-

Trump slams 'dirty' Canada despite withdrawal of Reagan ad

Trump slams 'dirty' Canada despite withdrawal of Reagan ad

-

Bagnaia seals third Malaysian MotoGP pole in a row

-

Trump heads for Asia and Xi trade talks

Trump heads for Asia and Xi trade talks

-

Blue Jays thrash Dodgers 11-4 to win World Series opener

-

Heat win first game since arrest of Rozier, who has 'full support'

Heat win first game since arrest of Rozier, who has 'full support'

-

Rybakina out of Tokyo semi-finals with injury

-

Messi brace fuels Miami over Nashville in MLS Cup series opener

Messi brace fuels Miami over Nashville in MLS Cup series opener

-

Batting great Williamson cuts back on New Zealand commitments

-

Australia's Cummins shuts down talk of four quicks against England

Australia's Cummins shuts down talk of four quicks against England

-

Kerr wants Australia captaincy back on eagerly awaited return

-

NBA chief Silver 'deeply disturbed' by illegal betting scandal

NBA chief Silver 'deeply disturbed' by illegal betting scandal

-

North Korea using crypto, IT workers to dodge UN sanctions: report

-

Trump ends Canada access at shared border library

Trump ends Canada access at shared border library

-

'Most beautiful': Thailand's former Queen Sirikit

-

Thailand's former queen Sirikit dead at 93: palace

Thailand's former queen Sirikit dead at 93: palace

-

Piastri stays calm after winding up 12th in practice

-

Verstappen on top again as McLaren struggle, Piastri 12th

Verstappen on top again as McLaren struggle, Piastri 12th

-

UN members to sign cybercrime treaty opposed by rights groups

-

Heat back Rozier as NBA grapples with gambling scandal fallout

Heat back Rozier as NBA grapples with gambling scandal fallout

-

Dodgers pitcher Vesia expected to miss World Series: Roberts

-

Red Bull chief says no more 'silly games' after fine

Red Bull chief says no more 'silly games' after fine

-

US hits Colombia's leader with drug sanctions, sparking sharp rebuke

-

Nuno left waiting for first West Ham win after defeat at Leeds

Nuno left waiting for first West Ham win after defeat at Leeds

-

Gambling scandal shows dangers of NBA's embrace of betting

-

Late leveller saves Milan blushes in draw with lowly Pisa

Late leveller saves Milan blushes in draw with lowly Pisa

-

NFL fines Giants, coach and rusher for concussion protocol blunders

-

Trump heads for Asia and Xi talks, as Kim speculation swirls

Trump heads for Asia and Xi talks, as Kim speculation swirls

-

Leclerc tops reserve-filled first practice in Mexico

-

Canadians pull tariff ad after furious Trump scraps trade talks

Canadians pull tariff ad after furious Trump scraps trade talks

-

Nexperia, the new crisis looming for Europe's carmakers

-

Pope beatifies 11 priests killed by Nazi, Communist regimes

Pope beatifies 11 priests killed by Nazi, Communist regimes

-

Five things to know about Argentina's pivotal midterm election

-

Porsche loses almost one billion euros on shift back to petrol

Porsche loses almost one billion euros on shift back to petrol

-

Oasis guitar sold at auction for $385k

-

US sending aircraft carrier to counter Latin America drug traffickers

US sending aircraft carrier to counter Latin America drug traffickers

-

Nigeria sacks top brass after denying coup plot

-

Mexican president hails progress in trade talks with US

Mexican president hails progress in trade talks with US

-

Sinner waltzes into Vienna semi-finals

-

P&G profits rise as company sees lower tariff hit

P&G profits rise as company sees lower tariff hit

-

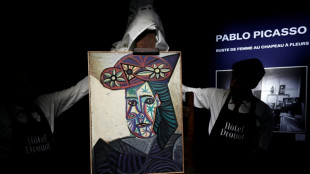

Forgotten Picasso portrait of Dora Maar sells for $37 mn

-

Rescued baby gorilla to stay in Istanbul after DNA test

Rescued baby gorilla to stay in Istanbul after DNA test

-

Fernandes turned down Saudi offer to pursue Man Utd dreams

-

Amorim pleads for 'calm' as Man Utd face Brighton

Amorim pleads for 'calm' as Man Utd face Brighton

-

NY attorney general pleads not guilty, says Trump seeking 'revenge'

