-

Fatherhood, sleep, T20 World Cup final: Henry's whirlwind journey

Fatherhood, sleep, T20 World Cup final: Henry's whirlwind journey

-

Conservative Nigerian city sees women drive rickshaw taxis

-

T20 World Cup hero Allen says New Zealand confidence high for final

T20 World Cup hero Allen says New Zealand confidence high for final

-

The silent struggle of an anti-war woman in Russia

-

Iran hits Kurdish groups in Iraq as conflict widens

Iran hits Kurdish groups in Iraq as conflict widens

-

China sets lowest growth target in decades as consumption lags

-

Afghans rally against Pakistan and civilian casualties

Afghans rally against Pakistan and civilian casualties

-

South Korea beat Philippines 3-0 to reach women's quarter-finals

-

Mercedes' Russell not fazed by being tipped as pre-season favourite

Mercedes' Russell not fazed by being tipped as pre-season favourite

-

Australia beat Taiwan in World Baseball Classic opener

-

Underdogs Wales could hurt Irish after Scotland display: Popham

Underdogs Wales could hurt Irish after Scotland display: Popham

-

Gilgeous-Alexander rules over Knicks again in Thunder win

-

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

-

Alonso, Stroll fear 'permanent nerve damage' from vibrating Aston Martin

-

China boosts military spending with eyes on US, Taiwan

China boosts military spending with eyes on US, Taiwan

-

Seoul leads rebound across Asian stocks, oil extends gains

-

Tourism on hold as Middle East war casts uncertainty

Tourism on hold as Middle East war casts uncertainty

-

Bayern and Kane gambling with house money as Gladbach come to town

-

Turkey invests in foreign legion to deliver LA Olympics gold

Turkey invests in foreign legion to deliver LA Olympics gold

-

Galthie's France blessed with unprecedented talent: Saint-Andre

-

Voice coach to the stars says Aussie actors nail tricky accents

Voice coach to the stars says Aussie actors nail tricky accents

-

Rahm rejection of DP World Tour deal 'a shame' - McIlroy

-

Israel keeps up Lebanon strikes as ground forces advance

Israel keeps up Lebanon strikes as ground forces advance

-

China prioritises energy and diplomacy over Iran support

-

Canada PM Carney says can't rule out military participation in Iran war

Canada PM Carney says can't rule out military participation in Iran war

-

Verstappen says new Red Bull car gave him 'goosebumps'

-

Swiss to vote on creating giant 'climate fund'

Swiss to vote on creating giant 'climate fund'

-

Google to open German centre for 'AI development'

