-

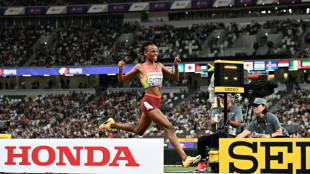

Kenya's Chebet wins 10,000m gold to set up tilt at world double

Kenya's Chebet wins 10,000m gold to set up tilt at world double

-

Lyles, Thompson and Tebogo cruise through world 100m heats

-

Vuelta final stage shortened amid protest fears

Vuelta final stage shortened amid protest fears

-

Collignon stuns De Minaur as Belgium take Davis Cup lead over Australia

-

Nepal returns to calm as first woman PM takes charge, visits wounded

Nepal returns to calm as first woman PM takes charge, visits wounded

-

Olympic champion Alfred eases through 100m heats at Tokyo worlds

-

Winning coach Erasmus 'emotional' at death of former Springboks

Winning coach Erasmus 'emotional' at death of former Springboks

-

Barca's Flick blasts Spain over Yamal injury issue

-

Rampant Springboks inflict record 43-10 defeat to humble All Blacks

Rampant Springboks inflict record 43-10 defeat to humble All Blacks

-

Italy's Bezzecchi claims San Marino MotoGP pole as Marquez brothers denied

-

Rampant South Africa inflict record 43-10 defeat on All Blacks

Rampant South Africa inflict record 43-10 defeat on All Blacks

-

Collignon stuns De Minaur as Belgium take 2-0 Davis Cup lead over Australia

-

Mourning Nepalis hope protest deaths will bring change

Mourning Nepalis hope protest deaths will bring change

-

Carreras boots Argentina to nervy 28-26 win over Australia

-

Nepal returns to calm as first woman PM takes charge

Nepal returns to calm as first woman PM takes charge

-

How mowing less lets flowers bloom along Austria's 'Green Belt'

-

Too hot to study, say Italian teachers as school (finally) resumes

Too hot to study, say Italian teachers as school (finally) resumes

-

Alvarez, Crawford both scale 167.5 pounds for blockbuster bout

-

Tokyo fans savour athletics worlds four years after Olympic lockout

Tokyo fans savour athletics worlds four years after Olympic lockout

-

Akram tells Pakistan, India to forget noise and 'enjoy' Asia Cup clash

-

Kicillof, the Argentine governor on a mission to stop Milei

Kicillof, the Argentine governor on a mission to stop Milei

-

Something to get your teeth into: 'Jaws' exhibit marks 50 years

-

Germany, France, Argentina, Austria on brink of Davis Cup finals

Germany, France, Argentina, Austria on brink of Davis Cup finals

-

War with Russia weighs heavily on Ukrainian medal hope Doroshchuk

-

Suspect in Charlie Kirk killing caught, widow vows to carry on fight

Suspect in Charlie Kirk killing caught, widow vows to carry on fight

-

Dunfee and Perez claim opening world golds in Tokyo

-

Ben Griffin leads PGA Procore Championship in Ryder Cup tune-up

Ben Griffin leads PGA Procore Championship in Ryder Cup tune-up

-

'We're more than our pain': Miss Palestine to compete on global stage

-

Ingebrigtsen seeks elusive 1500m world gold after injury-plagued season

Ingebrigtsen seeks elusive 1500m world gold after injury-plagued season

-

Thailand's Chanettee leads by two at LPGA Queen City event

-

Dolphins' Hill says focus is on football amid domestic violence allegations

Dolphins' Hill says focus is on football amid domestic violence allegations

-

Nigerian chef aims for rice hotpot record

-

What next for Brazil after Bolsonaro's conviction?

What next for Brazil after Bolsonaro's conviction?

