-

US vaccine panel to hold high-stakes policy meeting

US vaccine panel to hold high-stakes policy meeting

-

In Nigeria's nightclubs, the bathroom selfie is king - or, rather, queen

-

Glitter and Soviet nostalgia: Russia revives Eurovision rival contest

Glitter and Soviet nostalgia: Russia revives Eurovision rival contest

-

EU seeks 'face-saving' deal on UN climate target

-

Busan film competition showcases Asian cinema's 'strength'

Busan film competition showcases Asian cinema's 'strength'

-

Senational Son bags first MLS hat-trick as LAFC beat Real Salt Lake

-

Title rivals Piastri, Norris bid to secure teams' crown for McLaren

Title rivals Piastri, Norris bid to secure teams' crown for McLaren

-

Europe, Mediterranean coast saw record drought in August: AFP analysis of EU data

-

Australia unveils 'anti-climactic' new emissions cuts

Australia unveils 'anti-climactic' new emissions cuts

-

Warholm and Bol headline hurdling royalty on Day 7 of Tokyo worlds

-

'Raped, jailed, tortured, left to die': the hell of being gay in Turkmenistan

'Raped, jailed, tortured, left to die': the hell of being gay in Turkmenistan

-

Asian markets fluctuate after Fed cuts interest rates

-

Dodgers ponder using Ohtani as relief pitcher

Dodgers ponder using Ohtani as relief pitcher

-

US adversaries stoke Kirk conspiracy theories, researchers warn

-

Jimmy Kimmel show yanked after government pressure on Kirk comments

Jimmy Kimmel show yanked after government pressure on Kirk comments

-

Canada confident of dethroning New Zealand in Women's World Cup semis

-

Australia vows to cut emissions by 62 to 70% by 2035

Australia vows to cut emissions by 62 to 70% by 2035

-

Top UN Gaza investigator hopeful Israeli leaders will be prosecuted

-

Japan seeks to ramp up Asian Games buzz with year to go

Japan seeks to ramp up Asian Games buzz with year to go

-

Judge weighs court's powers in Trump climate case

-

Australian scientists grapple with 'despicable' butterfly heist

Australian scientists grapple with 'despicable' butterfly heist

-

US faces pressure in UN Security Council vote on Gaza

-

As media declines, gory Kirk video spreads on 'unrestrained' social sites

As media declines, gory Kirk video spreads on 'unrestrained' social sites

-

'I don't cry anymore': In US jail, Russian dissidents fear deportation

-

Jimmy Kimmel show off air 'indefinitely' after his Kirk comments

Jimmy Kimmel show off air 'indefinitely' after his Kirk comments

-

Meta expands AI glasses line in a bet on the future

-

Trump's UK state visit gets political after royal welcome

Trump's UK state visit gets political after royal welcome

-

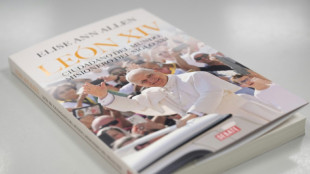

Pope Leo puts the brake on Church reforms

-

ABC says Jimmy Kimmel off air 'indefinitely' after Charlie Kirk comments

ABC says Jimmy Kimmel off air 'indefinitely' after Charlie Kirk comments

-

Tourists return to Peru's Machu Picchu after community protest

-

Simeone calls for more protection after Liverpool scuffle

Simeone calls for more protection after Liverpool scuffle

-

Trump gets lavish UK banquet - and an awkward guest

-

Colombia's Restrepo aims to make history as World Athletics head

Colombia's Restrepo aims to make history as World Athletics head

-

US stocks finish mixed as Fed cuts rates for first time in 2025

-

Palmer blames 'lack of concentration' for Bayern defeat

Palmer blames 'lack of concentration' for Bayern defeat

-

12-million-year-old porpoise fossil found in Peru

-

Van Dijk grabs Liverpool win, PSG start Champions League defence in style

Van Dijk grabs Liverpool win, PSG start Champions League defence in style

-

Kane doubles up as Bayern sink Chelsea in Champions League

-

Van Dijk snatches Champions League win for Liverpool as Simeone sees red

Van Dijk snatches Champions League win for Liverpool as Simeone sees red

-

Cardi B expecting child with football player boyfriend Diggs

-

Kvaratskhelia stunner helps holders PSG to winning Champions League start

Kvaratskhelia stunner helps holders PSG to winning Champions League start

-

Thuram on target as Inter Milan cruise at Ajax

-

Chimps ingest alcohol daily: study

Chimps ingest alcohol daily: study

-

With eye on US threat, Venezuela holds Caribbean military exercises

-

Only 40% of countries have booked lodging for Amazon climate meet

Only 40% of countries have booked lodging for Amazon climate meet