-

Winter Paralympics to start with icy blast as Ukraine lead ceremony boycott

Winter Paralympics to start with icy blast as Ukraine lead ceremony boycott

-

Sci-fi without AI: Oscar nominated 'Arco' director prefers human touch

-

Ex-guerrillas battle low support in Colombia election

Ex-guerrillas battle low support in Colombia election

-

'She's coming back': Djokovic predicts Serena return

-

Hamilton vows 'no holding back' in his 20th Formula One season

Hamilton vows 'no holding back' in his 20th Formula One season

-

Two-thirds of Cuba, including Havana, hit by blackout

-

US sinks Iranian warship off Sri Lanka as war spreads

US sinks Iranian warship off Sri Lanka as war spreads

-

After oil, US moves to secure access to Venezuelan minerals

-

Arteta hits back at Brighton criticism after Arsenal boost title bid

Arteta hits back at Brighton criticism after Arsenal boost title bid

-

Carrick says 'defeat hurts' after first loss as Man Utd boss

-

Ecuador expels Cuba envoy, rest of mission

Ecuador expels Cuba envoy, rest of mission

-

Arsenal stretch lead at top of Premier League as Man City falter

-

Title race not over vows Guardiola after Man City held by Forest

Title race not over vows Guardiola after Man City held by Forest

-

Rosenior hails 'world class' Joao Pedro after hat-trick crushes Villa

-

Brazil ratifies EU-Mercosur trade deal

Brazil ratifies EU-Mercosur trade deal

-

Real Sociedad edge rivals Athletic to reach Copa del Rey final

-

Chelsea boost top four push as Joao Pedro treble routs Villa

Chelsea boost top four push as Joao Pedro treble routs Villa

-

Leverkusen sink Hamburg to keep in touch with top four

-

Love match: WTA No. 1 Sabalenka announces engagement

Love match: WTA No. 1 Sabalenka announces engagement

-

Man City falter as Premier League leaders Arsenal go seven points clear

-

Man City title bid rocked by Forest draw

Man City title bid rocked by Forest draw

-

Defending champ Draper ready to ramp up return at Indian Wells

Trump’s 50% tariffs on europe

In a move that has sent shockwaves through global markets, U.S. President Donald Trump has threatened to impose 50% tariffs on imports from the European Union, initially set for June 1, 2025, but later delayed to July 9 to allow for negotiations. This aggressive trade policy has sparked intense debate about its motivations and potential consequences for the European economy, which relies heavily on exports to the United States. The proposed tariffs, described as a tool to reshape global trade dynamics, raise questions about the strategic intent behind such a drastic measure and its implications for transatlantic relations.

The European Union, a key trading partner of the United States, exported goods worth billions to the U.S. in 2024, with sectors like pharmaceuticals, automotive, and luxury goods leading the charge. A 50% tariff would significantly increase the cost of these goods, potentially reducing demand and squeezing profit margins for European companies. For instance, Germany’s automotive industry, including brands like BMW and Porsche, faces heightened risks, as does France’s luxury sector, which employs over 600,000 people. Italy’s high-end leather goods and the European aerospace sector, exemplified by companies like Airbus, could also face severe disruptions. The European Commission has estimated that such tariffs could shave 0.5% off the EU’s GDP, a substantial blow to an economy already grappling with global uncertainties.

Trump’s rationale appears rooted in a long-standing belief that tariffs are a solution to perceived trade imbalances. He has publicly expressed frustration with the EU, accusing it of being “very difficult to deal with” and slow to negotiate. His administration argues that the EU benefits disproportionately from trade with the U.S., a claim that resonates with his domestic base but overlooks the mutual benefits of transatlantic commerce. The president’s strategy seems to leverage tariffs as a negotiating tactic, pressuring the EU to concede to terms more favourable to U.S. interests, such as increased purchases of American goods like soya beans, arms, and liquefied natural gas. The delay to July 9, following a phone call with European Commission President Ursula von der Leyen, suggests a willingness to negotiate, but the threat of tariffs remains a powerful bargaining chip.

Critics argue that Trump’s approach is less about economic fairness and more about political posturing. By targeting the EU, he reinforces a narrative of protecting American jobs and manufacturing, a cornerstone of his economic agenda. His recent announcement to double steel tariffs to 50% and impose 25% tariffs on autos underscores this focus on domestic industry. However, the broader economic fallout could be severe. European officials, including Germany’s Lars Klingbeil, have warned that such a trade conflict harms both sides, endangering jobs and economic stability. The EU has signalled readiness to retaliate with counter-tariffs, potentially targeting U.S. products like Boeing aircraft, which could escalate tensions into a full-blown trade war.

The timing of the tariff threat adds to its disruptive potential. Europe’s economy, while showing resilience in some areas—Germany’s GDP grew unexpectedly in early 2025 due to strong exports—is not immune to external shocks. The uncertainty surrounding Trump’s tariffs has already rattled markets, with European stocks tumbling after the initial announcement before recovering slightly upon the delay. Companies like HP, which cited tariff-related costs as a factor in cutting earnings forecasts, illustrate the ripple effects on global supply chains. Small businesses and consumers, particularly in the U.S., could face higher prices, while European exporters risk losing market share if forced to absorb tariff costs.

Trump’s tariff strategy also faces legal challenges. A U.S. trade court recently ruled that his use of emergency powers to impose tariffs was unlawful, though an appeals court temporarily reinstated them. This legal uncertainty complicates the administration’s plans, yet Trump’s team has hinted at alternative mechanisms, such as invoking a 1930 trade law to bypass judicial rulings. These manoeuvres reflect a determination to press forward, regardless of opposition, aligning with Trump’s broader goal of reshaping the global economic order.

