-

Ghana moves to rewrite mining laws for bigger share of gold revenues

Ghana moves to rewrite mining laws for bigger share of gold revenues

-

South Africa drops 'Melania' just ahead of release

-

Senegal coach Thiaw banned, fined after AFCON final chaos

Senegal coach Thiaw banned, fined after AFCON final chaos

-

Russia's sanctioned oil firm Lukoil to sell foreign assets to Carlyle

-

Australian Open chief Tiley says 'fine line' after privacy complaints

Australian Open chief Tiley says 'fine line' after privacy complaints

-

Trump-era trade stress leads Western powers to China

-

Gold soars towards $5,600 as Trump rattles sabre over Iran

Gold soars towards $5,600 as Trump rattles sabre over Iran

-

Russia's Petrosian skates in Valieva shadow at Milan-Cortina Olympics

-

China executes 11 linked to Myanmar scam compounds

China executes 11 linked to Myanmar scam compounds

-

Germany to harden critical infrastructure as Russia fears spike

-

Colombia plane crash investigators battle poor weather to reach site

Colombia plane crash investigators battle poor weather to reach site

-

Serena Williams refuses to rule out return to tennis

-

Vietnam, EU vow stronger ties as bloc's chief visits Hanoi

Vietnam, EU vow stronger ties as bloc's chief visits Hanoi

-

New glove, same fist: Myanmar vote ensures military's grip

-

Deutsche Bank logs record profits, as new probe casts shadow

Deutsche Bank logs record profits, as new probe casts shadow

-

Thai foreign minister says hopes Myanmar polls 'start of transition' to peace

-

No white flag from Djokovic against Sinner as Alcaraz faces Zverev threat

No white flag from Djokovic against Sinner as Alcaraz faces Zverev threat

-

Vietnam and EU upgrade ties as EU chief visits Hanoi

-

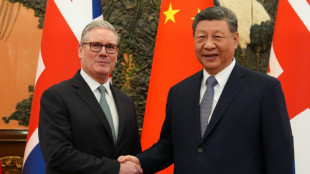

Starmer, Xi stress need for stronger UK-China ties to face global headwinds

Starmer, Xi stress need for stronger UK-China ties to face global headwinds

-

Senegal coach Thiaw gets five-match ban after AFCON final chaos

-

Phan Huy: the fashion prodigy putting Vietnam on the map

Phan Huy: the fashion prodigy putting Vietnam on the map

-

Hongkongers snap up silver as gold becomes 'too expensive'

