-

Threatened Ugandan opposition leader needs UN help: lawyer

Threatened Ugandan opposition leader needs UN help: lawyer

-

'I got lucky' - Cramping Sinner drops set on way to Melbourne last 16

-

Extreme heat triggers Melbourne suspension rule as Sinner battles on

Extreme heat triggers Melbourne suspension rule as Sinner battles on

-

'Zap you': Top players wrestle with scorching Melbourne heat

-

Lula revived Brazilian cinema, says 'The Secret Agent' director

Lula revived Brazilian cinema, says 'The Secret Agent' director

-

Wall Street intends to stay open around the clock

-

Struggling Sinner drops set before making Melbourne last 16

Struggling Sinner drops set before making Melbourne last 16

-

Ukraine, Russia to hold second day of direct talks on US plan

-

Pacers outlast Thunder in NBA Finals rematch

Pacers outlast Thunder in NBA Finals rematch

-

Vernon avoids crashes to win Tour Down Under stage in brutal heat

-

NSW Waratahs forward banned for punching teammate

NSW Waratahs forward banned for punching teammate

-

'One in a Million': Syrian refugee tale wows Sundance

-

Extreme heat triggers suspension rule at baking Australian Open

Extreme heat triggers suspension rule at baking Australian Open

-

US military to prioritize homeland and curbing China, limit support for allies

-

Europe and India seek closer ties with 'mother of all deals'

Europe and India seek closer ties with 'mother of all deals'

-

Bangladesh readies for polls, worry among Hasina supporters

-

Greenland, Denmark set aside troubled history to face down Trump

Greenland, Denmark set aside troubled history to face down Trump

-

Paris fashion doyenne Nichanian bows out at Hermes after 37 years

-

Anisimova ramps up Melbourne title bid with imperious win

Anisimova ramps up Melbourne title bid with imperious win

-

Keys revels in Melbourne heat as Djokovic steps up history bid

-

Nepal skipper eyes new summit with 'nothing to lose' at T20 World Cup

Nepal skipper eyes new summit with 'nothing to lose' at T20 World Cup

-

Defending champion Keys surges into Australian Open last 16

-

Pegula beats heat to sweep into last 16 at Australian Open

Pegula beats heat to sweep into last 16 at Australian Open

-

Teenage giantkiller Jovic gets help from 'kind' Djokovic in Melbourne

-

Venezuela says over 600 prisoners released; families' patience wanes

Venezuela says over 600 prisoners released; families' patience wanes

-

Teen Blades Brown shoots 60 to share PGA La Quinta lead with Scheffler

-

Icy storm threatens Americans with power outages, extreme cold

Icy storm threatens Americans with power outages, extreme cold

-

FBI probes death of Colts owner Jim Irsay

-

Barcola's winner sends PSG top despite lack of 'confidence'

Barcola's winner sends PSG top despite lack of 'confidence'

-

Inter fight back to thrash Pisa and extend Serie A lead to six points

-

Defiant protests over US immigration crackdown, child's detention

Defiant protests over US immigration crackdown, child's detention

-

Gold nears $5,000, silver shines as stocks churn to end turbulent week

-

Ukraine, Russia hold first direct talks on latest US peace plan

Ukraine, Russia hold first direct talks on latest US peace plan

-

Robbie Williams tops Beatles for most number one albums in UK

-

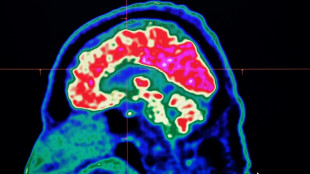

Final report casts doubt on existence of Canada mystery brain illness

Final report casts doubt on existence of Canada mystery brain illness

-

What's driving Guatemala's surge in gang violence?

