-

Trump launches 'Board of Peace' at Davos

Trump launches 'Board of Peace' at Davos

-

Stocks rally as Trump drops Greenland tariff threats

-

Mercedes unveil 2026 F1 car for new 2026 rules

Mercedes unveil 2026 F1 car for new 2026 rules

-

Djokovic, Sinner plough on in Melbourne, Wawrinka makes history

-

Kitzbuehel's Hahnenkamm, the terrifying Super Bowl of skiing

Kitzbuehel's Hahnenkamm, the terrifying Super Bowl of skiing

-

'Oasis of stability': Madrid becomes luxury housing haven

-

Swiatek says packed tennis season makes it 'impossible' to switch off

Swiatek says packed tennis season makes it 'impossible' to switch off

-

Sloppy Osaka grinds past 'mad' Cirstea to stay alive at Australian Open

-

Iran Guards chief says 'finger on trigger', warns US against 'miscalculations'

Iran Guards chief says 'finger on trigger', warns US against 'miscalculations'

-

Imperious Sinner barrels into Australian Open round three

-

Storms, heavy rain kill 9 children across Afghanistan

Storms, heavy rain kill 9 children across Afghanistan

-

Games giant Ubisoft suffers share price collapse

-

Exhausted Wawrinka battles on in Melbourne farewell after five-set epic

Exhausted Wawrinka battles on in Melbourne farewell after five-set epic

-

'Too dangerous to go to hospital': a glimpse into Iran's protest crackdown

-

Bruised European allies wary after Trump's Greenland climbdown

Bruised European allies wary after Trump's Greenland climbdown

-

Austrian ex-agent goes on trial in Russia spying case

-

Japan suspends restart of world's biggest nuclear plant

Japan suspends restart of world's biggest nuclear plant

-

Djokovic, Swiatek roll into Melbourne third round, Keys defence alive

-

New Zealand landslips kill at least two, others missing

New Zealand landslips kill at least two, others missing

-

Djokovic says heaving Australian Open crowds 'good problem'

-

Swiatek in cruise control to make Australian Open third round

Swiatek in cruise control to make Australian Open third round

-

Austrian ex-agent to go on trial in Russia spying case

-

Bangladesh launches campaigns for first post-Hasina elections

Bangladesh launches campaigns for first post-Hasina elections

-

Afghan resistance museum gets revamp under Taliban rule

-

Multiple people missing in New Zealand landslips

Multiple people missing in New Zealand landslips

-

Sundance Film Festival hits Utah, one last time

-

Philippines convicts journalist on terror charge called 'absurd'

Philippines convicts journalist on terror charge called 'absurd'

