-

Serena Williams refuses to rule out return to tennis

Serena Williams refuses to rule out return to tennis

-

Vietnam, EU vow stronger ties as bloc's chief visits Hanoi

-

New glove, same fist: Myanmar vote ensures military's grip

New glove, same fist: Myanmar vote ensures military's grip

-

Deutsche Bank logs record profits, as new probe casts shadow

-

Thai foreign minister says hopes Myanmar polls 'start of transition' to peace

Thai foreign minister says hopes Myanmar polls 'start of transition' to peace

-

No white flag from Djokovic against Sinner as Alcaraz faces Zverev threat

-

Vietnam and EU upgrade ties as EU chief visits Hanoi

Vietnam and EU upgrade ties as EU chief visits Hanoi

-

Starmer, Xi stress need for stronger UK-China ties to face global headwinds

-

Senegal coach Thiaw gets five-match ban after AFCON final chaos

Senegal coach Thiaw gets five-match ban after AFCON final chaos

-

Phan Huy: the fashion prodigy putting Vietnam on the map

-

Hongkongers snap up silver as gold becomes 'too expensive'

Hongkongers snap up silver as gold becomes 'too expensive'

-

Britain's Starmer meets China's Xi for talks on trade, security

-

Chinese quadriplegic runs farm with just one finger

Chinese quadriplegic runs farm with just one finger

-

Gold soars past $5,500 as Trump sabre rattles over Iran

-

China's ambassador warns Australia on buyback of key port

China's ambassador warns Australia on buyback of key port

-

'Bombshell': What top general's fall means for China's military

-

As US tensions churn, new generation of protest singers meet the moment

As US tensions churn, new generation of protest singers meet the moment

-

Venezuelans eye economic revival with hoped-for oil resurgence

-

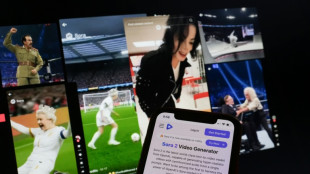

Online platforms offer filtering to fight AI slop

Online platforms offer filtering to fight AI slop

-

With Trump allies watching, Canada oil hub faces separatist bid

-

Samsung Electronics posts record profit on AI demand

Samsung Electronics posts record profit on AI demand

-

Rockets veteran Adams out for rest of NBA season

-

Holders PSG happy to take 'long route' via Champions League play-offs

Holders PSG happy to take 'long route' via Champions League play-offs

-

French Senate adopts bill to return colonial-era art

-

Allrounder Molineux named Australian women's cricket captain

Allrounder Molineux named Australian women's cricket captain

-

Sabalenka faces Svitolina roadblock in Melbourne final quest

-

Barcelona rout Copenhagen to reach Champions League last 16

Barcelona rout Copenhagen to reach Champions League last 16

-

Liverpool, Man City and Barcelona ease into Champions League last 16

-

Tesla profits tumble on lower EV sales, AI spending surge

Tesla profits tumble on lower EV sales, AI spending surge

-

Real Madrid face Champions League play-off after Benfica loss

-

LA mayor urges US to reassure visiting World Cup fans

LA mayor urges US to reassure visiting World Cup fans

-

Madrid condemned to Champions League play-off after Benfica loss

-

Meta shares jump on strong earnings report

Meta shares jump on strong earnings report

-

Haaland ends barren run as Man City reach Champions League last 16

-

PSG and Newcastle drop into Champions League play-offs after stalemate

PSG and Newcastle drop into Champions League play-offs after stalemate

-

Salah ends drought as Liverpool hit Qarabag for six to reach Champions League last 16

-

Barca rout Copenhagen to reach Champions League last 16

Barca rout Copenhagen to reach Champions League last 16

-

Arsenal complete Champions League clean sweep for top spot

-

Kolo Muani and Solanke send Spurs into Champions League last 16

Kolo Muani and Solanke send Spurs into Champions League last 16

-

Bayern inflict Kane-ful Champions League defeat on PSV

-

Pedro double fires Chelsea into Champions League last 16, dumps out Napoli

Pedro double fires Chelsea into Champions League last 16, dumps out Napoli

-

US stocks move sideways, shruggging off low-key Fed meeting

-

US capital Washington under fire after massive sewage leak

US capital Washington under fire after massive sewage leak

-

Anti-immigration protesters force climbdown in Sundance documentary

-

US ambassador says no ICE patrols at Winter Olympics

US ambassador says no ICE patrols at Winter Olympics

-

Norway's Kristoffersen wins Schladming slalom

-

Springsteen releases fiery ode to Minneapolis shooting victims

Springsteen releases fiery ode to Minneapolis shooting victims

-

Brady latest to blast Belichick Hall of Fame snub

-

Trump battles Minneapolis shooting fallout as agents put on leave

Trump battles Minneapolis shooting fallout as agents put on leave

-

SpaceX eyes IPO timed to planet alignment and Musk birthday: report

Cash-keen Taliban betting on Afghanistan's mines

A miner in the mountains of eastern Afghanistan poured water over a block of jade, exposing the green stone that is part of the Taliban authorities' push to capitalise on the country's rich mineral resources.

