-

Minneapolis activists track Trump's immigration enforcers

Minneapolis activists track Trump's immigration enforcers

-

Court orders Dutch to protect Caribbean island from climate change

-

Sterling agrees Chelsea exit after troubled spell

Sterling agrees Chelsea exit after troubled spell

-

Rules-based trade with US is 'over': Canada central bank head

-

Lucas Paqueta signs for Flamengo in record South American deal

Lucas Paqueta signs for Flamengo in record South American deal

-

Holocaust survivor urges German MPs to tackle resurgent antisemitism

-

'Extraordinary' trove of ancient species found in China quarry

'Extraordinary' trove of ancient species found in China quarry

-

Villa's Tielemans ruled out for up to 10 weeks

-

Google unveils AI tool probing mysteries of human genome

Google unveils AI tool probing mysteries of human genome

-

UK proposes to let websites refuse Google AI search

-

'I wanted to die': survivors recount Mozambique flood terror

'I wanted to die': survivors recount Mozambique flood terror

-

Trump issues fierce warning to Minneapolis mayor over immigration

-

Anglican church's first female leader confirmed at London service

Anglican church's first female leader confirmed at London service

-

Germany cuts growth forecast as recovery slower than hoped

-

Amazon to cut 16,000 jobs worldwide

Amazon to cut 16,000 jobs worldwide

-

One dead, five injured in clashes between Colombia football fans

-

Dollar halts descent, gold keeps climbing before Fed update

Dollar halts descent, gold keeps climbing before Fed update

-

US YouTuber IShowSpeed gains Ghanaian nationality at end of Africa tour

-

Sweden plans to ban mobile phones in schools

Sweden plans to ban mobile phones in schools

-

Turkey football club faces probe over braids clip backing Syrian Kurds

-

Deutsche Bank offices searched in money laundering probe

Deutsche Bank offices searched in money laundering probe

-

US embassy angers Danish veterans by removing flags

-

Netherlands 'insufficiently' protects Caribbean island from climate change: court

Netherlands 'insufficiently' protects Caribbean island from climate change: court

-

Fury confirms April comeback fight against Makhmudov

-

Susan Sarandon to be honoured at Spain's top film awards

Susan Sarandon to be honoured at Spain's top film awards

-

Trump says 'time running out' as Iran rejects talks amid 'threats'

-

Spain eyes full service on train tragedy line in 10 days

Spain eyes full service on train tragedy line in 10 days

-

Greenland dispute 'strategic wake-up call for all of Europe,' says Macron

-

'Intimidation and coercion': Iran pressuring families of killed protesters

'Intimidation and coercion': Iran pressuring families of killed protesters

-

Europe urged to 'step up' on defence as Trump upends ties

-

Sinner hails 'inspiration' Djokovic ahead of Australian Open blockbuster

Sinner hails 'inspiration' Djokovic ahead of Australian Open blockbuster

-

Dollar rebounds while gold climbs again before Fed update

-

Aki a doubt for Ireland's Six Nations opener over disciplinary issue

Aki a doubt for Ireland's Six Nations opener over disciplinary issue

-

West Ham sign Fulham winger Traore

-

Relentless Sinner sets up Australian Open blockbuster with Djokovic

Relentless Sinner sets up Australian Open blockbuster with Djokovic

-

Israel prepares to bury last Gaza hostage

-

Iran rejects talks with US amid military 'threats'

Iran rejects talks with US amid military 'threats'

-

Heart attack ends iconic French prop Atonio's career

-

SKorean chip giant SK hynix posts record operating profit for 2025

SKorean chip giant SK hynix posts record operating profit for 2025

-

Greenland's elite dogsled unit patrols desolate, icy Arctic

-

Dutch tech giant ASML posts bumper profits, cuts jobs

Dutch tech giant ASML posts bumper profits, cuts jobs

-

Musetti rues 'really painful' retirement after schooling Djokovic

-

Russian volcano puts on display in latest eruption

Russian volcano puts on display in latest eruption

-

Thailand uses contraceptive vaccine to limit wild elephant births

-

Djokovic gets lucky to join Pegula, Rybakina in Melbourne semi-finals

Djokovic gets lucky to join Pegula, Rybakina in Melbourne semi-finals

-

Trump says to 'de-escalate' Minneapolis, as aide questions agents' 'protocol'

