-

Venezuelans eye economic revival with hoped-for oil resurgence

Venezuelans eye economic revival with hoped-for oil resurgence

-

Online platforms offer filtering to fight AI slop

-

With Trump allies watching, Canada oil hub faces separatist bid

With Trump allies watching, Canada oil hub faces separatist bid

-

Samsung Electronics posts record profit on AI demand

-

Rockets veteran Adams out for rest of NBA season

Rockets veteran Adams out for rest of NBA season

-

Holders PSG happy to take 'long route' via Champions League play-offs

-

French Senate adopts bill to return colonial-era art

French Senate adopts bill to return colonial-era art

-

Allrounder Molineux named Australian women's cricket captain

-

Sabalenka faces Svitolina roadblock in Melbourne final quest

Sabalenka faces Svitolina roadblock in Melbourne final quest

-

Barcelona rout Copenhagen to reach Champions League last 16

-

Liverpool, Man City and Barcelona ease into Champions League last 16

Liverpool, Man City and Barcelona ease into Champions League last 16

-

Tesla profits tumble on lower EV sales, AI spending surge

-

Real Madrid face Champions League play-off after Benfica loss

Real Madrid face Champions League play-off after Benfica loss

-

LA mayor urges US to reassure visiting World Cup fans

-

Madrid condemned to Champions League play-off after Benfica loss

Madrid condemned to Champions League play-off after Benfica loss

-

Meta shares jump on strong earnings report

-

Haaland ends barren run as Man City reach Champions League last 16

Haaland ends barren run as Man City reach Champions League last 16

-

PSG and Newcastle drop into Champions League play-offs after stalemate

-

Salah ends drought as Liverpool hit Qarabag for six to reach Champions League last 16

Salah ends drought as Liverpool hit Qarabag for six to reach Champions League last 16

