-

In Greenland, locals fed up with deals done over their heads

In Greenland, locals fed up with deals done over their heads

-

Ex-marathon record holder Kosgei trades Kenya for Turkey at Olympics

-

Ariana snubbed and Chalamet supreme? Five Oscars takeaways

Ariana snubbed and Chalamet supreme? Five Oscars takeaways

-

Germany summons Russian envoy, expels alleged spy handler

-

Iran warns 'finger on trigger' as Trump says it wants talks

Iran warns 'finger on trigger' as Trump says it wants talks

-

Real Madrid stadium owners to face trial over concert noise

-

'Sinners' breaks all-time Oscars record with 16 nominations

'Sinners' breaks all-time Oscars record with 16 nominations

-

South Africa's Kruger park suffers 'devastating' damage from floods

-

Molinari leads Dubai Desert Classic as McIlroy struggles

Molinari leads Dubai Desert Classic as McIlroy struggles

-

Ligue 1 leaders Lens still waiting for PSG title charge

-

US touts 'New Gaza' filled with luxury real estate

US touts 'New Gaza' filled with luxury real estate

-

Athens hit with several months of rain in one day: expert

-

Ubisoft shares plunge after big-bang restructuring announced

Ubisoft shares plunge after big-bang restructuring announced

-

Mendis' unbeaten 93 anchors Sri Lanka to 271-6 against England

-

Reeling Napoli face Juve after 'unacceptable' Champions League showing

Reeling Napoli face Juve after 'unacceptable' Champions League showing

-

Actor Liz Hurley in tears as accuses UK tabloid of 'monstrous' conduct

-

What we know about Trump's Greenland 'framework' deal

What we know about Trump's Greenland 'framework' deal

-

Osaka 'confused' as testy exchange sours Australian Open win

-

Trump launches 'Board of Peace' at Davos

Trump launches 'Board of Peace' at Davos

-

Stocks rally as Trump drops Greenland tariff threats

-

Mercedes unveil 2026 F1 car for new 2026 rules

Mercedes unveil 2026 F1 car for new 2026 rules

-

Djokovic, Sinner plough on in Melbourne, Wawrinka makes history

-

Kitzbuehel's Hahnenkamm, the terrifying Super Bowl of skiing

Kitzbuehel's Hahnenkamm, the terrifying Super Bowl of skiing

-

'Oasis of stability': Madrid becomes luxury housing haven

-

Swiatek says packed tennis season makes it 'impossible' to switch off

Swiatek says packed tennis season makes it 'impossible' to switch off

-

Sloppy Osaka grinds past 'mad' Cirstea to stay alive at Australian Open

-

Iran Guards chief says 'finger on trigger', warns US against 'miscalculations'

Iran Guards chief says 'finger on trigger', warns US against 'miscalculations'

-

Imperious Sinner barrels into Australian Open round three

-

Storms, heavy rain kill 9 children across Afghanistan

Storms, heavy rain kill 9 children across Afghanistan

-

Games giant Ubisoft suffers share price collapse

-

Exhausted Wawrinka battles on in Melbourne farewell after five-set epic

Exhausted Wawrinka battles on in Melbourne farewell after five-set epic

-

'Too dangerous to go to hospital': a glimpse into Iran's protest crackdown

-

Bruised European allies wary after Trump's Greenland climbdown

Bruised European allies wary after Trump's Greenland climbdown

-

Austrian ex-agent goes on trial in Russia spying case

-

Japan suspends restart of world's biggest nuclear plant

Japan suspends restart of world's biggest nuclear plant

-

Djokovic, Swiatek roll into Melbourne third round, Keys defence alive

-

New Zealand landslips kill at least two, others missing

New Zealand landslips kill at least two, others missing

-

Djokovic says heaving Australian Open crowds 'good problem'

-

Swiatek in cruise control to make Australian Open third round

Swiatek in cruise control to make Australian Open third round

-

Austrian ex-agent to go on trial in Russia spying case

-

Bangladesh launches campaigns for first post-Hasina elections

Bangladesh launches campaigns for first post-Hasina elections

-

Afghan resistance museum gets revamp under Taliban rule

-

Multiple people missing in New Zealand landslips

Multiple people missing in New Zealand landslips

-

Sundance Film Festival hits Utah, one last time

-

Philippines convicts journalist on terror charge called 'absurd'

