-

Keys into Melbourne third round with Sinner, Djokovic primed

Keys into Melbourne third round with Sinner, Djokovic primed

-

Bangladesh launches campaigns for first post-Hasina polls

-

Stocks track Wall St rally as Trump cools tariff threats in Davos

Stocks track Wall St rally as Trump cools tariff threats in Davos

-

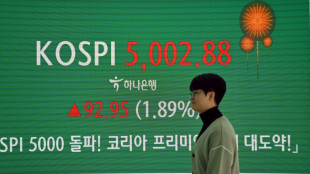

South Korea's economy grew just 1% in 2025, lowest in five years

-

Snowboard champ Hirano suffers fractures ahead of Olympics

Snowboard champ Hirano suffers fractures ahead of Olympics

-

'They poisoned us': grappling with deadly impact of nuclear testing

-

Keys blows hot and cold before making Australian Open third round

Keys blows hot and cold before making Australian Open third round

-

Philippine journalist found guilty of terror financing

-

Greenlanders doubtful over Trump resolution

Greenlanders doubtful over Trump resolution

-

Real Madrid top football rich list as Liverpool surge

-

'One Battle After Another,' 'Sinners' tipped to top Oscar noms

'One Battle After Another,' 'Sinners' tipped to top Oscar noms

-

Higher heating costs add to US affordability crunch

-

Eight stadiums to host 2027 Rugby World Cup matches in Australia

Eight stadiums to host 2027 Rugby World Cup matches in Australia

-

Plastics everywhere, and the myth that made it possible

-

Interim Venezuela leader to visit US

Interim Venezuela leader to visit US

-

Australia holds day of mourning for Bondi Beach shooting victims

-

Liverpool cruise as Bayern reach Champions League last 16

Liverpool cruise as Bayern reach Champions League last 16

-

Fermin Lopez brace leads Barca to win at Slavia Prague

-

Newcastle pounce on PSV errors to boost Champions League last-16 bid

Newcastle pounce on PSV errors to boost Champions League last-16 bid

-

Fermin Lopez brace hands Barca win at Slavia Prague

-

Kane double fires Bayern into Champions League last 16

Kane double fires Bayern into Champions League last 16

-

Newcastle pounce on PSV errors to close in on Champions League last 16

-

In Davos speech, Trump repeatedly refers to Greenland as 'Iceland'

In Davos speech, Trump repeatedly refers to Greenland as 'Iceland'

-

Liverpool see off Marseille to close on Champions League last 16

-

Caicedo strikes late as Chelsea end Pafos resistance

Caicedo strikes late as Chelsea end Pafos resistance

-

US Republicans begin push to hold Clintons in contempt over Epstein

-

Trump says agreed 'framework' for US deal over Greenland

Trump says agreed 'framework' for US deal over Greenland

-

Algeria's Zidane and Belghali banned over Nigeria AFCON scuffle

-

Iran says 3,117 killed during protests, activists fear 'far higher' toll

Iran says 3,117 killed during protests, activists fear 'far higher' toll

-

Atletico frustrated in Champions League draw at Galatasaray

-

Israel says struck Syria-Lebanon border crossings used by Hezbollah

Israel says struck Syria-Lebanon border crossings used by Hezbollah

-

Snapchat settles to avoid social media addiction trial

-

'Extreme cold': Winter storm forecast to slam huge expanse of US

'Extreme cold': Winter storm forecast to slam huge expanse of US

-

Jonathan Anderson reimagines aristocrats in second Dior Homme collection

-

Former England rugby captain George to retire in 2027

Former England rugby captain George to retire in 2027

-

Israel launches wave of fresh strikes on Lebanon

-

Ubisoft unveils details of big restructuring bet

Ubisoft unveils details of big restructuring bet

-

Abhishek fireworks help India beat New Zealand in T20 opener

-

Huge lines, laughs and gasps as Trump lectures Davos elite

Huge lines, laughs and gasps as Trump lectures Davos elite

-

Trump rules out 'force' against Greenland but demands talks

-

Stocks steadier as Trump rules out force to take Greenland

Stocks steadier as Trump rules out force to take Greenland

-

World's oldest cave art discovered in Indonesia

-

US hip-hop label Def Jam launches China division in Chengdu

US hip-hop label Def Jam launches China division in Chengdu

-

Dispersed Winter Olympics sites 'have added complexity': Coventry

-

Man City players to refund fans after Bodo/Glimt debacle

Man City players to refund fans after Bodo/Glimt debacle

-

France's Lactalis recalls baby formula over toxin

-

Pakistan rescuers scour blaze site for dozens missing

Pakistan rescuers scour blaze site for dozens missing

-

Keenan return to Irish squad boosts Farrell ahead of 6 Nations

-

US Treasury chief accuses Fed chair of 'politicising' central bank

US Treasury chief accuses Fed chair of 'politicising' central bank

-

Trump rules out force against Greenland but demands 'immediate' talks

Carbon 'capture' climate tech is booming, and confusing

Humanity's failure to draw down planet-heating carbon dioxide emissions -- 41 billion tonnes in 2022 -- has thrust once-marginal options for capping or reducing CO2 in the atmosphere to centre stage in climate policy and investment.

