-

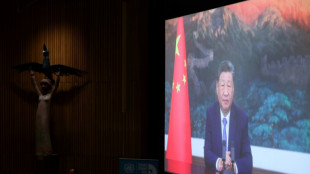

In first, China unveils specific emissions targets

In first, China unveils specific emissions targets

-

Alvarez hat-trick helps Atletico edge Rayo thriller

-

Con job? Climate change is my job, says island nation leader

Con job? Climate change is my job, says island nation leader

-

US stocks fall again while Alibaba gains on big AI push

-

Forest denied winning European return by Antony, Roma down Nice

Forest denied winning European return by Antony, Roma down Nice

-

Postecoglou's Forest held by Antony's Betis on European return

-

Eze nets first goal as Arsenal join Man City in League Cup last 16

Eze nets first goal as Arsenal join Man City in League Cup last 16

-

Guardians' Fry has facial fractures after taking fastball to face

-

Giants to go with rookie QB Dart, bench NFL veteran Wilson

Giants to go with rookie QB Dart, bench NFL veteran Wilson

-

Police clashes mar rally for Uganda opposition leader Bobi Wine

-

China unveils steady but restrained climate goals

China unveils steady but restrained climate goals

-

Trump 'incredibly impatient' with Russia on Ukraine, VP Vance says

-

France, US tell Iran still chance to avoid nuclear sanctions

France, US tell Iran still chance to avoid nuclear sanctions

-

Big news: Annual eating contest roars to life in Fat Bear Week

-

In UN debut, new Syria leader warns on Israel but backs dialogue

In UN debut, new Syria leader warns on Israel but backs dialogue

-

Malawi's ex-president Mutharika returns to power in crushing vote win

-

Under-fire Brazil senators scrap immunity bid

Under-fire Brazil senators scrap immunity bid

-

Morikawa calls on US Ryder Cup fans 'to go crazy'

-

India see off Bangladesh to book Asia Cup final spot

India see off Bangladesh to book Asia Cup final spot

-

Rubio calls for Russia to stop the 'killing' in Ukraine

-

Macron tells Iran president only hours remain to avert nuclear sanctions

Macron tells Iran president only hours remain to avert nuclear sanctions

-

UN humanitarian chief slams impunity in face of Gaza 'horror'

-

Danish PM apologises to victims of Greenland forced contraception

Danish PM apologises to victims of Greenland forced contraception

-

Planetary health check warns risk of 'destabilising' Earth systems

-

Typhoon Ragasa slams into south China after killing 14 in Taiwan

Typhoon Ragasa slams into south China after killing 14 in Taiwan

-

Monchi exit 'changes nothing' for Emery at Aston Villa

-

Taiwan lake flood victims spend second night in shelters

Taiwan lake flood victims spend second night in shelters

-

Europe ready for McIlroy taunts from rowdy US Ryder Cup fans

-

US comedian Kimmel calls Trump threats 'anti-American'

US comedian Kimmel calls Trump threats 'anti-American'

-

Australia win tense cycling mixed relay world title

-

Stokes will be battle-ready for Ashes, says England chief

Stokes will be battle-ready for Ashes, says England chief

-

Iran will never seek nuclear weapons, president tells UN

-

Zelensky says NATO membership not automatic protection, praises Trump after shift

Zelensky says NATO membership not automatic protection, praises Trump after shift

-

Becker regrets winning Wimbledon as a teenager

-

'Mind-readers' Canada use headphones in Women's Rugby World Cup final prep

'Mind-readers' Canada use headphones in Women's Rugby World Cup final prep

-

Rose would welcome Trump on stage if Europe keeps Ryder Cup

-

AI optimism cheers up markets following Fed rate warning

AI optimism cheers up markets following Fed rate warning

-

France doubles down on threat to build future fighter jet alone

-

Delay warning issued to fans ahead of Trump's Ryder Cup visit

Delay warning issued to fans ahead of Trump's Ryder Cup visit

-

EU chief backs calls to keep children off social media

-

US Treasury says in talks to support Argentina's central bank

US Treasury says in talks to support Argentina's central bank

-

'Everything broken': Chinese residents in typhoon path assess damage

-

Inside Barcelona's Camp Nou chaos: What is happening and why?