-

French court gives Algerian woman life sentence for murdering schoolgirl

French court gives Algerian woman life sentence for murdering schoolgirl

-

Ex-Liverpool boss Benitez takes over at Panathinaikos

-

Arteta's deadly set-piece plan hatched 10 years ago

Arteta's deadly set-piece plan hatched 10 years ago

-

Sri Lanka and Pakistan share spoils in washed out World Cup clash

-

Trump ends all Canada trade talks over 'fake' tariff ad

Trump ends all Canada trade talks over 'fake' tariff ad

-

World champion Liu leads at skating's Cup of China

Stocks rise on US inflation data, US-China trade hopes

Stock markets broadly advanced Friday after US inflation data bolstered expectations the Federal Reserve would again cut interest rates next week, with fresh optimism over US-China trade relations further boosting confidence.

After solid gains on Asian markets, European indexes showed more modest gains after advances Thursday while Wall Street opened higher.

Investors had keenly awaited a September reading on US inflation, delayed by weeks because the government shut down over a budget impasse, for guidance on further Fed rate cuts.

The core consumer price index increase, which strips out food and petrol prices, came in below expectations at 3.0 percent, the Labor Department said.

Although above the Fed's inflation target of two percent, the reading confirmed to traders that officials are more worried about a softening labour market -- cementing expectations of another 25 basis point cut next week.

"It is the jobs market that is becoming the more pressing issue for the Fed, with a clear chance that the 'low hire, low fire' economy becomes a 'no hire, let's fire' story," ING economists said in a research note.

"We continue to look for a 25 basis point rate cut next week, with a further 25 basis point move in December and 50 basis points of cuts in early 2026," they wrote.

Investors also welcomed a White House confirmation that President Donald Trump would meet China's Xi Jinping next week, stoking optimism for a cooling of trade tensions between the economic superpowers.

"News on trade is supporting risk sentiment across the board into the weekend," said Neil Wilson, UK investor strategist at Saxo Markets.

"But given this is Trump and brinkmanship goes hand in glove with showmanship, talks with Xi could go either way.

"And indeed the trade picture is not so optimistic everywhere we look. The Canadian dollar fell after Trump said he would halt all trade negotiations with the country," Wilson noted.

In Europe, encouraging data on business activity in the eurozone and Britain gave a slight lift but traders said many investors were booking profits heading into the weekend.

Crude futures remained supported after Washington imposed sanctions on two Russian oil giants in a bid to bring an end to the Ukraine war.

Oil prices soared this week on expectations the sanctions would sharply reduce supplies to countries that had continued to buy Russian oil, forcing them to turn to other suppliers.

- Key figures at around 1345 GMT -

New York - Dow: UP 0.8 percent at 47,1154.02 points

New York: S&P 500: UP 0.8 percent at 6,795.04

New York: Nasdaq: UP 1.1 percent at 23,192.99

London - FTSE 100: UP 0.2 percent at 9,598.95

Paris - CAC 40: DOWN 0.2 percent at 8,206.68

Frankfurt - DAX: UP 0.1 percent at 24,218.43

Tokyo - Nikkei 225: UP 1.4 percent at 49,299.65 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 25,160.15 (close)

Shanghai - Composite: UP 0.7 percent at 3,950.31 (close)

Euro/dollar: UP at $1.1627 from $1.1615 on Thursday

Pound/dollar: UP at $1.3337 from $1.3323

Dollar/yen: UP at 152.86 from 152.60 yen

Euro/pound: DOWN at 87.17 pence from 87.18 pence

Brent North Sea Crude: UP 0.6 percent at $66.36 per barrel

West Texas Intermediate: UP 0.5 percent at $62.08 per barrel

burs-bcp/js/rlp

H.Kuenzler--VB