-

Germany, France, Argentina, Austria on brink of Davis Cup finals

Germany, France, Argentina, Austria on brink of Davis Cup finals

-

War with Russia weighs heavily on Ukrainian medal hope Doroshchuk

-

Suspect in Charlie Kirk killing caught, widow vows to carry on fight

Suspect in Charlie Kirk killing caught, widow vows to carry on fight

-

Dunfee and Perez claim opening world golds in Tokyo

-

Ben Griffin leads PGA Procore Championship in Ryder Cup tune-up

Ben Griffin leads PGA Procore Championship in Ryder Cup tune-up

-

'We're more than our pain': Miss Palestine to compete on global stage

-

Ingebrigtsen seeks elusive 1500m world gold after injury-plagued season

Ingebrigtsen seeks elusive 1500m world gold after injury-plagued season

-

Thailand's Chanettee leads by two at LPGA Queen City event

-

Dolphins' Hill says focus is on football amid domestic violence allegations

Dolphins' Hill says focus is on football amid domestic violence allegations

-

Nigerian chef aims for rice hotpot record

-

What next for Brazil after Bolsonaro's conviction?

What next for Brazil after Bolsonaro's conviction?

-

Fitch downgrades France's credit rating in new debt battle blow

-

Fifty reported dead in Gaza as Israel steps up attacks on main city

Fifty reported dead in Gaza as Israel steps up attacks on main city

-

Greenwood among scorers as Marseille cruise to four-goal victory

-

Rodgers calls out 'cowardly' leak amid Celtic civil war

Rodgers calls out 'cowardly' leak amid Celtic civil war

-

Frenchman Fourmaux grabs Chile lead as Tanak breaks down

-

Germany, France, Argentina and Austria on brink of Davis Cup finals

Germany, France, Argentina and Austria on brink of Davis Cup finals

-

New coach sees nine-man Leverkusen beat Frankfurt

-

US moves to scrap emissions reporting by polluters

US moves to scrap emissions reporting by polluters

-

Matsuyama leads Ryder Cup trio at PGA Championship

-

US to stop collecting emissions data from polluters

US to stop collecting emissions data from polluters

-

Pope Leo thanks Lampedusans for welcoming migrants

-

Moscow says Ukraine peace talks frozen as NATO bolsters defences

Moscow says Ukraine peace talks frozen as NATO bolsters defences

-

Salt's rapid ton powers England to record 304-2 against South Africa in 2nd T20

-

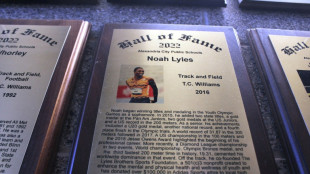

Noah Lyles: from timid school student to track's showman

Noah Lyles: from timid school student to track's showman

-

Boeing defense workers reject deal to end strike

-

Germany, Argentina close in on Davis Cup finals

Germany, Argentina close in on Davis Cup finals

-

Alvarez, Crawford both tip scales at 167.5 pounds for title bout

-

Armani will lays path to potential buyout by rival

Armani will lays path to potential buyout by rival

-

'We don't want to become a memory': minister of endangered Tuvalu

-

Ireland coach 'fully confident' Wafer fit for Women's Rugby World Cup quarter-final

Ireland coach 'fully confident' Wafer fit for Women's Rugby World Cup quarter-final