-

Louboutin taps Jaden Smith to lead well-heeled shoemaker's men's line

-

Pakistan beat UAE to set up India rematch in Asia Cup

Pakistan beat UAE to set up India rematch in Asia Cup

-

US Fed makes first rate cut of 2025 over employment risks

-

US sprint star Kerley joins drug-fueled Enhanced Games

US sprint star Kerley joins drug-fueled Enhanced Games

-

Decaying body found in US rapper's Tesla identified as teen girl

Stocks slide on Trump tariff threat against EU

Major stock markets slipped but without panic on Monday as investors digested US President Donald Trump's latest tariffs threat to hit the EU and Mexico with 30-percent levies.

Analysts said investors viewed that as yet another negotiating ploy against America's trading partners rather than a genuine warning -- though uncertainty swirled, further weakening the dollar.

US and European indices slid, though London's FTSE climbed. Asian markets closed lower.

Markets believe the latest threat of 30-percent tariffs on the EU, the United States' biggest trading partner, was "Trump-style brinkmanship -- sound and fury meant to shake down concessions before the August 1 deadline" when they are due to be applied, said Stephen Innes, managing partner at SPI Asset Management.

"Financial markets are acting like the 30-percent rate is a mere tactic from Donald Trump, rather than a reality," agreed Kathleen Brooks, research director at XTB.

Yet some, including Kim Heuacker, an associate consultant at Camarco, noted "there remains the genuine risk that, to save face, he (Trump) may activate the high tariffs".

The European Union, though stung by Trump's unexpected raising of the stakes amid trade negotiations, is holding off -- for now -- on prepared trade retaliation.

"This suggests that the EU is willing to retaliate in a measured way," said XTB's Brooks, adding: "There is still time for a negotiated solution."

EU trade chief Maros Sefcovic said on Monday, however, that the bloc could target 72 billion euros' ($84 billion) worth of US imports if talks fail.

With Trump's threat being discounted, bandwidth was being given to other news.

Bitcoin struck a record-high above $123,000, fuelled by a possible regulatory loosening in the United States for crypto assets that is being debated.

Attention was also focused on a "major statement" on Russia that Trump has teased ahead of hosting a visit to the White House by NATO chief Mark Rutte.

Oil traders were eyeing a possible US sanctions crackdown on Russian oil exports, with crude prices initially jumping then falling back.

Upcoming data on Tuesday on US inflation was also in focus, with expectations that the rate would rise a little. If it comes in higher than predicted, it would support warnings that Trump's tariffs are inflationary for Americans.

- Talks disarray -

Trump's threat to slap 30-percent tariffs on the European Union, issued Saturday, threw into disarray months of painstaking talks Brussels had been conducting with Washington.

European Commission chief Ursula von der Leyen has insisted the bloc still wants to reach an accord and on Sunday delayed EU retaliation.

That rebuffed a call from France for strong EU countermeasures, after China responded robustly with its own tariffs and ended up reaching a deal with the United States.

Since that accord, trade tensions have eased between the United States and China, with official data on Monday showing Chinese exports jumped more than expected in June.

That included a 32-percent surge in shipments to the United States, after a drop in May.

- Key figures at around 1345 GMT -

New York - Dow: DOWN 0.1 percent at 44,351.19 points

New York - S&P 500: DOWN 0.3 percent at 6,242.64

New York - Nasdaq Composite: DOWN 0.4 percent at 20,511.43

London - FTSE 100: UP 0.4 percent at 8,980.25

Paris - CAC 40: DOWN 0.5 percent at 7,787.77

Frankfurt - DAX: DOWN 0.9 percent at 24,044.56

Tokyo - Nikkei 225: DOWN 0.3 percent at 39,459.62 (close)

Hong Kong - Hang Seng Index: UP 0.3 percent at 24,203.32 (close)

Shanghai - Composite: UP 0.3 percent at 3,519.65 (close)

Euro/dollar: UP at $1.1685 from $1.1690

Pound/dollar: DOWN at $1.3479 from $1.3497

Dollar/yen: DOWN at 147.34 yen from 147.38 yen

Euro/pound: UP at 86.67 pence from 86.59 pence

Brent North Sea Crude: UP 0.1 percent at $70.43 per barrel

West Texas Intermediate: DOWN 0.1 percent at $68.41 per barrel

T.Ziegler--VB