-

Underdogs Wales could hurt Irish after Scotland display: Popham

Underdogs Wales could hurt Irish after Scotland display: Popham

-

Gilgeous-Alexander rules over Knicks again in Thunder win

-

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

-

Alonso, Stroll fear 'permanent nerve damage' from vibrating Aston Martin

-

China boosts military spending with eyes on US, Taiwan

China boosts military spending with eyes on US, Taiwan

-

Seoul leads rebound across Asian stocks, oil extends gains

-

Tourism on hold as Middle East war casts uncertainty

Tourism on hold as Middle East war casts uncertainty

-

Bayern and Kane gambling with house money as Gladbach come to town

-

Turkey invests in foreign legion to deliver LA Olympics gold

Turkey invests in foreign legion to deliver LA Olympics gold

-

Galthie's France blessed with unprecedented talent: Saint-Andre

-

Voice coach to the stars says Aussie actors nail tricky accents

Voice coach to the stars says Aussie actors nail tricky accents

-

Rahm rejection of DP World Tour deal 'a shame' - McIlroy

-

Israel keeps up Lebanon strikes as ground forces advance

Israel keeps up Lebanon strikes as ground forces advance

-

China prioritises energy and diplomacy over Iran support

-

Canada PM Carney says can't rule out military participation in Iran war

Canada PM Carney says can't rule out military participation in Iran war

-

Verstappen says new Red Bull car gave him 'goosebumps'

-

Swiss to vote on creating giant 'climate fund'

Swiss to vote on creating giant 'climate fund'

-

Google to open German centre for 'AI development'

-

Winter Paralympics to start with icy blast as Ukraine lead ceremony boycott

Winter Paralympics to start with icy blast as Ukraine lead ceremony boycott

-

Sci-fi without AI: Oscar nominated 'Arco' director prefers human touch

-

Ex-guerrillas battle low support in Colombia election

Ex-guerrillas battle low support in Colombia election

-

'She's coming back': Djokovic predicts Serena return

-

Hamilton vows 'no holding back' in his 20th Formula One season

Hamilton vows 'no holding back' in his 20th Formula One season

-

Two-thirds of Cuba, including Havana, hit by blackout

-

US sinks Iranian warship off Sri Lanka as war spreads

US sinks Iranian warship off Sri Lanka as war spreads

-

After oil, US moves to secure access to Venezuelan minerals

-

Arteta hits back at Brighton criticism after Arsenal boost title bid

Arteta hits back at Brighton criticism after Arsenal boost title bid

-

Carrick says 'defeat hurts' after first loss as Man Utd boss

-

Ecuador expels Cuba envoy, rest of mission

Ecuador expels Cuba envoy, rest of mission

-

Arsenal stretch lead at top of Premier League as Man City falter

-

Title race not over vows Guardiola after Man City held by Forest

Title race not over vows Guardiola after Man City held by Forest

-

Rosenior hails 'world class' Joao Pedro after hat-trick crushes Villa

-

Brazil ratifies EU-Mercosur trade deal

Brazil ratifies EU-Mercosur trade deal

-

Real Sociedad edge rivals Athletic to reach Copa del Rey final

-

Chelsea boost top four push as Joao Pedro treble routs Villa

Chelsea boost top four push as Joao Pedro treble routs Villa

-

Leverkusen sink Hamburg to keep in touch with top four

-

Love match: WTA No. 1 Sabalenka announces engagement

Love match: WTA No. 1 Sabalenka announces engagement

-

Man City falter as Premier League leaders Arsenal go seven points clear

-

Man City title bid rocked by Forest draw

Man City title bid rocked by Forest draw

-

Defending champ Draper ready to ramp up return at Indian Wells

-

Arsenal extend lead in title race after Saka sinks Brighton

Arsenal extend lead in title race after Saka sinks Brighton

-

US, European stocks rise as oil prices steady; Asian indexes tumble

-

Trump rates Iran war as '15 out of 10'

Trump rates Iran war as '15 out of 10'

