-

Kremlin says agreed to halt strikes on Kyiv until Sunday

Kremlin says agreed to halt strikes on Kyiv until Sunday

-

Carrick calls for calm after flying start to Man Utd reign

-

Djokovic to meet Alcaraz in Melbourne final after five-set marathon

Djokovic to meet Alcaraz in Melbourne final after five-set marathon

-

Italian officials to testify in trial over deadly migrant shipwreck

-

Iran says defence capabilities 'never' up for negotiation

Iran says defence capabilities 'never' up for negotiation

-

UN appeals for more support for flood-hit Mozambicans

-

Lijnders urges Man City to pile pressure on Arsenal in title race

Lijnders urges Man City to pile pressure on Arsenal in title race

-

Fulham sign Man City winger Oscar Bobb

-

Strasbourg's Argentine striker Panichelli sets sights on PSG, World Cup

Strasbourg's Argentine striker Panichelli sets sights on PSG, World Cup

-

Jesus 'made love': Colombian president irks Christians with steamy claim

-

IAEA board meets over Ukraine nuclear safety concerns

IAEA board meets over Ukraine nuclear safety concerns

-

Eurozone growth beats 2025 forecasts despite Trump woes

-

Dutch PM-elect Jetten says not yet time to talk to Putin

Dutch PM-elect Jetten says not yet time to talk to Putin

-

Social media fuels surge in UK men seeking testosterone jabs

-

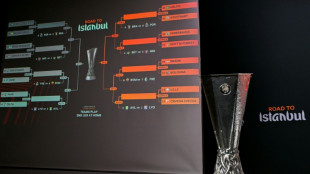

Forest face Fenerbahce, Celtic draw Stuttgart in Europa League play-offs

Forest face Fenerbahce, Celtic draw Stuttgart in Europa League play-offs

-

US speed queen Vonn crashes at Crans-Montana, one week before Olympics

-

Trump nominates former US Fed official as next central bank chief

Trump nominates former US Fed official as next central bank chief

-

New Dutch government pledges ongoing Ukraine support

-

Newcastle still coping with fallout from Isak exit, says Howe

Newcastle still coping with fallout from Isak exit, says Howe

-

Chad, France eye economic cooperation as they reset strained ties

-

Real Madrid to play Benfica, PSG face Monaco in Champions League play-offs

Real Madrid to play Benfica, PSG face Monaco in Champions League play-offs

-

Everton winger Grealish set to miss rest of season in World Cup blow

-

Trump brands Minneapolis nurse killed by federal agents an 'agitator'

Trump brands Minneapolis nurse killed by federal agents an 'agitator'

-

Arteta focuses on the positives despite Arsenal stumble

-

Fijian Drua sign France international back Vakatawa

Fijian Drua sign France international back Vakatawa

-

Kevin Warsh, a former Fed 'hawk' now in tune with Trump

-

Zverev rails at Alcaraz timeout in 'one of the best battles ever'

Zverev rails at Alcaraz timeout in 'one of the best battles ever'

-

Turkey leads Iran diplomatic push as Trump softens strike threat

-

Zelensky backs energy ceasefire, Russia bombs Ukraine despite Trump intervention

Zelensky backs energy ceasefire, Russia bombs Ukraine despite Trump intervention

-

'Superman' Li Ka-shing, Hong Kong billionaire behind Panama ports deal

-

Skiing great Lindsey Vonn crashes at Crans-Montana, one week before Olympics

Skiing great Lindsey Vonn crashes at Crans-Montana, one week before Olympics

-

Slot warns Liverpool 'can't afford mistakes' in top-four scrap

-

Paris show by late Martin Parr views his photos through political lens

Paris show by late Martin Parr views his photos through political lens

-

Artist chains up thrashing robot dog to expose AI fears

-

Alcaraz outlasts Zverev in epic to reach maiden Australian Open final

Alcaraz outlasts Zverev in epic to reach maiden Australian Open final

-

French PM forces final budget through parliament

-

French-Nigerian artists team up to craft future hits

French-Nigerian artists team up to craft future hits

-

Dutch watchdog launches Roblox probe over 'risks to children'

-

Trump brands Minneapolis nurse shot dead by federal agents an 'agitator'

Trump brands Minneapolis nurse shot dead by federal agents an 'agitator'

