-

Nobel physics laureate says Trump cuts will 'cripple' US research

Nobel physics laureate says Trump cuts will 'cripple' US research

-

UFC star McGregor suspended 18 months over missed drug tests

-

Trump talks up Canada trade deal chances with 'world-class' Carney

Trump talks up Canada trade deal chances with 'world-class' Carney

-

Ecuador president unharmed after apparent gun attack on motorcade

-

Lyon exact revenge on Arsenal, Barca thrash Bayern in women's Champions League

Lyon exact revenge on Arsenal, Barca thrash Bayern in women's Champions League

-

Trump says 'real chance' to end Gaza war as Israel marks attacks anniversary

-

Gerrard brands failed England generation 'egotistical losers'

Gerrard brands failed England generation 'egotistical losers'

-

NFL fines Cowboys owner Jones $250,000 over gesture to fans

-

Bengals sign veteran quarterback Flacco after Burrow injury

Bengals sign veteran quarterback Flacco after Burrow injury

-

New prime minister inspires little hope in protest-hit Madagascar

-

Is Trump planning something big against Venezuela's Maduro?

Is Trump planning something big against Venezuela's Maduro?

-

EU wants to crack down on 'conversion therapy'

-

French sex offender Pelicot says man who abused ex-wife knew she was asleep

French sex offender Pelicot says man who abused ex-wife knew she was asleep

-

Trump says 'real chance' to end Gaza war as Israel marks Oct 7 anniversary

-

UK prosecutors to appeal dropped 'terrorism' case against Kneecap rapper

UK prosecutors to appeal dropped 'terrorism' case against Kneecap rapper

-

Spain, Inter Miami star Alba retiring at end of season

-

EU targets foreign steel to rescue struggling sector

EU targets foreign steel to rescue struggling sector

-

Trump talks up Canada deal chances with visiting PM

-

Knight rides her luck as England survive Bangladesh scare

Knight rides her luck as England survive Bangladesh scare

-

Pro-Gaza protests flare in UK on anniversary of Hamas attack

-

Top rugby unions warn players against joining rebel R360 competition

Top rugby unions warn players against joining rebel R360 competition

-

Outcast Willis 'not overthinking' England absence despite Top 14 clean sweep

-

Trump says 'real chance' of Gaza peace deal

Trump says 'real chance' of Gaza peace deal

-

Macron urged to quit to end France political crisis

-

No.1 Scheffler seeks three-peat at World Challenge

No.1 Scheffler seeks three-peat at World Challenge

-

Canadian PM visits Trump in bid to ease tariffs

-

Stocks falter, gold shines as traders weigh political turmoil

Stocks falter, gold shines as traders weigh political turmoil

-

Senators accuse US attorney general of politicizing justice

-

LeBron's 'decision of all decisions' a PR stunt

LeBron's 'decision of all decisions' a PR stunt

-

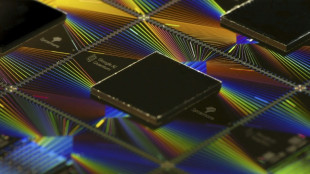

Observing quantum weirdness in our world: Nobel physics explained

-

WTO hikes 2025 trade growth outlook but tariffs to bite in 2026

WTO hikes 2025 trade growth outlook but tariffs to bite in 2026

-

US Supreme Court hears challenge to 'conversion therapy' ban for minors

-

Italy's Gattuso expresses Gaza heartache ahead of World Cup qualifier with Israel

Italy's Gattuso expresses Gaza heartache ahead of World Cup qualifier with Israel

