-

Lufthansa planning thousands of job cuts: sources

Lufthansa planning thousands of job cuts: sources

-

China at UN warns of return to 'Cold War mentality'

-

England great Alphonsi expects Canada to shine in Women's Rugby World Cup final

England great Alphonsi expects Canada to shine in Women's Rugby World Cup final

-

Tottenham reject interest in reported record £4.5bn sale

-

Man Utd boss Amorim admits uncertainty ahead of Brentford clash

Man Utd boss Amorim admits uncertainty ahead of Brentford clash

-

Zverev wins Beijing opener as Gauff launches title defence

-

Barca duo Raphinha, Joan Garcia injured, out for PSG clash

Barca duo Raphinha, Joan Garcia injured, out for PSG clash

-

Trump hopes more opponents to be charged after 'dirty cop' Comey

-

US Fed's preferred inflation gauge rises, with more cost pressures expected

US Fed's preferred inflation gauge rises, with more cost pressures expected

-

Facebook, Instagram to offer paid ad-free UK subscriptions

-

Former UK PM Blair could lead transitional authority in Gaza: reports

Former UK PM Blair could lead transitional authority in Gaza: reports

-

Netanyahu says Palestinian state would be 'national suicide' for Israel

-

The nations and firms threatened by Trump's pharma tariffs

The nations and firms threatened by Trump's pharma tariffs

-

Trailblazing rugby chief Griffin proud of 'incredible' strides for women's game

-

Brother of Oasis stars denies rape, other charges

Brother of Oasis stars denies rape, other charges

-

EU steps up 'drone wall' plans after Russian incursions

-

Kenyan jeans factory to fire workers as US deal expires

Kenyan jeans factory to fire workers as US deal expires

-

Arteta hails Saliba's impact as new Arsenal deal looms

-

England's Jones channels grief in bid for Women's Rugby World Cup glory

England's Jones channels grief in bid for Women's Rugby World Cup glory

-

UN identifies 158 firms linked to Israeli settlements

-

Canada's Patrick Watson channels dread into new 'Uh Oh' album

Canada's Patrick Watson channels dread into new 'Uh Oh' album

-

Trump brands indicted opponent Comey a 'dirty cop'

-

Walker an all-time great, says Guardiola ahead of Man City return

Walker an all-time great, says Guardiola ahead of Man City return

-

Alonso warns against overconfidence before Madrid derby

-

Fritz says path to Grand Slam glory goes through Alcaraz, Sinner

Fritz says path to Grand Slam glory goes through Alcaraz, Sinner

-

UK court drops terror case against Kneecap rapper

-

UK's Starmer urges liberals to fight 'the lies' told by far right

UK's Starmer urges liberals to fight 'the lies' told by far right

-

Bagnaia and Pennetta among first Winter Olympic torch carriers: organisers

-

Sarkozy conviction exposes political divide in crisis-hit France

Sarkozy conviction exposes political divide in crisis-hit France

-

Ryder Cup begins in electric atmosphere at Bethpage Black

-

UK to launch digital ID scheme to curb illegal migration

UK to launch digital ID scheme to curb illegal migration

-

Chelsea's Palmer sidelined with groin injury

-

India retires Soviet fighter jet after six decades

India retires Soviet fighter jet after six decades

-

Slovak parliament approves anti-LGBTQ constitutional change

-

Train tragedy hunger striker captures hearts in Greece

Train tragedy hunger striker captures hearts in Greece

-

I.Coast historic beachside town boasts new modern art museum

-

PSG captain Marquinhos out with thigh injury

PSG captain Marquinhos out with thigh injury

-

UK court drops terror charge against Kneecap rapper

-

Turkish Airlines inks big Boeing deal after Erdogan visits US

Turkish Airlines inks big Boeing deal after Erdogan visits US

-

Liverpool's Leoni faces year out after ACL injury on debut

-

'We are not afraid,' jailed Istanbul mayor tells court

'We are not afraid,' jailed Istanbul mayor tells court

-

Canada's women tilt for World Cup thanks to 'incredible' crowdfunding

-

India retires 'flying coffin' Soviet fighter jet after six decades

India retires 'flying coffin' Soviet fighter jet after six decades

-

Erasmus makes late Springboks change as Nche injured

-

Ukrainian YouTuber arrested in Japan over Fukushima livestream

Ukrainian YouTuber arrested in Japan over Fukushima livestream

-

Foreign doctors in Gaza describe worst wounds 'they've ever seen'