-

Fitch downgrades France's credit rating in new debt battle blow

-

Fifty reported dead in Gaza as Israel steps up attacks on main city

Fifty reported dead in Gaza as Israel steps up attacks on main city

-

Greenwood among scorers as Marseille cruise to four-goal victory

-

Rodgers calls out 'cowardly' leak amid Celtic civil war

Rodgers calls out 'cowardly' leak amid Celtic civil war

-

Frenchman Fourmaux grabs Chile lead as Tanak breaks down

-

Germany, France, Argentina and Austria on brink of Davis Cup finals

Germany, France, Argentina and Austria on brink of Davis Cup finals

-

New coach sees nine-man Leverkusen beat Frankfurt

-

US moves to scrap emissions reporting by polluters

US moves to scrap emissions reporting by polluters

-

Matsuyama leads Ryder Cup trio at PGA Championship

-

US to stop collecting emissions data from polluters

US to stop collecting emissions data from polluters

-

Pope Leo thanks Lampedusans for welcoming migrants

-

Moscow says Ukraine peace talks frozen as NATO bolsters defences

Moscow says Ukraine peace talks frozen as NATO bolsters defences

-

Salt's rapid ton powers England to record 304-2 against South Africa in 2nd T20

-

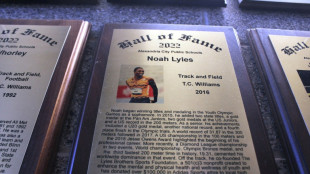

Noah Lyles: from timid school student to track's showman

Noah Lyles: from timid school student to track's showman

-

Boeing defense workers reject deal to end strike

-

Germany, Argentina close in on Davis Cup finals

Germany, Argentina close in on Davis Cup finals

-

Alvarez, Crawford both tip scales at 167.5 pounds for title bout

Most markets rise, euro boosted after EU strikes US trade deal

Most stock markets rose with the euro Monday after the European Union and United States hammered out the "biggest-ever" deal to avert a potentially damaging trade war.

News of the deal, announced by Donald Trump and European Commission head Ursula von der Leyen on Sunday, followed US agreements last week, including with Japan, and comes ahead of a new round of China-US talks.

Investors were also gearing up for a busy week of data, central bank decisions and earnings from some of the world's biggest companies.

Trump and von der Leyen announced at his golf resort in Scotland that a baseline tariff of 15 percent would be levied on EU exports to the United States.

"We've reached a deal. It's a good deal for everybody. This is probably the biggest deal ever reached in any capacity," Trump said, adding that the levies would apply across the board, including for Europe's crucial automobile sector, pharmaceuticals and semiconductors.

Brussels also agreed to purchase "$750 billion worth of energy" from the United States, as well as make $600 billion in additional investments.

"It's a good deal," von der Leyen said. "It will bring stability. It will bring predictability. That's very important for our businesses on both sides of the Atlantic."

The news boosted the euro, which jumped to $1.1779 from Friday's close of $1.1749.

And equities built on their recent rally, fanned by relief that countries were reaching deals with Washington.

Hong Kong led winners, jumping around one percent, with Shanghai, Sydney, Seoul, Wellington, Taipei and Jakarta also up, along with European and US futures.

Tokyo fell for a second day, having soared about five percent on Wednesday and Thursday in reaction to Japan's US deal. Singapore and Seoul were also lower.

The broad gains came after another record day for the S&P 500 and Nasdaq on Wall Street.

"The news flow from both the extension with China and the agreement with the EU is clearly market-friendly, and should put further upside potential into the euro... and should also put renewed upside into EU equities," said Chris Weston at Pepperstone.

Traders are gearing up for a packed week, with a delegation including US Treasury Secretary Scott Bessent holding fresh trade talks with a Chinese team headed by Vice Premier He Lifeng in Stockholm.

While both countries in April imposed tariffs on each other's products that reached triple-digit levels, US duties this year have temporarily been lowered to 30 percent and China's countermeasures slashed to 10 percent.

The 90-day truce, instituted after talks in Geneva in May, is set to expire on August 12.

Also on the agenda are earnings from tech titans Amazon, Apple, Meta Microsoft, as well as data on US economic growth and jobs.

The Federal Reserve's latest policy meeting is expected to conclude with officials standing pat on interest rates, though investors are keen to see what their views are on the outlook for the rest of the year in light of Trump's tariffs and recent trade deals.

The Bank of Japan is also forecast to hold off on any big moves on borrowing costs.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 0.7 percent at 41,148.07 (break)

Hong Kong - Hang Seng Index: UP 1.0 percent at 25,631.28

Shanghai - Composite: UP 0.3 percent at 3,602.97

Dollar/yen: UP at 147.74 yen from 147.68 yen on Friday

Euro/dollar: UP at $1.1755 from $1.1738

Pound/dollar: UP at $1.3436 from $1.3431

Euro/pound: UP at 87.48 pence from 87.40 pence

West Texas Intermediate: UP 0.5 percent at $65.48 per barrel

Brent North Sea Crude: UP 0.5 percent at $68.80 per barrel

New York - Dow: UP 0.5 percent at 44,901.92 (close)

London - FTSE 100: DOWN 0.2 percent at 9,120.31 (close)

A.Zbinden--VB