-

Trump talks up Canada deal chances with visiting PM

Trump talks up Canada deal chances with visiting PM

-

Knight rides her luck as England survive Bangladesh scare

-

Pro-Gaza protests flare in UK on anniversary of Hamas attack

Pro-Gaza protests flare in UK on anniversary of Hamas attack

-

Top rugby unions warn players against joining rebel R360 competition

-

Outcast Willis 'not overthinking' England absence despite Top 14 clean sweep

Outcast Willis 'not overthinking' England absence despite Top 14 clean sweep

-

Trump says 'real chance' of Gaza peace deal

-

Macron urged to quit to end France political crisis

Macron urged to quit to end France political crisis

-

No.1 Scheffler seeks three-peat at World Challenge

-

Canadian PM visits Trump in bid to ease tariffs

Canadian PM visits Trump in bid to ease tariffs

-

Stocks falter, gold shines as traders weigh political turmoil

-

Senators accuse US attorney general of politicizing justice

Senators accuse US attorney general of politicizing justice

-

LeBron's 'decision of all decisions' a PR stunt

-

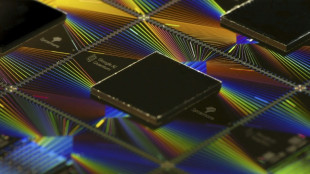

Observing quantum weirdness in our world: Nobel physics explained

Observing quantum weirdness in our world: Nobel physics explained

-

WTO hikes 2025 trade growth outlook but tariffs to bite in 2026

-

US Supreme Court hears challenge to 'conversion therapy' ban for minors

US Supreme Court hears challenge to 'conversion therapy' ban for minors

-

Italy's Gattuso expresses Gaza heartache ahead of World Cup qualifier with Israel