-

Israel says killed 'three terrorists' in Gaza

-

After Trump-fueled brawls, Canada-US renew Olympic hockey rivalry

After Trump-fueled brawls, Canada-US renew Olympic hockey rivalry

-

Eileen Gu - Olympic champion who bestrides rivals US, China

-

Trump, first lady attend premier of multimillion-dollar 'Melania' documentary

Trump, first lady attend premier of multimillion-dollar 'Melania' documentary

-

US Senate eyes funding deal vote as government shutdown looms

-

Cuddly Olympics mascot facing life or death struggle in the wild

Cuddly Olympics mascot facing life or death struggle in the wild

-

UK schoolgirl game character Amelia co-opted by far-right

-

Anger as bid to ramp up Malaysia's football fortunes backfires

Anger as bid to ramp up Malaysia's football fortunes backfires

-

Panama court annuls Hong Kong firm's canal port concession

-

Pioneer African Olympic skier returns to Sarajevo slopes for documentary

Pioneer African Olympic skier returns to Sarajevo slopes for documentary

-

Trump threatens tariffs on nations selling oil to Cuba

| VOD | -0.17% | 14.685 | $ | |

| RYCEF | -2.69% | 16 | $ | |

| RELX | -0.81% | 35.875 | $ | |

| CMSC | -0.21% | 23.645 | $ | |

| BTI | -0.13% | 60.13 | $ | |

| NGG | -0.1% | 84.965 | $ | |

| RIO | -2.64% | 92.68 | $ | |

| AZN | 0.39% | 92.95 | $ | |

| GSK | 1.21% | 51.275 | $ | |

| RBGPF | 1.65% | 83.78 | $ | |

| CMSD | 0.17% | 24.1 | $ | |

| JRI | 0.27% | 12.99 | $ | |

| BP | 0.42% | 38.2 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| BCC | -1.57% | 78.93 | $ | |

| BCE | 0.14% | 25.52 | $ |

Voluntary deforestation carbon credits failing: study

Only a small fraction of private sector forest-based carbon credits available for purchase to offset greenhouse gas emissions actually help prevent deforestation, according to new research.

Across nearly a score of offset projects examined in central Africa, South America and Southeast Asia, only 5.4 million out of 89 million credits -- about six percent -- actually resulted in carbon reduction through forest preservation, scientists reported this week in the journal Science.

In carbon markets, a single credit represents one tonne of CO2 that is either removed from the atmosphere by growing trees, or prevented from entering it through avoided deforestation.

Each year, burning fossil fuels -- and, to a much lesser extent, deforestation -- emit roughly 40 billion tonnes of CO2, the main driver of global warming.

As climate change accelerates and pressure mounts on corporations and countries to slash emissions, the market for carbon credits has exploded.

In 2021, more than 150 million credits valued at $1.3 billion originated in the so-called voluntary carbon market under the banner of REDD+, or Reduced Emissions from Deforestation and Forest Degradation in Developing Countries.

Such schemes, however, have long been dogged by charges of poor transparency, dodgy accounting practices, and in-built conflicts of interest.

As wildfires spread across regions that include forests supporting carbon credit schemes, permanence has also become a concern.

Earlier this year Zimbabwe sent a shudder through the private forest-based offsets market by announcing it would appropriate half of all the revenue generated from offsets on its land, exposing yet another vulnerability.

The projects under scrutiny in the new study are distinct from a parallel forest-based offsets programme backed by the United Nations, also known as REDD+, and carried out through bi-lateral agreements and multilateral lending institutions.

"Carbon credits provide major polluters with some semblance of climate credentials," said senior author Andreas Kontoleon, a professor in the University of Cambridge's department of land economy.

- 'Selling hot air' -

"Yet we can see that claims of saving vast swathes of forest from the chainsaw to balance emissions are overblown."

"These carbon credits are essentially predicting whether someone will chop down a tree and selling that prediction," he added in a statement. "If you exaggerate or get it wrong -- intentionally or not -- you are selling hot air."

Over-estimations of forest preservation have allowed the number of private sector carbon credits on the market to keep rising, which suppresses prices.

As of late July, the most competitive nature-based carbon credits sold at about $2.5 per tonne of CO2, down from an average of $9.5 in 2022, according to S&P Global Commodity Insights.

The new study is among the first peer-reviewed assessments across a number of representative projects.

Kontoleon and his team looked at 18 private sector REDD+ projects in Peru, Colombia, Cambodia, Tanzania and the Democratic Republic of Congo.

To assess their performance, the researchers identified parallel sites within each region with similar conditions but without forest protection schemes.

"We used real-world comparison sites to show what each REDD+ forest project would most probably look like now," said lead author Thales West, a researcher at VU University Amsterdam.

Of the 18 projects, 16 claimed to have avoided far more deforestation than took place at the comparison sites.

Of the 89 million carbon credits expected to be generated by all 18 projects in 2020, 60 million would have barely reduced deforestation, if at all, the study found.

There are several possible reasons that REDD+ schemes have fallen so far short of their carbon sequestration claims.

One is that they are calculated on the basis of historical trends that can be inaccurate or deliberately inflated.

The operation must also project deforestation or afforestation rates over an extended period of time, which is difficult.

In addition, projects may be located in areas where substantial conservation would have occurred in any case.

Most problematic, perhaps, is the ever-present incentive to exaggerate, the researcher said.

"There are perverse incentives to generate huge numbers of carbon credits, and at the moment the market is essentially unregulated," said Kontoleon.

"The industry needs to work on closing loopholes that might allow bad faith actors to exploit offset markets."

G.Schulte--BTB