-

Guirassy extends streak as Dortmund cruise past 10-man Heidenheim

Guirassy extends streak as Dortmund cruise past 10-man Heidenheim

-

Vingegaard touching Vuelta glory with stage 20 triumph as protests continue

-

'World's fastest anime fan' Lyles in element at Tokyo worlds

'World's fastest anime fan' Lyles in element at Tokyo worlds

-

De Minaur's Australia trail as Germany, Argentina into Davis Cup finals

-

Airstrikes, drones, tariffs: being US friend not what it used to be

Airstrikes, drones, tariffs: being US friend not what it used to be

-

Cyclists swerve protest group in road during Vuelta stage 20

-

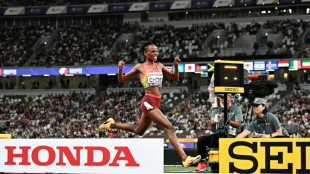

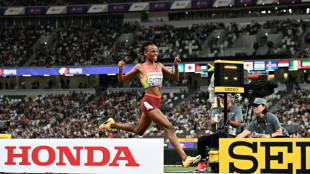

A Tokyo full house revels in Chebet and sprinters at world athletics champs

A Tokyo full house revels in Chebet and sprinters at world athletics champs

-

Holders New Zealand fight past South Africa into Women's Rugby World Cup semis

-

Ex-Olympic champion Rissveds overcomes depression to win world mountain bike gold

Ex-Olympic champion Rissveds overcomes depression to win world mountain bike gold

-

Kenya's Chebet wins 10,000m gold, suggests no tilt at world double

-

Arsenal ruin Postecoglou's Forest debut as Zubimendi bags brace

Arsenal ruin Postecoglou's Forest debut as Zubimendi bags brace

-

Shot put legend Crouser wins third successive world title

-

Bezzecchi wins San Marino MotoGP sprint as Marc Marquez crashes out

Bezzecchi wins San Marino MotoGP sprint as Marc Marquez crashes out

-

Kenya's Chebet wins 10,000m gold to set up tilt at world double

-

Lyles, Thompson and Tebogo cruise through world 100m heats

Lyles, Thompson and Tebogo cruise through world 100m heats

-

Vuelta final stage shortened amid protest fears

-

Collignon stuns De Minaur as Belgium take Davis Cup lead over Australia

Collignon stuns De Minaur as Belgium take Davis Cup lead over Australia

-

Nepal returns to calm as first woman PM takes charge, visits wounded

-

Olympic champion Alfred eases through 100m heats at Tokyo worlds

Olympic champion Alfred eases through 100m heats at Tokyo worlds

-

Winning coach Erasmus 'emotional' at death of former Springboks

-

Barca's Flick blasts Spain over Yamal injury issue

Barca's Flick blasts Spain over Yamal injury issue

-

Rampant Springboks inflict record 43-10 defeat to humble All Blacks

-

Italy's Bezzecchi claims San Marino MotoGP pole as Marquez brothers denied

Italy's Bezzecchi claims San Marino MotoGP pole as Marquez brothers denied

-

Rampant South Africa inflict record 43-10 defeat on All Blacks

-

Collignon stuns De Minaur as Belgium take 2-0 Davis Cup lead over Australia

Collignon stuns De Minaur as Belgium take 2-0 Davis Cup lead over Australia

-

Mourning Nepalis hope protest deaths will bring change

-

Carreras boots Argentina to nervy 28-26 win over Australia

Carreras boots Argentina to nervy 28-26 win over Australia

-

Nepal returns to calm as first woman PM takes charge

-

How mowing less lets flowers bloom along Austria's 'Green Belt'

How mowing less lets flowers bloom along Austria's 'Green Belt'