-

India-Pakistan to clash in first Asia Cup final

India-Pakistan to clash in first Asia Cup final

-

South Asia monsoon: climate change's dangerous impact on lifeline rains

-

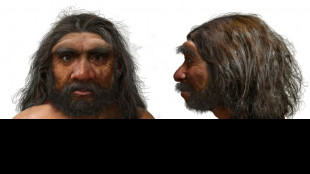

Million-year-old skull could change human evolution timeline

Million-year-old skull could change human evolution timeline

-

Gauff launches China Open title defence in style

Oil rises, stocks mixed as investors watch rates, conflict

Oil prices rose and stock markets diverged Wednesday as investors tracked the Israel-Iran conflict and a looming US interest rate decision.

Wall Street's main indices were mixed in early deals after the open as investors awaited the Federal Reserve rate decision and weighed the latest news from Iran.

Despite rising tensions after President Donald Trump called for Iran's surrender, "there has been no sense of panic from investors", said David Morrison, market analyst at financial services firm Trade Nation.

"As far as the US is concerned, events are taking place a long way from home," he said.

"But there's also a feeling that investors are betting on a short and sharp engagement, resulting in a more stable position across the Middle East than the one that currently exists."

In Europe, the London stock market rose but Paris and Frankfurt were down in afternoon deals after Asian equities closed in different directions.

