-

Serie A chief blasts Rabiot's criticism of Milan match in Australia

Serie A chief blasts Rabiot's criticism of Milan match in Australia

-

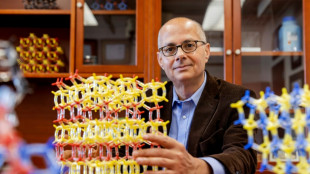

From refugee to Nobel: Yaghi hails science's 'equalising force'

-

De Minaur, Auger-Aliassime through to Shanghai quarter-finals

De Minaur, Auger-Aliassime through to Shanghai quarter-finals

-

Canal Istanbul stirs fear and uncertainty in nearby villages

-

Root backs England to end Ashes drought in Australia

Root backs England to end Ashes drought in Australia

-

British PM Starmer hails India opportunities after trade deal

-

England captain Kane could miss Wales friendly

England captain Kane could miss Wales friendly

-

Tennis increases support for players under corruption, doping investigation

-

Russia says momentum from Putin-Trump meeting 'gone'

Russia says momentum from Putin-Trump meeting 'gone'

-

EU wants key sectors to use made-in-Europe AI

-

De Minaur, Rinderknech through to Shanghai quarter-finals

De Minaur, Rinderknech through to Shanghai quarter-finals

-

Gisele Pelicot says 'never' gave consent to accused rapist

-

Thousands stranded as record floods submerge Vietnam streets

Thousands stranded as record floods submerge Vietnam streets

-

Sabalenka battles to keep Wuhan record alive, Pegula survives marathon

-

Trio wins chemistry Nobel for new form of molecular architecture

Trio wins chemistry Nobel for new form of molecular architecture

-

Tarnished image and cheating claims in Malaysia football scandal

-

Family affair as Rinderknech joins Vacherot in Shanghai quarters

Family affair as Rinderknech joins Vacherot in Shanghai quarters

-

New documentary shows life in Gaza for AFP journalists

-

Tennis stars suffer, wilt and quit in 'brutal' China heat

Tennis stars suffer, wilt and quit in 'brutal' China heat

-

Wildlife flee as floods swamp Indian parks

-

Record flooding hits Vietnam city, eight killed in north

Record flooding hits Vietnam city, eight killed in north

-

Battling cancer made Vendee Globe win 'more complicated', says skipper Dalin

-

England, Portugal, Norway closing in on 2026 World Cup

England, Portugal, Norway closing in on 2026 World Cup

-

Child protection vs privacy: decision time for EU

-

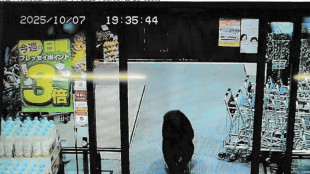

Bear injures two in Japan supermarket, man killed in separate attack

Bear injures two in Japan supermarket, man killed in separate attack

-

In Simandou mountains, Guinea prepares to cash in on iron ore

-

Morikawa says not to blame for 'rude' Ryder Cup fans

Morikawa says not to blame for 'rude' Ryder Cup fans

-

Far right harvests votes as climate rules roil rural Spain

-

'Return to elegance': highlights from Paris Fashion Week

'Return to elegance': highlights from Paris Fashion Week

-

Britain's storied Conservative party faces uncertain future

-

New Zealand's seas warming faster than global average: report

New Zealand's seas warming faster than global average: report

-

Snakebite surge as Bangladesh hit by record rains

-

Yankees deny Blue Jays playoff sweep as Mariners beat Tigers

Yankees deny Blue Jays playoff sweep as Mariners beat Tigers

-

Australia police foil 'kill team' gang hit near daycare centre

-

US, Qatar, Turkey to join third day of Gaza peace talks in Egypt

US, Qatar, Turkey to join third day of Gaza peace talks in Egypt

-

Gold tops $4,000 for first time as traders pile into safe haven

-

Indian garment exporters reel under US tariffs

Indian garment exporters reel under US tariffs

-

NBA back in China after six-year absence sparked by democracy tweet

-

Energy storage and new materials eyed for chemistry Nobel

Energy storage and new materials eyed for chemistry Nobel

-

Trump unlikely to win Nobel Peace Prize, but who will?

