-

'I wanted to die': survivors recount Mozambique flood terror

'I wanted to die': survivors recount Mozambique flood terror

-

Trump issues fierce warning to Minneapolis mayor over immigration

-

Anglican church's first female leader confirmed at London service

Anglican church's first female leader confirmed at London service

-

Germany cuts growth forecast as recovery slower than hoped

-

Amazon to cut 16,000 jobs worldwide

Amazon to cut 16,000 jobs worldwide

-

One dead, five injured in clashes between Colombia football fans

-

Dollar halts descent, gold keeps climbing before Fed update

Dollar halts descent, gold keeps climbing before Fed update

-

US YouTuber IShowSpeed gains Ghanaian nationality at end of Africa tour

-

Sweden plans to ban mobile phones in schools

Sweden plans to ban mobile phones in schools

-

Turkey football club faces probe over braids clip backing Syrian Kurds

-

Deutsche Bank offices searched in money laundering probe

Deutsche Bank offices searched in money laundering probe

-

US embassy angers Danish veterans by removing flags

-

Netherlands 'insufficiently' protects Caribbean island from climate change: court

Netherlands 'insufficiently' protects Caribbean island from climate change: court

-

Fury confirms April comeback fight against Makhmudov

-

Susan Sarandon to be honoured at Spain's top film awards

Susan Sarandon to be honoured at Spain's top film awards

-

Trump says 'time running out' as Iran rejects talks amid 'threats'

-

Spain eyes full service on train tragedy line in 10 days

Spain eyes full service on train tragedy line in 10 days

-

Greenland dispute 'strategic wake-up call for all of Europe,' says Macron

-

'Intimidation and coercion': Iran pressuring families of killed protesters

'Intimidation and coercion': Iran pressuring families of killed protesters

-

Europe urged to 'step up' on defence as Trump upends ties

-

Sinner hails 'inspiration' Djokovic ahead of Australian Open blockbuster

Sinner hails 'inspiration' Djokovic ahead of Australian Open blockbuster

-

Dollar rebounds while gold climbs again before Fed update

-

Aki a doubt for Ireland's Six Nations opener over disciplinary issue

Aki a doubt for Ireland's Six Nations opener over disciplinary issue

-

West Ham sign Fulham winger Traore

-

Relentless Sinner sets up Australian Open blockbuster with Djokovic

Relentless Sinner sets up Australian Open blockbuster with Djokovic

-

Israel prepares to bury last Gaza hostage

-

Iran rejects talks with US amid military 'threats'

Iran rejects talks with US amid military 'threats'

-

Heart attack ends iconic French prop Atonio's career

-

SKorean chip giant SK hynix posts record operating profit for 2025

SKorean chip giant SK hynix posts record operating profit for 2025

-

Greenland's elite dogsled unit patrols desolate, icy Arctic

-

Dutch tech giant ASML posts bumper profits, cuts jobs

Dutch tech giant ASML posts bumper profits, cuts jobs

-

Musetti rues 'really painful' retirement after schooling Djokovic

-

Russian volcano puts on display in latest eruption

Russian volcano puts on display in latest eruption

-

Thailand uses contraceptive vaccine to limit wild elephant births

-

Djokovic gets lucky to join Pegula, Rybakina in Melbourne semi-finals

Djokovic gets lucky to join Pegula, Rybakina in Melbourne semi-finals

-

Trump says to 'de-escalate' Minneapolis, as aide questions agents' 'protocol'

-

'Extremely lucky' Djokovic into Melbourne semi-finals as Musetti retires

'Extremely lucky' Djokovic into Melbourne semi-finals as Musetti retires

-

'Animals in a zoo': Players back Gauff call for more privacy

-

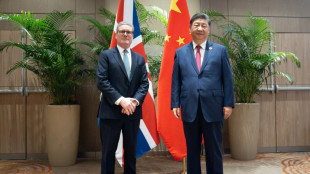

Starmer heads to China to defend 'pragmatic' partnership

Starmer heads to China to defend 'pragmatic' partnership

-

Uganda's Quidditch players with global dreams

-

'Hard to survive': Kyiv's elderly shiver after Russian attacks on power and heat

'Hard to survive': Kyiv's elderly shiver after Russian attacks on power and heat

-

South Korea's ex-first lady jailed for 20 months for taking bribes

-

Polish migrants return home to a changed country

Polish migrants return home to a changed country

-

Dutch tech giant ASML posts bumper profits, eyes bright AI future

-

South Korea's ex-first lady jailed for 20 months for corruption

South Korea's ex-first lady jailed for 20 months for corruption

-

Minnesota congresswoman unbowed after attacked with liquid

-

Backlash as Australia kills dingoes after backpacker death

Backlash as Australia kills dingoes after backpacker death

-

Brazil declares acai a national fruit to ward off 'biopiracy'

