-

Underdogs Wales could hurt Irish after Scotland display: Popham

Underdogs Wales could hurt Irish after Scotland display: Popham

-

Gilgeous-Alexander rules over Knicks again in Thunder win

-

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

-

Alonso, Stroll fear 'permanent nerve damage' from vibrating Aston Martin

-

China boosts military spending with eyes on US, Taiwan

China boosts military spending with eyes on US, Taiwan

-

Seoul leads rebound across Asian stocks, oil extends gains

-

Tourism on hold as Middle East war casts uncertainty

Tourism on hold as Middle East war casts uncertainty

-

Bayern and Kane gambling with house money as Gladbach come to town

-

Turkey invests in foreign legion to deliver LA Olympics gold

Turkey invests in foreign legion to deliver LA Olympics gold

-

Galthie's France blessed with unprecedented talent: Saint-Andre

-

Voice coach to the stars says Aussie actors nail tricky accents

Voice coach to the stars says Aussie actors nail tricky accents

-

Rahm rejection of DP World Tour deal 'a shame' - McIlroy

-

Israel keeps up Lebanon strikes as ground forces advance

Israel keeps up Lebanon strikes as ground forces advance

-

China prioritises energy and diplomacy over Iran support

-

Canada PM Carney says can't rule out military participation in Iran war

Canada PM Carney says can't rule out military participation in Iran war

-

Verstappen says new Red Bull car gave him 'goosebumps'

-

Swiss to vote on creating giant 'climate fund'

Swiss to vote on creating giant 'climate fund'

-

Google to open German centre for 'AI development'

-

Winter Paralympics to start with icy blast as Ukraine lead ceremony boycott

Winter Paralympics to start with icy blast as Ukraine lead ceremony boycott

-

Sci-fi without AI: Oscar nominated 'Arco' director prefers human touch

-

Ex-guerrillas battle low support in Colombia election

Ex-guerrillas battle low support in Colombia election

-

'She's coming back': Djokovic predicts Serena return

-

Hamilton vows 'no holding back' in his 20th Formula One season

Hamilton vows 'no holding back' in his 20th Formula One season

-

Two-thirds of Cuba, including Havana, hit by blackout

-

US sinks Iranian warship off Sri Lanka as war spreads

US sinks Iranian warship off Sri Lanka as war spreads

-

After oil, US moves to secure access to Venezuelan minerals

-

Arteta hits back at Brighton criticism after Arsenal boost title bid

Arteta hits back at Brighton criticism after Arsenal boost title bid

-

Carrick says 'defeat hurts' after first loss as Man Utd boss

-

Ecuador expels Cuba envoy, rest of mission

Ecuador expels Cuba envoy, rest of mission

-

Arsenal stretch lead at top of Premier League as Man City falter

-

Title race not over vows Guardiola after Man City held by Forest

Title race not over vows Guardiola after Man City held by Forest

-

Rosenior hails 'world class' Joao Pedro after hat-trick crushes Villa

-

Brazil ratifies EU-Mercosur trade deal

Brazil ratifies EU-Mercosur trade deal

-

Real Sociedad edge rivals Athletic to reach Copa del Rey final

-

Chelsea boost top four push as Joao Pedro treble routs Villa

Chelsea boost top four push as Joao Pedro treble routs Villa

-

Leverkusen sink Hamburg to keep in touch with top four

-

Love match: WTA No. 1 Sabalenka announces engagement

Love match: WTA No. 1 Sabalenka announces engagement

-

Man City falter as Premier League leaders Arsenal go seven points clear

-

Man City title bid rocked by Forest draw

Man City title bid rocked by Forest draw

-

Defending champ Draper ready to ramp up return at Indian Wells

-

Arsenal extend lead in title race after Saka sinks Brighton

Arsenal extend lead in title race after Saka sinks Brighton

-

US, European stocks rise as oil prices steady; Asian indexes tumble

-

Trump rates Iran war as '15 out of 10'

Trump rates Iran war as '15 out of 10'

-

Nepal votes in key post-uprising polls

-

US Fed warns 'economic uncertainty' weighing on consumers

US Fed warns 'economic uncertainty' weighing on consumers

-

Florida family sues Google after AI chatbot allegedly coached suicide

-

Alcaraz unbeaten run under threat from Sinner, Djokovic at Indian Wells

Alcaraz unbeaten run under threat from Sinner, Djokovic at Indian Wells

-

Iran's supreme leader gone, but opposition still at war with itself

-

Mideast war rekindles European fears over soaring gas prices

Mideast war rekindles European fears over soaring gas prices

-

'Miracle to walk' says golfer after lift shaft fall

China’s profitless push

Can we keep up? Chinese companies are sacrificing margins—sometimes incurring outright losses—to win global market share in strategic industries from electric vehicles and batteries to solar and consumer tech. The tactic is turbocharging exports, pressuring Western competitors and forcing policymakers in Europe and the United States to erect new defenses while they scramble to lower costs at home.

Electric vehicles: a race to the bottom on price. In late spring 2025, China’s largest carmakers unleashed another round of steep price cuts, with entry-level models reduced to mass-market price points. Regulators in Beijing have since urged manufacturers to rein in the bruising price war, citing risks to industry health and employment. Yet the incentives keep coming as dozens of brands fight for share in the world’s most competitive EV market. The financial fallout is visible: leading pure-play EV makers continue to post substantial quarterly losses, while ambitious new entrants have acknowledged that their car divisions remain in the red even as sales surge.

