-

Guirassy extends streak as Dortmund cruise past 10-man Heidenheim

Guirassy extends streak as Dortmund cruise past 10-man Heidenheim

-

Vingegaard touching Vuelta glory with stage 20 triumph as protests continue

-

'World's fastest anime fan' Lyles in element at Tokyo worlds

'World's fastest anime fan' Lyles in element at Tokyo worlds

-

De Minaur's Australia trail as Germany, Argentina into Davis Cup finals

-

Airstrikes, drones, tariffs: being US friend not what it used to be

Airstrikes, drones, tariffs: being US friend not what it used to be

-

Cyclists swerve protest group in road during Vuelta stage 20

-

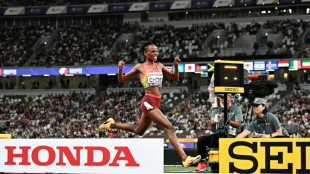

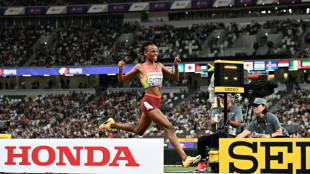

A Tokyo full house revels in Chebet and sprinters at world athletics champs

A Tokyo full house revels in Chebet and sprinters at world athletics champs

-

Holders New Zealand fight past South Africa into Women's Rugby World Cup semis

-

Ex-Olympic champion Rissveds overcomes depression to win world mountain bike gold

Ex-Olympic champion Rissveds overcomes depression to win world mountain bike gold

-

Kenya's Chebet wins 10,000m gold, suggests no tilt at world double

-

Arsenal ruin Postecoglou's Forest debut as Zubimendi bags brace

Arsenal ruin Postecoglou's Forest debut as Zubimendi bags brace

-

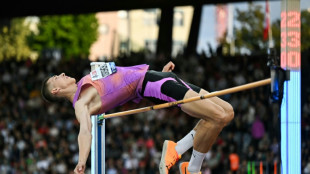

Shot put legend Crouser wins third successive world title

-

Bezzecchi wins San Marino MotoGP sprint as Marc Marquez crashes out

Bezzecchi wins San Marino MotoGP sprint as Marc Marquez crashes out

-

Kenya's Chebet wins 10,000m gold to set up tilt at world double

-

Lyles, Thompson and Tebogo cruise through world 100m heats

Lyles, Thompson and Tebogo cruise through world 100m heats

-

Vuelta final stage shortened amid protest fears

-

Collignon stuns De Minaur as Belgium take Davis Cup lead over Australia

Collignon stuns De Minaur as Belgium take Davis Cup lead over Australia

-

Nepal returns to calm as first woman PM takes charge, visits wounded

-

Olympic champion Alfred eases through 100m heats at Tokyo worlds

Olympic champion Alfred eases through 100m heats at Tokyo worlds

-

Winning coach Erasmus 'emotional' at death of former Springboks

-

Barca's Flick blasts Spain over Yamal injury issue

Barca's Flick blasts Spain over Yamal injury issue

-

Rampant Springboks inflict record 43-10 defeat to humble All Blacks

-

Italy's Bezzecchi claims San Marino MotoGP pole as Marquez brothers denied

Italy's Bezzecchi claims San Marino MotoGP pole as Marquez brothers denied

-

Rampant South Africa inflict record 43-10 defeat on All Blacks

-

Collignon stuns De Minaur as Belgium take 2-0 Davis Cup lead over Australia

Collignon stuns De Minaur as Belgium take 2-0 Davis Cup lead over Australia

-

Mourning Nepalis hope protest deaths will bring change

-

Carreras boots Argentina to nervy 28-26 win over Australia

Carreras boots Argentina to nervy 28-26 win over Australia

-

Nepal returns to calm as first woman PM takes charge

-

How mowing less lets flowers bloom along Austria's 'Green Belt'

How mowing less lets flowers bloom along Austria's 'Green Belt'

