-

Underdogs Wales could hurt Irish after Scotland display: Popham

Underdogs Wales could hurt Irish after Scotland display: Popham

-

Gilgeous-Alexander rules over Knicks again in Thunder win

-

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

-

Alonso, Stroll fear 'permanent nerve damage' from vibrating Aston Martin

-

China boosts military spending with eyes on US, Taiwan

China boosts military spending with eyes on US, Taiwan

-

Seoul leads rebound across Asian stocks, oil extends gains

-

Tourism on hold as Middle East war casts uncertainty

Tourism on hold as Middle East war casts uncertainty

-

Bayern and Kane gambling with house money as Gladbach come to town

-

Turkey invests in foreign legion to deliver LA Olympics gold

Turkey invests in foreign legion to deliver LA Olympics gold

-

Galthie's France blessed with unprecedented talent: Saint-Andre

-

Voice coach to the stars says Aussie actors nail tricky accents

Voice coach to the stars says Aussie actors nail tricky accents

-

Rahm rejection of DP World Tour deal 'a shame' - McIlroy

-

Israel keeps up Lebanon strikes as ground forces advance

Israel keeps up Lebanon strikes as ground forces advance

-

China prioritises energy and diplomacy over Iran support

-

Canada PM Carney says can't rule out military participation in Iran war

Canada PM Carney says can't rule out military participation in Iran war

-

Verstappen says new Red Bull car gave him 'goosebumps'

-

Swiss to vote on creating giant 'climate fund'

Swiss to vote on creating giant 'climate fund'

-

Google to open German centre for 'AI development'

-

Winter Paralympics to start with icy blast as Ukraine lead ceremony boycott

Winter Paralympics to start with icy blast as Ukraine lead ceremony boycott

-

Sci-fi without AI: Oscar nominated 'Arco' director prefers human touch

-

Ex-guerrillas battle low support in Colombia election

Ex-guerrillas battle low support in Colombia election

-

'She's coming back': Djokovic predicts Serena return

-

Hamilton vows 'no holding back' in his 20th Formula One season

Hamilton vows 'no holding back' in his 20th Formula One season

-

Two-thirds of Cuba, including Havana, hit by blackout

-

US sinks Iranian warship off Sri Lanka as war spreads

US sinks Iranian warship off Sri Lanka as war spreads

-

After oil, US moves to secure access to Venezuelan minerals

-

Arteta hits back at Brighton criticism after Arsenal boost title bid

Arteta hits back at Brighton criticism after Arsenal boost title bid

-

Carrick says 'defeat hurts' after first loss as Man Utd boss

-

Ecuador expels Cuba envoy, rest of mission

Ecuador expels Cuba envoy, rest of mission

-

Arsenal stretch lead at top of Premier League as Man City falter

-

Title race not over vows Guardiola after Man City held by Forest

Title race not over vows Guardiola after Man City held by Forest

-

Rosenior hails 'world class' Joao Pedro after hat-trick crushes Villa

-

Brazil ratifies EU-Mercosur trade deal

Brazil ratifies EU-Mercosur trade deal

-

Real Sociedad edge rivals Athletic to reach Copa del Rey final

-

Chelsea boost top four push as Joao Pedro treble routs Villa

Chelsea boost top four push as Joao Pedro treble routs Villa

-

Leverkusen sink Hamburg to keep in touch with top four

-

Love match: WTA No. 1 Sabalenka announces engagement

Love match: WTA No. 1 Sabalenka announces engagement

-

Man City falter as Premier League leaders Arsenal go seven points clear

-

Man City title bid rocked by Forest draw

Man City title bid rocked by Forest draw

-

Defending champ Draper ready to ramp up return at Indian Wells

-

Arsenal extend lead in title race after Saka sinks Brighton

Arsenal extend lead in title race after Saka sinks Brighton

-

US, European stocks rise as oil prices steady; Asian indexes tumble

-

Trump rates Iran war as '15 out of 10'

Trump rates Iran war as '15 out of 10'

-

Nepal votes in key post-uprising polls

-

US Fed warns 'economic uncertainty' weighing on consumers

US Fed warns 'economic uncertainty' weighing on consumers

-

Florida family sues Google after AI chatbot allegedly coached suicide

-

Alcaraz unbeaten run under threat from Sinner, Djokovic at Indian Wells

Alcaraz unbeaten run under threat from Sinner, Djokovic at Indian Wells

-

Iran's supreme leader gone, but opposition still at war with itself

-

Mideast war rekindles European fears over soaring gas prices

Mideast war rekindles European fears over soaring gas prices

-

'Miracle to walk' says golfer after lift shaft fall

France's debt is growing

France is facing an unprecedented financial challenge. With public debt exceeding €3.2 trillion, representing more than 110% of gross domestic product (GDP), the eurozone's second-largest economy is on a dangerous path. The budget deficit is around 5.5% of GDP and is expected to rise to over 6% this year. These figures significantly exceed EU targets, which allow a maximum deficit of 3% and a debt ratio of 60% of GDP. The financial markets are becoming increasingly nervous, and interest rates on French government bonds are climbing to record levels. What has led to this debt chaos, and how can France avoid the looming abyss?

The roots of the crisis run deep. For decades, France has had a relaxed attitude towards debt, which differs from the strict budgetary discipline of other countries such as Germany. During the coronavirus pandemic and the energy crisis resulting from the war in Ukraine, the government pumped billions into the economy to support households and businesses. Subsidies for electricity prices and generous social benefits kept the economy stable but led to a sharp rise in debt. Since 2017, when President Emmanuel Macron took office, public debt has grown by almost one trillion euros. Critics accuse the government of delaying necessary structural reforms, while the government's spending ratio is just under 60% of GDP – one of the highest in the world.