-

Philipsen wins sprint for Vuelta treble

-

Nepal ex-chief justice Karki becomes next PM after protests

Nepal ex-chief justice Karki becomes next PM after protests

-

Peruvians live in fear as extortion runs rampant

-

Philipsen wins Vuelta stage 19 for treble

Philipsen wins Vuelta stage 19 for treble

-

UN expert urges protection for indigenous Botswana people

-

Costa Rica arrests four in murder of Nicaraguan exile

Costa Rica arrests four in murder of Nicaraguan exile

-

Moscow says peace talks frozen as Zelensky warns Putin wants all of Ukraine

-

Strasbourg skipper Emegha to join Chelsea at end of season

Strasbourg skipper Emegha to join Chelsea at end of season

-

Nepal's first woman chief justice to become next PM

-

Suspect arrested in killing of US activist Charlie Kirk

Suspect arrested in killing of US activist Charlie Kirk

-

Eurovision will 'respect' any boycott decisions over Israel

-

UN General Assembly votes for Hamas-free Palestinian state

UN General Assembly votes for Hamas-free Palestinian state

-

Nepal ex-chief justice Sushila Karki named as next PM

-

EU to fast-track review of 2035 combustion-engine ban

EU to fast-track review of 2035 combustion-engine ban

-

Suspect arrested in shooting death of US activist Charlie Kirk

-

Big-spending Liverpool are Premier League's strongest: Arsenal boss Arteta

Big-spending Liverpool are Premier League's strongest: Arsenal boss Arteta

-

Baby gorilla to return to Nigeria after Istanbul airport rescue

-

Frank praises Levy's legacy at Spurs after shock exit

Frank praises Levy's legacy at Spurs after shock exit

-

Russia cuts interest rate as economy slows

Stock fluctuate as trade relief fades, eyes on data and earnings

Stocks were mixed Tuesday as the positivity sparked by recent US trade deals dissipated, with investors now focused on the release of key data and earnings, and the Federal Reserve's next policy meeting.

While Donald Trump's agreement with the European Union on Sunday was seen as better than a tariff standoff, observers pointed out that the US president's 15 percent levies -- with none on American goods -- were still much higher than before.

The pact, which followed a similar one with Japan last week, still left many concerned about the economic consequences, with auto companies particularly worried.

"The 15 percent blanket levy on EU and Japanese imports may have helped markets sidestep a cliff, but it's no free pass," said Stephen Innes at SPI Asset Management.

"With the average effective US tariff rate now sitting at 18.2 percent... the barrier to global trade remains significant. The higher tail risk didn't detonate, but its potential impact on the global economy hasn't disappeared either."

And National Australia Bank's Ray Attrill added: "It hasn't taken long for markets to conclude that this relatively good news is still, in absolute terms, bad news as far as the near term (through 2025) implications for eurozone growth are concerned."

Traders are also keeping an eye on US talks with other major economies, including India and South Korea.

After a tepid day on Wall Street -- which still saw the S&P and Nasdaq hit records -- Asia was mixed.

Tokyo, Hong Kong, Singapore, Manila and Taipei were all in the red, while Shanghai, Sydney, Seoul, Wellington, Bangkok and Jakarta rose.

London, Paris and Frankfurt edged up at the open.

The euro held its losses from Monday, having taken a hit from worries about the effects of the trade deal on the eurozone.

The first of two days of negotiations between top US and Chinese officials in Stockholm concluded Monday with no details released, though there are hopes they will agree to extend a 90-day truce that ends on August 12.

The two imposed triple-digit tariffs on each other earlier this year in a tit-for-tat escalation, but then walked them back under the temporary agreement reached in May.

Investors are also looking ahead to a busy few days that includes earnings from tech titans Apple, Microsoft, Meta and Amazon, as well as data on US economic growth and jobs creation.

That all comes as the Fed concludes its policy meeting amid increasing pressure from Trump to slash rates, even with inflation staying stubbornly high.

While it is expected to stand pat on borrowing costs, its post-meeting statement and comments from boss Jerome Powell will be pored over for clues about its plans for the second half of the year in light of the tariffs.

Oil prices extended Monday's rally after Trump shortened a deadline for Russia to end its war in Ukraine to August 7 or 9, following which he vowed to sanction countries buying its crude.

- Key figures at around 0715 GMT -

Tokyo - Nikkei 225: DOWN 0.8 percent at 40,674.55 (close)

Hong Kong - Hang Seng Index: DOWN 0.6 percent at 25,405.39

Shanghai - Composite: UP 0.3 percent at 3,609.71 (close)

London - FTSE 100: UP 0.1 percent at 9,091.97

Euro/dollar: DOWN at $1.1555 from $1.1597 on Monday

Pound/dollar: DOWN at $1.3329 from $1.3356

Dollar/yen: DOWN at 148.39 yen from 148.52 yen

Euro/pound: UP at 86.69 pence from 86.80 pence

West Texas Intermediate: FLAT at $66.72 per barrel

Brent North Sea Crude: UP 0.1 percent at $70.09 per barrel

New York - Dow: DOWN 0.1 percent at 44,837.56 (close)

S.Gantenbein--VB