-

Real Madrid will 'keep fighting' in title race, vows Arbeloa

Real Madrid will 'keep fighting' in title race, vows Arbeloa

-

Australia join South Korea in quarters of Women's Asian Cup

-

Kane to miss Bayern game against Gladbach with calf knock

Kane to miss Bayern game against Gladbach with calf knock

-

Henman says Raducanu needs more physicality to rise up rankings

-

France recall fit-again Jalibert to face Scotland

France recall fit-again Jalibert to face Scotland

-

Harry Styles fans head in one direction: to star's home village

-

Syrian jailed over stabbing at Berlin Holocaust memorial

Syrian jailed over stabbing at Berlin Holocaust memorial

-

Second Iranian ship heading to Sri Lanka after submarine attack

-

Middle East war spirals as Iran hits Kurds in Iraq

Middle East war spirals as Iran hits Kurds in Iraq

-

Norris hungrier than ever to defend Formula One world title

-

Fatherhood, sleep, T20 World Cup final: Henry's whirlwind journey

Fatherhood, sleep, T20 World Cup final: Henry's whirlwind journey

-

Conservative Nigerian city sees women drive rickshaw taxis

-

T20 World Cup hero Allen says New Zealand confidence high for final

T20 World Cup hero Allen says New Zealand confidence high for final

-

The silent struggle of an anti-war woman in Russia

-

Iran hits Kurdish groups in Iraq as conflict widens

Iran hits Kurdish groups in Iraq as conflict widens

-

China sets lowest growth target in decades as consumption lags

-

Afghans rally against Pakistan and civilian casualties

Afghans rally against Pakistan and civilian casualties

-

South Korea beat Philippines 3-0 to reach women's quarter-finals

-

Mercedes' Russell not fazed by being tipped as pre-season favourite

Mercedes' Russell not fazed by being tipped as pre-season favourite

-

Australia beat Taiwan in World Baseball Classic opener

-

Underdogs Wales could hurt Irish after Scotland display: Popham

Underdogs Wales could hurt Irish after Scotland display: Popham

-

Gilgeous-Alexander rules over Knicks again in Thunder win

-

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

-

Alonso, Stroll fear 'permanent nerve damage' from vibrating Aston Martin

-

China boosts military spending with eyes on US, Taiwan

China boosts military spending with eyes on US, Taiwan

-

Seoul leads rebound across Asian stocks, oil extends gains

-

Tourism on hold as Middle East war casts uncertainty

Tourism on hold as Middle East war casts uncertainty

-

Bayern and Kane gambling with house money as Gladbach come to town

-

Turkey invests in foreign legion to deliver LA Olympics gold

Turkey invests in foreign legion to deliver LA Olympics gold

-

Galthie's France blessed with unprecedented talent: Saint-Andre

-

Voice coach to the stars says Aussie actors nail tricky accents

Voice coach to the stars says Aussie actors nail tricky accents

-

Rahm rejection of DP World Tour deal 'a shame' - McIlroy

-

Israel keeps up Lebanon strikes as ground forces advance

Israel keeps up Lebanon strikes as ground forces advance

-

China prioritises energy and diplomacy over Iran support

-

Canada PM Carney says can't rule out military participation in Iran war

Canada PM Carney says can't rule out military participation in Iran war

-

Verstappen says new Red Bull car gave him 'goosebumps'

-

Swiss to vote on creating giant 'climate fund'

Swiss to vote on creating giant 'climate fund'

-

Google to open German centre for 'AI development'

-

Winter Paralympics to start with icy blast as Ukraine lead ceremony boycott

Winter Paralympics to start with icy blast as Ukraine lead ceremony boycott

-

Sci-fi without AI: Oscar nominated 'Arco' director prefers human touch

-

Ex-guerrillas battle low support in Colombia election

Ex-guerrillas battle low support in Colombia election

-

'She's coming back': Djokovic predicts Serena return

-

Hamilton vows 'no holding back' in his 20th Formula One season

Hamilton vows 'no holding back' in his 20th Formula One season

-

Two-thirds of Cuba, including Havana, hit by blackout

-

US sinks Iranian warship off Sri Lanka as war spreads

US sinks Iranian warship off Sri Lanka as war spreads

-

After oil, US moves to secure access to Venezuelan minerals

-

Arteta hits back at Brighton criticism after Arsenal boost title bid

Arteta hits back at Brighton criticism after Arsenal boost title bid

-

Carrick says 'defeat hurts' after first loss as Man Utd boss

-

Ecuador expels Cuba envoy, rest of mission

Ecuador expels Cuba envoy, rest of mission

-

Arsenal stretch lead at top of Premier League as Man City falter

Is Australia’s Economy Doomed?

