-

Patrick Reed: Bad press stings, but leave my kids out of it

Patrick Reed: Bad press stings, but leave my kids out of it

-

George Clooney explores passage of time in Netflix film 'Jay Kelly'

-

Young bodybuilders lift Japan's ailing care sector

Young bodybuilders lift Japan's ailing care sector

-

Stocks rally as traders cheer Trump-Xi meeting plan

-

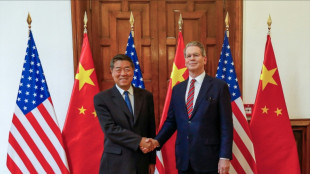

China, US 'can find ways to resolve concerns' as negotiators set to meet

China, US 'can find ways to resolve concerns' as negotiators set to meet

-

Trump says all Canada trade talks 'terminated'

-

New Japan PM vows to take US ties to 'new heights' with Trump

New Japan PM vows to take US ties to 'new heights' with Trump

-

Women sue over sexual abuse in Australian military

-

South Korea says 'considerable' chance Kim, Trump will meet next week

South Korea says 'considerable' chance Kim, Trump will meet next week

-

Brazil's Lula says would tell Trump tariffs were 'mistake'

-

Trump's Asia tour set to spotlight trade challenges

Trump's Asia tour set to spotlight trade challenges

-

Ivorian brothers dream of transforming cocoa industry

-

Over 1,000 enter Thailand from Myanmar after scam hub raid

Over 1,000 enter Thailand from Myanmar after scam hub raid

-

Top Nigerian environmentalist sees little coming out of COP30

-

Europe must nurse itself after US aid cuts: WHO director

Europe must nurse itself after US aid cuts: WHO director

-

Venezuela's Maduro to US: 'No crazy war, please!'

