-

'Anguish' as Cuba plunges into new electricity blackout

'Anguish' as Cuba plunges into new electricity blackout

-

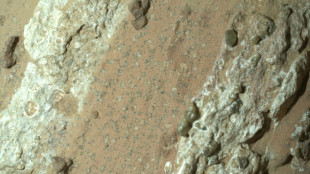

Martian rocks offer clues that might indicate ancient life

-

Musk's title of richest person challenged by Oracle's Ellison

Musk's title of richest person challenged by Oracle's Ellison

-

New French PM vows 'profound break' with past as protests flare

-

Kuldeep stars as India crush UAE in Asia Cup T20

Kuldeep stars as India crush UAE in Asia Cup T20

-

Bolsonaro judge criticizes trial, warns of 'political' verdict

-

Italy's Pellizzari scorches to Vuelta stage 17 honours

Italy's Pellizzari scorches to Vuelta stage 17 honours

-

Italy to remain top wine producer in world: 2025 estimates

-

400-year-old Rubens found in Paris mansion

400-year-old Rubens found in Paris mansion

-

Pellizzari takes Vuelta stage 17 honours

-

Deadly floods inundate Indonesia's Bali and Flores islands

Deadly floods inundate Indonesia's Bali and Flores islands

-

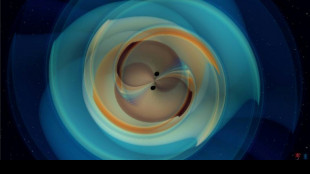

Gravitational waves from black hole smash confirm Hawking theory

-

Israel launches deadly strike on Yemen rebel media arm

Israel launches deadly strike on Yemen rebel media arm

-

Fossil energy 'significant' driver of climate-fuelled heatwaves: study

-

Oldest known lizard ancestor discovered in England

Oldest known lizard ancestor discovered in England

-

Smoke from 2023 Canada fires linked to thousands of deaths: study

-

Software company Oracle shares surge more than 35% on huge AI deals

Software company Oracle shares surge more than 35% on huge AI deals

-

UK aims to transform Alzheimer's diagnosis with blood test trial

-

US Senate panel advances nomination of Trump's Fed governor pick

US Senate panel advances nomination of Trump's Fed governor pick

-

Israeli strikes shake quiet Qatar, strain US ties

-

Russian drones in Poland put NATO to the test

Russian drones in Poland put NATO to the test

-

Emotional Axelsen well beaten on return from six months out

-

US producer inflation unexpectedly falls in first drop since April

US producer inflation unexpectedly falls in first drop since April

-

Viking ships make final high-risk voyage to new Oslo home

-

UK PM expresses 'confidence' in ambassador to US after Epstein letter

UK PM expresses 'confidence' in ambassador to US after Epstein letter

-

Belgium seeks US help in drug trafficking fight

-

Spain PM's wife denies embezzlement in fresh court hearing

Spain PM's wife denies embezzlement in fresh court hearing

-

Stock markets strike records despite geopolitical unrest

-

Spain to deploy 'extraordinary' security for Vuelta finale

Spain to deploy 'extraordinary' security for Vuelta finale

-

Ex-Premier League referee Coote charged with making indecent child image

-

Ryder Cup pairings not 'set in stone', says Europe captain Donald

Ryder Cup pairings not 'set in stone', says Europe captain Donald

-

What we know about Israel's attack on Hamas in Qatar

-

Australia Davis Cup captain Hewitt handed ban for pushing anti-doping official

Australia Davis Cup captain Hewitt handed ban for pushing anti-doping official

-

New French PM vows 'profound break' with past to exit crisis

-

Israel vows to strike foes anywhere after Qatar attack

Israel vows to strike foes anywhere after Qatar attack

-

Kony defence urges ICC judges to halt case

-

British horse racing strikes over proposed tax rise on betting

British horse racing strikes over proposed tax rise on betting

-

Zara owner Inditex shares soar as sales growth revives

-

Poland calls urgent NATO talks after Russian drone incursion

Poland calls urgent NATO talks after Russian drone incursion

-

Three dead, three missing in attempts to cross Channel

-

Hong Kong legislature rejects same-sex partnerships bill

Hong Kong legislature rejects same-sex partnerships bill

-

Von der Leyen urges EU to fight for place in 'hostile' world

-

Kidnapped Israeli-Russian academic Tsurkov released in Iraq

Kidnapped Israeli-Russian academic Tsurkov released in Iraq

-

Syrian jailed for life over deadly knife attack at German festival

-

Top EU court upholds nuclear green label

Top EU court upholds nuclear green label

-

Pacific Island leaders back 'ocean of peace' at fraught summit

-

Israel defends Qatar strikes after rebuke from Trump

Israel defends Qatar strikes after rebuke from Trump

-

'Block everything': France faces disruption as new PM starts job

-

Ozempic maker Novo Nordisk to cut 9,000 global jobs

Ozempic maker Novo Nordisk to cut 9,000 global jobs

-

Five athletes who could sparkle at world championships

| RYCEF | 1.48% | 14.87 | $ | |

| AZN | -0.67% | 80.68 | $ | |

| CMSC | 0.54% | 24.27 | $ | |

| GSK | -0.78% | 40.465 | $ | |

| RELX | -4.56% | 45.13 | $ | |

| BTI | -0.17% | 56.165 | $ | |

| NGG | 0.07% | 70.41 | $ | |

| VOD | -1.28% | 11.71 | $ | |

| RIO | 0.49% | 62.175 | $ | |

| BCC | 0.46% | 85.68 | $ | |

| CMSD | 0.16% | 24.409 | $ | |

| BCE | -0.37% | 24.11 | $ | |

| JRI | 1.27% | 13.957 | $ | |

| SCS | -0.78% | 16.75 | $ | |

| BP | 1.53% | 34.62 | $ | |

| RBGPF | 0% | 77.27 | $ |

