-

Stocks rally as Trump drops Greenland tariff threats

Stocks rally as Trump drops Greenland tariff threats

-

Mercedes unveil 2026 F1 car for new 2026 rules

-

Djokovic, Sinner plough on in Melbourne, Wawrinka makes history

Djokovic, Sinner plough on in Melbourne, Wawrinka makes history

-

Kitzbuehel's Hahnenkamm, the terrifying Super Bowl of skiing

-

'Oasis of stability': Madrid becomes luxury housing haven

'Oasis of stability': Madrid becomes luxury housing haven

-

Swiatek says packed tennis season makes it 'impossible' to switch off

-

Sloppy Osaka grinds past 'mad' Cirstea to stay alive at Australian Open

Sloppy Osaka grinds past 'mad' Cirstea to stay alive at Australian Open

-

Iran Guards chief says 'finger on trigger', warns US against 'miscalculations'

-

Imperious Sinner barrels into Australian Open round three

Imperious Sinner barrels into Australian Open round three

-

Storms, heavy rain kill 9 children across Afghanistan

-

Games giant Ubisoft suffers share price collapse

Games giant Ubisoft suffers share price collapse

-

Exhausted Wawrinka battles on in Melbourne farewell after five-set epic

-

'Too dangerous to go to hospital': a glimpse into Iran's protest crackdown

'Too dangerous to go to hospital': a glimpse into Iran's protest crackdown

-

Bruised European allies wary after Trump's Greenland climbdown

-

Austrian ex-agent goes on trial in Russia spying case

Austrian ex-agent goes on trial in Russia spying case

-

Japan suspends restart of world's biggest nuclear plant

-

Djokovic, Swiatek roll into Melbourne third round, Keys defence alive

Djokovic, Swiatek roll into Melbourne third round, Keys defence alive

-

New Zealand landslips kill at least two, others missing

-

Djokovic says heaving Australian Open crowds 'good problem'

Djokovic says heaving Australian Open crowds 'good problem'

-

Swiatek in cruise control to make Australian Open third round

-

Austrian ex-agent to go on trial in Russia spying case

Austrian ex-agent to go on trial in Russia spying case

-

Bangladesh launches campaigns for first post-Hasina elections

-

Afghan resistance museum gets revamp under Taliban rule

Afghan resistance museum gets revamp under Taliban rule

-

Multiple people missing in New Zealand landslips

-

Sundance Film Festival hits Utah, one last time

Sundance Film Festival hits Utah, one last time

-

Philippines convicts journalist on terror charge called 'absurd'

