-

UK's Crufts dog show opens with growing global appeal

UK's Crufts dog show opens with growing global appeal

-

PSG prepare for Chelsea clash with Monaco rematch

-

Google opens AI centre as Berlin defends US tech reliance

Google opens AI centre as Berlin defends US tech reliance

-

Second Iranian ship nears Sri Lanka after submarine attack

-

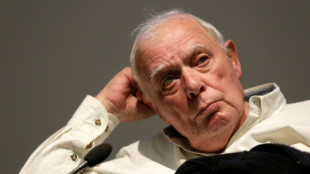

Portugal mourns acclaimed writer Antonio Lobo Antunes

Portugal mourns acclaimed writer Antonio Lobo Antunes

-

Union loses fight against Tesla at German factory

-

Wales revel in being the underdogs, says skipper Lake

Wales revel in being the underdogs, says skipper Lake

-

German school students rally against army recruitment drive

-

Wary European states pledge military aid for Cyprus, Gulf

Wary European states pledge military aid for Cyprus, Gulf

-

Liverpool injuries frustrating Slot in tough season

-

Real Madrid will 'keep fighting' in title race, vows Arbeloa

Real Madrid will 'keep fighting' in title race, vows Arbeloa

-

Australia join South Korea in quarters of Women's Asian Cup

-

Kane to miss Bayern game against Gladbach with calf knock

Kane to miss Bayern game against Gladbach with calf knock

-

Henman says Raducanu needs more physicality to rise up rankings

-

France recall fit-again Jalibert to face Scotland

France recall fit-again Jalibert to face Scotland

-

Harry Styles fans head in one direction: to star's home village

-

Syrian jailed over stabbing at Berlin Holocaust memorial

Syrian jailed over stabbing at Berlin Holocaust memorial

-

Second Iranian ship heading to Sri Lanka after submarine attack

-

Middle East war spirals as Iran hits Kurds in Iraq

Middle East war spirals as Iran hits Kurds in Iraq

-

Norris hungrier than ever to defend Formula One world title

-

Fatherhood, sleep, T20 World Cup final: Henry's whirlwind journey

Fatherhood, sleep, T20 World Cup final: Henry's whirlwind journey

-

Conservative Nigerian city sees women drive rickshaw taxis

-

T20 World Cup hero Allen says New Zealand confidence high for final

T20 World Cup hero Allen says New Zealand confidence high for final

-

The silent struggle of an anti-war woman in Russia

-

Iran hits Kurdish groups in Iraq as conflict widens

Iran hits Kurdish groups in Iraq as conflict widens

-

China sets lowest growth target in decades as consumption lags

-

Afghans rally against Pakistan and civilian casualties

Afghans rally against Pakistan and civilian casualties

-

South Korea beat Philippines 3-0 to reach women's quarter-finals

-

Mercedes' Russell not fazed by being tipped as pre-season favourite

Mercedes' Russell not fazed by being tipped as pre-season favourite

-

Australia beat Taiwan in World Baseball Classic opener

-

Underdogs Wales could hurt Irish after Scotland display: Popham

Underdogs Wales could hurt Irish after Scotland display: Popham

-

Gilgeous-Alexander rules over Knicks again in Thunder win

-

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

-

Alonso, Stroll fear 'permanent nerve damage' from vibrating Aston Martin

-

China boosts military spending with eyes on US, Taiwan

China boosts military spending with eyes on US, Taiwan

-

Seoul leads rebound across Asian stocks, oil extends gains

-

Tourism on hold as Middle East war casts uncertainty

Tourism on hold as Middle East war casts uncertainty

-

Bayern and Kane gambling with house money as Gladbach come to town

-

Turkey invests in foreign legion to deliver LA Olympics gold

Turkey invests in foreign legion to deliver LA Olympics gold

-

Galthie's France blessed with unprecedented talent: Saint-Andre

-

Voice coach to the stars says Aussie actors nail tricky accents

Voice coach to the stars says Aussie actors nail tricky accents

-

Rahm rejection of DP World Tour deal 'a shame' - McIlroy

-

Israel keeps up Lebanon strikes as ground forces advance

Israel keeps up Lebanon strikes as ground forces advance

-

China prioritises energy and diplomacy over Iran support

-

Canada PM Carney says can't rule out military participation in Iran war

Canada PM Carney says can't rule out military participation in Iran war

-

Verstappen says new Red Bull car gave him 'goosebumps'

-

Swiss to vote on creating giant 'climate fund'

Swiss to vote on creating giant 'climate fund'

-

Google to open German centre for 'AI development'

-

Winter Paralympics to start with icy blast as Ukraine lead ceremony boycott

Winter Paralympics to start with icy blast as Ukraine lead ceremony boycott

-

Sci-fi without AI: Oscar nominated 'Arco' director prefers human touch

Finance’s Role in Economic Ruin

The finance industry, often hailed as the backbone of modern economies, has a darker side that increasingly threatens global stability. Since the 2008 financial crisis, triggered by reckless speculation in mortgage-backed securities, the sector’s unchecked growth has sown seeds of destruction. In the United States alone, the financial sector’s share of GDP rose from 2.8% in 1950 to 8.4% by 2020, yet it produced no tangible goods, instead profiting from debt and risk. Critics argue this shift diverts capital from productive industries like manufacturing—down from 27% to 11% of US GDP over the same period to speculative bubbles.

The 2023 collapse of Silicon Valley Bank, fuelled by over-leveraged bets on tech stocks, cost $20 billion in bailouts and sparked a domino effect across European markets. In the UK, the 2022 mini-budget crisis, exacerbated by hedge fund short-selling of gilts, pushed borrowing costs to record highs. Economist Ann Pettifor warns, “Finance thrives on instability it creates”. With global debt at $305 trillion—three times world GDP—experts fear the industry’s pursuit of profit through complex derivatives and high-frequency trading could precipitate another crash. Is finance an engine of growth or a wrecking ball?

Why China props up Putin

Zelenskyy anti-graft gamble

Seven-Day Sanctions Showdown

Trump vs. EU: A good deal?

Japan's financial precipice

Iraq vs. Iran – The end?

France's debt is growing

Azerbaijan defies Russia

Geopolitics: Peru's balancing act

Spain defies NATO's 5% goal

Israel's Covert Nuclear Rise