-

Tarnished image and cheating claims in Malaysia football scandal

Tarnished image and cheating claims in Malaysia football scandal

-

Family affair as Rinderknech joins Vacherot in Shanghai quarters

-

New documentary shows life in Gaza for AFP journalists

New documentary shows life in Gaza for AFP journalists

-

Tennis stars suffer, wilt and quit in 'brutal' China heat

-

Wildlife flee as floods swamp Indian parks

Wildlife flee as floods swamp Indian parks

-

Record flooding hits Vietnam city, eight killed in north

-

Battling cancer made Vendee Globe win 'more complicated', says skipper Dalin

Battling cancer made Vendee Globe win 'more complicated', says skipper Dalin

-

England, Portugal, Norway closing in on 2026 World Cup

-

Child protection vs privacy: decision time for EU

Child protection vs privacy: decision time for EU

-

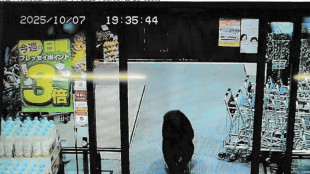

Bear injures two in Japan supermarket, man killed in separate attack

-

In Simandou mountains, Guinea prepares to cash in on iron ore

In Simandou mountains, Guinea prepares to cash in on iron ore

-

Morikawa says not to blame for 'rude' Ryder Cup fans

-

Far right harvests votes as climate rules roil rural Spain

Far right harvests votes as climate rules roil rural Spain

-

'Return to elegance': highlights from Paris Fashion Week

-

Britain's storied Conservative party faces uncertain future

Britain's storied Conservative party faces uncertain future

-

New Zealand's seas warming faster than global average: report

-

Snakebite surge as Bangladesh hit by record rains

Snakebite surge as Bangladesh hit by record rains

-

Yankees deny Blue Jays playoff sweep as Mariners beat Tigers

-

Australia police foil 'kill team' gang hit near daycare centre

Australia police foil 'kill team' gang hit near daycare centre

-

US, Qatar, Turkey to join third day of Gaza peace talks in Egypt

-

Gold tops $4,000 for first time as traders pile into safe haven

Gold tops $4,000 for first time as traders pile into safe haven

-

Indian garment exporters reel under US tariffs

-

NBA back in China after six-year absence sparked by democracy tweet

NBA back in China after six-year absence sparked by democracy tweet

-

Energy storage and new materials eyed for chemistry Nobel

-

Trump unlikely to win Nobel Peace Prize, but who will?

Trump unlikely to win Nobel Peace Prize, but who will?

-

Qatar, Turkey to join third day of Gaza peace talks in Egypt

-

Study finds women have higher genetic risk of depression

Study finds women have higher genetic risk of depression

-

Dolly Parton's sister calls for fan prayers over health issues

-

On Trump's orders, 200 troops from Texas arrive in Illinois

On Trump's orders, 200 troops from Texas arrive in Illinois

-

Two bodies found, two missing after Madrid building collapse

-

Panthers raise banner as NHL three-peat bid opens with win

Panthers raise banner as NHL three-peat bid opens with win

-

Nobel physics laureate says Trump cuts will 'cripple' US research

-

UFC star McGregor suspended 18 months over missed drug tests

UFC star McGregor suspended 18 months over missed drug tests

-

Trump talks up Canada trade deal chances with 'world-class' Carney

-

Ecuador president unharmed after apparent gun attack on motorcade

Ecuador president unharmed after apparent gun attack on motorcade

-

Lyon exact revenge on Arsenal, Barca thrash Bayern in women's Champions League

-

Trump says 'real chance' to end Gaza war as Israel marks attacks anniversary

Trump says 'real chance' to end Gaza war as Israel marks attacks anniversary

-

Gerrard brands failed England generation 'egotistical losers'

-

NFL fines Cowboys owner Jones $250,000 over gesture to fans

NFL fines Cowboys owner Jones $250,000 over gesture to fans

-

Bengals sign veteran quarterback Flacco after Burrow injury

-

New prime minister inspires little hope in protest-hit Madagascar

New prime minister inspires little hope in protest-hit Madagascar

-

Is Trump planning something big against Venezuela's Maduro?