Philippines convicts journalist on terror charge called 'absurd'

-

Anisimova grinds down Siniakova in 'crazy' Australian Open clash

-

Djokovic rolls into Melbourne third round, Keys defence alive

Djokovic rolls into Melbourne third round, Keys defence alive

-

Vine, Narvaez take control after dominant Tour Down Under stage win

-

Chile police arrest suspect over deadly wildfires

Chile police arrest suspect over deadly wildfires

-

Djokovic eases into Melbourne third round - with help from a tree

Precious metals fall again, stocks mixed as traders wind down

Precious metals extended losses Tuesday on profit-taking after hitting recent records, while equities fluctuated in quiet trade as investors wound down ahead of the New Year break.

Traders were taking it easy in the last few days of 2025 following a stellar 12 months that have seen tech firms push several stock markets to all-time highs, while bitcoin, gold and silver have also enjoyed multiple peaks.

Minutes from the Federal Reserve's most recent policy meeting -- at which it cut interest rates a third straight time -- are due to be released later in the day and will be scanned for an idea about whether a fourth can be expected in January.

The US central bank's monetary easing in the back end of this year has been a key driver of the markets' rally, compounding a surge in the tech sector on the back of the vast amounts of cash pumped into all things AI.

It has also helped offset recent worries about a possible tech bubble and warnings that traders might not see a return on their investments in artificial intelligence for some time.

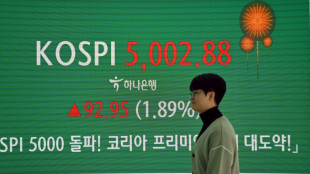

Still, Asian markets have enjoyed a healthy year, with Seoul's Kospi piling on more than 75 percent and Tokyo's Nikkei 225 more than 26 percent -- both having hit records earlier in the year.

But the two edged down Tuesday, with Sydney, Mumbai and Taipei also lower. Hong Kong, Singapore, Wellington, Bangkok and Jakarta rose. Shanghai was flat.

London rose at the open, Frankfurt was flat and Paris dipped.

The mixed performance followed losses for all three main indexes on Wall Street.

The big moves of late have been seen in precious metals, with gold hitting a record just shy of $4,550. Silver, meanwhile, topped out at $84 after soaring around 150 percent this year.

Investors have been piling into the commodities on bets for more US rate cuts, a weaker dollar and geopolitical tensions.

Silver has also been boosted by increased central bank purchases and supply concerns.

However, both metals have pulled back sharply this week on profit-taking, with gold now around $4,360 and silver at $74.50.

"Headlines screamed collapse, but zooming out, all that really happened was a reset to three- or four-day levels," wrote SPI Asset Management's Stephen Innes.

"The market ran hot, tripped over its own shoelaces, and landed back where it had been standing earlier in the week. One beneficial side effect is that silver flushed enough excess to no longer screen as overbought, which matters more than the move itself."

Oil dipped, having jumped more than two percent Monday when investors rowed back bets on peace talks to end Russia's war with Ukraine as a meeting between US President Donald Trump and Ukrainian counterpart Volodymyr Zelensky ended with little progress.

That surge followed Friday's similar-sized rally on optimism for a breakthrough to end the nearly four-year conflict.

An end to the war could see sanctions on Russian oil removed, which would see a huge fresh supply hit the market.

Bitcoin, which has tumbled since spiking above $126,000 in October, was stabilising just below $90,000 after a shaky end to the year.

- Key figures at around 0815 GMT -

Tokyo - Nikkei 225: DOWN 0.4 percent at 50,339.48 (close)

Hong Kong - Hang Seng Index: UP 0.9 percent at 25,854.60 (close)

Shanghai - Composite: FLAT at 3,965.12 (close)

London - FTSE 100: UP 0.1 percent at 9,878.94

Euro/dollar: UP at $1.1768 from $1.1766 on Monday

Pound/dollar: DOWN at $1.3503 from $1.3504

Dollar/yen: DOWN at 156.00 yen from 156.06 yen

Euro/pound: UP at 87.15 pence from 87.00 pence

West Texas Intermediate: FLAT at $58.07 per barrel

Brent North Sea Crude: FLAT at $61.92 per barrel

New York - Dow: DOWN 0.5 percent at 48,461.93 (close)

J.Sauter--VB