets. The dollar retreated against the euro and other major currencies, although it recovered some of its losses after Trump denied he would fire Powell.

Besides the Fed drama, markets have also weighed Trump's myriad tariff actions amid worries about inflation. The US president has vowed numerous tariff increases on August 1 if trading partners fail to secure deals.

After the June consumer price index showed increased pricing pressure following US tariffs on Tuesday, the producer price index was unchanged on a month-on-month basis, cooling from growing 0.3 percent in May.

But the Fed's "Beige Book" survey of economic conditions, however, pointed to increasing impacts from Trump's various tariffs.

Many firms said they passed along "at least a portion of cost increases" to consumers due to tariffs, while also expressing expectations that costs will remain elevated.

Among individual companies, Goldman Sachs jumped 0.9 percent after quarterly earnings easily topped analyst estimates. CEO David Solomon predicted an uptick in dealmaking, pointing to greater "confidence level on the part of CEOs, that significant scaled industry consolidation is possible."

Ford slumped 2.9 percent after disclosing that it would account for $570 million in costs connected to fuel injectors in several models from recent years, including Bronco Sport vehicles from 2021 to 2024.

But Johnson & Johnson surged 6.2 percent as it lifted its full-year forecast after quarterly earnings topped estimates. Analysts noted that the health care company also lowered its estimate for the cost hit from tariffs.

- Key figures at around 2150 GMT -

New York - Dow: UP 0.5 percent at 44,254.78 (close)

New York - S&P 500: UP 0.3 percent at 6,263.70 (close)

New York - Nasdaq Composite: UP 0.3 percent at 20,730.49 (close)

London - FTSE 100: DOWN 0.1 percent at 8,926.55 points (close)

Paris - CAC 40: DOWN 0.6 percent at 7,722.09 (close)

Frankfurt - DAX: DOWN 0.2 percent at 24,009.38 (close)

Tokyo - Nikkei 225: FLAT at 39,663.40 (close)

Hong Kong - Hang Seng Index: DOWN 0.3 percent at 24,517.76 (close)

Shanghai - Composite: FLAT at 3,503.78 (close)

Euro/dollar: UP at $1.1641 from $1.1601 on Tuesday

Pound/dollar: UP at $1.3414 from $1.3384

Dollar/yen: DOWN at 147.80 yen from 148.88 yen

Euro/pound: UP at 86.72 pence from 86.68 pence

West Texas Intermediate: DOWN 0.2 percent at $66.38 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $68.52 per barrel

burs-jmb/jgc

S.Leonhard--VB