-

Britain's Starmer meets China's Xi for talks on trade, security

Britain's Starmer meets China's Xi for talks on trade, security

-

Chinese quadriplegic runs farm with just one finger

-

Gold soars past $5,500 as Trump sabre rattles over Iran

Gold soars past $5,500 as Trump sabre rattles over Iran

-

China's ambassador warns Australia on buyback of key port

-

'Bombshell': What top general's fall means for China's military

'Bombshell': What top general's fall means for China's military

-

As US tensions churn, new generation of protest singers meet the moment

-

Venezuelans eye economic revival with hoped-for oil resurgence

Venezuelans eye economic revival with hoped-for oil resurgence

-

Online platforms offer filtering to fight AI slop

-

With Trump allies watching, Canada oil hub faces separatist bid

With Trump allies watching, Canada oil hub faces separatist bid

-

Samsung Electronics posts record profit on AI demand

-

Rockets veteran Adams out for rest of NBA season

Rockets veteran Adams out for rest of NBA season

-

Holders PSG happy to take 'long route' via Champions League play-offs

-

French Senate adopts bill to return colonial-era art

French Senate adopts bill to return colonial-era art

-

Allrounder Molineux named Australian women's cricket captain

-

Sabalenka faces Svitolina roadblock in Melbourne final quest

Sabalenka faces Svitolina roadblock in Melbourne final quest

-

Barcelona rout Copenhagen to reach Champions League last 16

-

Liverpool, Man City and Barcelona ease into Champions League last 16

Liverpool, Man City and Barcelona ease into Champions League last 16

-

Tesla profits tumble on lower EV sales, AI spending surge

-

Real Madrid face Champions League play-off after Benfica loss

Real Madrid face Champions League play-off after Benfica loss

-

LA mayor urges US to reassure visiting World Cup fans

-

Madrid condemned to Champions League play-off after Benfica loss

Madrid condemned to Champions League play-off after Benfica loss

-

Meta shares jump on strong earnings report

-

Haaland ends barren run as Man City reach Champions League last 16

Haaland ends barren run as Man City reach Champions League last 16

-

PSG and Newcastle drop into Champions League play-offs after stalemate

-

Salah ends drought as Liverpool hit Qarabag for six to reach Champions League last 16

Salah ends drought as Liverpool hit Qarabag for six to reach Champions League last 16

-

Barca rout Copenhagen to reach Champions League last 16

-

Arsenal complete Champions League clean sweep for top spot

Arsenal complete Champions League clean sweep for top spot

-

Kolo Muani and Solanke send Spurs into Champions League last 16

Trump push to 'drill, baby, drill' may hit industry roadblock

President Donald Trump wants to boost US oil production, pledging to bring costs down as he returned to office this week -- but analysts warn his efforts could be hampered by the industry itself.

Taking aim at an "inflation crisis" which he said was driven by rising energy prices, Trump vowed: "Today I will also declare a national energy emergency. We will drill, baby, drill."

"We will be a rich nation again. And it is that liquid gold under our feet that will help to do it," he pledged in his inaugural address on Monday.

While the United States is the world's leading crude oil producer, the US president wants to boost oil and gas production to lower costs, fill strategic reserves and "export American energy all over the world."

In declaring a national energy emergency, Trump reversed some drilling bans, including in a protected area in Alaska.

"It's hard to reconcile the notion that we have an energy emergency, when the US produced 13.2 million barrels per day of crude oil in 2024," said analyst Stewart Glickman of CFRA.

This was "more than any other country."

The US Energy Information Administration also estimates that US production will hit 13.5 million barrels a day this year, "which would imply yet another annual record," Glickman told AFP.

- Economic interest -

But analysts say the prospect of oversupply and worries about global demand currently could make US producers reluctant to step on the accelerator -- to prevent crude prices from falling too much.

US oil companies will likely "act in their own interest" economically, and drill when they expect it to be profitable, said Andrew Lipow, president of Lipow Oil Associates.

That will depend on the price of oil, he added, alongside the return on capital.

Some oil majors are already cautious about global supply.

"We are seeing record levels of demand for oil, record levels for demand for products coming out of our refineries," said ExxonMobil CEO Darren Woods on CNBC in November.

"But we also see a lot of supply in the world right now," he said, adding that much of it comes from the United States.

Woods recounted how, after the merger of Exxon and Mobil in 1999, the group owned 45 refineries.

But when he took the helm in 2017, it only had 22 refineries, he told CNBC.

Trump's strategy has also puzzled analysts considering the Organization of the Petroleum Exporting Countries and its allies (OPEC+) has 5.8 million barrels per day of unused capacity, said Robert Yawger of Mizuho Americas.

Eight members of OPEC+, including Saudi Arabia and Russia, have planned to gradually reverse production cuts of 2.2 million barrels per day since last year.

- Profitability -

The new US administration "has to justify increases in production by the bottom line. It has to be cost-effective," said Yawger.

"They're not going to repeat the problem that we've done in the past, and that's just oversupply the market and kill the golden goose," he added.

The emergence of shale oil and gas at the turn of the 2010s disrupted the American oil industry.

Concerned about the rise of the United States, Saudi Arabia decided to retaliate by flooding the oil market, causing the price of a barrel of West Texas Intermediate (WTI), the American benchmark, to fall to $26 in 2016.

A part of the shale oil industry shuttered, and surviving players vowed to manage their growth and finances more effectively.

"Misguided, irrational energy policies are done," said Jeff Eshelman, president of the Independent Petroleum Association of America, said in response to Trump's announcements.

"America's vast resources will be unleashed responsibly," he added.

A.Zbinden--VB