The Australian economy, long admired for its resilience and resource-driven growth, faces mounting concerns about its future trajectory. With global economic headwinds, domestic challenges, and structural vulnerabilities coming to the fore, analysts are questioning whether the nation’s prosperity is at risk. While some warn of a potential downturn, others argue that Australia’s adaptability and strengths could steer it clear of doom. A closer look reveals a complex picture of risks and opportunities shaping the country’s economic outlook.

Australia’s economy has historically thrived on its vast natural resources, particularly iron ore, coal, and natural gas, which have fueled exports to Asia, especially China. However, global demand for these commodities is softening. China’s economic slowdown, coupled with its pivot toward green energy, has reduced reliance on Australian coal and iron ore. In 2024, iron ore prices dropped significantly, impacting export revenues. This decline has exposed Australia’s heavy dependence on a single market, raising alarms about the need for diversification. Efforts to expand trade with India and Southeast Asia are underway, but these markets cannot yet offset the loss of Chinese demand.

Domestically, inflation remains a persistent challenge. In 2024, inflation hovered around 3.5%, down from its 2022 peak but still above the Reserve Bank of Australia’s (RBA) 2-3% target. High energy costs and supply chain disruptions have kept prices elevated, squeezing household budgets. Wage growth, while improving, has not kept pace with inflation, eroding real incomes. The RBA’s response—raising interest rates to 4.35%—has cooled the housing market but increased borrowing costs for households and businesses. Mortgage stress is rising, with many Australians grappling with higher repayments amid stagnant wages.

The housing crisis is another sore point. Skyrocketing property prices in cities like Sydney and Melbourne have locked out first-time buyers, fueling inequality. Construction costs have surged due to labor shortages and expensive materials, slowing new housing supply. Government initiatives to boost affordable housing have fallen short, leaving young Australians pessimistic about homeownership. This dynamic not only strains social cohesion but also hampers economic mobility, as wealth concentrates among older, property-owning generations.

Labor market dynamics add further complexity. Unemployment remains low at around 4.1%, a near-historic achievement. However, underemployment is creeping up, and many jobs are in low-wage, insecure sectors like retail and hospitality. Skilled worker shortages in critical industries—healthcare, engineering, and technology—persist, hampering productivity. Immigration, a traditional solution, has resumed post-pandemic, but visa processing delays and global competition for talent limit its impact. Without addressing these gaps, Australia risks stalling its economic engine.

Climate change poses a long-term threat. Extreme weather events—floods, bushfires, and droughts—have become more frequent, disrupting agriculture and infrastructure. The agricultural sector, a key economic pillar, faces declining yields due to unpredictable weather. Transitioning to renewable energy is essential, but progress is uneven. While Australia leads in solar adoption, its reliance on coal for domestic power generation undermines green ambitions. The cost of transitioning to net-zero emissions by 2050 is estimated at hundreds of billions, straining public finances already stretched by aging population costs.

Public debt, while manageable at around 40% of GDP, is another concern. Pandemic-era stimulus and infrastructure spending have driven deficits, with net debt projected to reach $1 trillion by 2027. Tax revenues from mining have cushioned the blow, but their decline could force tough choices—higher taxes or spending cuts—both politically contentious. The government’s focus on renewable energy and defense spending, including the AUKUS nuclear submarine deal, adds pressure to an already tight budget.

Yet, Australia is not without strengths. Its services sector, particularly education and tourism, is rebounding post-COVID, with international students and visitors returning in droves. The tech sector, though small, is growing, with startups in fintech and biotech attracting global investment. Critical minerals like lithium and rare earths offer new export opportunities as the world electrifies. Trade agreements with the UK, EU, and Indo-Pacific nations could open new markets, reducing reliance on China. Moreover, Australia’s stable institutions and skilled workforce provide a foundation for long-term growth.