-

US, Japanese firms unwittingly hired North Korean animators: report

US, Japanese firms unwittingly hired North Korean animators: report

-

Precision timing for Britain's Big Ben as clocks go back

-

False claim spreads of Japan 'mass deportations' ministry

False claim spreads of Japan 'mass deportations' ministry

-

Alaska Airlines grounds entire fleet over IT outage

-

Ecuador's president says he was target of attempted poisoning

Ecuador's president says he was target of attempted poisoning

-

Rybakina seals WTA Finals spot in reaching Tokyo semis

-

Aldeguer fastest in rain-hit Malaysian MotoGP practice

Aldeguer fastest in rain-hit Malaysian MotoGP practice

-

Herbert's three TD passes lead Chargers NFL rout of Vikings

-

Gilgeous-Alexander hits career-high 55 in Thunder double overtime win

Gilgeous-Alexander hits career-high 55 in Thunder double overtime win

-

Rebuilding wrecked Syria vital for regional stability: UN

-

India trials Delhi cloud seeding to combat deadly smog

India trials Delhi cloud seeding to combat deadly smog

-

Top 14 offers France scrum-halves last audition as Dupont replacement

-

Mbappe's Real Madrid aiming to end Barca Clasico dominance

Mbappe's Real Madrid aiming to end Barca Clasico dominance

-

Ashes in from the wilderness as England take on Australia

-

High-flying Bayern pull away early in Bundesliga with Kane in complete control

High-flying Bayern pull away early in Bundesliga with Kane in complete control

-

Isak-less Liverpool look to hit stride, Man City 'back' to their best

-

Asian stocks rally as traders cheer Trump-Xi meeting plan

Asian stocks rally as traders cheer Trump-Xi meeting plan

-

Japan inflation rises as new PM eyes economic package

-

UK to press 'coalition of willing' for more long-range missiles for Ukraine

UK to press 'coalition of willing' for more long-range missiles for Ukraine

-

Surgeons remove up to 100 magnets from N. Zealand teen's gut

-

Guayaquil mayor blames Ecuador's president as drug violence spirals

Guayaquil mayor blames Ecuador's president as drug violence spirals

-

Autistic adults push back on 'fear-based' Trump rhetoric

-

New frontline in Canada-US tensions: the World Series

New frontline in Canada-US tensions: the World Series

-

Champion de Crespigny surprised to be named Wallabies skipper

-

Trump completes demolition of White House East Wing: satellite images

Trump completes demolition of White House East Wing: satellite images

-

Ohtani ready for 'big series' as Dodgers face Blue Jays

-

EU leaders lay out conditions for emissions target deal

EU leaders lay out conditions for emissions target deal

-

EU takes small step towards using Russian assets for Ukraine

-

White House's East Wing demolished for Trump ballroom: satellite images

White House's East Wing demolished for Trump ballroom: satellite images

-

Bajic stuns Palace in Conference League

-

Anthropic announces massive AI chip deal with Google

Anthropic announces massive AI chip deal with Google

-

Piastri confirms McLaren 'clean slate' after Texas tussle

-

Forest beat Porto on Dyche debut, Villa shocked by Go Ahead Eagles

Forest beat Porto on Dyche debut, Villa shocked by Go Ahead Eagles

-

Frenchman Hadjar coy on Red Bull switch

Stocks rally as traders cheer Trump-Xi meeting plan

Most stock markets rallied Friday after the White House confirmed President Donald Trump would meet China's Xi Jinping next week, stoking optimism for a cooling of trade tensions between the economic superpowers.

The gains came as the surge in oil prices sputtered, having seen huge rises over the previous two days on news that Washington had imposed sanctions on two Russian crude giants in a bid to bring an end to the Ukraine war.

Equities have endured a volatile period after the US president sparked fresh trade war fears two weeks ago by threatening to hit Beijing with 100 percent tariffs over its recent controls on rare-earth minerals, sparking tit-for-tat measures.

However, the row has calmed down since then, soothing nerves, and on Thursday White House Press Secretary Karoline Leavitt announced Trump would meet his Chinese counterpart on October 30, on the sidelines of the APEC summit in South Korea.

"I think we're going to come out very well and everyone's going to be very happy," Trump said later Thursday regarding his sit-down with Xi.

The face-to-face will be the first since Trump returned to power in January.

China's commerce minister Wang Wentao provided an extra sense of optimism Friday by telling reporters that the two sides "can find ways to resolve each other's concerns".

That came as a new round of trade talks between high-level officials from both countries got underway in Malaysia.

Equity traders gave big cheer to the news, with all three main indexes on Wall Street finishing well up and pushing back towards records.

And Asia was happy to pick up the baton.

Tokyo climbed more than one percent, while Hong Kong, Shanghai, Seoul, Singapore, Bangkok and Indonesia were also in positive territory, though Sydney, Manila and Mumbai fell.

London, Paris and Frankfurt opened with gains.

Tech firms were again among the best performers, helped by a strong revenue forecast from US giant Intel Corp.

Oil prices edged down slightly after soaring around eight percent this week following Trump's decision to hit Russia's two largest oil companies, Rosneft and Lukoil, saying his peace talks with President Vladimir Putin were not going "anywhere".

The move was joined by another round of measures by the European Union as leaders try to pressure Moscow to end its three-and-a-half-year invasion of Ukraine.

According to industry analysts, the two companies account for just over half of Russia's oil output, and both also produce natural gas.

While observers said the move could tip the crude market into a deficit next year, they warned the impact depended on the effectiveness of enforcement.

"Seeing is believing here," said National Australia Bank's Ray Attrill.

"While the news has seen Brent crude rise from $63 to $66 a barrel (and from $61 at the start of the week), the reality is likely to be that Russian oil will before too long continue to be exported in similar quantities as now, via ever-circuitous routes and elaborate disguises."

Investors are now keenly awaiting the release later in the day of US consumer price data, which has been delayed by the government shutdown in Washington.

But while the reading will be closely watched for its implications for Federal Reserve policy, markets widely expect the central bank to cut interest rates again when it meets next week.

- Key figures at around 0715 GMT -

Tokyo - Nikkei 225: UP 1.4 percent at 49,299.65 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 25,150.80

Shanghai - Composite: UP 0.7 percent at 3,950.31 (close)

London - FTSE 100: UP 0.1 percent at 9,590.25

West Texas Intermediate: DOWN 0.7 percent at $61.39 per barrel

Brent North Sea Crude: DOWN 0.7 percent at $65.54 per barrel

Euro/dollar: DOWN at $1.1612 from $1.1615 on Thursday

Pound/dollar: DOWN at $1.3329 from $1.3323

Dollar/yen: UP at 152.94 from 152.60 yen

Euro/pound: DOWN at 87.12 pence from 87.18 pence

New York - Dow: UP 0.3 percent at 46,734.61 (close)

T.Germann--VB