-

'World's fastest anime fan' Lyles in element at Tokyo worlds

'World's fastest anime fan' Lyles in element at Tokyo worlds

-

De Minaur's Australia trail as Germany, Argentina into Davis Cup finals

-

Airstrikes, drones, tariffs: being US friend not what it used to be

Airstrikes, drones, tariffs: being US friend not what it used to be

-

Cyclists swerve protest group in road during Vuelta stage 20

-

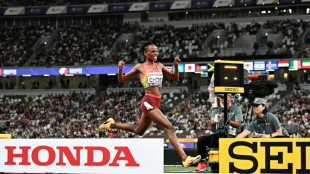

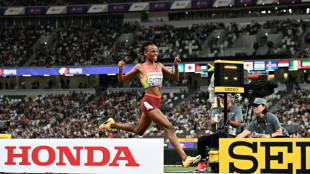

A Tokyo full house revels in Chebet and sprinters at world athletics champs

A Tokyo full house revels in Chebet and sprinters at world athletics champs

-

Holders New Zealand fight past South Africa into Women's Rugby World Cup semis

-

Ex-Olympic champion Rissveds overcomes depression to win world mountain bike gold

Ex-Olympic champion Rissveds overcomes depression to win world mountain bike gold

-

Kenya's Chebet wins 10,000m gold, suggests no tilt at world double

-

Arsenal ruin Postecoglou's Forest debut as Zubimendi bags brace

Arsenal ruin Postecoglou's Forest debut as Zubimendi bags brace

-

Shot put legend Crouser wins third successive world title

-

Bezzecchi wins San Marino MotoGP sprint as Marc Marquez crashes out

Bezzecchi wins San Marino MotoGP sprint as Marc Marquez crashes out

-

Kenya's Chebet wins 10,000m gold to set up tilt at world double

-

Lyles, Thompson and Tebogo cruise through world 100m heats

Lyles, Thompson and Tebogo cruise through world 100m heats

-

Vuelta final stage shortened amid protest fears

-

Collignon stuns De Minaur as Belgium take Davis Cup lead over Australia

Collignon stuns De Minaur as Belgium take Davis Cup lead over Australia

-

Nepal returns to calm as first woman PM takes charge, visits wounded

-

Olympic champion Alfred eases through 100m heats at Tokyo worlds

Olympic champion Alfred eases through 100m heats at Tokyo worlds

-

Winning coach Erasmus 'emotional' at death of former Springboks

-

Barca's Flick blasts Spain over Yamal injury issue

Barca's Flick blasts Spain over Yamal injury issue

-

Rampant Springboks inflict record 43-10 defeat to humble All Blacks

-

Italy's Bezzecchi claims San Marino MotoGP pole as Marquez brothers denied

Italy's Bezzecchi claims San Marino MotoGP pole as Marquez brothers denied

-

Rampant South Africa inflict record 43-10 defeat on All Blacks

-

Collignon stuns De Minaur as Belgium take 2-0 Davis Cup lead over Australia

Collignon stuns De Minaur as Belgium take 2-0 Davis Cup lead over Australia

-

Mourning Nepalis hope protest deaths will bring change

-

Carreras boots Argentina to nervy 28-26 win over Australia

Carreras boots Argentina to nervy 28-26 win over Australia

-

Nepal returns to calm as first woman PM takes charge

-

How mowing less lets flowers bloom along Austria's 'Green Belt'

How mowing less lets flowers bloom along Austria's 'Green Belt'

-

Too hot to study, say Italian teachers as school (finally) resumes

-

Alvarez, Crawford both scale 167.5 pounds for blockbuster bout

Alvarez, Crawford both scale 167.5 pounds for blockbuster bout

-

Tokyo fans savour athletics worlds four years after Olympic lockout

-

Akram tells Pakistan, India to forget noise and 'enjoy' Asia Cup clash

Akram tells Pakistan, India to forget noise and 'enjoy' Asia Cup clash

-

Kicillof, the Argentine governor on a mission to stop Milei

-

Something to get your teeth into: 'Jaws' exhibit marks 50 years

Something to get your teeth into: 'Jaws' exhibit marks 50 years

-

Germany, France, Argentina, Austria on brink of Davis Cup finals

-

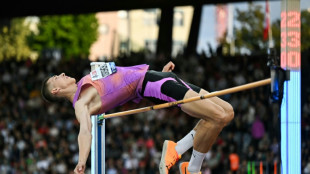

War with Russia weighs heavily on Ukrainian medal hope Doroshchuk

War with Russia weighs heavily on Ukrainian medal hope Doroshchuk

-

Suspect in Charlie Kirk killing caught, widow vows to carry on fight

-

Dunfee and Perez claim opening world golds in Tokyo

Dunfee and Perez claim opening world golds in Tokyo

-

Ben Griffin leads PGA Procore Championship in Ryder Cup tune-up

-

'We're more than our pain': Miss Palestine to compete on global stage

'We're more than our pain': Miss Palestine to compete on global stage

-

Ingebrigtsen seeks elusive 1500m world gold after injury-plagued season

-

Thailand's Chanettee leads by two at LPGA Queen City event

Thailand's Chanettee leads by two at LPGA Queen City event

-

Dolphins' Hill says focus is on football amid domestic violence allegations

-

Nigerian chef aims for rice hotpot record

Nigerian chef aims for rice hotpot record

-

What next for Brazil after Bolsonaro's conviction?