Pacific Avenue Capital Partners Advances European Strategy with Team Expansion and Dedicated Sidecar Vehicle

PARIS, FR / ACCESS Newswire / September 10, 2025 / Pacific Avenue Capital Partners ("Pacific Avenue"), a global private equity firm specializing in corporate carve-outs and complex transactions, today announced key milestones in its European expansion. Less than a year after opening its Paris office and appointing Xavier Lambert as Head of Europe, the firm has built a high-caliber team with full execution capabilities. It has also expanded its presence across the region and raised a dedicated sidecar vehicle to support investments in new platforms throughout Europe.

Since Mr. Lambert's arrival in late 2024, Pacific Avenue has added seven professionals in Europe across M&A, business development, operations, and administration. In addition to its Paris office, the firm now has team members in London and Zurich, enhancing its ability to source and support transactions across the continent. The team's diverse experience positions the firm to navigate complexity and drive value across a broad range of European opportunities.

Among the recent additions are three professionals who bring deep functional expertise and strengthen Pacific Avenue's capabilities in key European markets.

Damien Faujour joins Pacific Avenue as a Vice President based in Paris, where he focuses on deal sourcing, execution, and portfolio operations. He was previously a Vice President at OpenGate Capital and began his career in restructuring and leveraged finance at Houlihan Lokey.

Sebastian Reinecke joins Pacific Avenue as a Vice President of Operations based in Zurich. He was previously an Associate Director of Corporate Development, M&A, Strategy & Transformation at Solenis.

Pierre Chapuis joins Pacific Avenue as a Vice President of Business Development based in London, where he is focused on origination efforts across Europe. He was previously a Vice President at Mimir Invest, where he worked on sourcing complex investment opportunities, with an emphasis on corporate carve-outs.

Additionally, the team is supported by an Associate, Nicola del Dot, and Analyst, Patrick Clair, focused on M&A, as well as an office manager, Stephanie Cayla. The European team brings a strong set of sourcing, execution, and operational capabilities to Pacific Avenue's growing European platform.

"I am proud of the exceptional team we have built in Europe in such a short period of time. With the collective expertise across Europe and North America, alongside the dedicated capital to deploy in Europe, our focus is on being the preferred solution for corporate sellers and management teams across the region, unlocking value, and driving sustainable growth."

- Xavier Lambert, Head of Europe, Pacific Avenue Capital Partners

The firm's growth in Europe is further underscored by the successful raise of a European sidecar vehicle alongside its recently closed second institutional fund. On August 12, 2025, Pacific Avenue announced the closing of over $1.65 billion in committed capital across Fund II and a European sidecar dedicated to pursuing new platform investment opportunities across the continent.

"Our expansion in Europe marks a pivotal step in our evolution as a global leader in complex transactions and corporate carve-outs. In under a year, we have built a highly experienced team and laid the groundwork to build a successful franchise in Europe. The strength and depth of our European platform enables us to execute with speed and certainty, reinforcing our position as the go-to partner for corporate carve-outs worldwide."

- Chris Sznewajs, Founder and Managing Partner, Pacific Avenue Capital Partners

With a fully staffed team, growing market presence, and dedicated capital, Pacific Avenue is now firmly positioned to continue to build on its momentum as it executes its strategy of transforming businesses and being a solution provider to sellers globally.

About Pacific Avenue Capital Partners

Pacific Avenue Capital Partners is a global private equity firm, headquartered in Los Angeles with an office in Paris, France. The Firm is focused on corporate divestitures and other complex situations in the middle market. Pacific Avenue has extensive M&A and operations experience, allowing the Firm to navigate complex transactions and unlock value through operational improvement, capital investment, and accelerated growth. Pacific Avenue takes a collaborative approach in partnering with strong management teams to drive lasting and strategic change while assisting businesses in reaching their full potential. Pacific Avenue has approximately $3.8 billion of Assets Under Management (AUM) as of August 31, 2025 (based on Q2 2025 valuations presented pro forma for the Fund II and sidecar closings). The members of the Pacific Avenue team have closed over 120 transactions, including over 50 corporate divestitures, across a multitude of industries throughout their combined careers. For more information, please visit www.pacificavenuecapital.com.

CONTACT:

Chris Baddon

Principal

[email protected]

SOURCE: Pacific Avenue Capital Partners

View the original press release on ACCESS Newswire

A.Ammann--VB