-

Europe urged to 'step up' on defence as Trump upends ties

Europe urged to 'step up' on defence as Trump upends ties

-

Sinner hails 'inspiration' Djokovic ahead of Australian Open blockbuster

-

Dollar rebounds while gold climbs again before Fed update

Dollar rebounds while gold climbs again before Fed update

-

Aki a doubt for Ireland's Six Nations opener over disciplinary issue

-

West Ham sign Fulham winger Traore

West Ham sign Fulham winger Traore

-

Relentless Sinner sets up Australian Open blockbuster with Djokovic

-

Israel prepares to bury last Gaza hostage

Israel prepares to bury last Gaza hostage

-

Iran rejects talks with US amid military 'threats'

-

Heart attack ends iconic French prop Atonio's career

Heart attack ends iconic French prop Atonio's career

-

SKorean chip giant SK hynix posts record operating profit for 2025

-

Greenland's elite dogsled unit patrols desolate, icy Arctic

Greenland's elite dogsled unit patrols desolate, icy Arctic

-

Dutch tech giant ASML posts bumper profits, cuts jobs

-

Musetti rues 'really painful' retirement after schooling Djokovic

Musetti rues 'really painful' retirement after schooling Djokovic

-

Russian volcano puts on display in latest eruption

-

Thailand uses contraceptive vaccine to limit wild elephant births

Thailand uses contraceptive vaccine to limit wild elephant births

-

Djokovic gets lucky to join Pegula, Rybakina in Melbourne semi-finals

-

Trump says to 'de-escalate' Minneapolis, as aide questions agents' 'protocol'

Trump says to 'de-escalate' Minneapolis, as aide questions agents' 'protocol'

-

'Extremely lucky' Djokovic into Melbourne semi-finals as Musetti retires

-

'Animals in a zoo': Players back Gauff call for more privacy

'Animals in a zoo': Players back Gauff call for more privacy

-

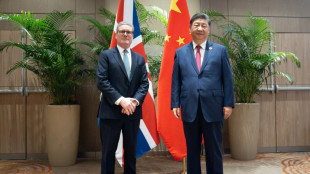

Starmer heads to China to defend 'pragmatic' partnership

-

Uganda's Quidditch players with global dreams

Uganda's Quidditch players with global dreams

-

'Hard to survive': Kyiv's elderly shiver after Russian attacks on power and heat

-

South Korea's ex-first lady jailed for 20 months for taking bribes

South Korea's ex-first lady jailed for 20 months for taking bribes

-

Polish migrants return home to a changed country

-

Dutch tech giant ASML posts bumper profits, eyes bright AI future

Dutch tech giant ASML posts bumper profits, eyes bright AI future

-

South Korea's ex-first lady jailed for 20 months for corruption

-

Minnesota congresswoman unbowed after attacked with liquid

Minnesota congresswoman unbowed after attacked with liquid

-

Backlash as Australia kills dingoes after backpacker death

-

Brazil declares acai a national fruit to ward off 'biopiracy'

Brazil declares acai a national fruit to ward off 'biopiracy'

-

Anisimova 'loses her mind' after Melbourne quarter-final exit

-

Home hope Goggia on medal mission at Milan-Cortina Winter Olympics

Home hope Goggia on medal mission at Milan-Cortina Winter Olympics

-

Omar attacked in Minneapolis after Trump vows to 'de-escalate'

-

Pistons escape Nuggets rally, Thunder roll Pelicans

Pistons escape Nuggets rally, Thunder roll Pelicans

-

Dominant Pegula sets up Australian Open semi-final against Rybakina

-

'Animals in a zoo': Swiatek backs Gauff call for more privacy

'Animals in a zoo': Swiatek backs Gauff call for more privacy

-

Japan PM's tax giveaway roils markets and worries voters

-

Amid Ukraine war fallout, fearful Chechen women seek escape route

Amid Ukraine war fallout, fearful Chechen women seek escape route

-

Rybakina surges into Melbourne semis as Djokovic takes centre stage

-

Dollar struggles to recover from losses after Trump comments

Dollar struggles to recover from losses after Trump comments

-

Greenland blues to Delhi red carpet: EU finds solace in India

-

Will the EU ban social media for children in 2026?

Will the EU ban social media for children in 2026?

