-

Israeli warships intercept Gaza aid flotilla with Greta onboard

Israeli warships intercept Gaza aid flotilla with Greta onboard

-

Air traffic controllers warn of US shutdown strain

-

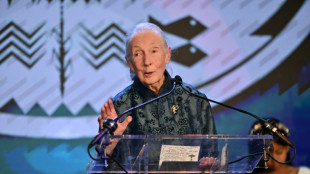

'Conservation giant': World reacts to Jane Goodall's death

'Conservation giant': World reacts to Jane Goodall's death

-

Haaland scores twice but Man City denied by Monaco in Champions League

-

Guirassy helps Dortmund sink Bilbao in Champions League

Guirassy helps Dortmund sink Bilbao in Champions League

-

Trump offers security guarantees to Qatar after Israel strikes

-

Ramos snatches Champions League holders PSG late win at Barca

Ramos snatches Champions League holders PSG late win at Barca

-

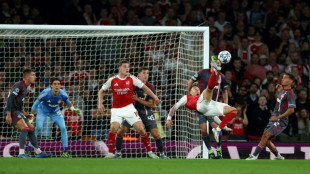

Martinelli extends Arsenal's perfect start in Champions League

-

Hojlund and De Bruyne combine to push Napoli past Sporting

Hojlund and De Bruyne combine to push Napoli past Sporting

-

Russia cut power to defunct Chernobyl nuclear plant, Ukraine says

-

First woman coach breaks barriers in Brazil basketball

First woman coach breaks barriers in Brazil basketball

-

Gaza aid flotilla says Israeli warships 'intercepted' boats

-

Vinicius, Rodrygo back in Ancelotti's Brazil squad

Vinicius, Rodrygo back in Ancelotti's Brazil squad

-

Emery relishes Villa's 'special' Rotterdam visit

-

Colombia gives chunk of druglord Escobar's ranch to conflict victims

Colombia gives chunk of druglord Escobar's ranch to conflict victims

-

Gaza aid flotilla says Israeli warships intercepting boats

-

Trump says to push China's Xi on soybeans as US farmers struggle

Trump says to push China's Xi on soybeans as US farmers struggle

-

French navy boards Russia 'shadow fleet' ship, arrests two

-

New probe opens into Hunter S. Thompson's 2005 death

New probe opens into Hunter S. Thompson's 2005 death

-

Renowned British chimpanzee expert Jane Goodall dies at 91

-

Gordon penalties lead Newcastle to big win over Union SG

Gordon penalties lead Newcastle to big win over Union SG

-

Jane Goodall: crusader for chimpanzees and the planet

-

Thuram set to miss France's World Cup qualifiers with hamstring knock

Thuram set to miss France's World Cup qualifiers with hamstring knock

-

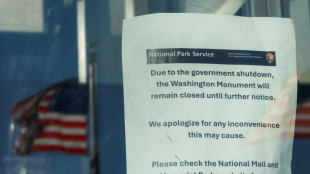

W.House says firings 'imminent' as plan to reopen govt collapses

-

Jane Fonda relaunches Cold War-era Hollywood free speech movement

Jane Fonda relaunches Cold War-era Hollywood free speech movement

-

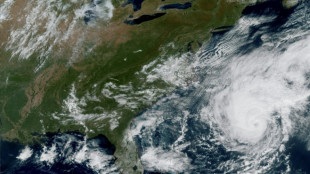

Hurricane Imelda bound for Bermuda as a Cat 2 storm

-

French navy boards Russia 'shadow fleet' ship: AFP

French navy boards Russia 'shadow fleet' ship: AFP

-

Canada blocks theme park from sending whales to China

-

Deadly family drama shuts Oktoberfest for a day

Deadly family drama shuts Oktoberfest for a day

-

Senate rejects plan to end US government shutdown

-

Troll-in-chief Trump mocks Democrats over shutdown

Troll-in-chief Trump mocks Democrats over shutdown

-

Supreme Court blocks Trump from immediately firing Fed Gov. Cook

-

Israel issues 'last' warning for Gazans to flee main city

Israel issues 'last' warning for Gazans to flee main city

-

Jonathan Anderson brings new twist to Dior women with Paris debut

-

India 'welcome' to collect trophy from me, says Asian cricket boss

India 'welcome' to collect trophy from me, says Asian cricket boss

-

Schwarzenegger's 'action hero' pope says don't give up on climate change

-

'I'm breathing again': Afghans relieved after internet restored

'I'm breathing again': Afghans relieved after internet restored

-

Shein picks France for its first permanent stores

-

Deadly family drama in Munich briefly shuts Oktoberfest

Deadly family drama in Munich briefly shuts Oktoberfest

-

Japanese trainer Saito hopes for better Arc experience second time round

-

'Normal' Sinner romps to 21st title but Swiatek stunned in Beijing

'Normal' Sinner romps to 21st title but Swiatek stunned in Beijing

-

Stella McCartney takes on 'barbaric' feather industry

-

Mobile and internet restored across Afghanistan: AFP journalists

Mobile and internet restored across Afghanistan: AFP journalists

-

Wall Street stocks slide as US shutdown begins

-

US senators struggle for off-ramp as shutdown kicks in

US senators struggle for off-ramp as shutdown kicks in

-

