-

Auger-Aliassime retires in Melbourne heat with cramp

Auger-Aliassime retires in Melbourne heat with cramp

-

Melbourne home hope De Minaur 'not just making up the numbers'

-

Risking death, Indians mess with the bull at annual festival

Risking death, Indians mess with the bull at annual festival

-

Ghana's mentally ill trapped between prayer and care

-

UK, France mull social media bans for youth as debate rages

UK, France mull social media bans for youth as debate rages

-

Japan PM to call snap election seeking stronger mandate

-

Switzerland's Ruegg sprints to second Tour Down Under title

Switzerland's Ruegg sprints to second Tour Down Under title

-

China's Buddha artisans carve out a living from dying trade

-

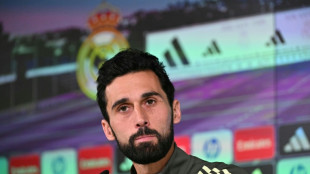

Stroking egos key for Arbeloa as Real Madrid host Monaco

Stroking egos key for Arbeloa as Real Madrid host Monaco

-

'I never felt like a world-class coach', says Jurgen Klopp

-

Ruthless Anisimova races into Australian Open round two

Ruthless Anisimova races into Australian Open round two

-

Australia rest Cummins, Hazlewood, Maxwell for Pakistan T20 series

-

South Korea, Italy agree to deepen AI, defence cooperation

South Korea, Italy agree to deepen AI, defence cooperation

-

Vietnam begins Communist Party congress to pick leaders

-

China's 2025 economic growth among slowest in decades

China's 2025 economic growth among slowest in decades

-

Gauff, Medvedev through in Australia as Djokovic begins record Slam quest

-

Who said what at 2025 Africa Cup of Nations

Who said what at 2025 Africa Cup of Nations

-

Grizzlies win in London as heckler interrupts US anthem

-

Three-time finalist Medvedev grinds into Australian Open round two

Three-time finalist Medvedev grinds into Australian Open round two

-

Auger-Aliassime retires from Melbourne first round with cramp

-

Rams fend off Bears comeback as Patriots advance in NFL playoffs

Rams fend off Bears comeback as Patriots advance in NFL playoffs

-

Thousands march in US to back Iranian anti-government protesters

-

Gotterup charges to Sony Open victory in Hawaii

Gotterup charges to Sony Open victory in Hawaii

-

Gold, silver hit records and stocks fall as Trump fans trade fears

-

Auger-Aliassime retires injured from Melbourne first round

Auger-Aliassime retires injured from Melbourne first round

-

Gauff through, Auger-Aliassime retires as Djokovic begins record quest

-

China says economy grew 5% last year, among slowest in decades

China says economy grew 5% last year, among slowest in decades

-

Young star Zheng may have to give back Australian Open prize money

-

Gauff overcomes wobble in winning start to Melbourne title bid

Gauff overcomes wobble in winning start to Melbourne title bid

-

Harry set for final courtroom battle against UK media

-

'It wasn't clean': Mother mourns son killed in US Maduro assault

'It wasn't clean': Mother mourns son killed in US Maduro assault

-

Louvre heist probe: What we know

-

Surging billionaire wealth a political threat, Oxfam warns as Davos opens

Surging billionaire wealth a political threat, Oxfam warns as Davos opens

-

Morocco fans stunned, disappointed as Senegal win Africa title

-

Senegal fuelled by 'injustice' in AFCON final triumph, says hero Gueye

Senegal fuelled by 'injustice' in AFCON final triumph, says hero Gueye

-

Morocco coach Regragui laments 'shameful' scenes in AFCON final defeat

-

Maye, Boutte wonder-catch carry Patriots past Texans

Maye, Boutte wonder-catch carry Patriots past Texans

-

Train collision in Spain kills 21, injures dozens

-

Brazilians Abner, Endrick help Lyon climb to 4th in Ligue 1

Brazilians Abner, Endrick help Lyon climb to 4th in Ligue 1

-

Barca beaten at Real Sociedad as Liga title race tightens

-

Socialist to face far-right candidate for Portugal's presidency

Socialist to face far-right candidate for Portugal's presidency

-

Senegal stun hosts Morocco to win AFCON title after final walk-off protest

-

Syria's leader agrees truce with Kurds after govt troops advance

Syria's leader agrees truce with Kurds after govt troops advance

-

Morant shines as Grizzlies top Magic in London

-

Real Sociedad end Barca winning streak to tighten Liga title race