-

Too hot to study, say Italian teachers as school (finally) resumes

-

Alvarez, Crawford both scale 167.5 pounds for blockbuster bout

Alvarez, Crawford both scale 167.5 pounds for blockbuster bout

-

Tokyo fans savour athletics worlds four years after Olympic lockout

-

Akram tells Pakistan, India to forget noise and 'enjoy' Asia Cup clash

Akram tells Pakistan, India to forget noise and 'enjoy' Asia Cup clash

-

Kicillof, the Argentine governor on a mission to stop Milei

-

Something to get your teeth into: 'Jaws' exhibit marks 50 years

Something to get your teeth into: 'Jaws' exhibit marks 50 years

-

Germany, France, Argentina, Austria on brink of Davis Cup finals

-

War with Russia weighs heavily on Ukrainian medal hope Doroshchuk

War with Russia weighs heavily on Ukrainian medal hope Doroshchuk

-

Suspect in Charlie Kirk killing caught, widow vows to carry on fight

-

Dunfee and Perez claim opening world golds in Tokyo

Dunfee and Perez claim opening world golds in Tokyo

-

Ben Griffin leads PGA Procore Championship in Ryder Cup tune-up

-

'We're more than our pain': Miss Palestine to compete on global stage

'We're more than our pain': Miss Palestine to compete on global stage

-

Ingebrigtsen seeks elusive 1500m world gold after injury-plagued season

-

Thailand's Chanettee leads by two at LPGA Queen City event

Thailand's Chanettee leads by two at LPGA Queen City event

-

Dolphins' Hill says focus is on football amid domestic violence allegations

-

Nigerian chef aims for rice hotpot record

Nigerian chef aims for rice hotpot record

-

What next for Brazil after Bolsonaro's conviction?

-

Fitch downgrades France's credit rating in new debt battle blow

Fitch downgrades France's credit rating in new debt battle blow

-

Fifty reported dead in Gaza as Israel steps up attacks on main city

-

Greenwood among scorers as Marseille cruise to four-goal victory

Greenwood among scorers as Marseille cruise to four-goal victory

-

Rodgers calls out 'cowardly' leak amid Celtic civil war

Netflix sinks as Wall Street flees 'stay-at-home' stocks

One day after shares of at-home fitness company Peloton tumbled, Netflix found itself in Wall Street's hot seat Friday as markets reassess the diminishing growth prospects of so-called "pandemic stocks."

The streaming video service lost some $40 billion in market capitalization after releasing results Thursday night that projected growth of just 2.5 million subscribers in the first quarter, its slowest expansion since 2010 and a big downshift from the 55 million subscribers over the last two years as Covid-19 transformed daily life.

Netflix shares finished 21.8 percent lower, a similar level to that experienced Thursday by Peloton, which recovered some of its losses on Friday.

Such sell-offs are a particularly brutal manifestation of a market dynamic that's been going on for months in stay-at-home equities, whose investment thesis has worsened with the lessening risk of pandemic-caused lockdowns.

Gregori Volokhine, president of Meeschaert Financial Services, notes that Netflix, Amazon, PayPal, eBay and Etsy have all fallen between 20 and 50 percent from their peaks.

"More people are going out and leaving their homes," Volokhine said. "This trend has been going on for months."

Many of these companies attained valuations built on the idea that the fast growth seen during the pandemic would continue.

"Theoretically... these are growth stocks in that you were supposed to grow into your valuation with higher earnings," said Kim Forrest, chief investment officer at Bokeh Capital Partners, adding that the calculus changes "if you aren't growing."

The company most identified with the at-home pandemic bet may be Peloton, which saw trading suspended four times on Thursday following a report by CNBC which cited internal documents and said Peloton would pause the making of its Bike product for two months.

In a memo to staff late Thursday, Peloton Chief Executive John Foley said, "rumors that we are halting all production of bikes and treads are false."

But Foley said the company was "resetting our production levels for sustainable growth." He also opened the door to staff layoffs, saying "we now need to evaluate our organization structure and size of our team."

After losing 23.9 percent on Thursday, Peloton shares jumped 11.7 percent by the close Friday.

- Staying power? -

Market watchers warn against treating all companies uniformly.

Jeffrey Wlodarczak, an analyst at Pivotal Research, still broadly believes in Netflix's prospects, but expects moderating growth.

"It is just operating at a slower pace given the massive pull forward of demand enabled by pandemic shutdowns," he said. "Over time, we expect normalization in subscriber results and for the stock to work."

Volokhine, while bearish on Peloton and skeptical of the staying power of the at-home fitness trend, pointed to Zoom, the video conferencing software that boomed during the pandemic. While it may survive, he predicts it won't grow as quickly as in the past.

"People are using Zoom more and more, but they already have subscriptions," he said. "In a way, the market can only go down."

Another challenge for these stocks comes from the headwinds facing the broader equity market as the Federal Reserve pivots away from easy-money policies and begins to eye interest rate hikes.

"Liquidity is going to be in a tighter place this year than it had been in the last 18 or so months," said Zachary Hill, a strategist at Horizon Investments.

Hill thinks the shakeout in monetary policy will be particularly difficult for "very speculative, long-growth" companies rather than tech giants like Apple, Amazon and Microsoft that are "some of the biggest cash flow generating machines in the entire world."

B.Shevchenko--BTB