-

UK's Crufts dog show opens with growing global appeal

UK's Crufts dog show opens with growing global appeal

-

PSG prepare for Chelsea clash with Monaco rematch

-

Google opens AI centre as Berlin defends US tech reliance

Google opens AI centre as Berlin defends US tech reliance

-

Second Iranian ship nears Sri Lanka after submarine attack

-

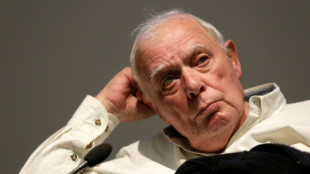

Portugal mourns acclaimed writer Antonio Lobo Antunes

Portugal mourns acclaimed writer Antonio Lobo Antunes

-

Union loses fight against Tesla at German factory

-

Wales revel in being the underdogs, says skipper Lake

Wales revel in being the underdogs, says skipper Lake

-

German school students rally against army recruitment drive

-

Wary European states pledge military aid for Cyprus, Gulf

Wary European states pledge military aid for Cyprus, Gulf

-

Liverpool injuries frustrating Slot in tough season

-

Real Madrid will 'keep fighting' in title race, vows Arbeloa

Real Madrid will 'keep fighting' in title race, vows Arbeloa

-

Australia join South Korea in quarters of Women's Asian Cup

-

Kane to miss Bayern game against Gladbach with calf knock

Kane to miss Bayern game against Gladbach with calf knock

-

Henman says Raducanu needs more physicality to rise up rankings

-

France recall fit-again Jalibert to face Scotland

France recall fit-again Jalibert to face Scotland

-

Harry Styles fans head in one direction: to star's home village

-

Syrian jailed over stabbing at Berlin Holocaust memorial

Syrian jailed over stabbing at Berlin Holocaust memorial

-

Second Iranian ship heading to Sri Lanka after submarine attack

-

Middle East war spirals as Iran hits Kurds in Iraq

Middle East war spirals as Iran hits Kurds in Iraq

-

Norris hungrier than ever to defend Formula One world title

-

Fatherhood, sleep, T20 World Cup final: Henry's whirlwind journey

Fatherhood, sleep, T20 World Cup final: Henry's whirlwind journey

-

Conservative Nigerian city sees women drive rickshaw taxis

-

T20 World Cup hero Allen says New Zealand confidence high for final

T20 World Cup hero Allen says New Zealand confidence high for final

-

The silent struggle of an anti-war woman in Russia

-

Iran hits Kurdish groups in Iraq as conflict widens

Iran hits Kurdish groups in Iraq as conflict widens

-

China sets lowest growth target in decades as consumption lags

-

Afghans rally against Pakistan and civilian casualties

Afghans rally against Pakistan and civilian casualties

-

South Korea beat Philippines 3-0 to reach women's quarter-finals

-

Mercedes' Russell not fazed by being tipped as pre-season favourite

Mercedes' Russell not fazed by being tipped as pre-season favourite

-

Australia beat Taiwan in World Baseball Classic opener

-

Underdogs Wales could hurt Irish after Scotland display: Popham

Underdogs Wales could hurt Irish after Scotland display: Popham

-

Gilgeous-Alexander rules over Knicks again in Thunder win

-

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

-

Alonso, Stroll fear 'permanent nerve damage' from vibrating Aston Martin

-

China boosts military spending with eyes on US, Taiwan

China boosts military spending with eyes on US, Taiwan

-

Seoul leads rebound across Asian stocks, oil extends gains

-

Tourism on hold as Middle East war casts uncertainty

Tourism on hold as Middle East war casts uncertainty

-

Bayern and Kane gambling with house money as Gladbach come to town

-

Turkey invests in foreign legion to deliver LA Olympics gold

Turkey invests in foreign legion to deliver LA Olympics gold

-

Galthie's France blessed with unprecedented talent: Saint-Andre

-

Voice coach to the stars says Aussie actors nail tricky accents

Voice coach to the stars says Aussie actors nail tricky accents

-

Rahm rejection of DP World Tour deal 'a shame' - McIlroy

-

Israel keeps up Lebanon strikes as ground forces advance

Israel keeps up Lebanon strikes as ground forces advance

-

China prioritises energy and diplomacy over Iran support

-

Canada PM Carney says can't rule out military participation in Iran war

Canada PM Carney says can't rule out military participation in Iran war

-

Verstappen says new Red Bull car gave him 'goosebumps'