Carbon capture and storage (CCS) and direct air capture (DAC) are both complex industrial processes that isolate CO2 but these newly booming technologies are fundamentally different and often conflated.

Here's a primer on what they are and how they differ.

- What is carbon capture? -

CCS syphons off CO2 from the exhaust, or flue gas, of fossil fuel-fired power plants as well as heavy industry.

The exhaust from a coal-fired power plant is about 12 percent CO2, while in steel and cement production it is typically double that.

Unlike CCS, which by itself only prevents additional carbon dioxide from entering the atmosphere, DAC extracts CO2 molecules already there.

Crucially, this makes DAC a "negative emissions" technology.

It can therefore generate credits for companies seeking to offset their greenhouse gas output -- but only if the captured CO2 is permanently stored underground, such as in depleted oil and gas reservoirs or in saline aquifers.

The concentration of carbon dioxide in ambient air is only 420 parts per million (about 0.04 percent), so corralling CO2 using DAC is far more energy intensive.

Once isolated using either CCS or DAC, CO2 can be used to make products such as building materials or "green" aviation fuel, though some of that CO2 will seep back into the air.

"If the CO2 is utilised, then it is not removal," said Oliver Geden, a senior fellow at the German Institute for International Security Affairs.

- State of play -

The fossil fuel industry has been using CCS since the 1970s but not to prevent CO2 from leaching into the atmosphere.

Rather, oil and gas companies inject CO2 into oil fields to extract more crude more quickly.

Historically, bolting CCS facilities onto coal- and gas-fired power plants and then storing the CO2 to reduce emissions has proven technically feasible but uneconomical.

The world's largest CCS plant, the Petra Nova facility in Texas, was mothballed three years after opening in 2017.

But the looming climate crisis and government subsidies have revived interest in CCS for the power sector and beyond.

At the end of 2022, there were 35 commercial-scale facilities worldwide applying carbon capture technology to industry, fuel transformation or power generation, isolating a total of 45 million tonnes (Mt) of CO2, according to the International Energy Agency (IEA).

DAC, by contrast, is very new.

A total of 18 DAC plants globally only captured about as much CO2 last year (10,000 tonnes) as the world emits in 10 seconds.

- Scaling up -

Both CCS and DAC must be massively scaled up if they are to play a significant role in decarbonising the global economy.

To keep the mid-century net-zero target in play, CCS will need to divert 1.3 billion tonnes a year from power and industry -- 30 times more than last year -- by 2030, according to the IEA.

DAC must remove 60 Mt CO2 per year by that date, several thousand-fold more than today.

But the nascent industry is burgeoning with new actors, and the first million-tonne-per-year plant is scheduled to come on line in the United States next year, with others following.

"It's a huge challenge but it's not unprecedented," University of Wisconsin–Madison professor Gregory Nemet told AFP, citing other technologies, including solar panels, that have scaled up dramatically in a matter of decades.

Preparing a site to stock CO2 can take up to 10 years, so storage could become a serious bottleneck for both CCS and DAC development.

- Cost per tonne -

Carbon capture costs $15 to $20 per tonne for industrial processes with highly concentrated streams of CO2, and $40 to $120 per tonne for more diluted gas streams, such as in power generation.

DAC -- still in its infancy -- has much higher costs, ranging today from $600 to $1,000 per tonne of CO2 captured.

Those costs are projected to drop sharply to $100-$300 per tonne by 2050, according to the inaugural State of Carbon Dioxide Removal report, published earlier this year.

- Follow the money -

As countries and companies feel the pinch from decarbonisation timetables and net-zero commitments, more money -- public and private -- is flowing toward both CCS and DAC.

In the United States, the Inflation Reduction Act (IRA) earmarks billions of dollars in tax credits for CCS.

The earlier Infrastructure Investment and Jobs Act provides about $12 billion over five years.

Canada's 2022 budget also extends an investment tax credit that cuts the cost of CCS projects in half.

South Korea and China are also investing heavily in the sector, with China opening a 500,000 Mt plant last month in Jiangsu Province.

In Europe, support comes at the national level and is oriented toward industry and storage, especially in the North Sea.

For DAC, a range of companies -- Alphabet, Shopify, Meta, Stripe, Microsoft and H&M Group -- have paid into a fund with a promise to collectively buy at least $1 billion of "permanent carbon removal" between 2022 and 200.

Last month, JP Morgan struck a $20 million, nine-year carbon removal deal with DAC pioneer Climeworks, based in Switzerland.

L.Dubois--BTB