-

Lyles, Tebogo sail into world 200m final but Gout out

Lyles, Tebogo sail into world 200m final but Gout out

-

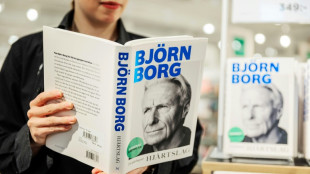

Tennis legend Bjorn Borg reveals cocaine use in memoir

-

Clashes, disruption in France on day of anti-Macron 'anger'

Clashes, disruption in France on day of anti-Macron 'anger'

-

Hodgkinson settles nerves in Tokyo after injury doubts

-

Coventry praises Milan-Cortina venue progress as IOC executives meet in Milan

Coventry praises Milan-Cortina venue progress as IOC executives meet in Milan

-

Jaden Smith at Louboutin stirs fresh 'nepo-baby' fashion debate

-

Bank of England holds rate as inflation stays high

Bank of England holds rate as inflation stays high

-

Tough topics top Trump-Starmer talks after regal welcome

-

Toulon's Jaminet eager to return for France after racist video

Toulon's Jaminet eager to return for France after racist video

-

Gold medallists Kipyegon, Chebet line up 5,000m clash for world double

-

London Fashion Week hopes to usher in new era with leadership change

London Fashion Week hopes to usher in new era with leadership change

-

Benfica negotiating with Mourinho to be new coach

-

Deliveroo CEO to step down following DoorDash takeover

Deliveroo CEO to step down following DoorDash takeover

-

Stock markets fluctuate after Fed rate cut

-

S. Korea prosecutors seek arrest of Unification Church leader

S. Korea prosecutors seek arrest of Unification Church leader

-

England star Kildunne fit for World Cup semi-final against France

-

Malnutrition causes unrecognised type of diabetes: experts

Malnutrition causes unrecognised type of diabetes: experts

-

China critic Takaichi joins party race, could become Japan's first woman leader

-

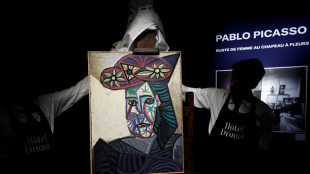

New Picasso portrait unveiled at Paris auction house

New Picasso portrait unveiled at Paris auction house

-

Israeli tanks, jets bombard Gaza City as Palestinians flee

-

Major disruption hits France on day of anti-Macron 'anger'

Major disruption hits France on day of anti-Macron 'anger'

-

Germany's Continental launches IPO of car parts unit

-

Messi, Inter Miami agree to extend contract beyond 2026: source

Messi, Inter Miami agree to extend contract beyond 2026: source

-

Cambodian PM accuses Thai forces of evicting civilians on border

-

Trump says designating Antifa 'a major terrorist organization'

Trump says designating Antifa 'a major terrorist organization'

-

Wallabies scrum-half Gordon back fit for Bledisloe Cup clashes

-

US vaccine panel to hold high-stakes policy meeting

US vaccine panel to hold high-stakes policy meeting

-

In Nigeria's nightclubs, the bathroom selfie is king - or, rather, queen

-

Glitter and Soviet nostalgia: Russia revives Eurovision rival contest

Glitter and Soviet nostalgia: Russia revives Eurovision rival contest

-

EU seeks 'face-saving' deal on UN climate target

-

Busan film competition showcases Asian cinema's 'strength'

Busan film competition showcases Asian cinema's 'strength'

-

Senational Son bags first MLS hat-trick as LAFC beat Real Salt Lake

-

Title rivals Piastri, Norris bid to secure teams' crown for McLaren

Title rivals Piastri, Norris bid to secure teams' crown for McLaren

-

Europe, Mediterranean coast saw record drought in August: AFP analysis of EU data