Touting the return of security, the Taliban government is rushing to court local and foreign investors to exploit the country's underground wealth and secure a crucial revenue stream -- though experts warn of the risks of cutting corners.

Emeralds, rubies, marble, gold and lithium: the resources buried across Afghanistan's rocky landscape are estimated to be worth a trillion dollars, according to US and UN assessments from 2010 and 2013.

Though decades of war spared these reserves from large-scale exploitation, roughly 200 contracts -- the majority with local companies -- worth billions of dollars in total have been signed since the Taliban's 2021 return to power, official figures show.

"We want Afghanistan to be self-sufficient but there are obstacles," Humayoun Afghan, the spokesman for the Ministry of Mines, told AFP.

"We have no experts, no infrastructure, no knowledge."

The Taliban authorities will "welcome anyone who wants to invest, especially those with mining experience", he added.

Many of these contracts focus on mining exploration, a process that can take years and yield little results, while loosely regulated extraction can leave behind environmental scars, experts caution.

The US Geological Survey (USGS) has noted the production of coal, talc and chromite, "sharply increased" in 2021 and 2022.

The authorities are prioritising resources that could lose value before tackling others, such as lithium, the prices of which may still rise on global markets.

The mines ministry regularly publishes tenders for exploration and extraction projects, sending their embassies lists of available mining projects to invite foreign companies to apply, according to documents reviewed by AFP.

The World Bank says the results are already visible: a 6.9 percent expansion of mining and quarrying drove an industrial sector increase of 2.6 percent in 2023-2024.

But while the government "has auctioned several small mining contracts to meet its cash requirements, many of these contracts have yet to commence operations", it said in a December report.

For mining sector expert Javed Noorani, authorities are tendering "maybe 10 times more than its own capacity to do things".

- 'Country is stabilised' -

The Taliban fought a two decade insurgency against the US and NATO-backed Afghan government in Kabul, seizing power in a rapid military campaign in 2021 after foreign forces withdrew.

Foreign investors had largely abandoned the country, but security has drastically improved and the country's road network has opened up.

Most now fear being associated with the "Islamic Emirate", which remains unrecognised internationally and under Western sanctions.

However, some countries that maintain diplomatic and economic ties with Kabul, such as Iran, Turkey, Uzbekistan and Qatar, have seized the opportunity, with China leading the way.

"The first thing investors say when they meet with us is that the county has been stabilised so now they want to invest," said Afghan, who estimates that 150,000 jobs have been created by the sector since 2021.

Despite improved stability in the mountainous country, there have been sporadic attacks on foreigners claimed by the Islamic State group -- including a Chinese mine worker killed while travelling in northern Takhar province in January.

- China in the lead -

The Chinese state-owned company MCC is already operating at the Mes Aynak copper deposit, the world's second-largest, located 40 kilometres (25 miles) from Kabul, under a 2008 contract revived by the Taliban government.

Chinese companies have secured at least three other major mining projects, particularly in gold and copper, Afghan said.

At a mine carved out of a mountainside in Goshta in eastern Nangarhar province, jade is extracted to be used in jewellery.

"The majority of our nephrite goes to China," said Habibrahman Kawal, co-owner of the mine.

Kawal is pleased with his thriving business, having never invested in mining before the Taliban takeover.

Only 14 mining companies currently active were operating under the previous government, according to the Britain-based Centre for Information Resilience.

"This suggests that a new set of companies dominates the mining sector in Afghanistan," it said.

The government declined to disclose revenue figures but it profits by taking stakes in some companies and collecting royalties.

- Environmental risks -

Shir Baz Kaminzada, president of the Afghanistan Chamber of Industries and Mines, said some investors disregard international sanctions knowing "they can make money". In countries with strict regulations, "you'll spend billions to start a mine".

"In a place like Afghanistan, where there's very little experience with mining and very few, if any, regulations for mining, that's an advantage to companies coming in," said geophysicist David Chambers, president of a non-profit providing technical assistance in mining activities.

This allows for faster work, but "could cause environmental or economic harm", he said.

The main danger lies in mine waste, as only one percent of what is excavated is removed.

The rest may contain iron sulfide minerals that contaminate the ground if it comes into contact with water.

The mines ministry claims to adhere to existing legislation to ensure that the mines are "cleaned" after extraction, without providing further details.

"Every dollar you don't spend in designing a safe tailings dam (to contain waste) or in cleaning up water, that's profit," said Chambers.

"But again, that leads to potential longer term costs."

In Afghanistan, Kaminzada admitted, "people are not taking care of the long term".

F.Fehr--VB