-

EU targets foreign steel to shield struggling sector

EU targets foreign steel to shield struggling sector

-

Djokovic vanquishes exhaustion to push through to Shanghai quarterfinals

-

Stocks, gold rise as investors weigh AI boom, political turmoil

Stocks, gold rise as investors weigh AI boom, political turmoil

-

Swiatek coasts through Wuhan debut while heat wilts players

-

Denmark's Rune calls for heat rule at Shanghai Masters

Denmark's Rune calls for heat rule at Shanghai Masters

-

Japanese football official sentenced for viewing child sexual abuse images

-

'Veggie burgers' face grilling in EU parliament

'Veggie burgers' face grilling in EU parliament

-

Trio wins physics Nobel for quantum mechanical tunnelling

-

Two years after Hamas attack, Israelis mourn at Nova massacre site

Two years after Hamas attack, Israelis mourn at Nova massacre site

-

German factory orders drop in new blow to Merz

-

Man City star Stones considered retiring after injury woes

Man City star Stones considered retiring after injury woes

-

Kane could extend Bayern stay as interest in Premier League cools

-

Renewables overtake coal but growth slows: reports

Renewables overtake coal but growth slows: reports

-

Extreme rains hit India's premier Darjeeling tea estates

-

Raducanu retires from opening match in Wuhan heat with dizziness

Raducanu retires from opening match in Wuhan heat with dizziness

-

UK's Starmer condemns pro-Palestinian protests on Oct 7 anniversary

-

Tokyo stocks hit new record as markets extend global rally

Tokyo stocks hit new record as markets extend global rally

-

Japan's Takaichi eyes expanding coalition, reports say

-

Canadian PM to visit White House to talk tariffs

Canadian PM to visit White House to talk tariffs

-

Indonesia school collapse toll hits 67 as search ends

-

Dodgers hold off Phillies, Brewers on the brink

Dodgers hold off Phillies, Brewers on the brink

-

Lawrence sparks Jaguars over Chiefs in NFL thriller

-

EU channels Trump with tariffs to shield steel sector

EU channels Trump with tariffs to shield steel sector

-

Labuschagne out as Renshaw returns to Australia squad for India ODIs

-

Open AI's Fidji Simo says AI investment frenzy 'new normal,' not bubble

Open AI's Fidji Simo says AI investment frenzy 'new normal,' not bubble

-

Tokyo stocks hit new record as Asian markets extend global rally

-

Computer advances and 'invisibility cloak' vie for physics Nobel

Computer advances and 'invisibility cloak' vie for physics Nobel

-

Nobel literature buzz tips Swiss postmodernist, Australians for prize

-

Dodgers hold off Phillies to win MLB playoff thriller

Dodgers hold off Phillies to win MLB playoff thriller

-

China exiles in Thailand lose hope, fearing Beijing's long reach

-

Israel marks October 7 anniversary as talks held to end Gaza war

Israel marks October 7 anniversary as talks held to end Gaza war

-

Indians lead drop in US university visas

-

Colombia's armed groups 'expanding,' warns watchdog

Colombia's armed groups 'expanding,' warns watchdog

-

Shhhh! California bans noisy TV commercials

| RYCEF | -1.03% | 15.54 | $ | |

| AZN | 0.61% | 86.015 | $ | |

| RELX | -2.02% | 45.49 | $ | |

| GSK | 0.24% | 43.555 | $ | |

| CMSC | -0.21% | 23.75 | $ | |

| BTI | 1.42% | 51.915 | $ | |

| NGG | 0.47% | 74.25 | $ | |

| BP | -0.11% | 34.79 | $ | |

| RIO | -0.64% | 66.555 | $ | |

| RBGPF | 0% | 78.22 | $ | |

| VOD | -0.27% | 11.26 | $ | |

| SCS | -0.53% | 16.89 | $ | |

| JRI | -0.35% | 14.13 | $ | |

| BCC | 0.03% | 75.204 | $ | |

| BCE | 0.43% | 23.29 | $ | |

| CMSD | -0.25% | 24.38 | $ |

Stocks falter, gold shines as traders weigh political turmoil

Wall Street stocks turned lower Tuesday and gold closed in on $4,000 per ounce as investors weighed the US government shutdown and political turmoil in France.

Wall Street rose at the open, however, with sentiment still buoyed by a multi-billion-dollar partnership deal between ChatGPT developer OpenAI and chipmaker Advanced Micro Devices (AMD).

AMD shares jumped seven percent in early deals Tuesday after double-digit gains on Monday, helping the S&P 500 and tech-heavy Nasdaq Composite set fresh record highs.

"Investors continue to 'follow the money' when it comes to anything to do with generative artificial intelligence," David Morrison, senior market analyst at Trade Nation, said in a note.

"This is despite fears that the whole investment thesis looks increasingly incestuous, as money gets pumped around companies within the sector," Morrison said.

But Wall Street's three main indices turned lower during morning trading amid a bout of profit-taking.

In Europe, the Paris stock market edged back up after a sell-off, even as President Emmanuel Macron faced a call from his first prime minister, Edouard Philippe, to resign over a deepening political and budget crisis.

London and Frankfurt also ended broadly stable, but the euro fell further against the dollar.

Philippe, who himself aspires to become president, urged Macron to call for an early presidential election.

"He must take the decision that is worthy of his function, which is to guarantee the continuity of the institutions by leaving in an orderly manner," Philippe told the RTL broadcaster.

The latest crisis erupted after Prime Minister Sebastien Lecornu, appointed less than a month ago, stepped down on Monday after failing to rally support for his new government.

Macron later ordered him to make a last-ditch effort to rally support for a coalition government, but there was no sign of progress.

Meanwhile gold approached within $10 of hitting $4,000 per ounce.

"Gold has benefited from multiple catalysts this year, including tariff uncertainty, stubborn inflation, and a falling US dollar," said analyst Bret Kenwell at eToro.

"Uncertainty around the government shutdown and prospects of lower interest rates have only seemed to fan the flames of this year’s rally," he added.

The US government shutdown stretched into a seventh day, with Republicans and Democrats appearing no closer to an agreement.

Bets on the Federal Reserve cutting interest rates this month and the political crisis in France are adding to the allure of gold, a safe-haven asset.

Kathleen Brooks, research director at trading group XTB, said the rally on the precious metal is part of the "debasement" trade.

"This trading theme is driving demand for alternative assets such as gold and crypto, as the dollar faces a long-term decline and fiscal concerns continue to rise around the world," she added.

In Asia, Tokyo eked out another record following the weekend election of a pro-stimulus advocate to lead Japan's ruling party, before paring gains to close flat.

The election of Sanae Takaichi -- expected to become Japan's prime minister this month -- ramped up optimism that she will kick-start the economy through stimulus measures.

Yields on 30-year Japanese bonds hit their highest level, reflecting fears the country's already colossal debt will balloon further.

- Key figures at around 1530 GMT -

New York - Dow: DOWN 0.2 percent at 46,607.47 points

New York - S&P 500: DOWN 0.4 percent at 6,716.51

New York - Nasdaq Composite: DOWN 0.6 percent at 22,807.81

London - FTSE 100: UP less than 0.1 percent at 9,483.58 (close)

Paris - CAC 40: UP less than 0.1 percent at 7,974.85 (close)

Frankfurt - DAX: UP less than 0.1 percent at 24,385.78 (close)

Tokyo - Nikkei 225: FLAT at 47,950.88 (close)

Hong Kong - Hang Seng Index: Closed for a holiday

Shanghai - Composite: Closed for a holiday

Euro/dollar: DOWN at $1.1676 from $1.1713 on Monday

Pound/dollar: DOWN at $1.3444 from $1.3485

Dollar/yen: UP at 151.13 yen from 150.24 yen

Euro/pound: DOWN at 86.84 pence from 86.86 pence

Brent North Sea Crude: DOWN 0.3 percent at $65.29 per barrel

West Texas Intermediate: DOWN 0.2 percent at $61.57 per barrel

burs-rl/sbk

A.Ammann--VB