-

UK comedian Russell Brand arrives at court to face rape charges

UK comedian Russell Brand arrives at court to face rape charges

-

Bangladesh's influential Islamists promise sharia as they ready for polls

-

Shell net profit sinks 35% in first-quarter as oil prices fall

Shell net profit sinks 35% in first-quarter as oil prices fall

-

Fearing Indian police, Kashmiris scrub 'resistance' tattoos

-

Australian PM says battle ahead to win election

Australian PM says battle ahead to win election

-

In show stretched over 50 years, Slovenian director shoots for space

-

Hard right wins local UK election in blow to PM Starmer

Hard right wins local UK election in blow to PM Starmer

-

Australian triple-murder suspect never asked after poisoned guests: husband

-

Brunson brilliance as Knicks clinch series, Clippers sink Nuggets

Brunson brilliance as Knicks clinch series, Clippers sink Nuggets

-

UK court to rule on Prince Harry security appeal

-

'Alarming deterioration' of US press freedom under Trump, says RSF

'Alarming deterioration' of US press freedom under Trump, says RSF

-

Hard right makes early gains as local polls test UK's main parties

-

China says open to US trade talks offer but wants tariffs scrapped

China says open to US trade talks offer but wants tariffs scrapped

-

Climate change takes spice from Indonesia clove farms

-

Bruised Real Madrid must stay in title fight against Celta

Bruised Real Madrid must stay in title fight against Celta

-

Top-five race heats up as Saints try to avoid unwanted history

-

Asian stocks gain after China teases US tariff talks

Asian stocks gain after China teases US tariff talks

-

South Korea former PM launches presidential bid

-

Mueller eyes one final title as Bayern exit draws near

Mueller eyes one final title as Bayern exit draws near

-

Canelo aims to land knockout blow against Scull in Saudi debut

-

Lions hopefuls get one last chance to shine with Champions Cup semis

Lions hopefuls get one last chance to shine with Champions Cup semis

-

Trump vs Toyota? Why US cars are a rare sight in Japan

-

Ryu, Ariya shake off major letdowns to start strong in Utah

Ryu, Ariya shake off major letdowns to start strong in Utah

-

Sean 'Diddy' Combs: the rap mogul facing life in prison

-

Sean 'Diddy' Combs sex crimes trial to begin Monday

Sean 'Diddy' Combs sex crimes trial to begin Monday

-

Backyard barnyard: rising egg prices prompt hen hires in US

-

Trinidad leader sworn in, vows fresh start for violence-weary state

Trinidad leader sworn in, vows fresh start for violence-weary state

-

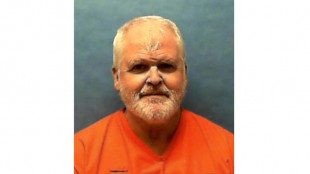

US veteran convicted of quadruple murder executed in Florida

-

UK comedian Russell Brand due in court on rape charges

UK comedian Russell Brand due in court on rape charges

-

Tokyo's tariff envoy says US talks 'constructive'

