-

Keys into Melbourne third round with Sinner, Djokovic primed

Keys into Melbourne third round with Sinner, Djokovic primed

-

Bangladesh launches campaigns for first post-Hasina polls

-

Stocks track Wall St rally as Trump cools tariff threats in Davos

Stocks track Wall St rally as Trump cools tariff threats in Davos

-

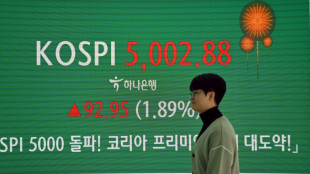

South Korea's economy grew just 1% in 2025, lowest in five years

-

Snowboard champ Hirano suffers fractures ahead of Olympics

Snowboard champ Hirano suffers fractures ahead of Olympics

-

'They poisoned us': grappling with deadly impact of nuclear testing

-

Keys blows hot and cold before making Australian Open third round

Keys blows hot and cold before making Australian Open third round

-

Philippine journalist found guilty of terror financing

-

Greenlanders doubtful over Trump resolution

Greenlanders doubtful over Trump resolution

-

Real Madrid top football rich list as Liverpool surge

-

'One Battle After Another,' 'Sinners' tipped to top Oscar noms

'One Battle After Another,' 'Sinners' tipped to top Oscar noms

-

Higher heating costs add to US affordability crunch

-

Eight stadiums to host 2027 Rugby World Cup matches in Australia

Eight stadiums to host 2027 Rugby World Cup matches in Australia

-

Plastics everywhere, and the myth that made it possible

-

Interim Venezuela leader to visit US

Interim Venezuela leader to visit US

-

Australia holds day of mourning for Bondi Beach shooting victims

-

Liverpool cruise as Bayern reach Champions League last 16

Liverpool cruise as Bayern reach Champions League last 16

-

Fermin Lopez brace leads Barca to win at Slavia Prague

-

Newcastle pounce on PSV errors to boost Champions League last-16 bid

Newcastle pounce on PSV errors to boost Champions League last-16 bid

-

Fermin Lopez brace hands Barca win at Slavia Prague

-

Kane double fires Bayern into Champions League last 16

Kane double fires Bayern into Champions League last 16

-

Newcastle pounce on PSV errors to close in on Champions League last 16

-

In Davos speech, Trump repeatedly refers to Greenland as 'Iceland'

In Davos speech, Trump repeatedly refers to Greenland as 'Iceland'