-

Barca rout Copenhagen to reach Champions League last 16

-

Arsenal complete Champions League clean sweep for top spot

Arsenal complete Champions League clean sweep for top spot

-

Kolo Muani and Solanke send Spurs into Champions League last 16

-

Bayern inflict Kane-ful Champions League defeat on PSV

Bayern inflict Kane-ful Champions League defeat on PSV

-

Pedro double fires Chelsea into Champions League last 16, dumps out Napoli

-

US stocks move sideways, shruggging off low-key Fed meeting

US stocks move sideways, shruggging off low-key Fed meeting

-

US capital Washington under fire after massive sewage leak

-

Anti-immigration protesters force climbdown in Sundance documentary

Anti-immigration protesters force climbdown in Sundance documentary

-

US ambassador says no ICE patrols at Winter Olympics

-

Norway's Kristoffersen wins Schladming slalom

Norway's Kristoffersen wins Schladming slalom

-

Springsteen releases fiery ode to Minneapolis shooting victims

-

Brady latest to blast Belichick Hall of Fame snub

Brady latest to blast Belichick Hall of Fame snub

-

Trump battles Minneapolis shooting fallout as agents put on leave

-

SpaceX eyes IPO timed to planet alignment and Musk birthday: report

SpaceX eyes IPO timed to planet alignment and Musk birthday: report

-

White House, Slovakia deny report on Trump's mental state

-

Iran vows to resist any US attack, insists ready for nuclear deal

Iran vows to resist any US attack, insists ready for nuclear deal

-

Colombia leader offers talks to end trade war with Ecuador

-

Former Masters champ Reed returning to PGA Tour from LIV

Former Masters champ Reed returning to PGA Tour from LIV

-

US Fed holds interest rates steady, defying Trump pressure

-

Norway's McGrath tops first leg of Schladming slalom

Norway's McGrath tops first leg of Schladming slalom

-

Iraq PM candidate Maliki denounces Trump's 'blatant' interference

-

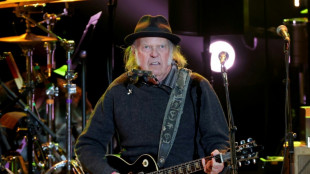

Neil Young gifts music to Greenland residents for stress relief

Neil Young gifts music to Greenland residents for stress relief

-

Rubio upbeat on Venezuela cooperation but wields stick

-

'No. 1 fan': Rapper Minaj backs Trump

'No. 1 fan': Rapper Minaj backs Trump

-

Fear in Sicilian town as vast landslide risks widening

-

'Forced disappearance' probe opened against Colombian cycling star Herrera

'Forced disappearance' probe opened against Colombian cycling star Herrera

-

Seifert, Santner give New Zealand consolation T20 win over India

-

King Charles III warns world 'going backwards' in climate fight

King Charles III warns world 'going backwards' in climate fight

-

Minneapolis activists track Trump's immigration enforcers

-

Court orders Dutch to protect Caribbean island from climate change

Court orders Dutch to protect Caribbean island from climate change

-

Sterling agrees Chelsea exit after troubled spell

Climate finance can be hard sell, says aide to banks and PMs

Trillions of dollars are needed to make poorer nations more resilient to climate change, and studies have estimated that every $1 invested today will save at least $4 in future.

So why is it so hard to raise this money, and what are some of the innovative ways of going about it?

- Wind over walls -

Developing countries, excluding China, will need $1 trillion a year by 2030 in outside help to reduce their carbon footprint and adapt to a warming planet, according to UN-commissioned experts.

This money could come from foreign governments, big lending institutions like the World Bank, or the private sector.

But some projects attract money more easily than others, said Avinash Persaud, special climate adviser to the president of the Inter-American Development Bank, a lender for Latin American and Caribbean nations.

For example, the private sector likes building solar farms and wind turbines because there's a return on investment when people buy the electricity.

But investors are much less interested in building defensive sea walls that generate no revenue, said Persaud, who hails from Barbados, and once advised the Caribbean nation's Prime Minister Mia Mottley.

"Unfortunately, there's no magic in finance. And so that does require a lot of public money," he told AFP on the sidelines of the UN COP29 climate summit in Azerbaijan.

- Political jitters -

But governments are limited in the amount they can borrow, he said, and reluctant to dip into their budgets for climate adaptation in poorer nations.

In the European Union, which is the largest contributor to international climate finance, major donors face political and economic pressures at home.

Meanwhile, newly-elected Donald Trump has threatened to pull the US, the world's largest economy, out of global cooperation on climate action.

This has posed enormous challenges at COP29, where nations are no closer to striking a long-sought deal to raise more money for developing countries.

"You're seeing the political landscape -- governments are not getting elected to raise their aid budgets and send more money abroad," said Persaud.

- Close the gap -

A defensive sea wall, for example, might not pay off for decades, making it difficult for debt-strapped countries to borrow enough money at reasonable rates to build it in the first place.

Persaud said development banks could help bring down the cost of borrowing, while new taxes on polluting industries like global shipping and coal, oil and gas could raise new money.

Such "innovative" schemes already exist, he said: in the United States, $0.09 of every barrel of oil goes into a fund to cover the cost of cleaning up a spill.

"Well, we're seeing a spill in the atmosphere... and maybe if we spread these things, make them global across fossil fuels, we could raise the money we need."

This could help poorer nations recover from disaster -- known in UN parlance as "loss and damage" -- something few investors go near, he said.

"If we can raise these levees -- the solidarity levees -- here and there, for those things that can't be funded any other way, then we can close that gap," he said.

- 'Science into finance' -

Persaud conceded "none of this is easy".

"Raising the money is hard. Spending it well is hard. Getting it to the the people who need it most is hard," he said.

But $1 trillion was a realistic ask if underpinned by $300 billion in public finance -- three times the existing pledge, he said.

Without "translating the science into finance", developing countries could not take the action necessary to help curb rises in global temperatures.

"If we don't get one, we don't get the other," he said.

M.Schneider--VB