-

Anisimova grinds down Siniakova in 'crazy' Australian Open clash

-

Djokovic rolls into Melbourne third round, Keys defence alive

Djokovic rolls into Melbourne third round, Keys defence alive

-

Vine, Narvaez take control after dominant Tour Down Under stage win

-

Chile police arrest suspect over deadly wildfires

Chile police arrest suspect over deadly wildfires

-

Djokovic eases into Melbourne third round - with help from a tree

-

Keys draws on champion mindset to make Australian Open third round

Keys draws on champion mindset to make Australian Open third round

-

Knicks halt losing streak with record 120-66 thrashing of Nets

-

Philippine President Marcos hit with impeachment complaint

Philippine President Marcos hit with impeachment complaint

-

Trump to unveil 'Board of Peace' at Davos after Greenland backtrack

-

Bitter-sweet as Pegula crushes doubles partner at Australian Open

Bitter-sweet as Pegula crushes doubles partner at Australian Open

-

Hong Kong starts security trial of Tiananmen vigil organisers

-

Keys into Melbourne third round with Sinner, Djokovic primed

Keys into Melbourne third round with Sinner, Djokovic primed

-

Bangladesh launches campaigns for first post-Hasina polls

-

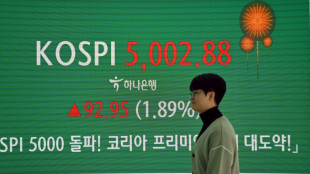

Stocks track Wall St rally as Trump cools tariff threats in Davos

Stocks track Wall St rally as Trump cools tariff threats in Davos

-

South Korea's economy grew just 1% in 2025, lowest in five years

-

Snowboard champ Hirano suffers fractures ahead of Olympics

Snowboard champ Hirano suffers fractures ahead of Olympics

-

'They poisoned us': grappling with deadly impact of nuclear testing

-

Keys blows hot and cold before making Australian Open third round

Keys blows hot and cold before making Australian Open third round

-

Philippine journalist found guilty of terror financing

-

Greenlanders doubtful over Trump resolution

Greenlanders doubtful over Trump resolution

-

Real Madrid top football rich list as Liverpool surge

-

'One Battle After Another,' 'Sinners' tipped to top Oscar noms

'One Battle After Another,' 'Sinners' tipped to top Oscar noms

-

Higher heating costs add to US affordability crunch

Stocks drop at end of record year for markets

Stock markets mostly fell Wednesday in thin trading, following a year of record gains for key assets as central banks cut interest rates and the tech sector boomed on growth of artificial intelligence.

London's benchmark FTSE 100 index edged down 0.1 percent in morning deals, having reached a record-high Tuesday close to 10,000 points.

That put it on course for an annual gain of more than 20 percent, thanks to interest-rate cuts from the Bank of England as well as US Federal Reserve.

Across the globe, stock markets have struck record highs and enjoyed double-digit gains in 2025.

"To push meaningfully higher in 2026, equities will need confirmation that the Fed can deliver at least the two rate cuts still priced by the market, with growth unimpeded," noted Stephen Innes of SPI Asset Management.

The Federal Reserve's monetary easing in the second half of this year has been a key driver of the global market improvements, compounding a surge in the tech sector on the back of the vast amounts of cash pumped into AI.

Minutes of the Fed's policy meeting in December, which were released on Tuesday, indicated that most of its officials see future rate cuts as appropriate, should inflation cool over time as expected.

At the same time, concerns that valuations of AI stocks are too high gnawed at investors late in 2025, and weighed on Wall Street on Tuesday.

AI chip juggernaut Nvidia became the world's first $5 trillion company at the end of October, while its current worth stands at around $4.5 trillion.

The price of gold, seen as a safe haven investment, scored multiple record highs this year.

The precious metal has benefitted from weakness to the dollar caused by the Fed's rate cuts and economic growth concerns triggered by President Donald Trump's war on tariffs.

Oil prices have retreated nearly 20 percent over the year, pressured by an oversupplied market.

Bitcoin, emphasising its volatile nature, soared to a record high above $126,000 in October before ending the year around $88,000.

In stocks trading Wednesday, the Paris market was down 0.6 percent after Hong Kong closed out the year down nearly one percent.

Over the year, Hong Kong's Hang Seng index won 28 percent. Tokyo trading had ended Tuesday, with the Nikkei 225 jumping more than 26 percent this year and Seoul rocketed 75 percent.

Frankfurt, which also ended its trading year Tuesday, rallied 23 percent in 2025, while Paris was up around 10 percent over the year.

On Wall Street, which holds a half day of trading on Wednesday, the main indices are set for double-digit annual gains with the tech-heavy Nasdaq Composite up over 21 percent for the year.

The MSCI All Country World Index, featuring a cross-section of major global companies, had an annual gain of around 21 percent.

On Wednesday, the price of silver slid further having struck record highs in December.

- Key figures at around 0945 GMT -

London - FTSE 100: DOWN 0.1 percent at 9,933.02 points

Paris - CAC 40: DOWN 0.6 percent at 8,123.03

Frankfurt - market closed for holiday

Hong Kong - Hang Seng Index: DOWN 0.9 percent at 25,630.54 (close)

Shanghai - Composite: UP 0.1 percent at 3,968.84 (close)

Tokyo - market closed for holiday

New York - Dow: DOWN 0.2 percent at 48,367.06 (close)

Euro/dollar: DOWN at $1.1727 from $1.1774 on Tuesday

Pound/dollar: DOWN at $1.3425 from $1.3503

Dollar/yen: UP at 156.60 yen from 156.00 yen

Euro/pound: UP at 87.34 pence from 87.15 pence

Brent North Sea Crude: DOWN 0.3 percent at $61.17 per barrel

West Texas Intermediate: DOWN 0.3 percent at $57.80 per barrel

burs-bcp/rl

T.Egger--VB