-

Qatar, Turkey to join third day of Gaza peace talks in Egypt

Qatar, Turkey to join third day of Gaza peace talks in Egypt

-

Study finds women have higher genetic risk of depression

-

Dolly Parton's sister calls for fan prayers over health issues

Dolly Parton's sister calls for fan prayers over health issues

-

On Trump's orders, 200 troops from Texas arrive in Illinois

-

Two bodies found, two missing after Madrid building collapse

Two bodies found, two missing after Madrid building collapse

-

Panthers raise banner as NHL three-peat bid opens with win

-

Nobel physics laureate says Trump cuts will 'cripple' US research

Nobel physics laureate says Trump cuts will 'cripple' US research

-

UFC star McGregor suspended 18 months over missed drug tests

-

Trump talks up Canada trade deal chances with 'world-class' Carney

Trump talks up Canada trade deal chances with 'world-class' Carney

-

Ecuador president unharmed after apparent gun attack on motorcade

AI gives stocks a lift, dollar mixed tracking Fed, tariffs

Investor enthusiasm for artificial intelligence helped lift Wall Street Thursday as Microsoft surfed a tech wave to pass $4 trillion in market value even as traders weighed Federal Reserve rates caution.

US tariffs and a Fed decision Wednesday to hold rates steady as inflation stays stubbornly high in the United States could not dampen down the bulls piling into tech.

Shares of Microsoft vaulted around five percent after it reported $27.2 billion in quarterly profits as it touted massive investments in AI, joining fellow AI star Nvidia in leaping the $4 trillion value barrier.

About 25 minutes into trading, the tech-rich Nasdaq Composite Index was up 1.3 percent at 21,396.04 while the S&P 500 and the Dow touted more modest gains with both the S&P 500 and Nasdaq above their all-time closing highs.

Europe was unable to match its US peers -- London barely in the green and eurozone indices Paris and Frankfurt slightly off two hours from the close.

Ahead of US jobs data Friday, focus was on company earnings, with Microsoft and Facebook owner Meta posting better-than-expected earnings, the latter seeing its shares soar 12 percent.

With US rates on pause for now, "often, that might have been enough to send traders scurrying for cover -- but strong earnings results from some of the leading US tech companies have kept sentiment strong, allowing markets to make new gains this morning," said Steve Clayton, head of equity funds at Hargreaves Lansdown.

The latest developments on the tariffs front saw US President Donald Trump announce a deal that sees 15 percent levies on South Korean goods and a commitment from Seoul to invest $350 billion in the United States.

The president Thursday said his sweeping tariffs were making the US "great & rich again".

Earlier, he revealed India would face 25-percent tolls, coupled with an unspecified penalty over New Delhi's purchases of Russian weapons and energy.

Trump has also signed an executive order implementing an additional tax on Brazilian products, as he lambasts what he calls Brazil's "witch hunt" against his far-right ally, former president Jair Bolsonaro, on coup charges.

Traders are keeping tabs on talks with other countries that are yet to sign deals with Washington ahead of Trump's self-imposed Friday deadline.

After a broadly negative session Wednesday on Wall Street, Asian markets struggled.

Hong Kong, Shanghai, Sydney, Singapore, Seoul, Manila, Wellington and Jakarta closed lower, while Tokyo, Taipei, Mumbai and Bangkok climbed.

The yen retreated against the dollar after the Bank of Japan decided against hiking interest rates, while lifting economic growth and inflation costs.

- Key figures at around 1345 GMT -

New York - Dow: UP 0.1 percent at 44,523.46 points

New York - S&P 500: UP 0.7 percent at 6,410.77

New York - Nasdaq: UP 1.3 percent at 21,396.04

London - FTSE 100: UP 0.2 percent at 9,152.69

Paris - CAC 40: DOWN 0.6 percent at 7,811.91

Frankfurt - DAX: DOWN 0.2 percent at 24,204.32

Tokyo - Nikkei 225: UP 1.0 percent at 41,069.82 (close)

Hong Kong - Hang Seng Index: DOWN 1.6 percent at 24,773.33 (close)

Shanghai - Composite: DOWN 1.2 percent at 3,573.21 (close)

Euro/dollar: UP at $1.1414 from $1.1409 on Wednesday

Pound/dollar: DOWN at $1.3197 from $1.3239

Dollar/yen: UP at 150.46 yen from 149.50 yen

Euro/pound: UP at 86.49 pence from 86.15 pence

West Texas Intermediate: DOWN 0.5 percent at $69.67 per barrel

Brent North Sea Crude: DOWN 0.6 percent at $72.05

burs-bcp/ajb/cw/kjm

M.Schneider--VB