-

Western powers warn Haiti against changing PM amid turmoil

Western powers warn Haiti against changing PM amid turmoil

-

Fury grows over five-year-old's detention in US immigration crackdown

-

TikTok in the US goes American, but questions remain

TikTok in the US goes American, but questions remain

-

France probes deaths of two babies after powdered milk recall

-

Across the globe, views vary about Trump's world vision

Across the globe, views vary about Trump's world vision

-

UN rights council decries 'unprecedented' crackdown in Iran, deepens scrutiny

-

Suryakumar, Kishan star as India thrash New Zealand in second T20

Suryakumar, Kishan star as India thrash New Zealand in second T20

-

Spanish prosecutors dismiss sex abuse case against Julio Iglesias

-

Suspected Russia 'shadow fleet' tanker bound for French port

Suspected Russia 'shadow fleet' tanker bound for French port

-

UK PM slams Trump for saying NATO troops avoided Afghan front line

-

Arteta tells Nwaneri to 'swim with sharks' on Marseille loan move

Arteta tells Nwaneri to 'swim with sharks' on Marseille loan move

-

Snow and ice storm set to sweep US

-

Palmer 'happy' at Chelsea despite homesick speculation: Rosenior

Palmer 'happy' at Chelsea despite homesick speculation: Rosenior

-

Ukraine-Russia-US talks open in Abu Dhabi as Moscow demands Donbas region

Stocks advance with focus on central banks, tech

Global stock markets mostly advanced on Friday as traders reacted to central bank activity and easing concerns over the technology sector.

Equity markets, particularly on Wall Street, have come under pressure in recent weeks amid questions about when, if ever, investors will see returns on the colossal amounts of cash pumped into artificial intelligence.

But blockbuster earnings from chip firm Micron Technology helped soothe nerves over a tech bubble and the tech-heavy Nasdaq close with a gain of 1.4 percent on Thursday.

The Nasdaq added 0.5 percent as trading got underway Friday. Shares in Micron Technology rose by 4.3 percent.

Shares in the so-called Magnificent Seven tech stocks, which includes AI chip maker Nvidia and Google parent company Alphabet, gained 0.3 percent overall.

"Stocks in the tech sector have been boosted by yesterday's bumper earnings from Micron," noted Joshua Mahony, chief market analyst at trading group Scope Markets.

"As we close out a week that has seen a huge amount of data and central bank announcements, there is an expectation that we start to see volumes and volatility ease off from here."

- Russia cuts key interest rate -

However, Briefing.com analyst Patrick O'Hare, said trading volume should be huge today driven by the expiration of options.

"Today is a quadruple witching expiration day, which involves the expiration of stock index futures, single-stock futures, stock index options, and single-stock options," he said.

As traders make purchases or sales to cover options volatility could spike.

"Participants are also waiting to see if yesterday's AI-related bounce following Micron's (MU) stellar report has legs," added O'Hare.

Below-forecast US inflation data Thursday also boosted hopes that the Federal Reserve would cut interest rates next month.

The yen fell against the dollar on profit-taking after the Bank of Japan on Friday hiked, as expected, its own borrowing costs to a three-decade high, hours after data showed prices had held steady.

Russia's central bank said it was cutting its benchmark interest rate to 16 percent as the country's economy sags under the financial burden of the Ukraine offensive and Western sanctions.

The Bank of England cut rates Thursday, when the European Central Bank left eurozone borrowing costs unchanged.

Germany's central bank on Friday predicted a slower recovery for Europe's biggest economy following three years of stagnation.

Shares in Oracle gained more than five percent as trading got underway in New York after TikTok said it has signed a joint venture deal with investors that would allow the company to maintain operations in the United States.

The deal will see Oracle take a 15-percent stake in the joint venture, with private equity fund Silver Lake and Abu Dhabi-based MGX, an Emirati state-owned investment fund for artificial intelligence technologies.

- Key figures at around 1330 GMT -

New York - Dow: UP 0.3 percent at 48,099.15 points

New York - S&P 500: UP 0.4 percent at 6,800.44

New York - Nasdaq Composite: UP 0.5 percent at 23,124.16

London - FTSE 100: UP less than 0.1 percent at 9,844.71

Paris - CAC 40: DOWN less than 0.1 percent at 8,145.04

Frankfurt - DAX: UP percent at 24,239.34

Tokyo - Nikkei 225: UP 1.0 percent at 49,507.21 (close)

Hong Kong - Hang Seng Index: UP 0.8 percent at 25,690.53 (close)

Shanghai - Composite: UP 0.4 percent at 3,890.45 (close)

Dollar/yen: UP at 157.23 yen from 155.63 yen on Thursday

Euro/dollar: UP at $1.1733 from $1.1721

Pound/dollar: UP at $1.3379 from $1.3378

Euro/pound: UP at 87.70 pence from 87.62 pence

Brent North Sea Crude: UP 0.7 percent at $60.21 per barrel

West Texas Intermediate: UP 0.7 percent at $56.39 per barrel

burs-rl/jj

O.Schlaepfer--VB