For the EU, the path forward involves balancing diplomacy with resolve. The European Commission, led by Ursula von der Leyen, has committed to fast-tracking trade talks, with negotiations set to intensify in the coming weeks. EU Trade Commissioner Maroš Šefčovič is expected to engage directly with U.S. counterparts, aiming for a deal that could reduce tariffs to zero on industrial goods. However, the EU remains firm in defending its interests, preparing countermeasures should talks falter. The bloc’s unity will be tested as member states like Italy, with leaders like Giorgia Meloni fostering ties with the White House, push for compromise, while others advocate a harder line.

The stakes are high for both sides. A failure to reach an agreement by July 9 could trigger a tariff regime that disrupts supply chains, inflates consumer prices, and erodes economic confidence. For Trump, the tariffs are a high-stakes gamble to assert U.S. dominance in global trade, but they risk alienating a key ally and destabilising an interconnected economy. For Europe, the challenge is to navigate this turbulent period without sacrificing its economic vitality or succumbing to pressure. As negotiations unfold, the world watches closely, aware that the outcome will shape the future of transatlantic trade and beyond.

Hormuz Shock Risk rising

Brazil's trade-war boom

Iran's revenge rewired

Cuba's golden Goose dies

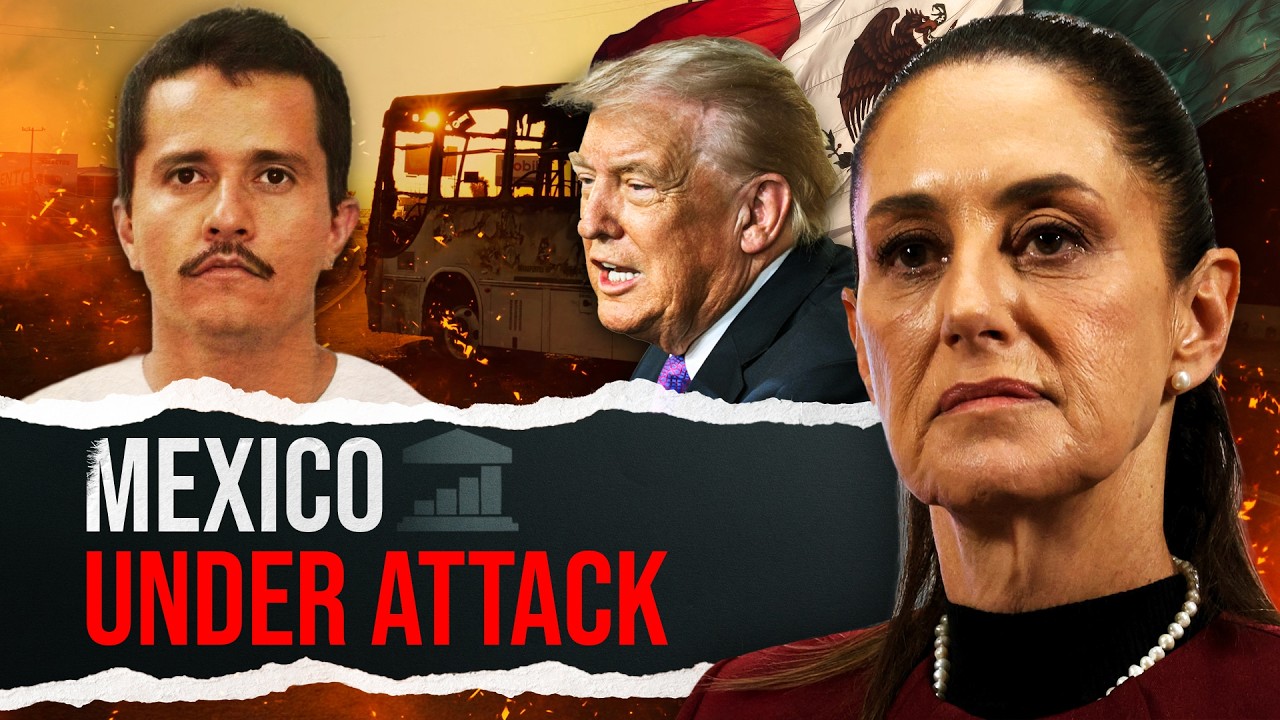

Mexico after El Mencho falls

Nicaragua on the brink?

Cuba: The Regime's last Card

Strike fears rise over Iran

U.S. Jobs stall, gdp slows

Japan’s right‑turn triumph

EU India deal gains unveiled