-

Oil prices rise, stocks slide as Middle East war stirs supply concerns

Oil prices rise, stocks slide as Middle East war stirs supply concerns

-

More flights take off despite continued fighting in Middle East

-

Ukraine, Russia free 200 POWs each

Ukraine, Russia free 200 POWs each

-

Middle East war halts work at WHO's Dubai emergency hub

-

Paramount's Ellison vows CNN editorial independence

Paramount's Ellison vows CNN editorial independence

-

US says attacks on alleged drug boats have spooked traffickers

-

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

-

India pile up 253-7 against England in T20 World Cup semi-final

-

Wary Europeans pledge 'defensive' military aid in Mideast war

Wary Europeans pledge 'defensive' military aid in Mideast war

-

Seven countries to boycott Paralympics ceremony over Russia: organisers

-

UK's Crufts dog show opens with growing global appeal

UK's Crufts dog show opens with growing global appeal

-

PSG prepare for Chelsea clash with Monaco rematch

-

Google opens AI centre as Berlin defends US tech reliance

Google opens AI centre as Berlin defends US tech reliance

-

Second Iranian ship nears Sri Lanka after submarine attack

-

Portugal mourns acclaimed writer Antonio Lobo Antunes

Portugal mourns acclaimed writer Antonio Lobo Antunes

-

Union loses fight against Tesla at German factory

-

Wales revel in being the underdogs, says skipper Lake

Wales revel in being the underdogs, says skipper Lake

-

German school students rally against army recruitment drive

-

Wary European states pledge military aid for Cyprus, Gulf

Wary European states pledge military aid for Cyprus, Gulf

-

Liverpool injuries frustrating Slot in tough season

-

Real Madrid will 'keep fighting' in title race, vows Arbeloa

Real Madrid will 'keep fighting' in title race, vows Arbeloa

-

Australia join South Korea in quarters of Women's Asian Cup

-

Kane to miss Bayern game against Gladbach with calf knock

Kane to miss Bayern game against Gladbach with calf knock

-

Henman says Raducanu needs more physicality to rise up rankings

-

France recall fit-again Jalibert to face Scotland

France recall fit-again Jalibert to face Scotland

-

Harry Styles fans head in one direction: to star's home village

-

Syrian jailed over stabbing at Berlin Holocaust memorial

Syrian jailed over stabbing at Berlin Holocaust memorial

-

Second Iranian ship heading to Sri Lanka after submarine attack

-

Middle East war spirals as Iran hits Kurds in Iraq

Middle East war spirals as Iran hits Kurds in Iraq

-

Norris hungrier than ever to defend Formula One world title

-

Fatherhood, sleep, T20 World Cup final: Henry's whirlwind journey

Fatherhood, sleep, T20 World Cup final: Henry's whirlwind journey

-

Conservative Nigerian city sees women drive rickshaw taxis

-

T20 World Cup hero Allen says New Zealand confidence high for final

T20 World Cup hero Allen says New Zealand confidence high for final

-

The silent struggle of an anti-war woman in Russia

-

Iran hits Kurdish groups in Iraq as conflict widens

Iran hits Kurdish groups in Iraq as conflict widens

-

China sets lowest growth target in decades as consumption lags

-

Afghans rally against Pakistan and civilian casualties

Afghans rally against Pakistan and civilian casualties

-

South Korea beat Philippines 3-0 to reach women's quarter-finals

-

Mercedes' Russell not fazed by being tipped as pre-season favourite

Mercedes' Russell not fazed by being tipped as pre-season favourite

-

Australia beat Taiwan in World Baseball Classic opener

-

Underdogs Wales could hurt Irish after Scotland display: Popham

Underdogs Wales could hurt Irish after Scotland display: Popham

-

Gilgeous-Alexander rules over Knicks again in Thunder win

-

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

-

Alonso, Stroll fear 'permanent nerve damage' from vibrating Aston Martin

-

China boosts military spending with eyes on US, Taiwan

China boosts military spending with eyes on US, Taiwan

-

Seoul leads rebound across Asian stocks, oil extends gains

-

Tourism on hold as Middle East war casts uncertainty

Tourism on hold as Middle East war casts uncertainty

-

Bayern and Kane gambling with house money as Gladbach come to town

-

Turkey invests in foreign legion to deliver LA Olympics gold

Turkey invests in foreign legion to deliver LA Olympics gold

-

Galthie's France blessed with unprecedented talent: Saint-Andre