Inside Barcelona's Camp Nou chaos: What is happening and why?

-

UK police arrest man after European airports cyberattack

-

Ballon d'Or disappointment will inspire Yamal: Barca coach Flick

Ballon d'Or disappointment will inspire Yamal: Barca coach Flick

-

French-German duo wins mega offshore wind energy project

-

Italy deploys frigate after drone 'attack' on Gaza aid flotilla

Italy deploys frigate after drone 'attack' on Gaza aid flotilla

-

Typhoon Ragasa slams into south China after killing 17 in Taiwan

-

NASA launches mission to study space weather

NASA launches mission to study space weather

-

Stocks torn between Fed rate warning, AI optimism

Oil prices seesaw as investors await Iran response to US strikes

Oil prices wobbled and stock markets wavered Monday as traders awaited Tehran's response to US strikes on Iranian nuclear facilities over the weekend.

European stocks mostly retreated while Asian equities were mixed, with markets keeping a close eye on whether Iran will block the crucial Strait of Hormuz, which carries one-fifth of global oil output.

When trading opened on Monday, international benchmark crude contract Brent and US equivalent WTI both jumped more than four percent to hit their highest price since January.

They later dipped briefly into the red before recovering to trade slightly higher in midday trading.

"Will Iran choose to choke off the Strait of Hormuz or not? That is the big question," said Bjarne Schieldrop, chief commodities analyst at SEB bank.

But, "looking at the oil price this morning it is clear that the oil market doesn't assign a very high probability of it happening," he added.

Iran is the world's ninth-biggest oil-producing country, exporting just under half of the 3.3 million barrels it produces per day.

Tensions remained elevated as Iran and Israel intensified attacks on each other on the war's 11th day.

"The markets are not yet reacting with any degree of panic to the US airstrike on Iran's nuclear facilities as they await to see how Tehran responds," said AJ Bell investment director Russ Mould.

In Europe, Paris and Frankfurt stock markets both fell.

A closely watched survey showed Monday that eurozone business activity was almost stagnant again in June.

London's stock exchange was flat, with the rise in crude prices boosting shares in British energy majors BP and Shell.

But airlines, including EasyJet and British Airways-owner IAG, suffered losses on fears of rising energy costs and disruptions in travel to the Middle East.

In Asia, Tokyo was lower while Hong Kong and Shanghai gained.

"So far, satellite images reportedly suggest that oil continues to flow through the Strait, which may explain the muted market reaction to the news," said Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

She added that there is optimism that Iran will avoid full-blown retaliation "to prevent its own oil facilities from becoming targets and to avoid a widening conflict that could hurt China -- its biggest oil customer."

But "if things get uglier" the price of US crude could even spike beyond $100 per barrel, she said. Brent was trading at almost $78 per barrel on Monday while WTI was close to $75.

The dollar rose against other currencies but analysts questioned to what extent this would hold out.

- Key figures at around 1045 GMT -

Brent North Sea Crude: UP 0.9 percent at $77.73 per barrel

West Texas Intermediate: UP 0.9 percent at $74.52 per barrel

London - FTSE 100: FLAT at 8,772.82 points

Paris - CAC 40: DOWN 0.4 percent at 7,556.36

Frankfurt - DAX: DOWN 0.3 percent at 23,278.65

Tokyo - Nikkei 225: DOWN 0.1 percent at 38,354.09 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 23,689.13 (close)

Shanghai - Composite: UP 0.7 percent at 3,381.58 (close)

New York - Dow: UP 0.1 percent at 42,206.82 (close)

Euro/dollar: DOWN at $1.1468 from $1.1516 on Friday

Pound/dollar: DOWN at $1.3381 from $1.3444

Dollar/yen: UP at 147.97 yen from 146.13 yen

Euro/pound: UP at 85.71 pence from 85.66 pence

burs-ajb/

A.Kunz--VB