-

China warns Papua New Guinea over Australian defence deal

China warns Papua New Guinea over Australian defence deal

-

Australian state bans testing of illicit drugs

-

Philippines 'ghost' flood projects leave residents stranded

Philippines 'ghost' flood projects leave residents stranded

-

Asian markets fluctuate as focus turns to Trump-Xi, BoJ

-

North Korea's Kim oversees drone test, orders AI development

North Korea's Kim oversees drone test, orders AI development

-

Kenya eye double gold on penultimate day of world championships

-

Canada, Mexico leaders agree to seek 'fairer' trade deal with US

Canada, Mexico leaders agree to seek 'fairer' trade deal with US

-

How did an Indian zoo get the world's most endangered great ape?

-

Amid emotional retirement reveal, Kershaw focused on beating Giants

Amid emotional retirement reveal, Kershaw focused on beating Giants

-

Dodgers pitching icon Kershaw to retire after 18th MLB season

-

Netflix seeks 'Money Heist' successor in Spanish hub

Netflix seeks 'Money Heist' successor in Spanish hub

-

Taiwan running out of time for satellite communications, space chief tells AFP

-

Gaza, Palestinian future to dominate UN gathering

Gaza, Palestinian future to dominate UN gathering

-

Young plaintiffs stand tall after taking on Trump climate agenda in court

-

Kirk killing sparks fierce US free speech debate

Kirk killing sparks fierce US free speech debate

-

Eying bottom line, US media giants bow to Trump

-

Indie studio bets on new game after buying freedom from Sega

Indie studio bets on new game after buying freedom from Sega

-

Marseille hoping to catch PSG at the right time in Ligue 1

-

Japan inflation slows in August, rice price surges ease

Japan inflation slows in August, rice price surges ease

-

Court seizes assets of Maradona's lawyer, sisters in fraud case

-

RFK Jr panelists make initial changes to childhood vaccine schedule

RFK Jr panelists make initial changes to childhood vaccine schedule

-

Progress stalled on Canada's pollution reduction goal

-

UN Security Council votes on reimposing Iran nuclear sanctions

UN Security Council votes on reimposing Iran nuclear sanctions

-

Depleted France eager to 'throw sand in England's machine' in World Cup semi-final