-

Liverpool see off Marseille to close on Champions League last 16

-

Caicedo strikes late as Chelsea end Pafos resistance

Caicedo strikes late as Chelsea end Pafos resistance

-

US Republicans begin push to hold Clintons in contempt over Epstein

-

Trump says agreed 'framework' for US deal over Greenland

Trump says agreed 'framework' for US deal over Greenland

-

Algeria's Zidane and Belghali banned over Nigeria AFCON scuffle

-

Iran says 3,117 killed during protests, activists fear 'far higher' toll

Iran says 3,117 killed during protests, activists fear 'far higher' toll

-

Atletico frustrated in Champions League draw at Galatasaray

-

Israel says struck Syria-Lebanon border crossings used by Hezbollah

Israel says struck Syria-Lebanon border crossings used by Hezbollah

-

Snapchat settles to avoid social media addiction trial

-

'Extreme cold': Winter storm forecast to slam huge expanse of US

'Extreme cold': Winter storm forecast to slam huge expanse of US

-

Jonathan Anderson reimagines aristocrats in second Dior Homme collection

-

Former England rugby captain George to retire in 2027

Former England rugby captain George to retire in 2027

-

Israel launches wave of fresh strikes on Lebanon

-

Ubisoft unveils details of big restructuring bet

Ubisoft unveils details of big restructuring bet

-

Abhishek fireworks help India beat New Zealand in T20 opener

-

Huge lines, laughs and gasps as Trump lectures Davos elite

Huge lines, laughs and gasps as Trump lectures Davos elite

-

Trump rules out 'force' against Greenland but demands talks

-

Stocks steadier as Trump rules out force to take Greenland

Stocks steadier as Trump rules out force to take Greenland

-

World's oldest cave art discovered in Indonesia

-

US hip-hop label Def Jam launches China division in Chengdu

US hip-hop label Def Jam launches China division in Chengdu

-

Dispersed Winter Olympics sites 'have added complexity': Coventry

-

Man City players to refund fans after Bodo/Glimt debacle

Man City players to refund fans after Bodo/Glimt debacle

-

France's Lactalis recalls baby formula over toxin

-

Pakistan rescuers scour blaze site for dozens missing

Pakistan rescuers scour blaze site for dozens missing

-

Keenan return to Irish squad boosts Farrell ahead of 6 Nations

-

US Treasury chief accuses Fed chair of 'politicising' central bank

US Treasury chief accuses Fed chair of 'politicising' central bank

-

Trump rules out force against Greenland but demands 'immediate' talks

London stocks hit record as 2026 kicks off with global gains

Stock markets rose Friday, the first trading day of 2026, with London's benchmark FTSE 100 index reaching 10,000 points for the first time.

After indices smashed records in 2025, ending with double-digit annual gains, London continued the trend in early new year deals.

The capital's top-tier index -- featuring the likes of energy group BP, telecoms firm Vodafone and banking giant HSBC -- gained more than one percent to reach an all-time high of 10,046.25 points soon after the start of trading Friday.

It later cooled but was still showing a gain of 0.5 percent compared with the close on Wednesday.

"The FTSE 100 hit the 10,000 jackpot level immediately after rounding off a tremendous year for UK shares," noted Dan Coatsworth, head of markets at AJ Bell trading group.

The index climbed more than 21 percent in 2025, the biggest gain for 16 years, helped in large part by cuts to British interest rates alongside reductions to borrowing costs by the US Federal Reserve as global inflation retreated.

Helping the FTSE 100 to its new record Friday was another solid gain to the share price of gold miner Fresnillo, whose stock rocketed 436 percent last year as the precious metal's price struck multiple record highs.

Paris and Frankfurt edged higher in late morning deals Friday after Hong Kong led Asian gains, closing up 2.8 percent.

Overall in 2025, Hong Kong jumped 28 percent, Tokyo won 26 percent and Seoul soared 75 percent.

Wall Street's S&P added 16.4 percent last year and the tech-rich Nasdaq 20.4 percent, with the dollar weakening on US rate cuts and President Donald Trump's war on tariffs.

However the dollar made a bright start to 2026, rising against the euro, yen and British pound.

Oil prices dipped, having lost nearly 20 percent last year on an oversupplied market.

"When it comes to the all important US economy, Wall Street is pricing in (that) growth will accelerate this year while inflation still moderates and interest rates get cut" further, said Kyle Rodda at Australian brokerage Capital.com.

AI chip juggernaut Nvidia became the world's first $5 trillion company in late 2025 as its market value soared on Wall Street.

The surge in the tech sector on vast amounts of cash pumped into artificial intelligence helped push stock markets to record highs last year, but concerns that valuations of AI stocks are too high gnawed at investors late in 2025.

In Asia on Friday, chip designer Biren Technologies soared as much as 119 percent in the exchange's first listing of the year.

It closed at HK$34.46, off its intra-day high of HK$42.88 but well up on its offer price of HK$19.60.

The Shanghai-based firm's listing raised more than $700 million, suggesting that investor appetite for anything related to AI remains insatiable.

"The industry is in a flourishing stage, with many firms striving for breakthroughs and significant growth potential," said Kenny Ng, a strategist at China Everbright Securities.

Key figures at around 1045 GMT -

London - FTSE 100: UP 0.4 percent at 9,974.25 points

Paris - CAC 40: UP 0.1 percent at 8,155.49

Frankfurt - DAX: UP 0.1 percent at 24,503.05

Hong Kong - Hang Seng Index: UP 2.8 percent at 26,338.47 (close)

Shanghai - market closed for holiday

Tokyo - market closed for holiday

New York - Dow: DOWN 0.6 percent at 48,063.29 points (close)

Euro/dollar: DOWN at $1.1717 from $1.1750 on Wednesday

Pound/dollar: DOWN at $1.3447 from $1.3478

Dollar/yen: UP at 156.85 from 156.66 yen

Euro/pound: DOWN at 87.16 pence from 87.18 pence

Brent North Sea Crude: DOWN 0.2 percent at $60.76 per barrel

West Texas Intermediate: DOWN 0.2 percent at $57.31 per barrel

burs-bcp/rl

A.Kunz--VB