-

YouTube to reinstate creators banned over misinformation

YouTube to reinstate creators banned over misinformation

-

Kane 'welcome' to make Spurs return: Frank

-

Trump says Ukraine can win back all territory, in sudden shift

Trump says Ukraine can win back all territory, in sudden shift

-

Real Madrid thrash Levante as Mbappe hits brace

-

Isak scores first Liverpool goal in League Cup win, Chelsea survive scare

Isak scores first Liverpool goal in League Cup win, Chelsea survive scare

-

US stocks retreat from records as tech giants fall

-

Escalatorgate: White House urges probe into Trump UN malfunctions

Escalatorgate: White House urges probe into Trump UN malfunctions

-

Zelensky says China could force Russia to stop Ukraine war

-

Claudia Cardinale: single mother who survived rape to be a screen queen

Claudia Cardinale: single mother who survived rape to be a screen queen

-

With smiles and daggers at UN, Lula and Trump agree to meet

-

Iran meets Europeans but no breakthrough as Tehran pushes back

Iran meets Europeans but no breakthrough as Tehran pushes back

-

US veterans confident in four Ryder Cup rookies

-

Ecuador's president claims narco gang behind fuel price protests

Ecuador's president claims narco gang behind fuel price protests

-

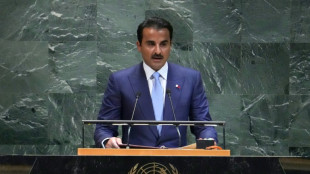

Qatar's ruler says to keep efforts to broker Gaza truce despite strike

-

Pakistan stay alive in Asia Cup with win over Sri Lanka

Pakistan stay alive in Asia Cup with win over Sri Lanka

-

S.Korea leader at UN vows to end 'vicious cycle' with North

-

Four years in prison for woman who plotted to sell Elvis's Graceland

Four years in prison for woman who plotted to sell Elvis's Graceland

-

'Greatest con job ever': Trump trashes climate science at UN

-

Schools shut, flights axed as Typhoon Ragasa nears Hong Kong, south China

Schools shut, flights axed as Typhoon Ragasa nears Hong Kong, south China

-

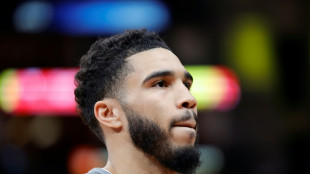

Celtics star Tatum doesn't rule out playing this NBA season

-

Trump says NATO nations should shoot down Russian jets breaching airspace

Trump says NATO nations should shoot down Russian jets breaching airspace

-

Trump says at Milei talks that Argentina does not 'need' bailout

-

Iran meets Europeans but no sign of sanctions breakthrough

Iran meets Europeans but no sign of sanctions breakthrough

-

NBA icon Jordan's insights help Europe's Donald at Ryder Cup

-

Powell warns of inflation risks if US Fed cuts rates 'too aggressively'

Powell warns of inflation risks if US Fed cuts rates 'too aggressively'

-

Arteta slams 'handbrake' criticism as Arsenal boss defends tactics

-

Jimmy Kimmel back on the air, but faces partial boycott

Jimmy Kimmel back on the air, but faces partial boycott

-

Triumphant Kenyan athletes receive raucous welcome home from Tokyo worlds

-

NASA says on track to send astronauts around the Moon in 2026

NASA says on track to send astronauts around the Moon in 2026

-

Djokovic to play Shanghai Masters in October

-

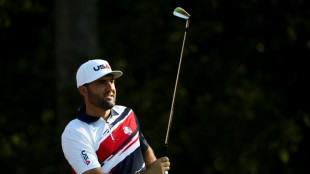

In US Ryder Cup pay spat, Schauffele and Cantlay giving all to charity

In US Ryder Cup pay spat, Schauffele and Cantlay giving all to charity

-

Congo's Nobel winner Mukwege pins hopes on new film

-

Scheffler expects Trump visit to boost USA at Ryder Cup

Scheffler expects Trump visit to boost USA at Ryder Cup

-

Top Madrid museum opens Gaza photo exhibition

-

Frank unfazed by trophy expectations at Spurs

Frank unfazed by trophy expectations at Spurs

-

US says dismantled telecoms shutdown threat during UN summit

-

Turkey facing worst drought in over 50 years

Turkey facing worst drought in over 50 years

-

Cities face risk of water shortages in coming decades: study

-

Trump mocks UN on peace and migration in blistering return

Trump mocks UN on peace and migration in blistering return

-

Stokes named as England captain for Ashes tour

-

Does taking paracetamol while pregnant cause autism? No, experts say

Does taking paracetamol while pregnant cause autism? No, experts say

-

We can build fighter jet without Germany: France's Dassault

-

Atletico owners negotiating with US firm Apollo over majority stake sale - reports

