-

'Emotional' Yu, 12, celebrates historic world swimming medal

'Emotional' Yu, 12, celebrates historic world swimming medal

-

Stocks struggle as Trump unveils new tariff sweep offsets earnings

-

Landslide-prone Nepal tests AI-powered warning system

Landslide-prone Nepal tests AI-powered warning system

-

El Salvador parliament adopts reform to allow Bukele to run indefinitely

-

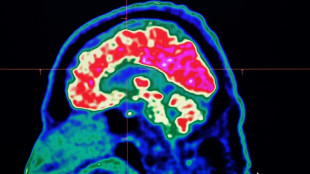

What are all these microplastics doing to our brains?

What are all these microplastics doing to our brains?

-

Zverev rallies in Toronto to claim milestone 500th ATP match win

-

Farrell says debate over Australia as Lions destination 'insulting'

Farrell says debate over Australia as Lions destination 'insulting'

-

After stadium delays, African Nations Championship kicks off

-

US tech titan earnings rise on AI as economy roils

US tech titan earnings rise on AI as economy roils

-

Nvidia says no 'backdoors' in chips as China questions security

-

Wallabies' Tizzano absent from third Lions Test after online abuse

Wallabies' Tizzano absent from third Lions Test after online abuse

-

Famed union leader Dolores Huerta urges US to mobilize against Trump

-

Richardson, Lyles ease through 100m heats at US trials

Richardson, Lyles ease through 100m heats at US trials

-

Correa returning to Astros in blockbuster MLB trade from Twins

-

Trump orders tariffs on dozens of countries in push to reshape global trade

Trump orders tariffs on dozens of countries in push to reshape global trade

-

Trump to build huge $200mn ballroom at White House

-

Heathrow unveils £49 bn expansion plan for third runway

Heathrow unveils £49 bn expansion plan for third runway

-

'Peaky Blinders' creator to pen new James Bond movie: studio

-

Top seed Gauff rallies to reach WTA Montreal fourth round

Top seed Gauff rallies to reach WTA Montreal fourth round

-

Gas workers uncover 1,000-year-old mummy in Peru

-

Brazil vows to fight Trump tariff 'injustice'

Brazil vows to fight Trump tariff 'injustice'