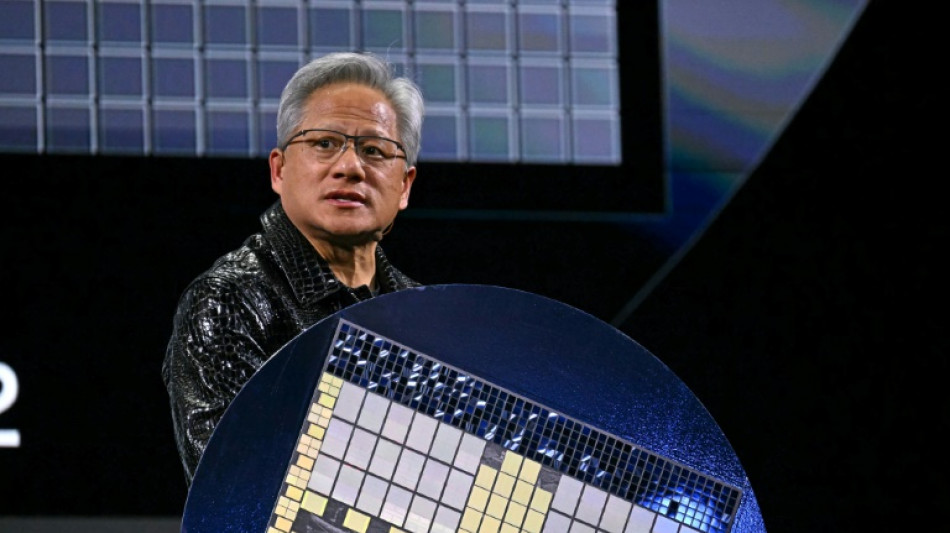

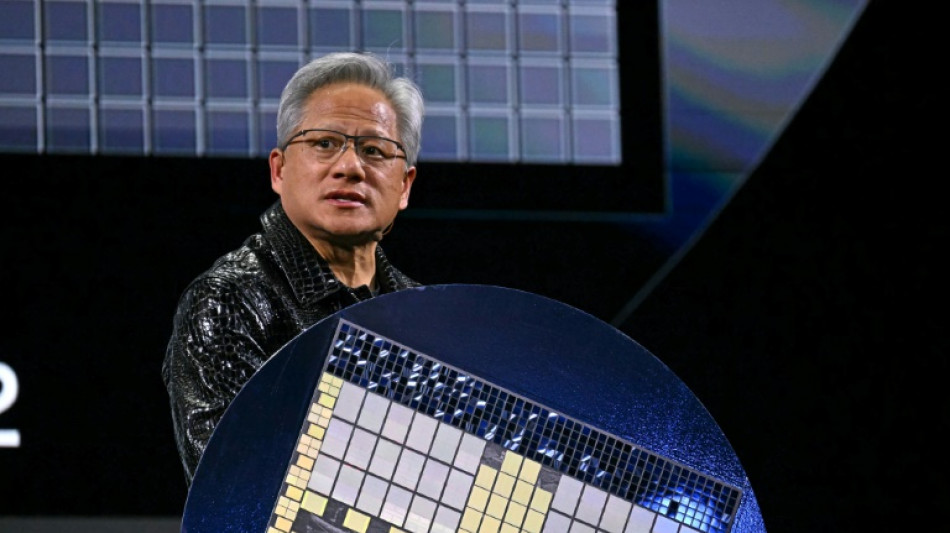

AI giant Nvidia becomes first company to reach $4 tn in value

Nvidia became the first company to touch $4 trillion in market value on Wednesday, a new milestone in Wall Street's bet that artificial intelligence will transform the economy.

Shortly after the stock market opened, Nvidia vaulted as high as $164.42, giving it a valuation above $4 trillion. The stock subsequently edged lower, ending just under the record threshold.

"The market has an incredible certainty that AI is the future," said Steve Sosnick of Interactive Brokers. "Nvidia is certainly the company most positioned to benefit from that gold rush."

Nvidia, led by electrical engineer Jensen Huang, now has a market value greater than the GDP of France, Britain or India, a testament to investor confidence that AI will spur a new era of robotics and automation.

The California chip company's latest surge is helping drive a recovery in the broader stock market, as Nvidia itself outperforms major indices.

Part of this is due to relief that President Donald Trump has walked back his most draconian tariffs, which pummeled global markets in early April.

Even as Trump announced new tariff actions in recent days, US stocks have stayed at lofty levels, with the tech-centered Nasdaq ending at a fresh record on Wednesday.

"You've seen the markets walk us back from a worst-case scenario in terms of tariffs," said Angelo Zino, technology analyst at CFRA Research.

While Nvidia still faces US export controls to China as well as broader tariff uncertainty, the company's deal to build AI infrastructure in Saudi Arabia during a Trump state visit in May showed a potential upside in the US president's trade policy.

"We've seen the administration using Nvidia chips as a bargaining chip," Zino said.

- New advances -

Nvidia's surge to $4 trillion marks a new benchmark in a fairly consistent rise over the last two years as AI enthusiasm has built.

In 2025 so far, the company's shares have risen more than 21 percent, whereas the Nasdaq has gained 6.7 percent.

Taiwan-born Huang has wowed investors with a series of advances, including its core product: graphics processing units (GPUs), key to many of the generative AI programs behind autonomous driving, robotics and other cutting-edge domains.

The company has also unveiled its Blackwell next-generation technology allowing more super processing capacity. One of its advances is "real-time digital twins," significantly speeding production development time in manufacturing, aerospace and myriad other sectors.

However, Nvidia's winning streak was challenged early in 2025 when China-based DeepSeek shook up the world of generative AI with a low-cost, high-performance model that challenged the hegemony of OpenAI and other big-spending behemoths.

Nvidia's lost some $600 billion in market valuation in a single session during this period.

Huang has welcomed DeepSeek's presence, while arguing against US export constraints.

- AI race -

In the most recent quarter, Nvidia reported earnings of nearly $19 billion despite a $4.5 billion hit from US export controls limiting sales of cutting-edge technology to China.

The first-quarter earnings period also revealed that momentum for AI remained strong. Many of the biggest tech companies -- Microsoft, Google, Amazon and Meta -- are jostling to come out on top in the multi-billion-dollar AI race.

A recent UBS survey of technology executives showed Nvidia widening its lead over rivals.

Zino said Nvidia's latest surge reflected a fuller understanding of DeepSeek, which has ultimately stimulated investment in complex reasoning models but not threatened Nvidia's business.

Nvidia is at the forefront of "AI agents," the current focus in generative AI in which machines are able to reason and infer more than in the past, he said.

"Overall the demand landscape has improved for 2026 for these more complex reasoning models," Zino said.

But the speedy growth of AI will also be a source of disruption.

Executives at Ford, JPMorgan Chase and Amazon are among those who have begun to say the "quiet part out loud," according to a Wall Street Journal report recounting recent public acknowledgment of white-collar job loss due to AI.

Shares of Nvidia closed the day at $162.88, up 1.8 percent, finishing at just under $4 trillion in market value.

T.Egger--VB