-

Ko, Woad share lead at LPGA season opener

Ko, Woad share lead at LPGA season opener

-

US Senate votes on funding deal - but shutdown still imminent

-

US charges prominent journalist after Minneapolis protest coverage

US charges prominent journalist after Minneapolis protest coverage

-

Trump expects Iran to seek deal to avoid US strikes

-

Guterres warns UN risks 'imminent financial collapse'

Guterres warns UN risks 'imminent financial collapse'

-

NASA delays Moon mission over frigid weather

-

First competitors settle into Milan's Olympic village

First competitors settle into Milan's Olympic village

-

Fela Kuti: first African to get Grammys Lifetime Achievement Award

-

'Schitt's Creek' star Catherine O'Hara dead at 71

'Schitt's Creek' star Catherine O'Hara dead at 71

-

Curran hat-trick seals 11 run DLS win for England over Sri Lanka

-

Cubans queue for fuel as Trump issues energy ultimatum

Cubans queue for fuel as Trump issues energy ultimatum

-

France rescues over 6,000 UK-bound Channel migrants in 2025

-

Surprise appointment Riera named Frankfurt coach

Surprise appointment Riera named Frankfurt coach

-

Maersk to take over Panama Canal port operations from HK firm

-

US arrests prominent journalist after Minneapolis protest coverage

US arrests prominent journalist after Minneapolis protest coverage

-

Analysts say Kevin Warsh a safe choice for US Fed chair

-

Trump predicts Iran will seek deal to avoid US strikes

Trump predicts Iran will seek deal to avoid US strikes

-

US oil giants say it's early days on potential Venezuela boom

-

Fela Kuti to be first African to get Grammys Lifetime Achievement Award

Fela Kuti to be first African to get Grammys Lifetime Achievement Award

-

Trump says Iran wants deal, US 'armada' larger than in Venezuela raid

-

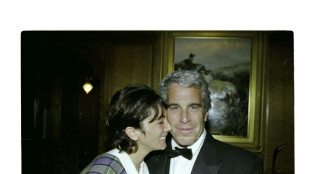

US Justice Dept releases new batch of documents, images, videos from Epstein files

US Justice Dept releases new batch of documents, images, videos from Epstein files