Oktoberfest briefly closed by bomb threat, deadly family drama

-

Swiatek out with a whimper as Navarro stuns top seed in Beijing

Swiatek out with a whimper as Navarro stuns top seed in Beijing

-

Gaza aid flotilla defies Israeli 'intimidation tactics'

-

Meta defends ads model in 550-mn-euro data protection trial

Meta defends ads model in 550-mn-euro data protection trial

-

Two pulled from Indonesia school collapse as rescuers race against time

Stocks waver as Trump raises trade risk with China

Stocks wavered on Friday, but the dollar mostly gained, after President Donald Trump put US-China trade tensions back on the boil by claiming Beijing "has totally violated" an agreement with Washington.

His social media post came hours after US Treasury Secretary Scott Bessent said trade talks with China aimed at putting to bed sky-high mutual tariffs -- currently suspended -- were "a bit stalled".

The development risks renewed trade pugilism between the world's two biggest economies.

"If President Trump does slap tariffs back on Chinese imports to the US... we may see demand for US assets, and the dollar, severely impaired by a chaotic and undiplomatic approach to trade policy," said Kathleen Brooks, research director at XTB.

Investors, though, appeared largely inured to Trump's now-familiar cycle of making dramatic trade threats then retreating, with many more focused on economic data.

New York indices slid at the start of trading, but London and Frankfurt were up, while Paris dipped. Asian share markets had already closed down, before Trump's latest broadside against Beijing was published.

A key US inflation indicator released Friday showed April core price rises had slowed to 2.1 percent, milder than expected.

That could support arguments for the Federal Reserve to cut US rates -- though analysts warned that the inflationary effects of Trump's tariffs were yet to come and could cause the Fed to maintain its watch-and-wait stance.

"The true weight of these policies is likely to emerge more fully in the months ahead," cautioned FOREX.com market analyst Fawad Razaqzada.

Markets were also assessing the impact of a US court ruling that invalidated most of Trump's sweeping tariffs -- though an appeals court suspended that order and the White House said the tariffs goal would be pursued one way or another.

"The ruling didn't mean that all tariffs were off the table, it could affect trade negotiations going forward," noted David Morrison, senior market analyst at Trade Nation, adding it only injected "ongoing uncertainty surrounding trade policy".

Stephen Innes, of SPI Asset Management, said the result was "a legal limbo... the kind that keeps traders awake at night".

The dollar gained against the euro and most other major currencies -- except for the yen, which strengthened after Tokyo inflation data came in above forecasts, fuelling expectations that Japan could raise interest rates in July.

Interest rates were also in focus in the eurozone, after official data showed inflation there hovering around the European Central Bank's two-percent target.

Consumer prices in top EU economy Germany showed a 2.1 percent rise in May -- the same as the previous month -- while they fell in Spain, to 1.9 percent, and in Italy, to 1.7 percent.

The ECB looks set to lower interest rates again on Thursday.

Oil prices were down on Friday, ahead of a Saturday meeting of eight key OPEC+ members to decide production quotas for July, with some analysts saying the cartel could make a larger-than-expected supply hike.

- Key figures at around 1335 GMT -

New York - Dow: DOWN 0.3 percent at 42,092.07 points

New York - S&P 500: DOWN 0.4 percent at 5,886.39

New York - Nasdaq Composite: DOWN 0.6 percent at 19,061.46

London - FTSE 100: UP 0.6 percent at 8,764.23

Paris - CAC 40: DOWN 0.1 percent at 7,771.10

Frankfurt - DAX: UP 0.6 percent at 24,076.87

Tokyo - Nikkei 225: DOWN 1.2 percent at 37,965.10 (close)

Hong Kong - Hang Seng Index: DOWN 1.2 percent at 23,289.77 (close)

Shanghai - Composite: DOWN 0.5 percent at 3,347.49 (close)

Euro/dollar: DOWN at $1.1316 from $1.1368 on Thursday

Pound/dollar: DOWN at $1.3458 from $1.3494

Dollar/yen: DOWN at 144.06 yen from 144.19 yen

Euro/pound: DOWN at 84.07 pence from 84.22 pence

Brent North Sea Crude: DOWN 0.8 percent at $62.60 per barrel

West Texas Intermediate: UP 0.9 percent at $60.36 per barrel

B.Wyler--VB