Still, structural issues loom large. Productivity growth has stagnated, lagging behind global peers. An overreliance on housing and mining for wealth creation has crowded out investment in manufacturing and innovation. The education system, once a global leader, struggles to produce graduates aligned with future needs, particularly in STEM fields. Indigenous economic exclusion remains a persistent drag, with gaps in employment and income barely narrowing.

The question of whether Australia’s economy is doomed hinges on its ability to adapt. Pessimists point to declining commodity prices, rising debt, and climate risks as harbingers of decline. Optimists highlight the nation’s track record of dodging recessions—avoiding one for over three decades until COVID—and its capacity for reform. Policy choices in the coming years will be critical. Boosting productivity, diversifying exports, and investing in skills and renewables could secure prosperity. Failure to act, however, risks a slow slide into stagnation.

For now, Australia stands at a crossroads. Doomed? Not yet. But the warning signs are clear, and complacency is not an option.

Hormuz Shock Risk rising

Brazil's trade-war boom

Iran's revenge rewired

Cuba's golden Goose dies

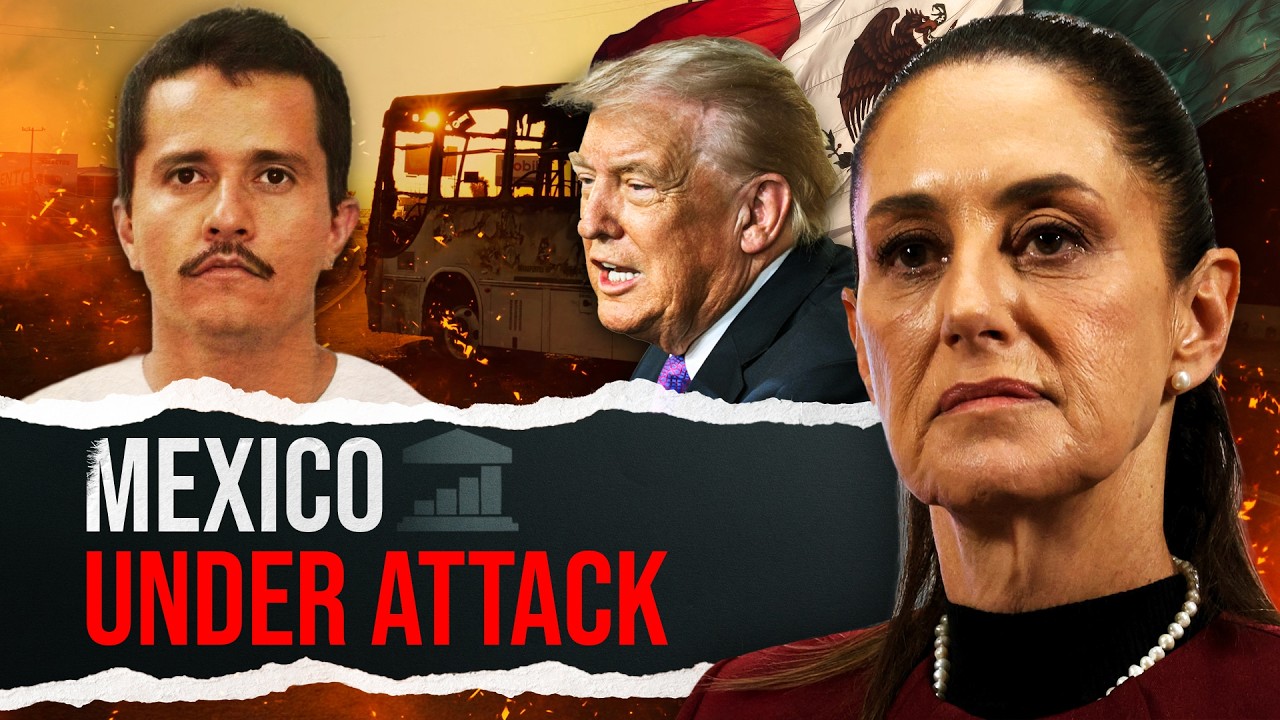

Mexico after El Mencho falls

Nicaragua on the brink?

Cuba: The Regime's last Card

Strike fears rise over Iran

U.S. Jobs stall, gdp slows

Japan’s right‑turn triumph

EU India deal gains unveiled