-

Four memorable showdowns between Alcaraz and Djokovic

-

Russian figure skating prodigy Valieva set for comeback -- but not at Olympics

Russian figure skating prodigy Valieva set for comeback -- but not at Olympics

-

Barcelona midfielder Lopez agrees contract extension

-

Djokovic says 'keep writing me off' after beating Sinner in late-nighter

Djokovic says 'keep writing me off' after beating Sinner in late-nighter

-

US Justice Dept releasing new batch of Epstein files

-

South Africa and Israel expel envoys in deepening feud

South Africa and Israel expel envoys in deepening feud

-

French eyewear maker in spotlight after presidential showing

-

Olympic dream 'not over', Vonn says after crash

Olympic dream 'not over', Vonn says after crash

-

Brazil's Lula discharged after cataract surgery

-

US Senate races to limit shutdown fallout as Trump-backed deal stalls

US Senate races to limit shutdown fallout as Trump-backed deal stalls

-

'He probably would've survived': Iran targeting hospitals in crackdown

-

Djokovic stuns Sinner to set up Australian Open final with Alcaraz

Djokovic stuns Sinner to set up Australian Open final with Alcaraz

-

Mateta omitted from Palace squad to face Forest

-

Djokovic 'pushed to the limit' in stunning late-night Sinner upset

Djokovic 'pushed to the limit' in stunning late-night Sinner upset

-

Tunisia's famed blue-and-white village threatened after record rains

-

Top EU official voices 'shock' at Minneapolis violence

Top EU official voices 'shock' at Minneapolis violence

-

Kremlin says agreed to halt strikes on Kyiv until Sunday

-

Carrick calls for calm after flying start to Man Utd reign

Carrick calls for calm after flying start to Man Utd reign

-

Djokovic to meet Alcaraz in Melbourne final after five-set marathon

-

Italian officials to testify in trial over deadly migrant shipwreck

Italian officials to testify in trial over deadly migrant shipwreck

-

Iran says defence capabilities 'never' up for negotiation

-

UN appeals for more support for flood-hit Mozambicans

UN appeals for more support for flood-hit Mozambicans

-

Lijnders urges Man City to pile pressure on Arsenal in title race

-

Fulham sign Man City winger Oscar Bobb

Fulham sign Man City winger Oscar Bobb

-

Strasbourg's Argentine striker Panichelli sets sights on PSG, World Cup

-

Jesus 'made love': Colombian president irks Christians with steamy claim

Jesus 'made love': Colombian president irks Christians with steamy claim

-

IAEA board meets over Ukraine nuclear safety concerns

-

Eurozone growth beats 2025 forecasts despite Trump woes

Eurozone growth beats 2025 forecasts despite Trump woes

-

Dutch PM-elect Jetten says not yet time to talk to Putin

How Belize became a poster child for 'debt-for-nature' swaps

When Covid hit Belize, its economy nosedived: closed borders meant fisheries and farmers had no export markets, and tourism centered on the tiny Central American nation's warm waters and wonders of biodiversity came to a halt.

"We lost approximately 14 percent of GDP," Prime Minister John Antonio Briceno told AFP in an interview. Nearly a third of the workforce of the country's 400,000 people were unemployed and there wasn't enough money "to keep the lights on," let alone maintain onerous debt repayments.

Then came a lifeline: environmental nonprofit The Nature Conservancy (TNC) offered to lend Belize money to pay off creditors if it promised to put part of the savings into marine protection.

So-called "debt-for-nature-swaps" are being hailed as an innovative financial tool for preserving ecosystems from climate change and overexploitation, even as critics warn their generosity is overstated and they are far from a cure-all.

Finalized in November 2021, a year after Briceno took office, the deal involved TNC buying back a $553 million "superbond" which held the government's entire commercial debt, negotiating a discount of 45 percent.

This was converted into a $364 million loan "blue bonds" in a sale arranged by Credit Suisse, unlocking $180 million for marine conservation over 20 years.

"For us, it was a win-win, it gave us a breather," said Briceno. Notably, the buyback reduced the country's debt-to-GDP ratio by more than 10 percent.

- Old idea, bigger scale -

Belize's coastline is home to the largest barrier reef in the northern hemisphere, providing significant habitat for threatened species including manatees, turtles and crocodiles.

But warming oceans from climate change, excessive fishing, and coastal development all pose major challenges.

Under the terms of the deal, Belize agreed to expand protection to 30 percent of its territorial waters, and spend $4.2 million annually on marine conservation.

Since then, TNC signed similar agreements with Barbados and Gabon. Ecuador negotiated the biggest swap of all in May, reducing its debt obligations by about $1.1 billion to benefit the Galapagos Islands under an arrangement overseen by Pew Bertarelli Ocean Legacy Project.

Slav Gatchev, managing director of sustainable debt at TNC, told AFP that although the first debt-for-nature swaps happened in the 1980s, now they operate at a far larger scale.

"A third of the outstanding commercial debt to lower and middle income countries is in some form of distress," he said, meaning environmental ministry budgets are stretched and it's hard for governments to invest in nature.

He sees an opportunity to refinance up to $1 trillion of the commercial and bilateral debt, in turn generating $250 billion for climate and nature.

- Paper parks? -

Andre Standing, a researcher for groups including the Coalition for Fair Fisheries Arrangements, told AFP the Belize deal was only possible because the country was about to default and it was therefore better for creditors to accept a lump sum -- rather than the altruistic act it was portrayed as by some.

Moreover, he added, such deals do nothing to address the debt crisis plaguing developing countries.

"That's true, but it's not intended to," Esteban Brenes, who leads conservation finance for the World Wide Fund for Nature (WWF), which is also looking to organize new debt swaps, told AFP.

"We're going to take a piece of the debt and use some proceeds for something better, but by no means are we going to solve the big problem," he said.

Another concern has been that countries might agree to lofty commitments to secure concessions but then fall to "paper park syndrome" where protections exist only in theory.

But Gatchev said the commitments are legally binding and governments could incur fees for breaking them.

"Our reputation as the world's largest conservation organization is on the line here, and we have no incentive to sugarcoat lack of compliance," he stressed.

Briceno, for his part, said the high-profile deal had increased environmental consciousness among his people, who were now quick to report illegal mangrove dredging, for instance.

The debt restructure was "a very good start," he continued, but his country needed far more assistance from the Global North.

"Developed countries destroyed their environment to be able to have development: high-rises, big vehicles, nice fancy homes," said Briceno.

"Now we want the same and you're telling us 'we can't afford you to destroy what we have destroyed' -- then pay us."

G.Haefliger--VB