-

Anisimova grinds down Siniakova in 'crazy' Australian Open clash

Anisimova grinds down Siniakova in 'crazy' Australian Open clash

-

Djokovic rolls into Melbourne third round, Keys defence alive

-

Vine, Narvaez take control after dominant Tour Down Under stage win

Vine, Narvaez take control after dominant Tour Down Under stage win

-

Chile police arrest suspect over deadly wildfires

-

Djokovic eases into Melbourne third round - with help from a tree

Djokovic eases into Melbourne third round - with help from a tree

-

Keys draws on champion mindset to make Australian Open third round

-

Knicks halt losing streak with record 120-66 thrashing of Nets

Knicks halt losing streak with record 120-66 thrashing of Nets

-

Philippine President Marcos hit with impeachment complaint

-

Trump to unveil 'Board of Peace' at Davos after Greenland backtrack

Trump to unveil 'Board of Peace' at Davos after Greenland backtrack

-

Bitter-sweet as Pegula crushes doubles partner at Australian Open

-

Hong Kong starts security trial of Tiananmen vigil organisers

Hong Kong starts security trial of Tiananmen vigil organisers

-

Keys into Melbourne third round with Sinner, Djokovic primed

-

Bangladesh launches campaigns for first post-Hasina polls

Bangladesh launches campaigns for first post-Hasina polls

-

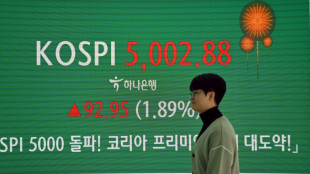

Stocks track Wall St rally as Trump cools tariff threats in Davos

-

South Korea's economy grew just 1% in 2025, lowest in five years

South Korea's economy grew just 1% in 2025, lowest in five years

-

Snowboard champ Hirano suffers fractures ahead of Olympics

-

'They poisoned us': grappling with deadly impact of nuclear testing

'They poisoned us': grappling with deadly impact of nuclear testing

-

Keys blows hot and cold before making Australian Open third round

-

Philippine journalist found guilty of terror financing

Philippine journalist found guilty of terror financing

-

Greenlanders doubtful over Trump resolution

-

Real Madrid top football rich list as Liverpool surge

Real Madrid top football rich list as Liverpool surge

-

'One Battle After Another,' 'Sinners' tipped to top Oscar noms

-

Higher heating costs add to US affordability crunch

Higher heating costs add to US affordability crunch

-

Eight stadiums to host 2027 Rugby World Cup matches in Australia

Nexperia, the new crisis looming for Europe's carmakers

European automakers already buffeted by US tariffs and a rocky shift toward electric vehicles now face a new threat: a shortage of key semiconductors supplied by Chinese-owned Nexperia.

Beijing is locked in a standoff with Dutch officials who invoked a Cold War-era law in September to effectively take over the company, whose factories are in Europe.

Carmakers as well as parts suppliers have already warned of shortages that would force stoppages at production lines across the Continent.

Who is Nexperia?

The company produces relatively simple technologies such as diodes, voltage regulators and transistors that are nonetheless crucial, as vehicles increasingly rely on electronics.

The chips are mainly found in cars but also in a wide range of industrial components as well as consumer and mobile electronics like refrigerators.

It makes them in Europe before sending them to China for finishing, and are then re-exported back to European clients.

Based in the Netherlands and once part of electronics giant Philips, it was bought by Wingtech Technology of China in 2018.

But in September, the Dutch government took the unusual step of taking over the company, citing its "Goods Availability Law" of 1952 to ensure essential items.

In response, China banned any re-exports of Nexperia chips to Europe, igniting fresh geopolitical tensions.

Why is the automotive sector vulnerable?

Nexperia supplies 49 percent of the electronic components used in the European automotive industry, according to German financial daily Handelsblatt.

The European auto lobby ACEA warned this month that production would be seriously hit.

"Without these chips, European automotive suppliers cannot build the parts and components needed to supply vehicle manufacturers and this therefore threatens production stoppages," the group said.

For Germany alone, analysts at Deutsche Bank forecast a production drop of 10 percent while warning of a 30-percent cut in a "worst-case scenario".

How are automakers responding?

German auto giant Volkswagen has warned that it cannot not rule out "short term" production stoppages, while emphasising that it is searching for alternative suppliers.

Nexperia does not supply it directly but some of its parts suppliers use its chips.

Bosch, for example, says it has not yet reduced employee shifts at its German sites "but we are preparing to do so at our Salzgitter site", a spokesman told AFP.

But French parts maker Valeo said it had "visibility for the coming weeks" with regards to "all its components".

It said it had found alternatives for "95 percent of the volumes" bought each year from Nexperia, but "they haven't yet been approved by our clients".

Other suppliers?

According to OPmobility, another French parts maker, Nexperia's chips, while widely used, are not "unique" in terms of technology and therefore "easily substitutable".

But suppliers have to get the new products approved by automakers, which cannot be done quickly.

"They're looking frantically for other suppliers but these firms cannot build production capacity overnight," said Ferdinand Dudenhoeffer, director of Germany's Center Automotive Research institute.

"In the worst case this situation could go on for 12 to 18 months," he told AFP.

He added however since the disruptions cause by global lockdowns during the Covid-19 pandemic, "we've learned to pay more attention, both among general management and purchasing teams".

In any case, Dudenhoeffer said, "100 percent protection against supply disruptions is impossible -- or in any case prohibitively expensive".

P.Staeheli--VB