-

'Extremely lucky' Djokovic into Melbourne semi-finals as Musetti retires

'Extremely lucky' Djokovic into Melbourne semi-finals as Musetti retires

-

'Animals in a zoo': Players back Gauff call for more privacy

-

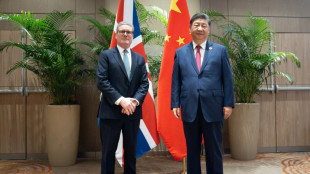

Starmer heads to China to defend 'pragmatic' partnership

Starmer heads to China to defend 'pragmatic' partnership

-

Uganda's Quidditch players with global dreams

Can Twitter become more profitable under Elon Musk?

Since going public in 2013, Twitter has only occasionally turned a profit, even if it has a commanding role in politics and culture worldwide.

The company's announcement on Monday that it had reached a deal for Tesla boss Elon Musk to buy it outright raises the question of whether this will lead to a brighter financial future for Twitter?

Musk has downplayed economic considerations as a motivation for his purchase, saying earlier this month at the TED2022 conference that, "This is not a way to make money."

Musk continued, "It's just that my strong, intuitive sense is that having a public platform that is maximally trusted and broadly inclusive is extremely important to the future of civilization."

Listed on the New York Stock Exchange for just under nine years, Twitter has posted a net loss every year, except 2018 and 2019 when it made a profit of just over $1 billion.

Musk is paying above $44 billion for the company, an amount dwarfed by Facebook's valuation of more than $500 billion.

Twitter's revenues are mainly derived from advertising rather than its user base, which isn't large enough to make up its finances.

At the end of last year, it claimed 217 million so-called "monetizable" users, who are exposed to advertising on the platform. That's far from the 1.93 billion Facebook subscribers.

Twitter is scheduled to release its first quarter results on Thursday. Wall Street expects earnings per share of three cents and revenues of $1.2 billion.

- Profitability not a priority -

Even if Twitter's business prospects may not be his top concern, the world's richest man will be looking to at least not lose money, especially since part of the acquisition could be financed by his own funds.

In a securities filing released last week, Musk pointed to a $13 billion debt facility from a financing consortium led by Morgan Stanley, a separate $12.5 billion margin loan from the same bank, as well as $21 billion from his personal fortune as being behind the deal.

Mr. Musk has not yet detailed how he intends to increase Twitter's revenue.

However in a tweet, he suggested lowering the price of Twitter Blue, the paid version of the network that costs $2.99 a month, granting a certified account to paying subscribers and removing advertising for these customers. He later withdrew the message.

Another option in Musk's hands would be to cut the workforce, which may align with his desire to lighten content moderation on the platform.

At the end of 2021, Twitter, which is based in San Francisco, employed 7,500 people worldwide. It also had around 1,500 moderators worldwide as of 2020, according to a New York University business school study.

Musk could also be looking to accelerate user growth and thus advertising revenue, or add new paid features to the platform.

"He's got his own kind of plan in place. If he can keep a model with a subscription-based offer alongside free options, that could work," said Angelino Zino, an analyst at CFRA.

- Debt worries -

By financing a significant portion of the acquisition with bank loans, Musk will increase Twitter's debt load, and on Monday, S&P Global Ratings warned it was considering lowering Twitter's rating from BB+.

Zino noted that Musk may ultimately collaborate with other investors so as not to commit his fortune alone.

"If he brings other great minds on the equity side of things, there might be greater probability of success on his end," he said.

K.Thomson--BTB