-

EU wants to crack down on 'conversion therapy'

EU wants to crack down on 'conversion therapy'

-

French sex offender Pelicot says man who abused ex-wife knew she was asleep

-

Trump says 'real chance' to end Gaza war as Israel marks Oct 7 anniversary

Trump says 'real chance' to end Gaza war as Israel marks Oct 7 anniversary

-

UK prosecutors to appeal dropped 'terrorism' case against Kneecap rapper

-

Spain, Inter Miami star Alba retiring at end of season

Spain, Inter Miami star Alba retiring at end of season

-

EU targets foreign steel to rescue struggling sector

-

Trump talks up Canada deal chances with visiting PM

Trump talks up Canada deal chances with visiting PM

-

Knight rides her luck as England survive Bangladesh scare

Stocks mostly rebound on US interest rate cut bets

Most stock markets bounced on Monday on hopes of US interest rate cuts after weak jobs figures raised concerns about the world's top economy.

The broad gains followed a Wall Street sell-off on Friday in reaction to the jobs data and news that dozens of countries would be hit with US tariffs ranging from 10 to 41 percent.

Major US indices spent the entire day in positive territory, with the broad-based S&P 500 finishing up 1.5 percent.

"Traders and investors have made a lot of money by deciding that tariffs won't matter, and they're not going to change that now," said Steve Sosnick of Interactive Brokers.

"I think the bias that most of them have now is 'Let's not think about tariffs as being a problem until they actually prove that they are.'"

European indices mostly started the week on the front foot, with Paris and Frankfurt both ending the day up more than one percent.

"Investors seem to be taking an optimistic view... betting on an increased likelihood of further monetary easing by the Fed after Friday's employment figures," said John Plassard, head of investment strategy at Cite Gestion Private Bank.

CME's FedWatch tool now has investors seeing a 94.1 percent chance of the Fed making a quarter-point cut in interest rates at the next meeting in September.

Plassard noted, however, that "uncertainty reigns" as US President Donald Trump's latest round of tariffs are set to take effect on Thursday.

Switzerland's stock market dropped around two percent at Monday's open, its first session as it returned from a holiday after a tough 39-percent US tariff rate was announced.

But the index later pared most of its losses on hopes the Swiss government, which announced it would make an improved offer to Washington, could negotiate a reduction in the levy, which is steeper than that imposed on the European Union and Britain.

London advanced, lifted by banking stocks after the sector was granted a reprieve from the worst of feared compensation claims over controversial car loans dating back to 2007.

Lloyds Banking Group jumped nine percent while Close Brothers, listed on the FTSE 250, soared more than 23 percent.

Asian investors started the week mixed, with Hong Kong and Shanghai advancing while Tokyo fell.

Stocks had struggled Friday as US jobs growth fell short of expectations in July, with revised data showing the weakest hiring since the Covid-19 pandemic -- fueling concerns that Trump's tariffs are starting to bite.

Trump responded to the data by firing the commissioner of labor statistics, accusing her of manipulating employment data for political reasons.

Markets reacted more favorably on Monday, as the hiring slowdown boosted hopes of Fed rate cuts to support the economy.

Elsewhere, oil prices fell more than two percent after a sharp output increase by eight OPEC+ countries, with markets anticipating abundant supply.

However, they later trimmed their losses after Trump threatened to hike tariffs on Indian goods further over its purchases of Russian oil.

- Key figures at around 2050 GMT -

New York - Dow: UP 1.3 percent at 44,173.64 (close)

New York - S&P 500: UP 1.5 percent at 6,329.94 (close)

New York - Nasdaq Composite: UP 2.0 percent at 21,053.58 (close)

London - FTSE 100: UP 0.7 percent at 9,128.30 (close)

Paris - CAC 40: UP 1.1 percent at 7,632.01 (close)

Frankfurt - DAX: UP 1.4 percent at 23,757.69 (close)

Tokyo - Nikkei 225: DOWN 1.3 percent at 40,290.70 (close)

Hong Kong - Hang Seng Index: UP 0.9 percent at 24,733.45 (close)

Shanghai - Composite: UP 0.9 percent at 3,583.31 (close)

Dollar/yen: DOWN at 147.08 yen from 147.40 yen on Friday

Euro/dollar: DOWN at $1.1573 from $1.1587

Pound/dollar: UP at $1.3285 from $1.3279

Euro/pound: DOWN at 87.11 pence from 87.25 pence

West Texas Intermediate: DOWN 1.6 percent at $66.29 per barrel

Brent North Sea Crude: DOWN 1.3 percent at $68.76 per barrel

burs-jmb/sst

C.Stoecklin--VB