-

Ledecky out-duels McIntosh in sizzing 400m free

Ledecky out-duels McIntosh in sizzing 400m free

-

Scheffler grabs PGA lead with sizzling 61 at CJ Cup Byron Nelson

-

'Divine dreams' and 38 virgins at Trump prayer event

'Divine dreams' and 38 virgins at Trump prayer event

-

Apple expects $900 mn tariff hit, US iPhone supply shifts to India

-

Lakers prepare for offseason rebuild after playoff exit

Lakers prepare for offseason rebuild after playoff exit

-

'Natural' for stars like Maguire to deliver now: Man Utd's Amorim

-

EU preparing new sanctions on Russia, French minister tells AFP

EU preparing new sanctions on Russia, French minister tells AFP

-

Apple expects $900 mn tariff hit as shifts US iPhone supply to India

-

US to end shipping loophole for Chinese goods Friday

US to end shipping loophole for Chinese goods Friday

-

Forest's Champions League dreams hit by Brentford defeat

-

Norris and Piastri taking championship battle in their stride

Norris and Piastri taking championship battle in their stride

-

Chelsea close in on UEFA Conference League final with win at Djurgarden

-

Spurs take control in Europa semi against Bodo/Glimt

Spurs take control in Europa semi against Bodo/Glimt

-

Man Utd seize control of Europa League semi against 10-man Bilbao

-

With minerals deal, Ukraine finds way to secure Trump support

With minerals deal, Ukraine finds way to secure Trump support

-

Amazon revenue climbs 9%, but outlook sends shares lower

-

Trump axes NSA Waltz after chat group scandal

Trump axes NSA Waltz after chat group scandal

-

Forest Champions League dreams hit after Brentford defeat

-

'Resilient' Warriors aim to close out Rockets in bruising NBA playoff series

'Resilient' Warriors aim to close out Rockets in bruising NBA playoff series

-

US expects Iran talks but Trump presses sanctions

| RBGPF | 100% | 67.21 | $ | |

| RIO | -1.45% | 58.55 | $ | |

| RYCEF | -0.99% | 10.12 | $ | |

| VOD | -0.31% | 9.73 | $ | |

| GSK | -2.84% | 38.75 | $ | |

| SCS | -0.51% | 9.87 | $ | |

| BCC | -0.61% | 92.71 | $ | |

| CMSC | 0.09% | 22.03 | $ | |

| BTI | -0.58% | 43.3 | $ | |

| NGG | -1.88% | 71.65 | $ | |

| RELX | -1.02% | 54.08 | $ | |

| BCE | -3.78% | 21.44 | $ | |

| JRI | 0.77% | 13.01 | $ | |

| AZN | -1.82% | 70.51 | $ | |

| CMSD | -0.18% | 22.26 | $ | |

| BP | 1.51% | 27.88 | $ |

Stocks, dollar sink and gold hits record as Trump tariff panic returns

Stocks and the dollar tumbled while gold hit a fresh record high as panic gripped markets again Friday after Donald Trump admitted that his global tariff blitz could see "a transition cost".

The US president's decision to delay crippling duties for 90 days sparked a frenzied scramble for equities that had been beaten down since his "Liberation Day" announcement unleashed a global panic.

However, the realisation that nothing had been resolved, coupled with Trump's decision to double down on his battle with economic superpower China, fuelled another bout of selling.

After blockbuster rallies Thursday in response to the 90-day tariff pause, markets across the region were back deep in negative territory at the end of a highly volatile week.

Tokyo sank more than four percent -- a day after surging more than nine percent -- while Sydney, Seoul, Singapore, Taipei, Wellington, Jakarta and Manila were also in the red.

Ho Chi Minh City stocks rallied, however, after Vietnam said it would hold talks with the US president.

Hong Kong also dropped but Shanghai fluctuated as traders focused on possible Chinese stimulus measures instead of the fact that the country was now facing duties of up to 145 percent.

Beijing also said Friday it would implement a moderately loose monetary policy in a bid to reassure investors.

The losses followed a similar story on Wall Street, where the S&P 500 lost 3.5 percent, the Dow 2.5 percent and the Nasdaq 4.3 percent. That ate into the previous day's gains of 9.5 percent, 7.9 percent and 12.2 percent.

The selling was not limited to equities. The dollar tanked against the yen, euro, pound and Swiss franc -- investors dropping what is usually considered a key safe haven currency as they look to unload US risk assets, including gold standard Treasuries.

The weaker dollar and the rush for safety has also sent gold to a fresh record high above $3,200, while fears of a possible global recession have battered oil prices, which extended losses Friday.

- 'Ground Zero' -

"There has been a pronounced 'sell US' vibe flowing through broad markets and into the classic safe-haven assets, with the dollar losing the safe-haven bid put in over the past week," said Pepperstone group's Chris Weston.

He added that the moves had "the feel of repatriation flows by foreign entities, with many re-focused on the idea that Trump's reluctant pause on tariffs was due to increased system risk and migrating capital away from Ground Zero".

With Treasuries being sold off, sending their yields higher and making US debt more expensive, there is a fear of a bigger calamity down the line.

Michael Krautzberger at Allianz Global Investors wrote: "A fall in the dollar could be a sign that markets are questioning its status as a global reserve currency.

"Looking forward, the big fear is that the response to the additional US tariff threats in recent days, especially on Chinese goods, is the opening salvo from the big foreign holders of US Treasuries in tariff-hit countries, as they sell their US Treasury holdings.

"A trade war morphing into a capital war would represent a significant escalation in recent tensions."

Trump says he wants to use tariffs to reorder the world economy by forcing manufacturers to base themselves in the United States and for other countries to decrease barriers to US goods.

While he acknowledged Thursday there would be "a transition cost and transition problems", the Republican dismissed the global market turmoil and insisted that "in the end it's going to be a beautiful thing".

And commerce secretary Howard Lutnick posted on social media that "the Golden Age is coming. We are committed to protecting our interests, engaging in global negotiations and exploding our economy".

Trump also warned that the huge tariffs delayed Wednesday would be reintroduced if no agreements had been made between Washington and other countries.

"If we can't make the deal we want to make... then we'd go back to where we were," he said.

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: DOWN 4.2 percent at 33,148.45 (break)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 20,452.64

Shanghai - Composite: DOWN 0.3 percent at 3,214.14

Dollar/yen: DOWN at 143.43 yen from 144.79 yen on Thursday

Euro/dollar: UP at $1.1305 from $1.1183

Pound/dollar: UP at $1.3021 from $1.2954

Euro/pound: UP at 86.83 pence from 86.33 pence

West Texas Intermediate: DOWN 0.7 percent at $59.63 per barrel

Brent North Sea Crude: DOWN 0.7 percent at $62.92 per barrel

New York - Dow: DOWN 2.5 percent at 39,593.66 (close)

London - FTSE 100: UP 3.0 percent at 7,913.25 (close)

H.Gerber--VB