-

Asian stocks swing as traders bide time ahead of US rate decision

Asian stocks swing as traders bide time ahead of US rate decision

-

Australia, Papua New Guinea delay mutual defence treaty

-

PGA's 2026 opener will not be played at drought-hit Kapalua

PGA's 2026 opener will not be played at drought-hit Kapalua

-

Toucans, tortoises saved in major Brazil trafficking bust

-

Britain rolls out royal red carpet for Trump's state visit

Britain rolls out royal red carpet for Trump's state visit

-

US Fed set for first rate cut of 2025 as Trump pressure looms

-

Broadway jeering Caesars Times Square casino bet

Broadway jeering Caesars Times Square casino bet

-

Rojas, McLaughlin-Levrone go for gold at world champs

-

Colombian FARC leaders ordered to make reparations for over 21,000 kidnappings

Colombian FARC leaders ordered to make reparations for over 21,000 kidnappings

-

Peru evacuates 1,400 tourists from Machu Picchu amid protest

-

Trump arrives in UK for historic second state visit

Trump arrives in UK for historic second state visit

-

Arsenal, Real Madrid win Champions League openers, Juve snatch dramatic draw

-

Friends like these: NY to get 'Central Perk' cafe from beloved sitcom

Friends like these: NY to get 'Central Perk' cafe from beloved sitcom

-

Mbappe penalty double gives Real Madrid opening win over Marseille

-

Juve salvage point against Dortmund with stunning late comeback

Juve salvage point against Dortmund with stunning late comeback

-

Redford's Sundance legacy hailed by filmmakers

-

Spurs accept Villarreal gift to make winning start in Champions League

Spurs accept Villarreal gift to make winning start in Champions League

-

Trump arrives in Britain for unprecedented second state visit

-

'A better future is possible': Youths sue Trump over climate change

'A better future is possible': Youths sue Trump over climate change

-

Redford's Sundance legacy 'beyond comprehension' for US filmmakers

-

Vuelta protests 'a completely new phenomenon', says Tour de France director

Vuelta protests 'a completely new phenomenon', says Tour de France director

-

Bangladesh beat Afghanistan to stay alive in Asia Cup

-

Trump extends delay on US TikTok ban until mid-December

Trump extends delay on US TikTok ban until mid-December

-

YouTube ramps up AI tools for video makers

-

Arsenal subs snatch win in Bilbao Champions League opener

Arsenal subs snatch win in Bilbao Champions League opener

-

Downton Abbey auction of props and costumes smashes estimates

-

Windsor prepares for global spotlight with Trump state visit

Windsor prepares for global spotlight with Trump state visit

-

Suspect in Charlie Kirk killing charged with murder

-

France duo out of Women's Rugby World Cup semi-final as bans upheld

France duo out of Women's Rugby World Cup semi-final as bans upheld

-

Simeone backs Atletico to hurt 'extraordinary' Liverpool

-

IEA says more oil and gas investment may be needed

IEA says more oil and gas investment may be needed

-

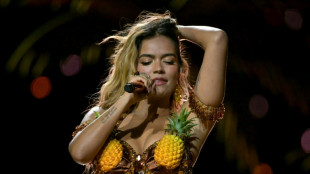

Sabrina Carpenter, Justin Bieber, Karol G to headline Coachella

-

Colombia halts US arms purchases in row over drug fight delisting

Colombia halts US arms purchases in row over drug fight delisting

-

Nestle says chairman Paul Bulcke to step down

-

Isak set for Liverpool debut in Atletico Madrid Champions League clash

Isak set for Liverpool debut in Atletico Madrid Champions League clash

-

Malawi votes in economic gloom as two presidents battle for power

-

No info in files that Epstein trafficked women to others: FBI chief

No info in files that Epstein trafficked women to others: FBI chief

-

Stocks slip, dollar down as Fed meets on rates

-

Faith Kipyegon: Supreme Kenyan champion and role model for mothers

Faith Kipyegon: Supreme Kenyan champion and role model for mothers

-

Hollywood giants sue Chinese AI firm over copyright infringement

-

Bayern's Kane keen to rekindle London rivalry against Chelsea

Bayern's Kane keen to rekindle London rivalry against Chelsea

-

Trump sues NYT for $15 bn in latest attack on media

-

IndyCar reveals 17-race 2026 season with March opening

IndyCar reveals 17-race 2026 season with March opening

-

Trump heads for landmark state visit with 'friend' King Charles

-

Kipyegon sparkles, Tinch's time away pays off with world gold

Kipyegon sparkles, Tinch's time away pays off with world gold

-

Kerr completes Kiwi world double after Beamish tonic

-