The political situation is exacerbating the crisis. Following early parliamentary elections in the summer of 2024, parliament is fragmented and majorities are difficult to form. Prime Minister François Bayrou, who has been in office since autumn 2024, has presented an ambitious austerity programme to reduce the deficit to below 3% by 2029. The measures include the abolition of two public holidays, a freeze on pensions and social benefits, the elimination of 3,000 civil service jobs and higher taxes on high incomes. However, these plans are meeting with fierce resistance. The right-wing nationalist party Rassemblement National and left-wing parties are threatening votes of no confidence, which could bring down Bayrou's government. His predecessor, Michel Barnier, was forced to resign after only three months in office when his draft budget failed.

The financial markets are watching the situation with suspicion. Interest rates on French government bonds are now exceeding those of Greece in some cases, which is an alarming sign. France spends around 50 billion euros a year on debt servicing alone, and the trend is rising. Experts warn that this figure could climb to between 80 and 90 billion euros by 2027, making investment in education, infrastructure and climate protection virtually impossible. Rating agencies such as S&P and Moody's still rate France's creditworthiness as solid, but have threatened downgrades if the deficits are not reduced.

The crisis also has European dimensions. France is systemically important for the eurozone, and an uncontrolled rise in debt could jeopardise the stability of the single currency. Unlike the Greek debt crisis in 2008, when rescue funds were used, a bailout package for France would be almost impossible to finance. The EU has launched disciplinary proceedings against France to exert pressure for budget consolidation, but political instability is hampering reforms.

What can France do? Bayrou's austerity plans are a first step, but their implementation is uncertain. Tax increases are politically sensitive, as France already has one of the highest tax rates in Europe. Spending cuts could slow economic growth, which is just over 1% this year. At the same time, experts are calling for structural reforms to increase productivity and reduce dependence on the public sector. Without clear political majorities, there is a risk that France will slide further into debt.

Citizens are already feeling the effects of the crisis. Strikes and protests against austerity measures are on the rise, and social tensions are running high. Many French people feel caught between high living costs and impending cuts. The government faces the challenge of regaining credibility without losing the trust of the markets or the population.

A way out of the debt chaos requires courage and a willingness to compromise. Bayrou has described the situation as ‘the last stop before the abyss.’ Whether France can overcome this crisis depends on whether politicians and society are prepared to make tough decisions. Time is pressing, because the financial markets will not tolerate any further delays. France is at a crossroads – between reform and risk.

Hormuz Shock Risk rising

Brazil's trade-war boom

Iran's revenge rewired

Cuba's golden Goose dies

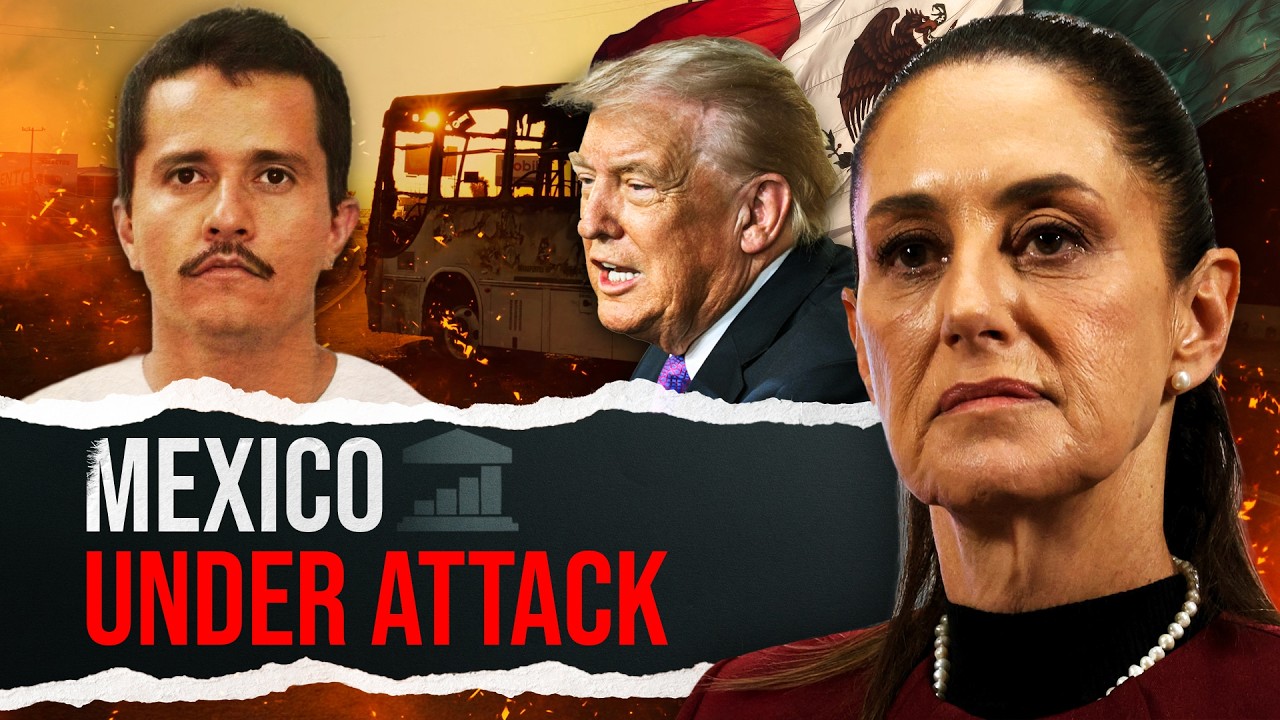

Mexico after El Mencho falls

Nicaragua on the brink?

Cuba: The Regime's last Card

Strike fears rise over Iran

U.S. Jobs stall, gdp slows

Japan’s right‑turn triumph

EU India deal gains unveiled