-

Netherlands faces 'test case' climate verdict over Caribbean island

-

Rybakina stuns Swiatek to reach Australian Open semi-finals

Rybakina stuns Swiatek to reach Australian Open semi-finals

-

US ouster of Maduro nightmare scenario for Kim: N. Korean ex-diplomat

-

Svitolina credits mental health break for reaching Melbourne semis

Svitolina credits mental health break for reaching Melbourne semis

-

Japan's Olympic ice icons inspire new skating generation

-

Safe nowhere: massacre at Mexico football field sows despair

Safe nowhere: massacre at Mexico football field sows despair

-

North Korea to soon unveil 'next-stage' nuclear plans, Kim says

-

French ex-senator found guilty of drugging lawmaker

French ex-senator found guilty of drugging lawmaker

-

US Fed set to pause rate cuts as it defies Trump pressure

World Bank and IMF climate snub 'worrying', says COP29 presidency

The hosts of the most recent UN climate talks are worried international lenders are retreating from their commitments to help boost funding for developing countries' response to global warming.

Major development banks have agreed to boost climate spending and are seen as crucial in the effort to dramatically increase finance to help poorer countries build resilience to impacts and invest in renewable energy.

But anxiety has grown as the Trump administration has slashed foreign aid and discouraged US-based development lenders such as the World Bank and the International Monetary Fund from focussing on climate finance.

Developing nations, excluding China, will need an estimated $1.3 trillion a year by 2035 in financial assistance to transition to renewable energy and climate-proof their economies from increasing weather extremes.

Nowhere near this amount has been committed.

At last year's UN COP29 summit in Azerbaijan, rich nations agreed to increase climate finance to $300 billion a year by 2035, an amount decried as woefully inadequate.

Azerbaijan and Brazil, which is hosting this year's COP30 conference, have launched an initiative to reduce the shortfall, with the expectation of "significant" contributions from international lenders.

But so far only two -- the African Development Bank and the Inter-American Development Bank -- have responded to a call to engage the initiative with ideas, said COP29 president Mukhtar Babayev.

"We call on their shareholders to urgently help us to address these concerns," he told climate negotiators at a high-level summit in the German city of Bonn this week.

"We fear that a complex and volatile global environment is distracting" many of those expected to play a big role in bridging the climate finance gap, he added.

- A 'worrisome trend' -

His team travelled to Washington in April for the IMF and World Bank's spring meetings hoping to find the same enthusiasm for climate lending they had encountered a year earlier.

But instead they found institutions "very much reluctant now to talk about climate at all", said Azerbaijan's top climate negotiator Yalchin Rafiyev.

This was a "worrisome trend", he said, given expectations these lenders would extend the finance needed in the absence of other sources.

"They're very much needed," he said.

The World Bank is directing 45 percent of its total lending to climate, as part of an action plan in place until June 2026, with the public portion of that spilt 50/50 between emissions reductions and building resilience.

The United States, the World Bank's biggest shareholder, has pushed in a different direction.

On the sidelines of the April spring meetings, US Treasury Secretary Scott Bessent urged the bank to focus on "dependable technologies" rather than "distortionary climate finance targets."

This could mean investing in gas and other fossil fuel-based energy production, he said.

Under the Paris Agreement, wealthy developed countries -- those most responsible for global warming to date -- are obliged to pay climate finance to poorer nations.

Other countries, most notably China, make voluntary contributions.

- Money matters -

Finance is a source of long-running tensions at UN climate negotiations.

Donors have consistently failed to deliver on past finance pledges, and have committed well below what experts agree developing nations need to cope with the climate crisis.

The issue flared up again this week in Bonn, with nations at odds over whether to debate financial commitments from rich countries during the formal meetings.

European nations have also pared back their foreign aid spending in recent months, raising fears that budgets for climate finance could also face a haircut.

At COP29, multilateral development banks (MDBs) led by the World Bank Group estimated they could provide $120 billion annually in climate financing to low and middle income countries, and mobilise another $65 billion from the private sector by 2030.

Their estimate for high income countries was $50 billion, with another $65 billion mobilised from the private sector.

Rob Moore, of policy think tank E3G, said these lenders are the largest providers of international public finance to developing countries.

"Whilst they are facing difficult political headwinds in some quarters, they would be doing both themselves and their clients a disservice by disengaging on climate change," he said.

The World Bank in particular has done "a huge amount of work" to align its lending with global climate goals.

"If they choose to step back this would be at their own detriment, and other banks like the regionally based MDBs would likely play a bigger role in shaping the economy of the future," he said.

The World Bank declined to comment on the record.

A.Ruegg--VB