-

Syria army enters Al-Hol camp holding relatives of jihadists: AFP

Syria army enters Al-Hol camp holding relatives of jihadists: AFP

-

Brook apologises, admits nightclub fracas 'not the right thing to do'

-

NATO chief says 'thoughtful diplomacy' only way to deal with Greenland crisis

NATO chief says 'thoughtful diplomacy' only way to deal with Greenland crisis

-

Widow of Iran's last shah says 'no turning back' after protests

-

Waugh targets cricket's 'last great frontier' with European T20 venture

Waugh targets cricket's 'last great frontier' with European T20 venture

-

Burberry sales rise as China demand improves

-

Botswana warns diamond oversupply to hit growth

Botswana warns diamond oversupply to hit growth

-

Spaniard condemns 'ignorant drunks' after Melbourne confrontation

-

Philippines to end short-lived ban on Musk's Grok chatbot

Philippines to end short-lived ban on Musk's Grok chatbot

-

Police smash European synthetic drug ring in 'largest-ever' op

-

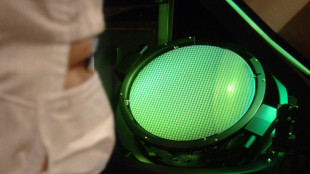

Japan to restart world's biggest nuclear plant Wednesday

Japan to restart world's biggest nuclear plant Wednesday

-

South Korean ex-PM Han gets 23 years jail for martial law role

-

Alcaraz, Sabalenka, Gauff surge into Australian Open third round

Alcaraz, Sabalenka, Gauff surge into Australian Open third round

-

Over 1,400 Indonesians left Cambodian scam groups in five days: embassy

-

Raducanu to 're-evaluate' after flat Australian Open exit

Raducanu to 're-evaluate' after flat Australian Open exit

-

Doncic triple-double leads Lakers comeback over Nuggets, Rockets down Spurs

-

Bangladesh will not back down to 'coercion' in India T20 World Cup row

Bangladesh will not back down to 'coercion' in India T20 World Cup row

-

Alcaraz comes good after shaky start to make Australian Open third round

-

Trump departs for Davos forum again after switching to new plane: AFP

Trump departs for Davos forum again after switching to new plane: AFP

-

Impressive Gauff storms into Australian Open third round

-

Dazzling Chinese AI debuts mask growing pains

Dazzling Chinese AI debuts mask growing pains

-

Medvedev battles into Melbourne third round after early scare

-

Denmark's Andresen upstages sprint stars to take Tour Down Under opener

Denmark's Andresen upstages sprint stars to take Tour Down Under opener

-

Turkey's Sonmez soaks in acclaim on historic Melbourne run

-

Sheppard leads Rockets to sink Spurs in Texas derby

Sheppard leads Rockets to sink Spurs in Texas derby

-

Sabalenka shuts down political talk after Ukrainian's ban call

-

Trump's plane returns to air base after 'minor' electrical issue: White House

Trump's plane returns to air base after 'minor' electrical issue: White House

-

Barcelona train crash kills 1 in Spain's second deadly rail accident in days

-

North produces enough nuclear material a year for 10-20 weapons: S. Korea president

North produces enough nuclear material a year for 10-20 weapons: S. Korea president

-

Japan ex-PM Abe's alleged killer faces verdict

-

Climate change fuels disasters, but deaths don't add up

Climate change fuels disasters, but deaths don't add up

-

Stocks stable after tariff-fuelled selloff but uncertainty boosts gold

-

What growth?: Taiwan's traditional manufacturers miss out on export boom

What growth?: Taiwan's traditional manufacturers miss out on export boom

-

'Super-happy' Sabalenka shines as Alcaraz gets set at Australian Open

-

With monitors and lawsuits, Pakistanis fight for clean air

With monitors and lawsuits, Pakistanis fight for clean air

-

Sabalenka sets up potential Raducanu showdown at Australian Open

-

Chile president picks Pinochet lawyers as ministers of human rights, defense

Chile president picks Pinochet lawyers as ministers of human rights, defense

-

Osaka says 'I'm a little strange' after Melbourne fashion statement

-

UN report declares global state of 'water bankruptcy'

UN report declares global state of 'water bankruptcy'