-

Barcelona beat Newcastle, Man City see off Napoli in Champions League

Barcelona beat Newcastle, Man City see off Napoli in Champions League

-

Texans' Ward won't face domestic violence charges

-

Alcaraz headlines Team Europe in Laver Cup title defense

Alcaraz headlines Team Europe in Laver Cup title defense

-

Rashford bags first Barca goals to seal win at Newcastle

-

Haaland hits 50 Champions League goals in Man City cruise over 10-man Napoli

Haaland hits 50 Champions League goals in Man City cruise over 10-man Napoli

-

Dodgers pitching icon Kershaw to retire - club

-

Eagles seek answers against Rams in battle of NFL unbeatens

Eagles seek answers against Rams in battle of NFL unbeatens

-

Afghanistan crash out of Asia Cup after six-wicket loss to Sri Lanka

-

US regulator sues Ticketmaster over 'illegal' ticket schemes

US regulator sues Ticketmaster over 'illegal' ticket schemes

-

US small businesses slam Trump tariffs as legal fight proceeds

-

All smiles as Melania and Kate meet kids in first public event

All smiles as Melania and Kate meet kids in first public event

-

EU states agree 'face-saving' broad UN emissions-cutting target

-

Madonna to release new album next year

Madonna to release new album next year

-

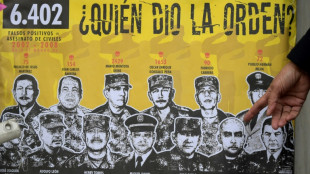

Colombian court issues first sentences for ex-soldiers over civilian killings

-

Chip-maker Nvidia takes stake in rival Intel

Chip-maker Nvidia takes stake in rival Intel

-

Putin has let me down, says Trump at end of UK state visit

-

Melania's hat, Epstein's ghost: takeaways from Trump's UK visit

Melania's hat, Epstein's ghost: takeaways from Trump's UK visit

-

UN Security Council to vote on Iran nuclear sanctions Friday

-

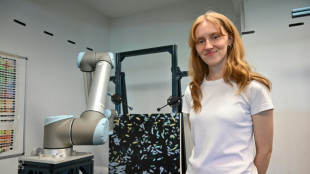

AI-backed robot painting aims to boost artist income

AI-backed robot painting aims to boost artist income

-

Former Barca presidents deny corruption at ref scandal court appearance

-

Canada, Mexico leaders meet amid US tariff war

Canada, Mexico leaders meet amid US tariff war

-

Mass rallies, disruptions in France on day of anger against Macron

-

Piastri says team orders clarified at McLaren

Piastri says team orders clarified at McLaren

-

'Box office' McLaughlin-Levrone -- rarely seen but worth the wait

-

Stocks rise on Nvidia-Intel deal, Fed rate cut

Stocks rise on Nvidia-Intel deal, Fed rate cut

-

US medical panel insists it's 'pro-vaccine'

Global stocks mostly rise, shrugging off US tariff threats

Stocks largely rose on Thursday, with London striking a record high and US indices also edging to fresh new peaks, as investors looked past US President Donald Trump's plethora of tariff threats.

Both the S&P 500 and Nasdaq shrugged off early weakness to eke out gains that left them at all-time highs.

US airline shares enjoyed a particularly buoyant session with Delta, United and American Airlines all winning double digit gains after Delta's results topped estimates.

Investors are largely ignoring a flood of tariff announcements from Trump this week affecting myriad important trading partners, analysts said.

"It's pretty clear that the market does not want to pay attention to tariff news until the tariffs are actually in place," said Steve Sosnick of Interactive Brokers.

"As long as there is any plausible, any possible reason for tariffs to get renegotiated or pushed back or modified, then the market is going to just not respond to the news," said Steve Sosnick of Interactive Brokers.

In Europe, London's FTSE 100 index rose more than one percent to set a new all-time high, lifted also by a surge in mining stocks after Trump said he would enact a 50-percent copper tariff on August 1.

Paris stocks advanced, tracking gains in Asia, but Frankfurt ended the day lower.

Negotiators from around the world have been trying to reach agreements with Washington since Trump in April unveiled his "Liberation Day" tariff bombshell, with a July 9 deadline pushed back to August 1.

"Indications that the EU is edging closer to a deal with the US, with an agreement thought to be possible in a few days, has added to the positive vibes," said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

Letters have been sent in recent days to more than 20 trading partners -- including Japan and South Korea -- setting out new tolls, with some higher and some lower than the initial levels.

There was little global reaction to news that Trump had hit Brazil with a 50-percent tariff as he blasted the trial of the country's ex-president Jair Bolsonaro.

Brazilian President Luiz Inacio Lula da Silva said he would impose reciprocal levies on the United States.

Brazil had not been among those threatened with higher duties, with the United States running a goods trade surplus with the South American giant.

- Key figures at around 2140 GMT -

New York - Dow: UP 0.4 percent at 44,650.64 (close)

New York - S&P 500: UP 0.3 percent at 6,280.46 (close)

New York - Nasdaq Composite: UP 0.1 percent at 20,630.66 (close)

London - FTSE 100: UP 1.2 percent at 8,975.96 (close)

Paris - CAC 40: UP 0.3 percent at 7,902.25 (close)

Frankfurt - DAX: DOWN 0.4 percent at 24,456.81 (close)

Tokyo - Nikkei 225: DOWN 0.4 percent at 39,646.36 (close)

Hong Kong - Hang Seng Index: UP 0.6 percent at 24,028.37 (close)

Shanghai - Composite: UP 0.5 percent at 3,509.68 (close)

Euro/dollar: DOWN at $1.1698 from $1.1720 on Wednesday

Pound/dollar: DOWN at $1.3576 from $1.3586

Dollar/yen: DOWN at 146.19 yen from 146.33 yen

Euro/pound: DOWN at 86.16 pence from 86.27 pence

Brent North Sea Crude: DOWN 2.5 percent at $68.64 per barrel

West Texas Intermediate: DOWN 2.7 percent at $66.57 per barrel

burs-jmb/ksb

G.Haefliger--VB