Green tech: overcapacity meets collapsing margins. China’s build-out in solar has morphed from a growth engine into a profitability trap. Module and polysilicon prices have fallen so far that key manufacturers forecast sizeable half-year losses, and producers are now discussing a coordinated effort to shutter older capacity. Industry reports describe spot prices for feedstocks dipping below production costs, a hallmark of cut-throat competition that spills over into export markets and undercuts rivals globally.

Trade blowback intensifies. The U.S. has moved to quadruple tariffs on Chinese-made EVs and lift duties on batteries, chips and solar cells. The European Union has imposed definitive countervailing duties on Chinese battery-electric cars and opened additional probes across green-tech supply chains. Brussels and Beijing have even explored minimum export prices to reduce undercutting—an extraordinary step that underscores how acute the pricing pressure has become.

Deflation at the factory gate. China’s factory-gate prices remain in negative territory year on year, reflecting slack domestic demand and excess capacity. That weakness transmits abroad via cheaper exports, squeezing margins for manufacturers elsewhere and complicating central banks’ inflation-fighting calculus. Beijing has rolled out an “anti-involution” campaign to curb ruinous discounting and steer investment toward “high-quality growth,” but implementation is uneven and local governments still depend on industrial output to stabilize employment.

Scale, speed—and logistics. Chinese champions are not only cutting prices; they are redesigning logistics to keep them low. One leading EV maker has built its own fleet of car carriers and is localizing production via overseas factories to sidestep tariffs and port bottlenecks. Such vertical integration magnifies the advantage from sprawling domestic supply chains in batteries, motors and power electronics.

What this means for Western competitors. The immediate effect is a margin squeeze across autos, solar and adjacent sectors. The strategic response taking shape in Europe and the U.S. is three-pronged: (1) trade defense to buy time; (2) industrial policy to catalyze domestic gigafactories and clean-tech manufacturing; and (3) consolidation to rebuild pricing power. Companies that cannot match China’s cost curve will need to differentiate—through software, design, brand and service—or partner to gain scale. Even in China, the current “profitless prosperity” looks unsustainable: consolidation is inevitable, and state guidance now favors capacity rationalization over raw volume.

The bottom line. China’s price-first strategy is remaking global competition. Whether others can keep up will hinge on how quickly they can de-risk supply chains, compress costs and innovate without hollowing out profitability. For now, the contest is being fought as much on balance sheets as it is on assembly lines.

Hormuz Shock Risk rising

Brazil's trade-war boom

Iran's revenge rewired

Cuba's golden Goose dies

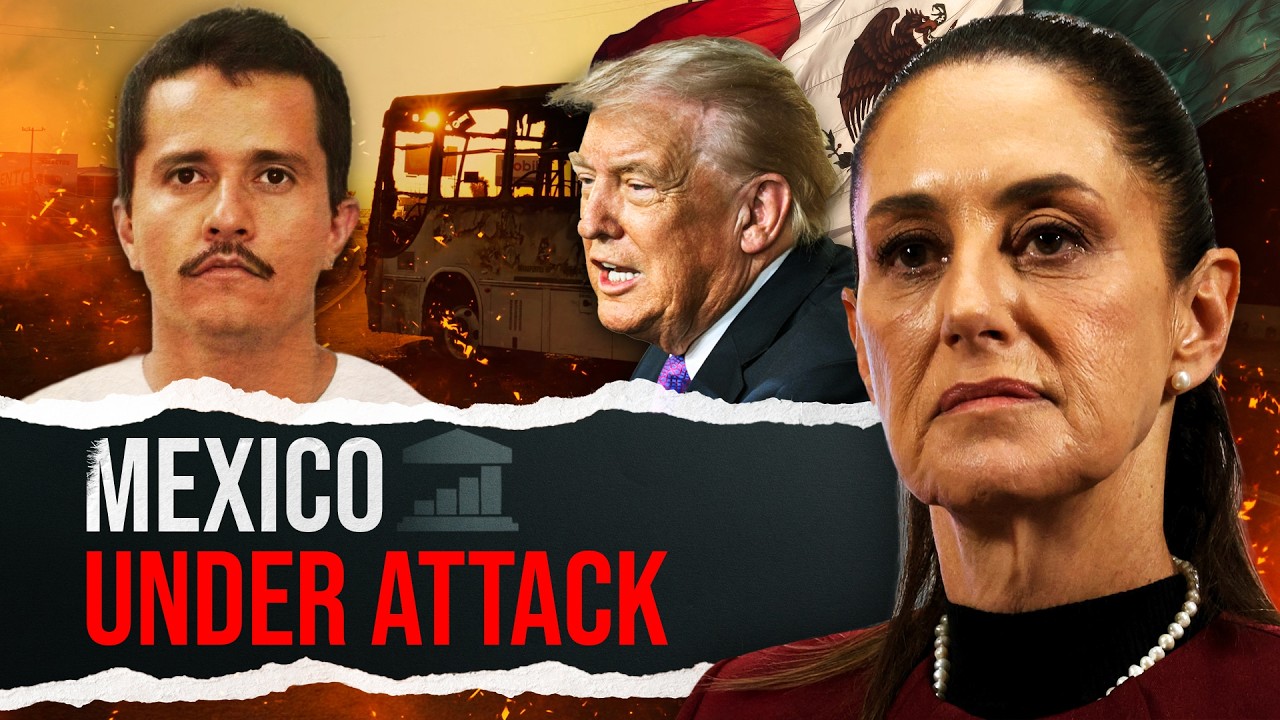

Mexico after El Mencho falls

Nicaragua on the brink?

Cuba: The Regime's last Card

Strike fears rise over Iran

U.S. Jobs stall, gdp slows

Japan’s right‑turn triumph

EU India deal gains unveiled