-

Michelsen stuns Musetti as Ruud rallies in Toronto

-

Oscars group picks 'A Star is Born' producer as new president

Oscars group picks 'A Star is Born' producer as new president

-

Apple profit beats forecasts on strong iPhone sales

-

Michelsen stuns Musetti at ATP Toronto Masters

Michelsen stuns Musetti at ATP Toronto Masters

-

Peru's president rejects court order on police amnesty

-

Google must open Android to rival app stores: US court

Google must open Android to rival app stores: US court

-

Amazon profits surge 35% as AI investments drive growth

-

Trump envoy to inspect Gaza aid as pressure mounts on Israel

Trump envoy to inspect Gaza aid as pressure mounts on Israel

-

US theater and opera legend Robert Wilson dead at 83

-

EA shooter 'Battlefield 6' to appear in October

EA shooter 'Battlefield 6' to appear in October

-

Heavyweight shooter 'Battlefield 6' to appear in October

-

Justin Timberlake says he has Lyme disease

Justin Timberlake says he has Lyme disease

-

Atkinson and Tongue strike as India struggle in England decider

-

US theater and opera auteur Bob Wilson dead at 83

US theater and opera auteur Bob Wilson dead at 83

-

In Darwin's wake: Two-year global conservation voyage sparks hope

-

Microsoft valuation surges above $4 trillion as AI lifts stocks

Microsoft valuation surges above $4 trillion as AI lifts stocks

-

Verstappen quells speculation by committing to Red Bull for 2026

-

Study reveals potato's secret tomato past

Study reveals potato's secret tomato past

-

Squiban solos to Tour de France stage win, Le Court maintains lead

-

Max Verstappen confirms he is staying at Red Bull next year

Max Verstappen confirms he is staying at Red Bull next year

-

Mitchell keeps New Zealand on top against Zimbabwe

-

Vasseur signs new contract as Ferrari team principal

Vasseur signs new contract as Ferrari team principal

-

French cities impose curfews for teens to curb crime

-

Seals sing 'otherworldly' songs structured like nursery rhymes

Seals sing 'otherworldly' songs structured like nursery rhymes

-

India captain Gill run out in sight of Gavaskar record

-

Trump's global trade policy faces test, hours from tariff deadline

Trump's global trade policy faces test, hours from tariff deadline

-

Study reveals potato's secret tomato heritage

-

Wirtz said I would 'enjoy' Bayern move, says Diaz

Wirtz said I would 'enjoy' Bayern move, says Diaz

-

West Ham's Paqueta cleared of betting charges

| CMSC | 1.09% | 22.85 | $ | |

| SCU | 0% | 12.72 | $ | |

| RIO | 0.47% | 59.77 | $ | |

| NGG | 0.28% | 70.39 | $ | |

| GSK | -4.9% | 37.15 | $ | |

| BTI | 0.97% | 53.68 | $ | |

| RBGPF | 0.69% | 74.94 | $ | |

| BP | -0.31% | 32.15 | $ | |

| BCC | -1.29% | 83.81 | $ | |

| JRI | 0.15% | 13.13 | $ | |

| CMSD | 0.9% | 23.27 | $ | |

| SCS | 0% | 10.33 | $ | |

| BCE | -0.86% | 23.33 | $ | |

| RYCEF | 7.62% | 14.18 | $ | |

| AZN | -4.79% | 73.09 | $ | |

| RELX | 0.21% | 51.89 | $ | |

| VOD | -2.31% | 10.81 | $ |

Most markets see much-needed gains as Fed's big day arrives

Most markets rose Wednesday to provide some respite from the hefty selling at the start of the week, with focus on the end of the Federal Reserve's policy meeting later in the day, when traders hope it will provide much-needed guidance on its plans for hiking interest rates.

After weeks of uncertainty, the US central bank will finally deliver its views on the state of the world's top economy and how officials plan to tackle inflation that is now at a four-decade high without knocking its recovery off course.

Minutes from its December gathering pointed to a more hawkish tilt, with plans to speed up the taper of its vast bond-buying programme, the selling of the assets it already has and three or four rate increases before the end of the year.

While boss Jerome Powell pledged any tightening would be carefully calibrated, the prospect of higher borrowing costs has rattled markets across the world with most key indexes deep in the red from the start of the year, with Wall Street particularly hard hit.

His comments after the meeting will be pored over for signs of the Fed's plans, which most commentators believe include a first hike in March.

Analysts were leaning positive ahead of the meeting.

Frances Stacy, at Optimal Capital, told Bloomberg Television that Powell would try to take a less hawkish tone, saying policy would be guided by data while supply chains were improving and inflation showed signs of peaking.

"I think what that's going to do is potentially reassure markets that the Fed 'put' is ready, willing and able," she said, referring to the bank's past in backstopping markets. "That could cause some serious enthusiasm and a short squeeze."

Michael Hewson at CMC Markets added: "While no changes to policy are expected... markets will be looking for clues as to how concerned Fed officials are about headline (consumer inflation) and whether they might be leaning towards a potential 50 basis point hike in March, rather than the 25 that is currently priced.

"Given the volatility this week, any sort of indication that Fed officials were leaning in this direction would be risky. However it wouldn't be beyond the realms of possibilities for them to put the idea out there."

Meanwhile, markets strategist Louis Navellier saw three rate hikes this year and that after the recent bout of selling across markets, buying opportunities were emerging.

"I'm very comfortable that we are going to have a bottom here soon. Remember, the market is a manic crowd," he said in a note.

After a second day of high volatility in New York, Asia enjoyed a little more stability.

Hong Kong, Shanghai, Singapore, Wellington, Jakarta and Bangkok rose, though Tokyo, Seoul, Taipei and Manila edged down. Sydney and Mumbai were closed for holidays.

London, Paris and Frankfurt rose healthily.

While there remains some optimism among analysts about the outlook, the International Monetary Fund on Tuesday lowered its growth outlook for the global economy saying it has started the year "in a weaker position than previously expected".

It said Omicron threatened to set back the recovery as countries impose containment measures, while other issues remained, including inflation and geopolitical tensions.

Included in those tensions is the standoff on the Ukraine-Russia border, with Moscow building up troop numbers and the West led by the United States warning the risk of an invasion "remains imminent".

US President Joe Biden said such a move would prompt "enormous consequences" and even "change the world", adding that he would consider imposing direct sanctions on Russian counterpart Vladimir Putin on top of a raft of measures being drawn up.

- Key figures around 0820 GMT -

Tokyo - Nikkei 225: DOWN 0.4 percent at 27,011.33 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 24,289.90 (close)

Shanghai - Composite: UP 0.7 percent at 3,455.67 (close)

London - FTSE 100: UP 0.9 percent at 7,436.00

Euro/dollar: DOWN at $1.1292 from $1.1305 late Tuesday

Pound/dollar: DOWN at $1.3505 from $1.3507

Euro/pound: DOWN at 83.62 pence from 83.66 pence

Dollar/yen: UP at 114.03 yen from 113.87 yen

West Texas Intermediate: UP 0.2 percent at $85.73 per barrel

Brent North Sea crude: UP 0.3 percent at $88.50 per barrel

New York - Dow: DOWN 0.2 percent at 34,297.73 (close)

K.Brown--BTB