-

EU targets foreign steel to shield struggling sector

-

Djokovic vanquishes exhaustion to push through to Shanghai quarterfinals

Djokovic vanquishes exhaustion to push through to Shanghai quarterfinals

-

Stocks, gold rise as investors weigh AI boom, political turmoil

-

Swiatek coasts through Wuhan debut while heat wilts players

Swiatek coasts through Wuhan debut while heat wilts players

-

Denmark's Rune calls for heat rule at Shanghai Masters

-

Japanese football official sentenced for viewing child sexual abuse images

Japanese football official sentenced for viewing child sexual abuse images

-

'Veggie burgers' face grilling in EU parliament

-

Trio wins physics Nobel for quantum mechanical tunnelling

Trio wins physics Nobel for quantum mechanical tunnelling

-

Two years after Hamas attack, Israelis mourn at Nova massacre site

-

German factory orders drop in new blow to Merz

German factory orders drop in new blow to Merz

-

Man City star Stones considered retiring after injury woes

-

Kane could extend Bayern stay as interest in Premier League cools

Kane could extend Bayern stay as interest in Premier League cools

-

Renewables overtake coal but growth slows: reports

-

Extreme rains hit India's premier Darjeeling tea estates

Extreme rains hit India's premier Darjeeling tea estates

-

Raducanu retires from opening match in Wuhan heat with dizziness

-

UK's Starmer condemns pro-Palestinian protests on Oct 7 anniversary

UK's Starmer condemns pro-Palestinian protests on Oct 7 anniversary

-

Tokyo stocks hit new record as markets extend global rally

Stock markets calmer as trade rally eases

Stock markets were calmer Friday, with European stocks consolidating weekly gains fuelled by the China-US trade war hiatus and as investors awaited further developments over tariffs.

Asian markets lost steam after enjoying one of their best weeks since US President Donald Trump's "Liberation Day" tariff bazooka last month caused indices to slump.

"European shares are largely holding onto yesterday's gains, which saw Germany's DAX reach a record high" at the close, said Derren Nathan, head of equity research at Hargreaves Lansdown.

London, Paris and Frankfurt were all higher Friday.

Luxury stocks were bolstered after Cartier-owner Richemont posted higher net profit and sales, driven by resilience in its jewelery business, despite the sector struggling with weak demand from China.

Pharmaceutical and energy stocks were up in London, as "investors were fishing for opportunities among areas that have recently been weak", said AJ Bell investment director Russ Mould.

"Pharma stocks have been volatile of late amid fears of tariffs on the sector, while a pullback in oil prices dragged down the big oil producers yesterday," he added.

Oil prices steadied after tumbling Thursday on the possibility a breakthrough in Iran nuclear talks, fuelled by Trump saying progress had been made on a deal.

The dollar edged down against the euro and the yen on raised expectations that the Federal Reserve would still cut interest rates this year following mixed inflation data.

Investors are now awaiting signals from the US president on trade talks, as countries seek deals to avoid his steep levies.

However, analysts warn that initial optimism over the US-China truce -- which saw them slash tit-for-tat tariffs for 90 days to allow for talks -- has faded, given that levies are still elevated and pose a threat to economic growth.

"Even if more trade deals are announced, it is still the case that tariffs on goods entering the US will be much higher than anyone dared to contemplate," said IG chief market analyst Chris Beauchamp.

In Asia, markets were more negative, with Shanghai and Hong Kong falling.

Japan's economy suffered its first quarterly contraction for a year in January-March, which analysts said did not help market sentiment.

The Nikkei index closed flat.

E-commerce titan Alibaba shed over six percent in Hong Kong after reporting a disappointing rise in first-quarter revenue amid sluggish consumer spending in China.

Other tech firms were also lower, with e-commerce rival JD.com down along with Tencent and Meituan.

- Key figures at around 1100 GMT -

London - FTSE 100: UP 0.5 percent at 8,675.25 points

Paris - CAC 40: UP 0.7 percent at 7,904.83

Frankfurt - DAX: UP 0.7 percent at 23,851.57

Tokyo - Nikkei 225: FLAT at 37,753.72 (close)

Hong Kong - Hang Seng Index: DOWN 0.5 percent at 23,345.05 (close)

Shanghai - Composite: DOWN 0.4 percent at 3,367.46 (close)

New York - Dow: UP 0.7 percent at 42,322.75 (close)

Euro/dollar: UP at $1.1203 from $1.1185 on Thursday

Pound/dollar: DOWN at $1.3296 from $1.3304

Dollar/yen: DOWN at 145.49 yen from 145.65 yen

Euro/pound: UP at 84.25 from 84.07 pence

Brent North Sea Crude: UP 0.5 percent at $64.86 per barrel

West Texas Intermediate: UP 0.5 percent at $61.93 per barrel

R.Braegger--VB