-

Nepal votes in key post-uprising polls

-

US Fed warns 'economic uncertainty' weighing on consumers

US Fed warns 'economic uncertainty' weighing on consumers

-

Florida family sues Google after AI chatbot allegedly coached suicide

-

Alcaraz unbeaten run under threat from Sinner, Djokovic at Indian Wells

Alcaraz unbeaten run under threat from Sinner, Djokovic at Indian Wells

-

Iran's supreme leader gone, but opposition still at war with itself

-

Mideast war rekindles European fears over soaring gas prices

Mideast war rekindles European fears over soaring gas prices

-

'Miracle to walk' says golfer after lift shaft fall

Tel Aviv’s Wartime rally

Israel’s equity benchmarks have climbed to fresh records even as the country wages simultaneous conflicts. The blue-chip index has advanced sharply in recent months, with the broader market notching new highs during intense geopolitical escalations. Gains accelerated after major security events in June and continued into September, leaving year-to-date performance near the top of the global league tables.

A market built for resilience. The Tel Aviv market is unusually heavy in banks, software, pharmaceuticals, and defense technology—sectors whose earnings are either globally diversified or directly insulated from domestic demand shocks. Banks benefit from still-elevated policy rates that support net interest margins, while leading software and cybersecurity names draw the majority of sales from overseas clients, muting local disruption. Defense contractors have logged outsized backlogs and new export orders as regional tensions lifted procurement cycles, translating quickly into revenue and earnings beats.

Policy cushions under the market. The central bank has held rates steady at 4.5% this year, balancing inflation control with financial-stability aims. That stance—combined with a well-telegraphed readiness to act in FX markets—has limited shekel volatility and anchored discount-rate assumptions in equity models. A more stable currency lowers the risk premia investors demand and supports multiples on exporters’ future cash flows.

War spending and external backstops. Wartime budgets channel orders into domestic defense supply chains and supporting services, while external security aid and strong diaspora/foreign flows mitigate balance-of-payments stress. For listed primes and tier-one suppliers, firm multi-quarter visibility on contracts reduces earnings uncertainty; investors price that visibility at a premium during crises. Recent quarterly results from a flagship defense name showed double-digit revenue and EPS growth alongside large new awards, reinforcing the thesis.

Sentiment mechanics: “buy bad news.” After initial drawdowns around major flare-ups, Israel’s market has often staged fast recoveries. Traders cite three dynamics: (1) systematic money returning once volatility spikes subside; (2) local pensions and provident funds averaging in on weakness; (3) foreign funds reassessing tail-risk after rapid, decisive military responses. That pattern was visible around the late-June strikes, when the main indices jumped across all five sessions and pushed to records.

Micro drivers: banks and defense lead, tech follows. Bank shares, a heavy index weight, re-rated on net interest income resilience and benign credit metrics. Defense stocks rallied on expanding backlogs and export deals; one leading contractor surged on earnings and a multi-billion-dollar award. Software and cyber names, with dollar-linked revenues, benefited from a firmer shekel and ongoing AI/digitization demand. Together, these groups offset pockets of weakness in domestically exposed small caps.

FX and rates as valuation levers. Equity multiples in Tel Aviv are sensitive to real yields and the ILS path. A steady policy rate and contained FX swings keep discount rates from ratcheting higher, while any signal of future cuts would, at the margin, lift present values for long-duration growth names. Central-bank communication this summer emphasized market stabilization alongside inflation convergence—guidance that helped compress risk premia.

boi.org.il

Global context: flows chase relative strength. In a year of choppy global equities, relative-momentum strategies and ETF rebalancing tend to channel flows into the best-performing markets. As Israel’s benchmarks outperformed, incremental passive and active allocations reinforced the move, pushing indices to successive highs. Daily print data in early September captured that continued grind higher.

What could stop the rally

- Escalation risk. A broader regional conflict that disrupts critical infrastructure or mobilization on a much larger scale would hit earnings expectations and risk appetite. Short, sharp flare-ups have been “buyable”; a drawn-out expansion may not be.

- Policy disappointment. A surprise tightening or a disorderly FX episode would lift discount rates and pressure valuations, especially in tech and rate-sensitive financials.

