-

Mertens and Zhang win Australian Open women's doubles title

Mertens and Zhang win Australian Open women's doubles title

-

Venezuelan interim president announces mass amnesty push

-

China factory activity loses steam in January

China factory activity loses steam in January

-

Melania Trump's atypical, divisive doc opens in theatres

-

Bad Bunny set for historic one-two punch at Grammys, Super Bowl

Bad Bunny set for historic one-two punch at Grammys, Super Bowl

-

Five things to watch for on Grammys night Sunday

-

Venezuelan interim president proposes mass amnesty law

Venezuelan interim president proposes mass amnesty law

-

Rose stretches lead at Torrey Pines as Koepka makes cut

-

Online foes Trump, Petro set for White House face-to-face

Online foes Trump, Petro set for White House face-to-face

-

Seattle Seahawks deny plans for post-Super Bowl sale

-

US Senate passes deal expected to shorten shutdown

US Senate passes deal expected to shorten shutdown

-

'Misrepresent reality': AI-altered shooting image surfaces in US Senate

-

Thousands rally in Minneapolis as immigration anger boils

Thousands rally in Minneapolis as immigration anger boils

-

US judge blocks death penalty for alleged health CEO killer Mangione

-

Lens win to reclaim top spot in Ligue 1 from PSG

Lens win to reclaim top spot in Ligue 1 from PSG

-

Gold, silver prices tumble as investors soothed by Trump Fed pick

-

Ko, Woad share lead at LPGA season opener

Ko, Woad share lead at LPGA season opener

-

US Senate votes on funding deal - but shutdown still imminent

-

US charges prominent journalist after Minneapolis protest coverage

US charges prominent journalist after Minneapolis protest coverage

-

Trump expects Iran to seek deal to avoid US strikes

-

Guterres warns UN risks 'imminent financial collapse'

Guterres warns UN risks 'imminent financial collapse'

-

NASA delays Moon mission over frigid weather

-

First competitors settle into Milan's Olympic village

First competitors settle into Milan's Olympic village

-

Fela Kuti: first African to get Grammys Lifetime Achievement Award

-

'Schitt's Creek' star Catherine O'Hara dead at 71

'Schitt's Creek' star Catherine O'Hara dead at 71

-

Curran hat-trick seals 11 run DLS win for England over Sri Lanka

-

Cubans queue for fuel as Trump issues energy ultimatum

Cubans queue for fuel as Trump issues energy ultimatum

-

France rescues over 6,000 UK-bound Channel migrants in 2025

-

Surprise appointment Riera named Frankfurt coach

Surprise appointment Riera named Frankfurt coach

-

Maersk to take over Panama Canal port operations from HK firm

-

US arrests prominent journalist after Minneapolis protest coverage

US arrests prominent journalist after Minneapolis protest coverage

-

Analysts say Kevin Warsh a safe choice for US Fed chair

-

Trump predicts Iran will seek deal to avoid US strikes

Trump predicts Iran will seek deal to avoid US strikes

-

US oil giants say it's early days on potential Venezuela boom

-

Fela Kuti to be first African to get Grammys Lifetime Achievement Award

Fela Kuti to be first African to get Grammys Lifetime Achievement Award

-

Trump says Iran wants deal, US 'armada' larger than in Venezuela raid

-

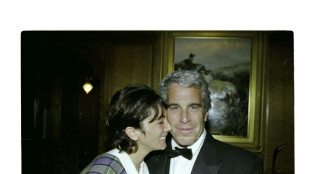

US Justice Dept releases new batch of documents, images, videos from Epstein files

US Justice Dept releases new batch of documents, images, videos from Epstein files

-

Four memorable showdowns between Alcaraz and Djokovic

-

Russian figure skating prodigy Valieva set for comeback -- but not at Olympics

Russian figure skating prodigy Valieva set for comeback -- but not at Olympics

-

Barcelona midfielder Lopez agrees contract extension

-

Djokovic says 'keep writing me off' after beating Sinner in late-nighter

Djokovic says 'keep writing me off' after beating Sinner in late-nighter

-

US Justice Dept releasing new batch of Epstein files

-

South Africa and Israel expel envoys in deepening feud

South Africa and Israel expel envoys in deepening feud

-

French eyewear maker in spotlight after presidential showing

-

Olympic dream 'not over', Vonn says after crash

Olympic dream 'not over', Vonn says after crash

-

Brazil's Lula discharged after cataract surgery

-

US Senate races to limit shutdown fallout as Trump-backed deal stalls

US Senate races to limit shutdown fallout as Trump-backed deal stalls

-

'He probably would've survived': Iran targeting hospitals in crackdown

-

Djokovic stuns Sinner to set up Australian Open final with Alcaraz

Djokovic stuns Sinner to set up Australian Open final with Alcaraz

-

Mateta omitted from Palace squad to face Forest

Zimbabwe's carbon credit takeover spooks locals, investors

It is shortly after sunrise, and Peter Mudenda looks for elephant tracks on a dirt road surrounded by mopane trees.