Atletico owners negotiating with US firm Apollo over majority stake sale - reports

-

Tabilo stuns Musetti for Chengdu title, Bublik wins in Hangzhou

-

Trump returns to UN to attack 'globalist' agenda

Trump returns to UN to attack 'globalist' agenda

-

No.1 Scheffler plays down great expectations at Ryder Cup

-

WHO sees no autism links to Tylenol, vaccines

WHO sees no autism links to Tylenol, vaccines

-

US Fed official urges proactive approach on rates to boost jobs market

-

Nearly 100 buffaloes die in Namibia stampede

Nearly 100 buffaloes die in Namibia stampede

-

UN chief warns 'aid cuts are wreaking havoc' amid slashed budgets

European stocks rise tracking big corporate news, China growth

European stock markets climbed on Monday as China's unexpectedly muted growth slowdown and optimism over the impact of the Omicron coronavirus variant boosted investor confidence.

Oil rose modestly on limited supply concerns, while the dollar was up against major rivals as Wall Street was closed for a US public holiday.

The fast-spreading Omicron strain had initially sparked fears for the global economic recovery, but studies indicating that it causes milder illness and government booster vaccine programmes have calmed traders' nerves.

London, Paris and Frankfurt all ended the day higher.

"The relatively lower mortality rates, coupled with ongoing vaccinations efforts, has raised hopes we will transition to endemic and that the economy will recover strongly," said market analyst Fawad Razaqzada of ThinkMarkets.

Britain's benchmark FTSE 100 index climbed to new highs in 2022 after pharma giant GlaxoSmithKline rejected a bid worth £50 billion ($68 billion, 60 billion euros) from Pfizer for a consumer healthcare unit.

GlaxoSmithKline shares rose to the top of the index, while Pfizer's sank to the bottom as the US pharma behemoth said it would press on with a bid for GSK Consumer healthcare.

Concerns over soaring inflation and the US Federal Reserve's stance on hiking interest rates to counter it did not temper investor confidence in European stocks.

The trend was "due to a relatively more dovish central bank and the potential for a strong rebound in economic growth as nations ease travel restrictions amid ongoing booster vaccination efforts", said Razaqzada.

"As we head into 2022, we believe that the post-pandemic bull market remains broadly intact," added Bank of Singapore analyst Eli Lee.

"Historically, bull markets do not end at the beginning of rate hike cycles, and positive trends in global economic growth and earnings continue to be positive fundamental drivers for the market."

China on Monday defied expectations and posted growth figures of 8.1 percent in 2021, although this slowed in the final months amid fresh coronavirus outbreaks, disruptive regulatory crackdowns and property market crises.

Covid infections in the world's second-largest economy climbed to their highest level since March 2020 as Beijing pursues its zero-Covid policy ahead of the Winter Olympics.

But mainland China shares were supported by news that the country's central bank had cut interest rates for the first time since the height of the pandemic last year as officials look to kickstart stuttering growth.

"Rising infections in China just three weeks before the Winter Olympics could lead to widespread economic uncertainty, particularly if the situation is not handled effectively in the short term," said XTB market analyst Walid Koudmani.

Benchmark oil contract Brent North Sea briefly reached the highest level for more than three years at $86.71 per barrel, adding to strong inflation concerns.

"Markets remain focused on the delicate balance between supply and demand which has appeared to impact price fluctuations quite significantly throughout most of the post pandemic economic recovery," said Koudmani.

Credit Suisse fell almost 1.8 percent after the Swiss bank's chairman resigned less than a year after taking the reins following reports he had broken Covid quarantine rules.

Antonio Horta-Osorio's immediate departure adds to the bank's troubles after it was last year rocked by links to the multi-billion-dollar meltdowns at financial firms Greensill and Archegos.

- Key figures around 1630 GMT -

London - FTSE 100: UP 0.9 percent at 7,611.23 points (close)

Frankfurt - DAX: UP 0.3 percent at 15,934.62 (close)

Paris - CAC 40: UP 0.8 percent at 7,201.64 (close)

EURO STOXX 50: UP 0.7 percent at 4,302.11

Tokyo - Nikkei 225: UP 0.7 percent at 28,333.52 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 24,218.03 (close)

Shanghai - Composite: UP 0.6 percent at 3,541.67 (close)

New York - DOW: Closed for a holiday

Euro/dollar: DOWN at $1.1407 from $1.1418 late on Friday

Pound/dollar: DOWN at $1.3652 from $1.3680

Euro/pound: UP at 83.55 pence from 83.43 pence

Dollar/yen: UP at 114.58 yen from 114.25 yen

Brent North Sea crude: UP 0.3 percent at $86.38 per barrel

West Texas Intermediate: UP 0.3 percent at $84.16 per barrel

K.Thomson--BTB