-

Trump heads for Davos maelstrom over Greenland

-

Ukraine's Oliynykova wants Russian, Belarusian players banned from tennis

Ukraine's Oliynykova wants Russian, Belarusian players banned from tennis

-

Kasatkina cannot wait to be back after outpouring of Melbourne support

-

Chile blaze victims plead for help from razed neighborhoods

Chile blaze victims plead for help from razed neighborhoods

-

Russian minister visits Cuba as Trump ramps up pressure on Havana

-

World order in 'midst of a rupture': Canada PM Carney tells Davos

World order in 'midst of a rupture': Canada PM Carney tells Davos

-

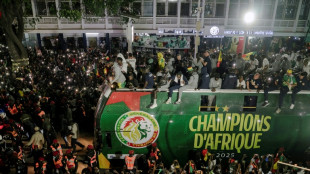

Senegal's 'historic' AFCON champs honoured with parade, presidential praise

-

Audi unveil new car for 2026 Formula One season

Audi unveil new car for 2026 Formula One season

-

Man City humiliated, holders PSG stumble, Arsenal remain perfect

-

Vinicius, Real Madrid need 'love' not whistles: Bellingham

Vinicius, Real Madrid need 'love' not whistles: Bellingham

-

Late Suarez winner stops Champions League holders PSG in Lisbon

Tech firms lead Asian markets higher, oil swings after Maduro ouster

Asian stocks rose Monday on the back of a fresh rally in tech firms and oil fluctuated as investors weighed the impact of the US ouster of Venezuelan leader Nicolas Maduro.

While the South American leader's removal added to geopolitical risk on global markets, traders chose to focus on the long-running artificial intelligence boom and hopes for more US interest rate cuts.

The first full week of business for 2026 will also see the release of key jobs data that could play a role in the Federal Reserve's decision-making on borrowing costs.

Investors will also be on the lookout for an idea about who US President Donald Trump chooses to take the helm at the central bank when Jerome Powell steps down in May.

In early trade, Asian stocks were up across the board, led by markets with heavy tech presence.

Tokyo surged 2.8 percent thanks to tech investor SoftBank's four percent gains and chip equipment maker Tokyo Electron's five percent advance.

The Kospi in Seoul gained more than two percent, with SK Hynix up more than three percent and Samsung Electronics soaring 4.6 percent.

Taipei was 2.5 percent up as chip titan TSMC rocketed more than five percent.

Hong Kong, Shanghai, Sydney, Singapore, Wellington and Manila were also well up.

The gains suggest investors were brushing off worries that valuations in the tech sector have become stretched and warnings about the timing and size of returns on huge AI investments.

"This move now stands as the strongest start to a year for Asian equities since 2012, coming on the heels of a global market that just delivered its best annual return since 2017," wrote Stephen Innes at SPI Asset Management.

Still, Kyle Rodda at Capital.com warned: "Valuations remain around levels exceeded only by the Dot.com bubble, while allocation to equities are at elevated levels at the same time allocation to cash is on the low side.

"Most simply put, the markets probably need to see more evidence of resilient US growth, continued disinflation and therefore US rate cuts, strong corporate earnings, and the pay-offs from artificial intelligence to keep on rising."

Safe-haven investment gold was up more than one percent at about $4,400 per ounce.

Oil shifted between gains and losses after US forces attacked Venezuela early Saturday, bombing military targets and spiriting away Maduro and his wife to face federal charges in New York.

Venezuela has the world's largest proven oil reserves, and more Venezuelan crude in the market could exacerbate oversupply concerns and add to recent pressure on prices.

Trump said the United States will now "run" Venezuela and send US companies to fix its dilapidated oil infrastructure.

But analysts say that alongside other major questions about the South American country's future, substantially lifting its oil production will not be easy, quick or cheap.

After years of under-investment and sanctions, Venezuela pumps around one million barrels per day, down from around 3.5 million in 1999.

"Any recovery in production would require substantial investment given the crumbling infrastructure resulting from years of mismanagement and underinvestment," UBS analyst Giovanni Staunovo told AFP.

Investing today also holds little appeal as oil prices are weighed down by a supply glut, and fell last year.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 2.8 percent at 51,759.10 (break)

Hong Kong - Hang Seng Index: UP 0.3 percent at 26,428.49

Shanghai - Composite: UP 0.9 percent at 4,004.99

West Texas Intermediate: DOWN 0.7 percent at $57.28 per barrel

Brent North Sea Crude: UP 0.1 percent at $60.79 per barrel

Euro/dollar: DOWN at $1.1696 from $1.1720 on Friday

Pound/dollar: DOWN at $1.3437 from $1.3460

Dollar/yen: UP at 157.06 yen from 156.85 yen

Euro/pound: DOWN at 87.05 pence from 87.07 pence

New York - Dow: UP 0.7 percent at 48,382.39 points (close)

London - FTSE 100: UP 0.2 percent at 9,951.14 (close)

M.Betschart--VB