-

Anisimova 'loses her mind' after Melbourne quarter-final exit

Anisimova 'loses her mind' after Melbourne quarter-final exit

-

Home hope Goggia on medal mission at Milan-Cortina Winter Olympics

Public or private? Funding debate splits reeling aid sector

As cuts by rich donors decimate aid budgets for the world's most vulnerable, private financing has been touted as the sector's saviour -- but not everyone is convinced.

The United Nations puts the annual funding deficit for aid at more than $4 trillion, with chilling consequences for health, education and humanitarian programmes in the poorest countries.

The yawning gap left by traditional aid sources such as governments, development banks and philanthropy thrusts private investment into the spotlight at a UN aid conference in Spain this week.

"We need the private sector and the jobs it creates because jobs are the surest way to put a nail in the coffin of poverty," World Bank chief Ajay Banga told attendees at the event in Seville.

Banga said the private sector could succeed with the "right conditions", including infrastructure, transparent laws and institutions, and an environment favourable for business.

The document adopted in Seville, which will frame future development cooperation, pledges to generate funds "from all sources, recognising the comparative advantages of public and private finance".

Private resources appeal to developing nations as "a more sustainable source of finance that doesn't lead to debt spirals and dependency on external resources", said Laura Carvalho, an economics professor at the University of Sao Paulo.

But they have so far failed to deliver at the scale required and are "perceived as a way to deviate from commitment" for rich nations, with many pledges becoming "fictional", she told AFP.

The UN Development Programme said tapping into potentially trillions of dollars of private capital had a role to play for development finance alongside traditional external aid and increased domestic resources, notably taxation.

"We have a lot of private capital... not all aligned to national development priorities. They are primarily motivated by profit," the agency's head Haoliang Xu told AFP.

According to a report by the Organisation for Economic Cooperation and Development (OECD), only 12 percent of private finance mobilised from 2018 to 2020 went to projects in low-income countries.

These are typically viewed as riskier investments with costlier interest on their loans, compounding their debt burden.

- 'Investor whitewash' -

Campaigners have criticised rich countries for pushing private finance over public sources of aid, citing a lack of accountability and debt issues.

International charity Oxfam said private creditors accounted for more than half of the debt of low- and middle-income countries, exacerbating the crisis "with their refusal to negotiate and their punitive terms".

"Wealthy Global North investors' ambitions have been whitewashed under the guise of financing development", whereas there was "no substitute" for foreign aid, Oxfam wrote in a statement.

For Rebecca Thissen, global advocacy lead at Climate Action Network International, rich countries must stop "clinging to the false hope that the private sector alone can fill the gap" in climate finance.

Grant-based public finance is instead necessary for helping poor nations respond to the devastating impact of fiercer storms, floods and droughts, which set back their development and for which they are least responsible, she said.

"Public international finance remains indispensable," Kenya's President William Ruto said Monday, urging the United States -- which snubbed the Seville talks -- to reconsider its disengagement from foreign aid under President Donald Trump.

With the OECD forecasting that official development assistance could fall by up to 17 percent this year, the focus is also on increasing public resources in low-income nations.

The language on this topic, which highlights taxation, national development banks and clamping down on tax evasion, is a "big win" in the Seville document, said Carvalho, who is also director of economic and climate prosperity at Open Society Foundations.

Even before the recent aid cuts, net flows of resources were moving from the Global South to the North through illicit financial networks, tax evasion, multinationals and debt servicing, she said.

"There is an opportunity to reform the system in a way that helps countries raise their own resources, as opposed to relying on external loans," Carvalho said.

L.Maurer--VB