Once a farmer, the 49-year-old gave up the plough several years ago when a massive forest protection project was launched in Binga, a remote semi-arid district in northern Zimbabwe.

He now makes a living digging fireguards, taking care of trees and keeping tabs on wildlife.

"I was getting a good yield... but I was quick to appreciate that we could benefit more as a community from a conservancy," Mudenda told AFP.

The conservancy is part of a wider project that makes money selling carbon credits, a financial tool aimed at tackling climate change.

But in Zimbabwe, the model has been upended by a shock announcement that the government intends to claim half of all revenues.

As more countries look to regulate the sector, the move has created uncertainty in a $2 billion global market, stoking fears that other governments may follow suit, analysts say.

"The approach they've taken is quite radical and a bit blunt," said Gilles Dufrasne of Carbon Market Watch, an advocacy group.

The scheme in Binga is part of Kariba REDD+, the largest carbon credit initiative of its kind.

Carbon credits aim at providing an important funding source for conservation.

Companies or individuals buy credits from entities that remove or reduce greenhouse gas emissions, such as investing in renewable energy, planting trees or nurturing old forests.

Each credit is worth the equivalent of one tonne of carbon dioxide -- a useful badge of honour for those keen on proving their green credentials.

A partnership between Zimbabwean firm Carbon Green Investments and South Pole, a Swiss-based carbon offsets developer, Kariba REDD+ was launched 2011.

It now covers 785,000 hectares (1.9 million acres) of forest, fostering a series of community-led activities from beekeeping to ecotourism.

Since its inception it has generated more than 100 million euros ($110 million) from the sale of carbon credits, according to South Pole -- a figure that is expected to mushroom.

- Carbon credit boom -

The global market is forecast to grow at least five-fold to $10 billion by 2030, according to a 2023 estimate by oil giant Shell and the Boston Consulting Group (BCG).

Much of the trade happens between companies in a so-called voluntary market.

But countries are also negotiating an international carbon offset trading system to reach their climate targets under the umbrella of United Nations-led climate talks.

South Pole says most of Kariba's income was produced over the past two years. Gucci and Nestle are among firms that have bought into it.

Last month, Zimbabwe, which is cash strapped and in desperate need of foreign currency, said it wants a slice of the pie.

Francis Vorhies, a conservation economist at South Africa's Stellenbosch University, said there was a logic behind Zimbabwe's move, given that the national market was based largely on government-controlled resources.

But the new policy has spooked investors and locals alike.

"This is business, not charity work. There are investors putting in their money," said Elmon Mudenda, a local councillor in Binga, who shares the same surname as the former farmer but is not related to him.

"Government must be careful to come up with friendly policies, so that we don't have communities going back to a mindset where they don't value the conservation of forests."

Under the new policy, 50 percent of all revenue from carbon offset projects should go to the national treasury.

- 'Devil in the details' -

At least another 20 percent should go to local investors, while and foreign partners would be allowed to pocket no more than 30 percent.

All carbon credit deals are to be subjected to central approval and all agreements previously entered would be declared "null and void", Harare declared last month.

"(It) does raise the question of what they're going to do with the money," said Dufrasne of Carbon Market Watch.

South Pole says it initially took a 25 percent commission on Kariba sales, before it started to buy the credits for itself at a time of low prices to later resell them.

About 20 percent of revenue currently goes to fund environmental protection activities, with the rest split between local councils, communities and leaseholders, according to the firm's website.

Stephen Wentzel, director of Carbon Green Investments, said Kariba would remain viable if the government was to put its cut back into the project.

But due to Zimbabwe's "historical reputation," foreign firms might shy away from buying credits directly, and harbour suspicions about how the funds will be used, he said.

"The devil is in the details," said South Pole's spokeswoman Nadia Kahkonen, explaining no concrete regulation has yet followed the announcement.

"Speculation and political discourse currently creates even more uncertainty... and will slow down if not halt investments in local projects."

L.Janezki--BTB