US Fed opens key meeting after Trump aide sworn in as governor

US Fed opens key meeting after Trump aide sworn in as governor

-

Tinch crowns atypical path to top with world hurdles gold

-

Masters deal with Amazon Prime boosts US TV coverage hours

Masters deal with Amazon Prime boosts US TV coverage hours

-

Thyssenkrupp says India's Jindal Steel makes bid for steel business

| RBGPF | 0% | 77.27 | $ | |

| CMSC | 0.29% | 24.39 | $ | |

| RYCEF | -0.06% | 15.64 | $ | |

| BCC | -3.31% | 82.39 | $ | |

| NGG | -1.04% | 70.88 | $ | |

| VOD | -0.34% | 11.77 | $ | |

| GSK | -0.62% | 40.05 | $ | |

| SCS | 0.06% | 16.88 | $ | |

| RIO | -0.44% | 63.44 | $ | |

| BCE | -1.11% | 23.43 | $ | |

| CMSD | 0.04% | 24.46 | $ | |

| RELX | -0.36% | 46.69 | $ | |

| JRI | -1.01% | 13.92 | $ | |

| AZN | -0.63% | 77.56 | $ | |

| BTI | -0.43% | 55.79 | $ | |

| BP | 0.64% | 34.43 | $ |

US stocks end at fresh records as markets shrug off tariff worries

A jump in US retail sales boosted world markets Thursday even as investors mulled the US rates outlook, US President Donald Trump's tariffs and the future of Federal Reserve boss Jerome Powell.

Both the S&P 500 and Nasdaq finished at fresh records as investors focused on solid US economic data and earnings and shrugged off lingering worries about tariffs and Powell.

"Right now, as long as the markets don't have a reason to sell off, they're going to go up," said Steve Sosnick of Interactive Brokers. "The news on the economy this week has been good enough."

Investors were wary heading into second-quarter earnings season, but "the data so far and the earnings are coming in better than expected," said Jack Ablin of Cresset Capital Management.

Earlier, European markets also finished strongly in the green.

Frankfurt and Paris closed almost 1.5 percent ahead although London could only manage a 0.5 percent rise amid a higher official UK jobless count and slowing wages growth.

Overall, US retail sales were up 0.6 percent in June to $720.1 billion, reversing a May 0.9 percent decline. The figures topped analyst expectations.

Besides retail sales, another week of modest weekly US jobless claims provided reassurance on the economy, said Art Hogan of B. Riley Wealth Management.

"We've been worried about earnings and trade wars, but the economic data (...) remains resilient," Hogan said.

Thursday's strong session on Wall Street followed a volatile round the day before. Stocks had briefly nose-dived on Wednesday following reports that Trump was planning to fire Powell, lambasting him for not cutting interest rates.

But the US president swiftly denied the story, sending markets higher again.

Powell's apparent security in the role also helped lift the dollar again Thursday, its latest rise in July after an historic retreat in the first six months of 2025.

Trump's unrelenting criticism of Powell has prompted foreign exchange traders to anticipate that "we are moving to a world where the US wants to have a more accommodative monetary policy," said Kit Juckes, chief FX strategist at Societe Generale.

But the dollar's resilience in the wake of the latest Powell-Trump dustup suggests markets still believe "monetary policy in the US is still credible," Juckes said.

Among individual companies, United Airlines climbed 3.1 percent as it offered an upbeat outlook on travel demand in the second half of 2025 despite reporting a drop in second-quarter profits.

Tokyo-listed shares in the Japanese owner of convenience store giant 7-Eleven plunged after a Canadian rival, Alimentation Couche-Tard, pulled out of a $47 billion takeover bid.

- Key figures at around 2050 GMT -

New York - Dow: UP 0.5 percent at 44,484.49 (close)

New York - S&P 500: UP 0.5 percent at 6,297.36 (close)

New York - Nasdaq Composite: UP 0.7 percent at 20,885.65 (close)

London - FTSE 100: UP 0.5 percent at 8,972.64 points (close)

Paris - CAC 40: UP 1.3 percent at 7,822.00 (close)

Frankfurt - DAX: UP 1.5 percent at 24,370.93 (close)

Tokyo - Nikkei 225: UP 0.6 percent at 39,901.19 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 24,498.95 (close)

Shanghai - Composite: UP 0.4 percent at 3,516.83 (close)

Euro/dollar: DOWN at $1.1600 from $1.1641 on Wednesday

Pound/dollar: DOWN at $1.3415 from $1.3422

Dollar/yen: UP at 148.60 yen from 147.88 yen

Euro/pound: DOWN at 86.43 pence from 86.71 pence

Brent North Sea Crude: UP 1.5 percent at $69.52 per barrel

West Texas Intermediate: UP 1.8 percent at $67.54 per barrel

P.Staeheli--VB