-

Fitch downgrades France's credit rating in new debt battle blow

Fitch downgrades France's credit rating in new debt battle blow

-

Fifty reported dead in Gaza as Israel steps up attacks on main city

-

Greenwood among scorers as Marseille cruise to four-goal victory

Greenwood among scorers as Marseille cruise to four-goal victory

-

Rodgers calls out 'cowardly' leak amid Celtic civil war

-

Frenchman Fourmaux grabs Chile lead as Tanak breaks down

Frenchman Fourmaux grabs Chile lead as Tanak breaks down

-

Germany, France, Argentina and Austria on brink of Davis Cup finals

Stocks tumble on US rate hike uncertainty

Equity markets mostly retreated Thursday, with the sharpest losses in Asia, after Federal Reserve chief Jerome Powell refused to be drawn on the pace of US interest rate hikes to battle decades-high inflation.

Although Powell on Wednesday firmed market expectations of a rate increase in March, investors were spooked by what happens thereafter.

His reluctance to give clear guidance on further tightening helped the dollar to reach a two-month high against the euro Thursday.

"Federal Reserve chair Jay Powell failed to stop the market rout with the central bank's latest policy update, with US stocks falling further after the announcement and the equity sell-off extending to most of Asia and Europe on Thursday," said AJ Bell investment director Russ Mould.

"It's what he didn't say that troubled investors. The key concerns are how aggressive the Fed will be with raising rates -- will they go up at every meeting this year, and will they go up by more than 0.25 percentage points each time?"

Fed officials still believe the price rises will be brought under control as economies reopen and supply chain problems abate, but the need to prevent them from running away is forcing them into an aggressive pivot.

The meeting "played out more hawkishly than we expected", said Steven Englander at Standard Chartered Bank.

"The (policy board) statement was largely as anticipated, but... Powell emphasised upside risks to inflation, pointing to a steady pace of policy withdrawal."

Powell's comments sent Wall Street sharply lower from their intra-day levels with tech firms, which are more susceptible to higher borrowing costs, taking the brunt.

Sharp Asian losses followed, particularly among tech stocks.

Seoul tanked more than three percent into a bear market -- a 20 percent drop from its recent high hit in August -- while Sydney fell into a correction, having given up 10 percent from its latest peak.

Tokyo took a 3.1-percent pounding as market heavyweights Sony and SoftBank -- which invests heavily in the tech sector -- led losses, while Hong Kong was two percent off.

Europe was mixed, with gains for London, Milan and Madrid, while Frankfurt and Paris fell in midday deals awaiting the Wall Street open.

- Oil below $90 -

Elsewhere, oil prices steadied, a day after benchmark European contract Brent North Sea briefly broke $90 per barrel for the first time in seven years owing to rising Ukraine-Russia tensions and falling US crude stockpiles.

Eyes are on the upcoming meeting of OPEC and other key producers, where they will discuss plans to continue to increase output.

"Energy traders are anticipating higher energy prices on potential geopolitical risks and as OPEC+ will stick to their plan to deliver another modest increase to production at next week's meeting," said OANDA's Edward Moya.

- Key figures around 1145 GMT -

London - FTSE 100: UP 0.5 percent at 7,504.16 points

Paris - CAC 40: DOWN 0.2 percent at 6,971.66

Frankfurt - DAX: DOWN 0.5 percent at 15,389.22

EURO STOXX 50: DOWN 0.3 percent at 4,150.27

Tokyo - Nikkei 225: DOWN 3.1 percent at 26,170.30 (close)

Hong Kong - Hang Seng Index: DOWN 2.0 percent at 23,807.00 (close)

Shanghai - Composite: DOWN 1.8 percent at 3,394.25 (close)

New York - Dow: DOWN 0.4 percent at 34,168.09 (close)

Euro/dollar: DOWN at $1.1188 from $1.1238 late Wednesday

Pound/dollar: DOWN at $1.3403 from $1.3458

Euro/pound: UP at 83.47 pence from 83.45 pence

Dollar/yen: UP at 115.18 yen from 114.64 yen

Brent North Sea crude: UP 0.2 percent at $88.89 per barrel

West Texas Intermediate: UP 0.1 percent at $87.39 per barrel

B.Shevchenko--BTB