-

Australia unveils 'anti-climactic' new emissions cuts

Australia unveils 'anti-climactic' new emissions cuts

-

Warholm and Bol headline hurdling royalty on Day 7 of Tokyo worlds

-

'Raped, jailed, tortured, left to die': the hell of being gay in Turkmenistan

'Raped, jailed, tortured, left to die': the hell of being gay in Turkmenistan

-

Asian markets fluctuate after Fed cuts interest rates

-

Dodgers ponder using Ohtani as relief pitcher

Dodgers ponder using Ohtani as relief pitcher

-

US adversaries stoke Kirk conspiracy theories, researchers warn

-

Jimmy Kimmel show yanked after government pressure on Kirk comments

Jimmy Kimmel show yanked after government pressure on Kirk comments

-

Canada confident of dethroning New Zealand in Women's World Cup semis

-

Australia vows to cut emissions by 62 to 70% by 2035

Australia vows to cut emissions by 62 to 70% by 2035

-

Top UN Gaza investigator hopeful Israeli leaders will be prosecuted

-

Japan seeks to ramp up Asian Games buzz with year to go

Japan seeks to ramp up Asian Games buzz with year to go

-

Judge weighs court's powers in Trump climate case

-

Australian scientists grapple with 'despicable' butterfly heist

Australian scientists grapple with 'despicable' butterfly heist

-

US faces pressure in UN Security Council vote on Gaza

-

As media declines, gory Kirk video spreads on 'unrestrained' social sites

As media declines, gory Kirk video spreads on 'unrestrained' social sites

-

'I don't cry anymore': In US jail, Russian dissidents fear deportation

Stock markets fluctuate after Fed rate cut

European stock markets rose while Asia was mixed on Thursday after the US Federal Reserve lowered interest rates but left investors wondering how many more cuts were in the pipeline.

Paris and Frankfurt stocks rose more than one percent, while London also edged up nearing the half-way stage.

That followed gains in Tokyo, and losses in Hong Kong and Shanghai.

Investors awaited a Bank of England update on monetary policy Thursday, with the BoE widely expected to maintain its key interest rate at four percent with UK inflation stubbornly high.

"While the rate cut machine has whirred back into action for the US, it's expected to remain idle in the UK for a bit longer," said Russ Mould, investment director at AJ Bell.

The central banks of Norway and Canada both opted to cut interest rates this week.

On the heels of recent economic reports showing weaker US jobs growth, the Fed on Wednesday said it would lower borrowing costs by 25 basis points, its first reduction since December.

The decision to cut came even as US inflation runs well above policymakers' two-percent target, but analysts said the main focus was on the jobs market.

Fed policymakers are split between those who expect at least two interest rate cuts later this year and those who anticipate one or fewer.

Fed boss Jerome Powell remained cagey, telling reporters decision-makers were approaching it "meeting by meeting".

After Powell's comments, "markets were left feeling less confident on the extent of the likely easing cycle", said Jim Reid, managing director at Deutsche Bank.

US markets ended on a tepid note, with the Dow up but S&P 500 and Nasdaq down.

Asian investors were also cautious.

Tokyo closed in the green as the Fed decision boosted the dollar against the yen and other currencies, helping Japanese exporters.

Seoul closed at a record high, fuelled by a tech stock surge led by Samsung Electronics and chipmaker SK hynix, which soared nearly six percent, following reports that China banned its tech firms from purchasing Nvidia chips.

Gold prices held losses around $3,660 an ounce, having spiked on Wednesday at a record above $3,707.

In company news, Chinese chip firms surged after the Financial Times reported that China's internet regulator had instructed firms including Alibaba and ByteDance to terminate orders for Nvidia's RTX Pro 6000D chips.

The state-of-the-art processors are made especially for China.

- Key figures at around 1030 GMT -

London - FTSE 100: UP 0.2 percent at 9,226.68 points

Paris - CAC 40: UP 1.2 percent at 7,880.36

Frankfurt - DAX: UP 1.2 percent at 23,647.93

Tokyo - Nikkei 225: UP 1.2 percent at 45,303.43 (close)

Shanghai - Composite: DOWN 1.2 percent at 3,831.66 (close)

Hong Kong - Hang Seng Index: DOWN 1.4 percent at 26,544.85 (close)

New York - Dow: UP 0.6 percent at 46,018.32 (close)

Euro/dollar: UP at $1.1841 from $1.1811 on Wednesday

Pound/dollar: UP at $1.3650 from $1.3626

Dollar/yen: UP at 147.29 yen from 147.00 yen

Euro/pound: UP at 86.76 pence from 86.70 pence

West Texas Intermediate: DOWN 0.7 percent at $63.59 per barrel

Brent North Sea Crude: DOWN 0.6 percent at $67.51 per barrel

T.Germann--VB