-

Swiss to vote on creating giant 'climate fund'

Swiss to vote on creating giant 'climate fund'

-

Google to open German centre for 'AI development'

-

Winter Paralympics to start with icy blast as Ukraine lead ceremony boycott

Winter Paralympics to start with icy blast as Ukraine lead ceremony boycott

-

Sci-fi without AI: Oscar nominated 'Arco' director prefers human touch

Embraer’s 950% surge

Embraer has rewritten the aerospace playbook. From a once-overlooked regional specialist, the Brazilian manufacturer has emerged as the industry’s quiet juggernaut—outpacing its far larger rivals in shareholder returns and converting a focused product strategy into record commercial momentum. Since the pandemic trough, Embraer’s New York–listed shares have risen by well over ninefold, vaulting from single digits to new highs and putting a spotlight on how a disciplined “middle-of-the-market” bet can beat scale.

At the heart of the surge is a portfolio calibrated for today’s constraints. Where Boeing fights through quality and compliance crises and Airbus wrestles with capacity limits and engine supply headaches, Embraer has leaned into the 70–150 seat segment with its second-generation E-Jets, expanded a resilient business-jet franchise, and steadily racked up wins for its C-390 Millennium airlifter. The result: an all-time-high firm order backlog nearing $30 billion this summer, alongside quarter-record revenues and deliveries. In a supply-choked world, dependable execution is a strategy—and it shows.

Commercial aviation is the spear tip. Flagship orders in 2025—from Japan’s ANA for E190-E2s to a landmark SAS deal for up to 55 E195-E2s—signaled that network planners across developed markets want lower trip costs without sacrificing comfort or range. E2 economics have given carriers a credible alternative to deploying larger narrowbodies on thin or regional routes, and Embraer’s cabin design (no middle seat, fast turns) aligns neatly with post-pandemic route rebuilding. New-market beachheads in Mexico and continued growth with operators in Europe and the Americas are translating into delivery growth that’s outpacing last year.

Defense has become the dark horse. The C-390 Millennium, once a niche challenger, has turned into Europe’s go-to Hercules alternative, notching selections and orders across NATO and beyond. Beyond mission flexibility and speed, Embraer’s willingness to localize industrial footprints in Europe has strengthened its political and logistical case. As defense budgets rose, that combination—performance plus partnership—pulled the program into the mainstream and diversified group earnings just as commercial demand returned.

Then there is executive aviation, an underestimated earnings engine. Phenom and Praetor jets continue to compound on the back of strong utilization, fleet replacements, and aftermarket growth. Together with services and support, these businesses have added ballast to Embraer’s cash generation and helped smooth cyclicality—another reason the equity rerated higher rather than snapping back to pre-crisis multiples.

The competitive contrast is stark. Airbus remains the global delivery leader with a gargantuan backlog—but constrained slots mean years-long waits, particularly in single-aisles. Boeing, meanwhile, is still working through a prolonged manufacturing and oversight reset that has capped output and sapped buyer confidence. Embraer isn’t “bigger” than either; it’s simply been better positioned to deliver reliable capacity now, in exactly the seat ranges airlines can actually crew, fuel, and fill profitably. In public markets, timing and credibility compound.

None of this is risk-free. The E2 family’s reliance on geared-turbofan technology ties Embraer to an engine ecosystem still normalizing after widespread inspection programs. Trade policy is a new wild card, with tariff chatter periodically jolting shares. And the urban-air-mobility bet via Eve remains a long-dated option, not a 2025 cash cow. But the core machine—commercial E-Jets, executive jets, C-390, and services—is running at record velocity with improving mix and scale.

“Destroyed” may be the language of headlines; what’s indisputable is the scoreboard: since its pandemic low, Embraer has delivered a stock performance that has eclipsed both transatlantic giants, while building a backlog and delivery cadence that validate its strategic lane. In today’s aerospace cycle, the middle seat wins.

Canada challenges Trump on Tariffs

Nuclear weapons for Poland against Russia?

Rebellion against Trump: "Ready for War?"

Ukraine: Problem with the ceasefire?

Ukraine Loses Kursk: A Collapse?

Russia's "Alliance" in the Balkans is sinking

US Federal Reserve with “announcement”

Germany doesn't want any more migrants?

Wealth that Brazil is not utilizing!

Taiwan: Is the "Silicon Shield" collapsing?

Next Chancellor of Germany and Trump