Real Sociedad end Barca winning streak to tighten Liga title race

-

Senegal stun hosts Morocco to win AFCON title after ugly scenes mar final

-

AC Milan in touch with Inter thanks to Fullkrug's first Serie A goal

AC Milan in touch with Inter thanks to Fullkrug's first Serie A goal

-

Lyon climb to fourth in Ligue 1 with victory over Brest

-

Morant shines as Grizzles top Magic in London

Morant shines as Grizzles top Magic in London

-

Trump admin orders 1,500 troops to prepare for possible Minnesota deployment

US stocks push higher while gold, silver notch fresh records

Wall Street stocks pushed higher Monday to begin a holiday-shortened trading week, while oil prices rallied amid worsening tensions between the United States and Venezuela.

Gold and silver also struck fresh record highs, as the United States pushed on with its Venezuela oil blockade.

US market watchers are expecting a low-key week, with equity markets closing early Wednesday and all day Thursday for the Christmas holiday, a dynamic expected to result in light trading volumes.

"US stock indices continue to power ahead in what some describe as the long-awaited traditional 'Santa rally'," said Axel Rudolph, an analyst at IG trading platform.

All three major US indices finished solidly higher after spending the entire day in positive territory. The broad-based S&P 500 closed up 0.6 percent.

Interactive Brokers' Steve Sosnick predicted stocks would drift higher in the absence of major trading catalysts.

"Barring any outside shocks, this kind of pattern is likely to prevail until the end of the year," Sosnick said.

Most leading tech names advanced in New York.

Tech firms also led the rally in Asia, with South Korea's Samsung Electronics, Taiwan's TSMC and Japan's Renesas among the best performers.

Tokyo was the standout, piling on 1.8 percent thanks to a weaker yen.

Hong Kong, Shanghai, Sydney, Seoul, Singapore, Mumbai, Bangkok, Wellington, Taipei and Manila stock markets all saw healthy advances.

However, in Europe both London and Paris fell, while Frankfurt ended the day flat.

Gold, which benefits from expectations of lower US interest rates, hit a fresh record of $4,442.19, while silver also struck a new peak.

The precious metals, which are go-to assets in times of crisis, also benefited from geopolitical worries as Washington steps up its oil blockade against Venezuela and after Ukraine hit a tanker from Russia's shadow fleet in the Mediterranean.

Oil prices rose more than two percent amid the geopolitical tensions.

Forex traders are keeping tabs on Tokyo after Japan's top currency official said he was concerned about the yen's recent weakness, which came after the central bank hiked interest rates to a 30-year high on Friday.

The comments stoked speculation that officials could intervene in currency markets to support the yen, which fell more than one percent against the dollar Friday after bank boss Kazuo Ueda chose not to signal more rate increases early in the new year.

Meanwhile, Oracle tech tycoon Larry Ellison offered a $40.4 billion personal guarantee to back Paramount's hostile bid for Warner Bros. Discovery, deepening a bidding war with Netflix.

Shares in Paramount jumped 4.3 percent and those in Warner Bros. Discovery rose 3.5 percent. Shares in Netflix slid 1.2 percent.

- Key figures at around 2115 GMT -

New York - Dow: UP 0.5 percent at 48,362.68 (close)

New York - S&P 500: UP 0.6 percent at 6,878.49 (close)

New York - Nasdaq Composite: UP 0.5 percent at 23,428.83 (close)

London - FTSE 100: DOWN 0.3 percent at 9,865.97 (close)

Paris - CAC 40: DOWN 0.4 percent at 8,121.07 (close)

Frankfurt - DAX: FLAT at 24,283.97 (close)

Tokyo - Nikkei 225: UP 1.8 percent at 50,402.39 (close)

Hong Kong - Hang Seng Index: UP 0.4 percent at 25,801.77 (close)

Shanghai - Composite: UP 0.7 percent at 3,917.36 (close)

Dollar/yen: DOWN at 156.99 yen from 157.75 yen on Friday

Euro/dollar: UP at $1.1756 from $1.1710

Pound/dollar: UP at $1.3458 from $1.3379

Euro/pound: DOWN at 87.35 pence from 87.52 pence

West Texas Intermediate: UP 2.6 percent at $58.01 per barrel

Brent North Sea Crude: UP 2.7 percent at $62.07 per barrel

burs-jmb/msp

H.Weber--VB