- Earnings air-pockets. If defense deliveries slip or banks guide to weaker credit growth/fees, the index’s two pillars wobble. Recent prints were strong but leave little room for execution errors.

- Valuation gravity. After a swift re-rating, some strategists warn momentum may outpace fundamentals; breadth indicators already flag froth in mid-caps. A modest pullback would not be surprising.

The bottom line

Israel’s stock surge is less a paradox than a reflection of market structure, policy buffers, and profit visibility in key sectors. Banks, software exporters, and defense suppliers can thrive even when domestic demand is strained; stable currency policy and predictable funding reinforce that resilience. The setup remains constructive while earnings and policy hold—yet highly sensitive to escalation, policy missteps, or an abrupt turn in global risk appetite.

Hormuz Shock Risk rising

Brazil's trade-war boom

Iran's revenge rewired

Cuba's golden Goose dies

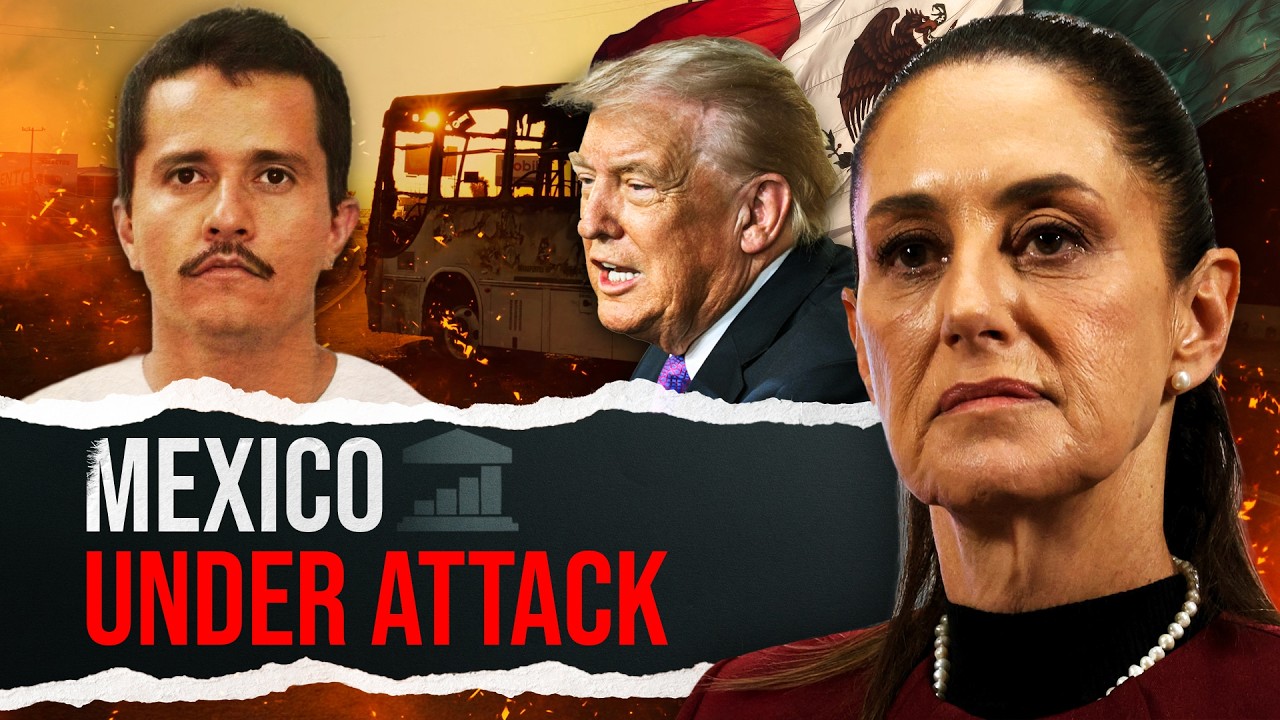

Mexico after El Mencho falls

Nicaragua on the brink?

Cuba: The Regime's last Card

Strike fears rise over Iran

U.S. Jobs stall, gdp slows

Japan’s right‑turn triumph

EU India deal gains unveiled