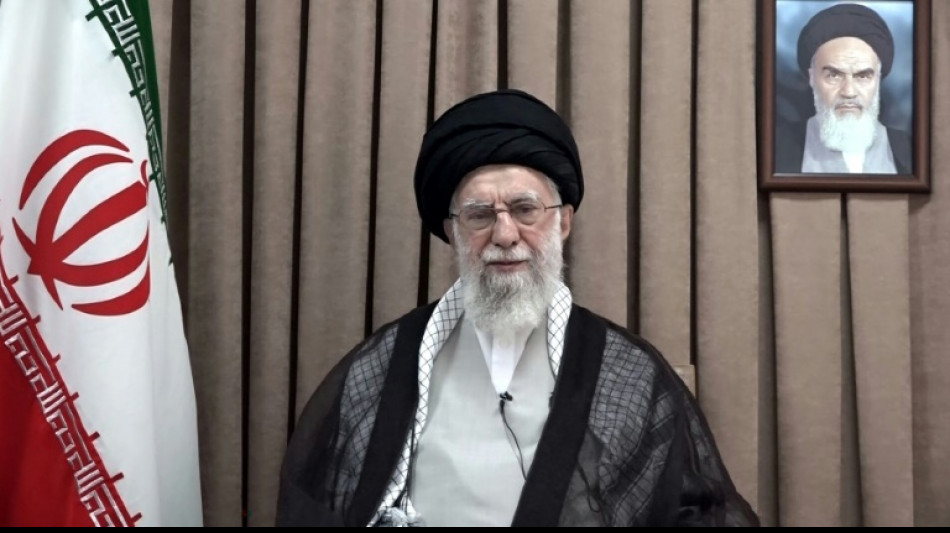

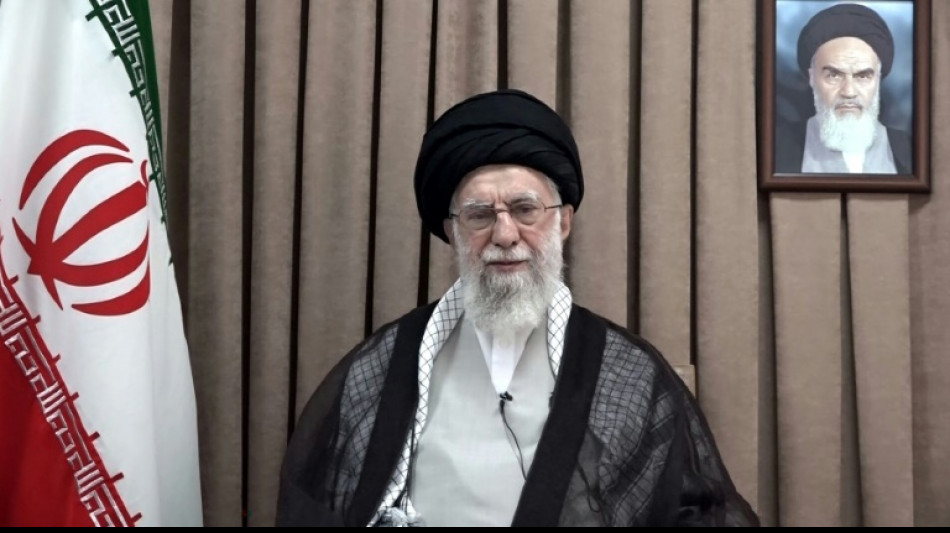

Oil prices rose after surging the previous day as Iran's supreme leader Ayatollah Ali Khamenei rejected Trump's call for an "unconditional surrender".

Six days into the conflict, Khamenei warned the United States would face "irreparable damage" if it intervenes in support of Israel.

Gas prices rose with concerns surrounding its supply.

Of particular concern is the possibility of Iran shutting off the Strait of Hormuz, through which around one fifth of global oil supply is transported.

"Global market direction remains clouded by tariffs, complicated by the Middle Eastern conflict and confounded by the lack of any obvious positive catalysts," said Richard Hunter, head of markets at Interactive Investor.

- Fed watch -

The Fed is widely expected to hold interest rates steady Wednesday, as officials gauge the impact of US tariffs on inflation.

The central bank has ignored calls from President Donald Trump to cut borrowing costs as the world's biggest economy faces pressure.

The US central bank will also release on Wednesday its rate and economic growth outlook for the rest of the year, which are expected to take account of Trump's tariff war.

Weak US retail sales and factory output data on Tuesday rekindled worries about the impact of tariffs on the economy but also provided hope that the Fed would still cut rates this year.

"The Fed would no doubt be cutting again by now if not for the uncertainty regarding tariffs and a recent escalation of tensions in the Middle East," said KPMG senior economist Benjamin Shoesmith.

In a busy week for monetary policy, Sweden's central bank cut its key interest rate on Wednesday to try and boost the country's economy, as it cited risks linked to trade tensions and the escalating conflict in the Middle East.

The Bank of England is expected to keep its key rate steady Thursday, especially after official data Wednesday showed UK annual inflation fell less than expected in May.

The Bank of Japan on Tuesday kept interest rates unchanged and said it would taper its purchase of government bonds at a slower pace, as trade uncertainty threatens to weigh on the world's number four economy.

- Key figures at around 1335 GMT -

Brent North Sea Crude: UP 1.3 percent at $77.41 per barrel

West Texas Intermediate: UP 1.3 percent at $74.24 per barrel

New York - Dow: UP 0.1 percent at 42,244.64 points

New York - S&P 500: FLAT at 5,984.80

New York - Nasdaq Composite: DOWN 0.1 percent at 19,503.61

London - FTSE 100: UP 0.2 at 8,848.38

Paris - CAC 40: DOWN 0.4 percent at 7,649.90

Frankfurt - DAX: DOWN 0.7 percent at 23,283.31

Tokyo - Nikkei 225: UP 0.9 percent at 38,885.15 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 23,710.69 (close)

Shanghai - Composite: FLAT at 3,388.81 (close)

New York - Dow: DOWN 0.7 percent at 42,215.80 (close)

Euro/dollar: UP at $1.1491 from $1.1488 on Tuesday

Pound/dollar: UP at $1.3437 from $1.3425

Dollar/yen: DOWN at 144.78 yen from 145.27 yen

Euro/pound: DOWN at 85.50 pence from 85.54 pence

burs-bcp-lth/rl

S.Spengler--VB