-

Too hot to study, say Italian teachers as school (finally) resumes

-

Alvarez, Crawford both scale 167.5 pounds for blockbuster bout

Alvarez, Crawford both scale 167.5 pounds for blockbuster bout

-

Tokyo fans savour athletics worlds four years after Olympic lockout

-

Akram tells Pakistan, India to forget noise and 'enjoy' Asia Cup clash

Akram tells Pakistan, India to forget noise and 'enjoy' Asia Cup clash

-

Kicillof, the Argentine governor on a mission to stop Milei

-

Something to get your teeth into: 'Jaws' exhibit marks 50 years

Something to get your teeth into: 'Jaws' exhibit marks 50 years

-

Germany, France, Argentina, Austria on brink of Davis Cup finals

-

War with Russia weighs heavily on Ukrainian medal hope Doroshchuk

War with Russia weighs heavily on Ukrainian medal hope Doroshchuk

-

Suspect in Charlie Kirk killing caught, widow vows to carry on fight

-

Dunfee and Perez claim opening world golds in Tokyo

Dunfee and Perez claim opening world golds in Tokyo

-

Ben Griffin leads PGA Procore Championship in Ryder Cup tune-up

-

'We're more than our pain': Miss Palestine to compete on global stage

'We're more than our pain': Miss Palestine to compete on global stage

-

Ingebrigtsen seeks elusive 1500m world gold after injury-plagued season

-

Thailand's Chanettee leads by two at LPGA Queen City event

Thailand's Chanettee leads by two at LPGA Queen City event

-

Dolphins' Hill says focus is on football amid domestic violence allegations

-

Nigerian chef aims for rice hotpot record

Nigerian chef aims for rice hotpot record

-

What next for Brazil after Bolsonaro's conviction?

-

Fitch downgrades France's credit rating in new debt battle blow

Fitch downgrades France's credit rating in new debt battle blow

-

Fifty reported dead in Gaza as Israel steps up attacks on main city

-

Greenwood among scorers as Marseille cruise to four-goal victory

Greenwood among scorers as Marseille cruise to four-goal victory

-

Rodgers calls out 'cowardly' leak amid Celtic civil war

Fed sharpens inflation-fighting tools as rate hikes near

The Federal Reserve has its inflation-fighting weapons ready to fire, and when the US central bank's policy committee convenes this coming week, the focus will not be on whether they will pull the trigger but rather how many times.

With the Omicron variant of Covid-19 adding to economic uncertainty and fueling a spike in consumer prices rose not seen for decades, the Fed's decision Wednesday will be closely scrutinized for signs policymakers will take more aggressive steps to contain inflation.

The policy-setting Federal Open Market Committee (FOMC), which opens its two-day meeting on Tuesday, is widely expected to begin hiking interest rates in March, though a few economists note the possibility of early action.

"I think it's kind of a holding operation rather than a blockbuster meeting, but the March one will be more fun," Ian Shepherdson, chief economist at Pantheon Macroeconomics, told AFP.

Only months ago, Fed Chair Jerome Powell and other top officials were arguing that the sharp rise in inflation would be "transitory," but that stance grew increasingly shaky with each new data report showing prices rising and spreading to many goods, beyond cars and energy.

By the end of 2021, policymakers conceded they had miscalculated and pivoted, announcing they were ready to attack inflation head on.

They started by tapering the bond buying program implemented to stimulate the economy, and accelerated the pace of the wind down at their last meeting in December.

- Hawkish or dovish? -

In recent weeks, Fed officials have given strong signals that once the tapering concludes in March, they will hike the benchmark lending rate for the first time since they slashed it to zero in March 2020 at the start of the Covid-19 pandemic.

"The move towards a March rate increase is pretty clear -- and I expect Powell in his press conference (Wednesday) to reinforce that perception," said David Wessel, a senior fellow in economic studies at the Brookings Institution.

Hiking could help contain consumer prices that spiked seven percent in 2021, with costs for gasoline, food, housing and used cars shooting up.

But the question remains as to how many times the Fed will increase rates.

The causes of the inflation are myriad, from global issues such as the semiconductor shortage to more domestic concerns like a scarcity of workers and the massive government outlays during the pandemic that have fattened Americans' wallets and boosted demand.

"If there's any mention of the persistence of inflation, that would also be an indication that the Fed is not just ready for lift off but that they want to fly high," Beth Ann Bovino, US chief economist at S&P Global Ratings, said in an interview.

FOMC members released forecasts at the December meeting indicating most expect three rate hikes this year, though many private economists now expect four.

Another sign would be if central bankers say the labor market has returned "maximum employment" after the mass layoffs that struck as the pandemic began, Bovino said.

- Omicron uncertainty -

Some traders are speculating the Fed could announce an early end to the tapering process and a surprise rate hike at next week's meeting, or opt to hike twice as much as they typically do at the March meeting.

But with complications from Omicron already evident, including a slump in retail sales during the December holiday season and an uptick in new unemployment benefit applications last week, Shepherdson doubts Powell would want to change tack.

"Why would he do that? It would be really perverse given the uncertainty," he said.

C.Meier--BTB